Virgin Ground Between Two Giants: Our New Gold Play

With gold approaching record highs and China's antimony ban sending prices soaring, this $5.5m ASX explorer caught our eye...

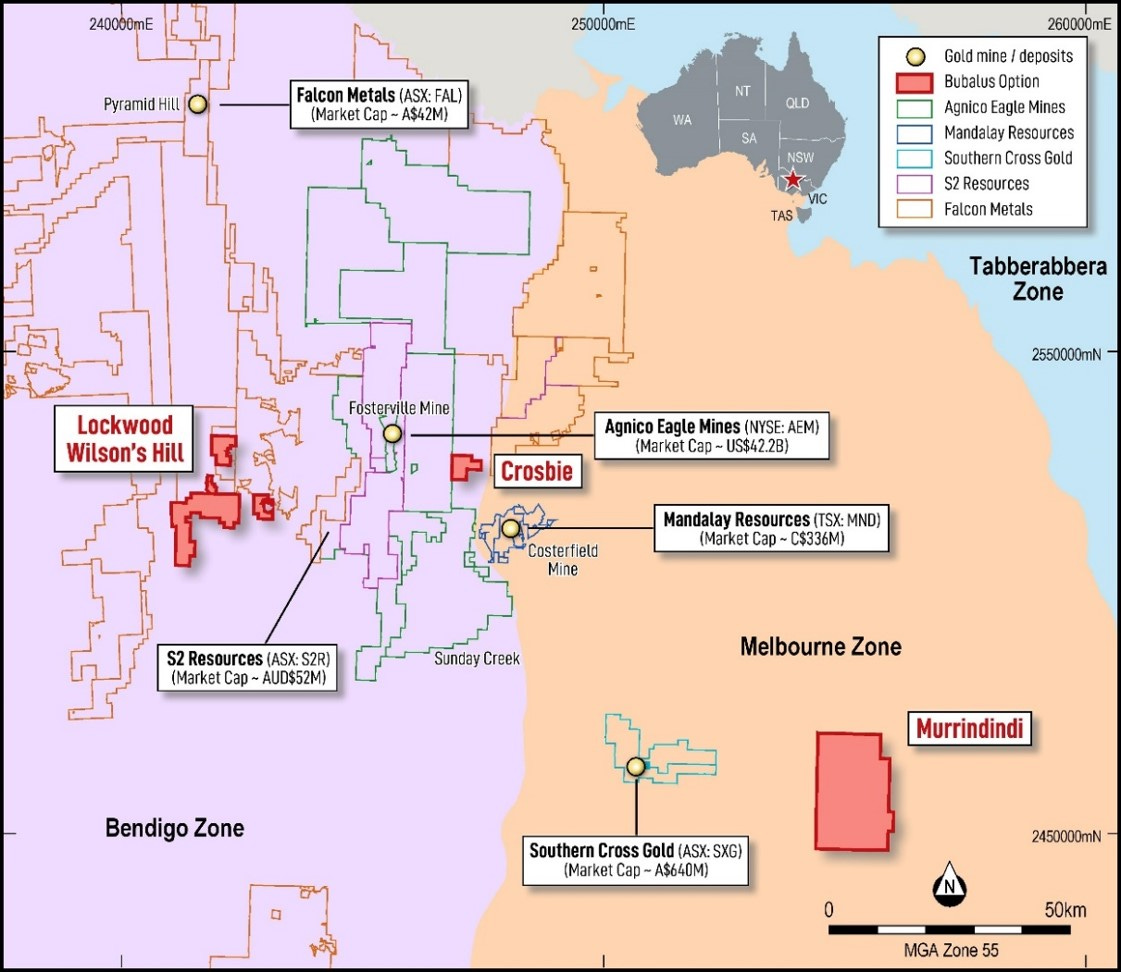

Between two of Australia's highest-grade producing gold mines sits untested ground and a tiny explorer ready to drill.

Meet Bubalus Resources (ASX: BUS), our newest portfolio addition.

At just 11.5 cents per share and $5.5 million market cap, BUS offers a cheap entry into a proven region for high-grade gold, with large potential upside.

The company's primary target at their new project, Crosbie, has never seen a drill bit despite rock chips already returning grades up to an impressive 19.1 g/t gold.

This timing feels perfect. Gold is approaching record highs with many experts eyeing US$3,000/oz in 2025, while the recent $5 billion takeover of De Grey Mining has highlighted the appetite for quality Australian gold assets.

The recent addition of local geologist Brendan Borg to the board also brings over 28 years of experience in mineral exploration and development. With permits secured and targets defined, his local knowledge could prove invaluable as the drills prepare to turn.

With BUS, we're drawn to the combination of proven high-grade territory, experienced local leadership, and how close they are to drilling. Add $3.5 million in cash, geology that mirrors Fosterville, and the bonus of antimony potential - we believe BUS is positioned for a serious re-rate in the coming months.

We're backing up the proverbial BUS by buying on market today. With drilling about to start, we're keen to see if this advanced gold explorer can become Australia's next significant gold find.

The Right Geology at the Right Time

The main target for BUS is the Crosbie prospect, nestled between two giants of Australian gold mining.

To one side sits Fosterville, a 4.5-million-ounce deposit at 4.3 g/t gold. On the other side sits Costerfield, Australia's second-highest-grade gold mine at 9.8 g/t.

All three sit in Victoria's renowned Bendigo zone, a region famous for its high-grade gold systems.

