Argentina's Mining Renaissance: How It's Unlocking a Nation's Buried Treasure

Argentina has gone from overlooked to mining's hottest frontier. We chatted with Geologo Trader to find out why he and the industry's heavyweights are piling in, plus his 2 best picks

Argentina's vast mineral wealth has always been there - rich deposits of gold, copper, lithium, and zinc sitting untouched beneath the Andes. What's changed is at the top. President Javier Milei has thrown open the doors to mining investment, and the transformation has been dramatic.

In just over 12 months, Milei turned a USD$8 billion trade deficit into a USD$18.5 billion surplus, slashed monthly inflation from 25.5 per cent to 2.4 per cent, and unveiled a suite of mining reforms that have the industry's heavyweights scrambling for position.

For small-cap investors, this creates a rare window. The majors are betting billions, but it's the junior explorers who could deliver the next big discovery. We've spent months analysing this opportunity, talking to experts on the ground, and identifying the small caps best positioned to ride Argentina's mining renaissance.

In this deep dive, we'll show you why Argentina's time has finally come, how the majors are positioning themselves, and which small-caps could be next in line.

We've even got exclusive insights from an Australian geologist working in Argentina, including his two top stock picks for 2025.

This marks our first Drill Down piece - where we take the same analytical approach we bring to our company coverage but apply it to entire sectors and regions with significant potential. Think of it as a companion to our regular insights, giving you a broader context for the specific opportunities we highlight week-to-week.

Decades of Promise, Decades of Pain

Argentina's vast mineral wealth has teased miners for decades. But a toxic mix of political instability, ever-shifting regulations, and the constant threat of resource nationalisation has kept the big money away.

The 1990s looked like the turning point. President Carlos Menem swept to power with a plan to open Argentina to foreign investment, eyeing the mining sector as the economy's silver bullet. His 1993 mining law had all the right ingredients: streamlined processing, foreign investment incentives, and tax breaks for explorers.

Then came the fatal flaw. Argentina handed each province complete control over mining within their territory - licensing, royalties, environmental regulations, the lot. What looked great on paper turned into an investor's nightmare.

Mining companies found themselves navigating a maze of contradictory rules that changed with every provincial border. Projects that worked under one administration could be shuttered by the next. Local communities, empowered by provincial control, could stop billion-dollar developments in their tracks.

The casualties were significant. Barrick Gold, one of the world's largest miners, walked away from billion-dollar projects, unable to overcome provincial resistance.

Pan American Silver's Navidad Project - one of the world's largest undeveloped silver deposits - has sat frozen for over a decade, caught in provincial mining bans, despite repeated attempts to work with local authorities.

Other big-name miners also hit their limits. Rio Tinto's Rincon Lithium Project sat in limbo until 2024, hammered by shifting regulations that made development impossible. Glencore's El Pachón copper project is a similar tale - forced to scale back in the early 2010s when government policies suddenly shifted to grab more state revenue.

When companies with multi-billion dollar war chests can't make projects work, you can imagine how the small-caps fared. Junior explorers all but vanished from Argentina. The country's vast reserves of gold, copper, and lithium lay untouched while easier jurisdictions attracted investment.

Then everything changed.

The Milei Era Begins

When Javier Milei swept to power in late 2023, he stuck a stake in the ground by declaring, "Today begins the reconstruction of Argentina. Today begins the end of Argentina's decline."

Argentina's mining sector saw a glimmer of hope. Milei came with a clear message: cut red tape, reduce regulation, and attract foreign investment. Think Trump meets Thatcher, but with a chainsaw aimed at Argentina's bureaucracy.

Within twelve months, the results were staggering. Government departments were dissolved and merged. Spending was slashed by 28%. For the first time in over a decade, Argentina posted a budget surplus.

Milei transformed a crippling USD$8 billion trade deficit into a USD$18.5 billion surplus - the highest in Argentina's history. Monthly inflation plummeted from 25.5% to 2.4%, a feat that had global markets taking notice.

With government spending cut, inflation falling, and costly subsidies stripped away, Milei turned his focus to Argentina's sleeping giant: the mining sector.

Milei's Mining Makeover

Milei's government has moved fast on mining reform. Slashed export taxes, streamlined regulations, and a simplified licensing process have triggered a surge of interest from mining companies worldwide.

The centrepiece is the Incentive Regime for Large Investments (RIGI), a comprehensive program designed to attract foreign capital through three key measures:

Tax incentives

- Corporate tax slashed from 35% to 25% for 30 years.

- Lower export taxes on mining products.

- Deductions for reinvesting profits in Argentina.

- Reduced import taxes on capital goods.

Regulatory stability

- Guaranteed stable rules for projects.

- Protection from sudden regulation changes.

- No surprise tax impositions.

Profit repatriation

- Efficient transfer of earnings out of Argentina.

- Major improvement from strict currency controls of the past.

While the provinces still control their mining resources, Milei's approach marks a clear break from the past. Milei’s administration has introduced national-level incentives to simplify the investment process across Argentina.