Recent surveys at Crosbie have found what you want to see in gold exploration - exposed granite connected with areas underground (chargeability anomalies) and quartz vein systems. The team has identified features that mirror Fosterville's geological setting.

For those that are unfamiliar with Victorian geology, granite intrusions are like natural gold-making engines. The formations act as heat and fluid sources and drive the formation of gold-bearing quartz veins.

At Crosbie, the presence of specific geological markers called aplite dykes, formed during the cooling and solidification of magma below the surface, supports the presence of a system capable of generating a similar gold deposit. These features strongly suggest the system below the earth's surface would act as a natural gold delivery network, similar to what's seen at Fosterville.

To put in layman’s terms, magma flowing beneath the earth's surface millions of years ago created gold veins at Fosterville.

Crosbie is showing all the hallmarks of that same system, and it's never been drilled.

Top 5 Reasons We’re Backing BUS

Strategic Location Near High-Grade Mines

There's an old saying in gold exploration: "If you want to find gold, go where it's already been found." With Crosbie's prime position and virgin ground status, there’s no better testing ground.

As mentioned, it lies between two of the top ten highest-grade producing gold mines in Australia.

Costerfield is the second-highest-grade-producing gold mine in Australia; Fosterville comes in ninth. It’s impressive territory.

Costerfield and Fosterville's success shows just how fertile this region is for high-grade gold. Two producing mines nearby also means established roads, power, and processing facilities - practical advantages that can make a huge difference in turning a discovery into a future mine

BUS is in the best location for a junior to be drilling for gold targets, and offers shareholders a sizeable potential upside on any discovery.

Strong Early Stage Indicators

You'd be forgiven for thinking BUS is just starting out, given the $8 million market cap. But the technical work completed to date tells an exciting story.

Rock chip sampling has returned grades up to 19.1 grams per tonne and 1.1% antimony, indicating to us that even though BUS has only scratched the surface, the signs are positive.

Read Bubalus Resources’ investor presentation

BUS has also conducted geophysical surveys to see if any targets lie beneath. The survey highlighted large chargeable anomalies, which means that significant deposits may lay below the surface.

With strong exploration potential in two commodities that are in favour, gold and antimony, we believe all the right ingredients are there for a potential discovery.

Drill Ready Status

BUS already has permits to drill and native title approval from a private landholder. A huge tick in our eyes.

Many small-cap explorers define targets and then have to wait months, sometimes years, to get permission to drill. That's not the case for BUS; they'll be able to drill as soon as they see fit.

As small-cap investors, we want to see action. Being drill-ready, with permits in hand, makes our eyes light up. We don't want to wait around and open ourselves up to market conditions. With gold prices surging and China's antimony ban sending shockwaves through the market, BUS can strike while the iron is hot.

The existing tracks and secured permits mean they could be testing these promising targets within months, giving investors early access to what could be Victoria's next significant gold story.

Diverse Resource Potential

The gold story alone is compelling enough. With geopolitical tensions rising, wars erupting, and Western countries eyeing interest rate cuts, gold's traditional role as a safe haven has only strengthened. The metal's 30% rise this year could be just the beginning, with experts eyeing US$3,000/oz in 2025.

Add in that many Western countries are looking to lower interest rates, possibly driving inflation, and gold's outlook becomes even more appealing. The combination of global instability and potential inflation creates perfect conditions for gold over the next 12-18 months.

While gold remains the main event, antimony has emerged as an intriguing second act. For those unfamiliar with antimony, this critical metal plays a crucial role in modern manufacturing - from flame retardants and semiconductors to ammunition, glass, and alloy strengthening.

What makes antimony particularly valuable right now is China's recent market-shifting decision. The world's largest producer began limiting exports in September 2024 before completely banning exports to the US last week, citing national security reasons.

With gold up 30% this year and showing no signs of slowing, plus antimony prices soaring 300% on China's export ban, the Crosbie target offers exceptional value. It's rare to find exposure to two strengthening commodities in one tiny explorer, especially in a region known for hosting both metals.

Experienced Local Leadership

With a change of management adding Brendan Borg to the team, BUS has brought in an experienced, well-credentialed geologist with decades of experience.

Brendan brings what you want to see in a Victorian gold play - a track record spanning major discoveries, successful capital raisings, offtakes and even takeovers.

With the new tenements being located in Victoria, it is comforting to know that Brendan lives only a couple hours' drive from the project.

Having someone who lives close by, understands the geology, and can build relationships with local stakeholders positions BUS well for what lies ahead.

You rarely find this combination in a small-cap explorer:

Proven high-grade territory between two producing mines

Two commodities with strong price momentum

Experienced local leadership

Drill-ready status with all permits secured

$3.5 million in cash to fund exploration

Just $5.5 million market cap

The potential here reminds us of other Victorian success stories. Take Southern Cross Gold (ASX: SXG) - they've run from a 20c IPO to $3.50 by uncovering high-grade gold.

With drilling soon and two red-hot commodities in their sights, we're backing BUS to write their own Victorian gold success story. At 11.5c a share, the current valuation could prove compelling in a proven gold region, especially given the geological similarities to Fosterville and the bonus of antimony potential.

We're buyers on market today and look forward to covering BUS' progress as they begin testing these promising targets. With proven ground, strong leadership, and exposure to two strengthening commodities, we believe the coming months could prove transformative for this advanced gold explorer.