This dual approach sets RIGI apart from previous reforms. Milei created a framework that's already attracting major mining investment by improving regulatory transparency while respecting provincial rights.

Major Miners Drive Argentina’s Mining Revival

Three of mining's biggest players committed billions to Argentina in 2024.

BHP ended a two-decade hiatus in July, partnering with Canada's Lundin Mining in a $3.25 billion buyout of Filo Corp (FIL.TO). The deal targets two copper mines along the Andes mountains bordering Chile.

That same month, Glencore paid USD$475 million to grab a 56.25% stake in the MARA Project from Pan American Silver Corp, taking full ownership of the project.

Rio Tinto followed in December with a USD$2.5 billion expansion of their Rincon lithium project - the company's first commercial-scale lithium operation. Rio's CEO Jakob Stausholm backed Milei's reforms, praising Argentina's "favourable economic policies" and "investment-friendly environment."

It’s a dramatic shift for Argentina, with Milei transforming the country from a mining backwater into a destination that's attracting the industry's heavyweights. For junior explorers, the message is clear: Argentina is open for business, and the majors are already betting big on its potential.

Small-Caps: Following The Major Money

While the big boys pour billions into Argentina, the real opportunity might lie with junior explorers. The country's vast deposits of gold, copper, silver, lithium, and zinc have positioned it among the world's most promising exploration destinations.

It’s perfect timing for junior miners with Argentina's economic reforms opening up capital markets, and the majors' sudden interest meaning any significant discovery could attract takeover attention.

Market forces are also aligning. Gold and silver prices continue to strengthen into 2025. Meanwhile, the global push for electrification has put Argentina's copper, lithium, and zinc deposits in the spotlight - you can't build a green economy without them.

Now, with Argentina's investment landscape stabilising and the majors marking their territory, we've identified the regions where junior explorers could strike it big.

Three Provinces Primed for Discovery

With all the positive sentiment changes towards mining in Argentina, you're probably thinking about which provinces present the best opportunity for small-cap explorers to see price appreciation. Don’t worry. We've got you covered.

San Juan: Copper Country

San Juan has caught the attention of mining powerhouses BHP and Lundin Mining. Perched high in the Andes along Chile's border, its mineral-rich geology boasts copper, gold, and silver deposits, and recent approvals to restart production facilities have cleared the path from discovery to development. For junior explorers, San Juan offers both the geology and the government support needed to succeed.

Santa Cruz: The Golden South

Deep in Patagonia, Santa Cruz has already proven its potential. AngloGold Ashanti's producing Cerro Vanguardia mine showcases what's possible here. The province's pro-mining government and rich gold-silver geology make it a prime target for exploration companies looking to replicate AngloGold's success.

Salta: Lithium's Heart

Sitting in the famous lithium triangle, Salta has transformed from prospective region to proven producer. Rio Tinto's billion-dollar Rincon Project demonstrates the scale of opportunity here. With abundant lithium brines and copper reserves, Salta has become a magnet for both exploration dollars and development capital.

Geologo Trader: The Expert On The Ground

To get beyond the headlines and press releases, we spoke with Jordan 🇦🇺 Webster, AKA Geólogo Trader 🇦🇺 , an Australian geologist working in Argentina. Be sure to follow Jordan’s Substack here and his X page here.

Jordan’s given us his unfiltered take on Argentina's mining transformation and revealed two stocks he believes are perfectly positioned for 2025.

"Since arriving, I've seen Milei eliminate one of Argentina’s biggest roadblocks to serious investment: the heavy-handed restrictions imposed by Kirchnerist protectionism. These policies strangled economic growth in the name of control. But with the introduction of the RIGI, Argentina has taken a major step toward attracting long-term capital.

With this barrier removed, pro-mining provinces like San Juan now have full federal support. The impact has been immediate - major investment commitments are rolling in, like the multi-billion-dollar Vicuña copper project, which is moving forward under the new RIGI framework.

The real opportunity, in my view, lies in being on the ground and identifying plays where the big money isn’t yet looking. Right now, everyone is chasing copper in San Juan - but how many listed companies are actively exploring for gold? San Juan is historically well-known for gold mining, and today, it’s home to Veladero (Barrick/Shandong), one of the largest gold mines in South America.

To be frank, I’m personally involved with a position in the company plus my own investments in two companies here because I see Argentina as one of the best places to generate real shareholder returns.

I believe Joseph van den Elsen is the right CEO to drive this forward - highly motivated, operating with a lean and cost-effective strategy, and backed by a strong network. He’s spent a decade in South America, speaks fluent Spanish, and understands the landscape better than most.

Pampa Metals (CSE: PM) X page here

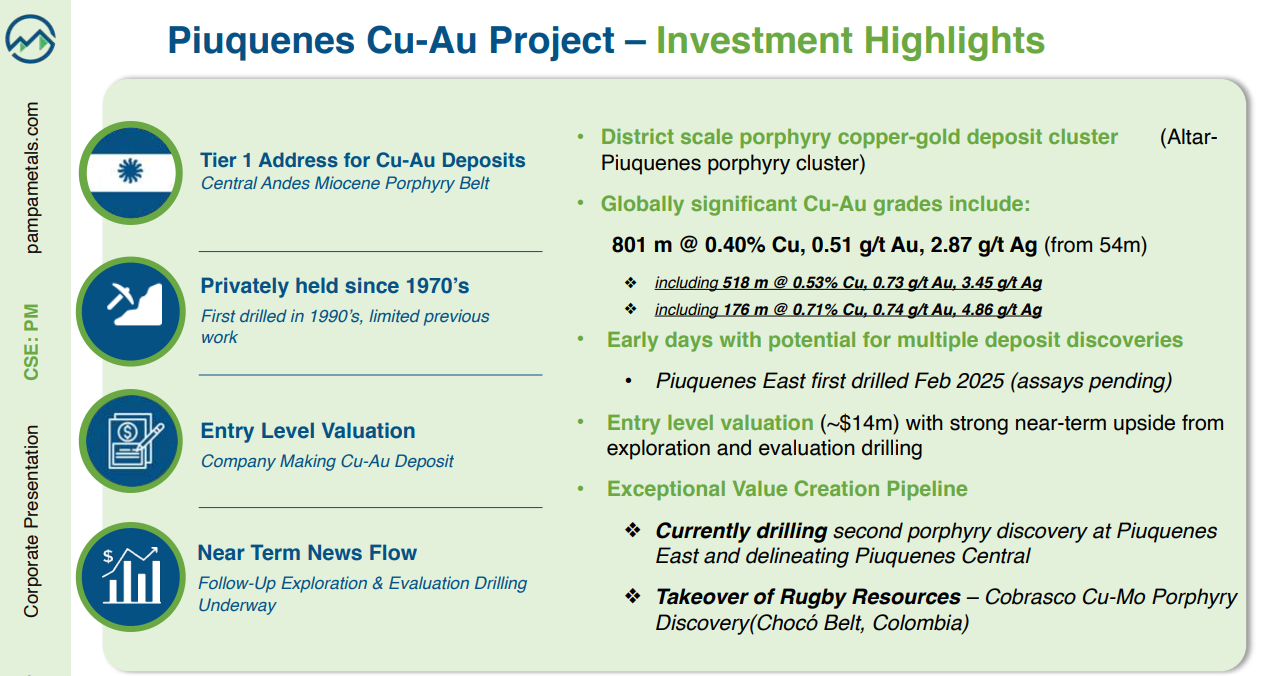

The most compelling opportunity I see is Pampa Metals. I’ll be straight up - once the Rugby Resources acquisition is finalised and Pampa moves to the ASX, it will be a unique three-asset copper play.

The proposed acquisition of Cobrasco in Colombia is huge. But on the Argentina side, the company’s current flagship project, Piuquenes in San Juan, is just as exciting.

The Piuquenes Opportunity

Piuquenes hosts two mineralised porphyries with massive upside potential. It sits directly next to Aldebaran Resources’ El Altar project, which boasts a market cap of over C$300M.

When I say “next to,” I mean literally over the hill - Pampa’s Piuquenes East porphyry, recently intercepted, is geologically the same system as Altar North, which sits on Aldebaran’s ground.

World-Class Copper-Gold Hits at Piuquenes Central

Since acquiring the project in 2023, Pampa Metals has delivered some impressive drill results:

· PIU01-2024DDH: 422m @ 0.48% Cu, 0.61 g/t Au (198m-620m)

· PIU02-2024DDH: 448m @ 0.42% Cu, 0.46 g/t Au (214m-662m)

· PIU03-2024DDH: 801m @ 0.40% Cu, 0.51 g/t Au (54m-855m EOH)

· PIU16-01DDH: 558m @ 0.38% Cu, 0.42 g/t Au (362m–920m EOH)

With a strong geological setting, direct proximity to a multi-hundred-million-dollar project, and Argentina finally opening its doors to foreign capital, Pampa Metals is one to watch.

Ronin Resources (ASX: RON) X page here

Ronin is in a great position - sitting on ~$3.4 million in cash (after its latest raise) and backed by a rock-solid shareholder register, including Tolga Kumova, Tim Neesham (CPS Capital Group), Joe (Chairman), Anthony Manini, and Faldi Ismail (Kaai Capital).

Being ASX-listed is a major advantage for those who understand the recent trend of market dynamics in mineral exploration.

Ronin is actively hunting for gold projects in San Juan, leveraging strong local connections built through boots-on-the-ground experience. With a clear strategy and major backers, this is one of the strongest shareholder bases you’ll find in a A$6M market cap company.”

The Wrap

Argentina's transformation has been swift and dramatic. A country that major miners abandoned just twelve months ago is now attracting billions in fresh investment.

Milei's reforms have done more than just remove barriers - they've rewritten Argentina's investment story, and the majors are diving in deep with multi-billion dollar commitments.

The next chapter belongs to the junior explorers. With Rio Tinto, BHP, and Glencore marking their territory, well-positioned small-caps could be next in line for a significant re-rate.

The window of opportunity won't stay open forever. The majors are betting big on Argentina's mineral wealth - the smart money is already moving in.

Vamos!