AZ9 Adds Another Piece to the Mongolian Puzzle

Asian Battery Metals grabs fresh ground directly next to Oval - adding another layer to a copper-nickel story that’s quickly gaining scale

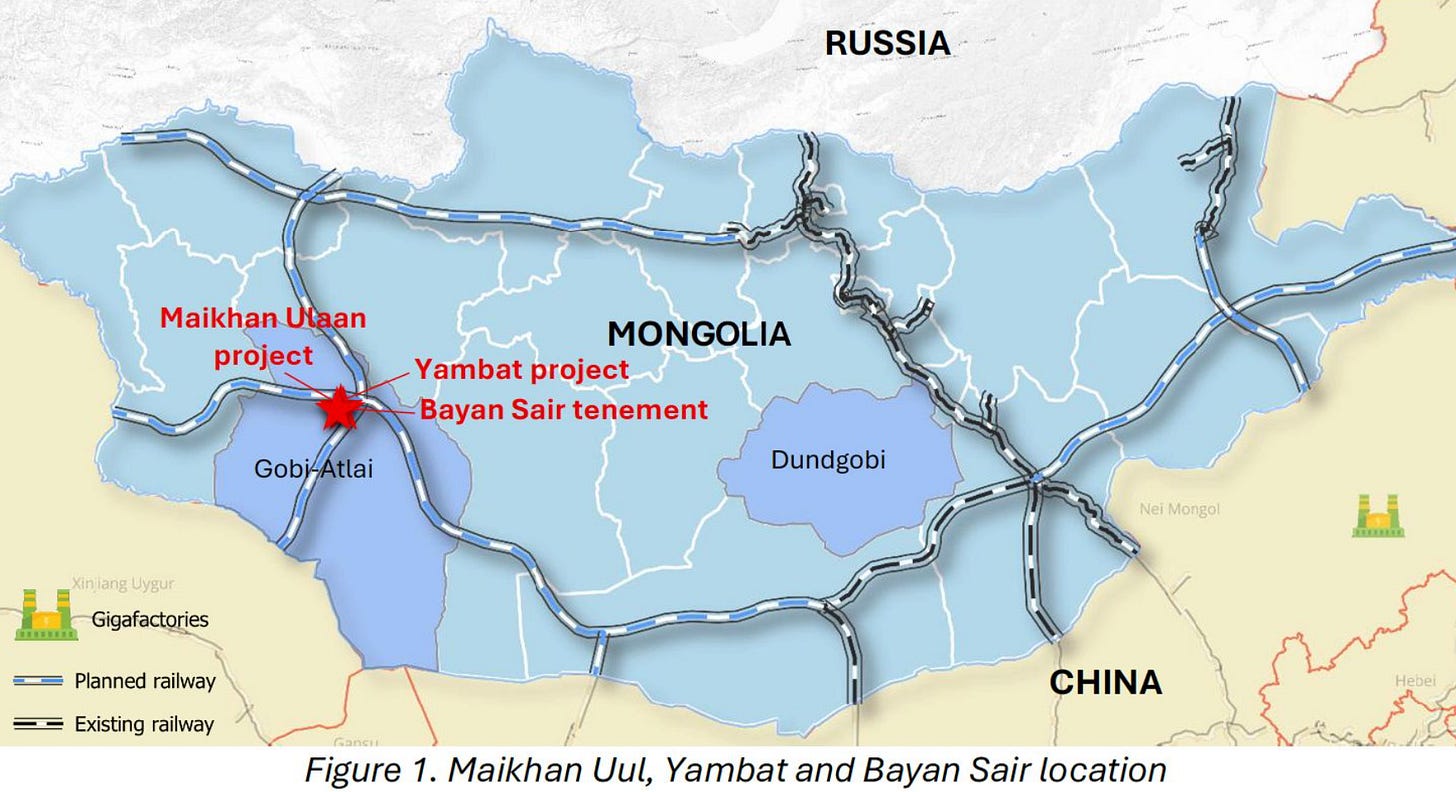

Asian Battery Metals (ASX: AZ9) has added another project to its portfolio on the doorstep of its flagship Oval copper discovery in Mongolia.

The company has picked up an exclusive option over the Maikhan Uul copper-gold project, a project with a foreign resource, just 8 kilometres from its copper-nickel Oval project.

For a $16M explorer with $4 million cash at bank, picking up ground in Mongolia’s South Gobi copper belt is a calculated swing. This is an astute way for AZ9 to grow their footprint around proven geology without stretching the balance sheet.

It also points to confidence in the area as it fits a simple strategy - if you think you’re onto a big system, grab the land around it before someone else does.

With fresh geophysics and drill rigs potentially on the horizon, the question now is whether this small-cap can turn a modest resource into a market-moving story.

Why it Matters

Maikhan Uul comes with a mining licence locked in through 2045. That means no bureaucratic grind before the first drill rig turns, which is a big tick for a junior.

Historical drilling has hit shallow copper and gold down to about 200 metres, with multiple mineralised zones that remain open at depth, another big tick in our eyes.

Back in 2015, drilling proved up a foreign resource estimate at around 5Mt @ 0.58% copper and 0.16 g/t gold.

It doesn’t count under JORC code, the standard at which resources are measured, but it shows the ground has already coughed up numbers worth chasing.

This agreement also gives AZ9 exposure to a copper-gold asset, a hot commodity in Mongolia given the recent in-country $160 million takeover of Xanadu Mines by Bastion Mining.

“The Maikhan Uul Cu-Au Project is a natural extension of our regional copper-focused exploration strategy and is strongly synergistic with our existing Oval Cu-Ni discovery”

- Asian Battery Metals Managing Director, Gan-Ochir Zunduisuren

Fitting it Into the Oval Story

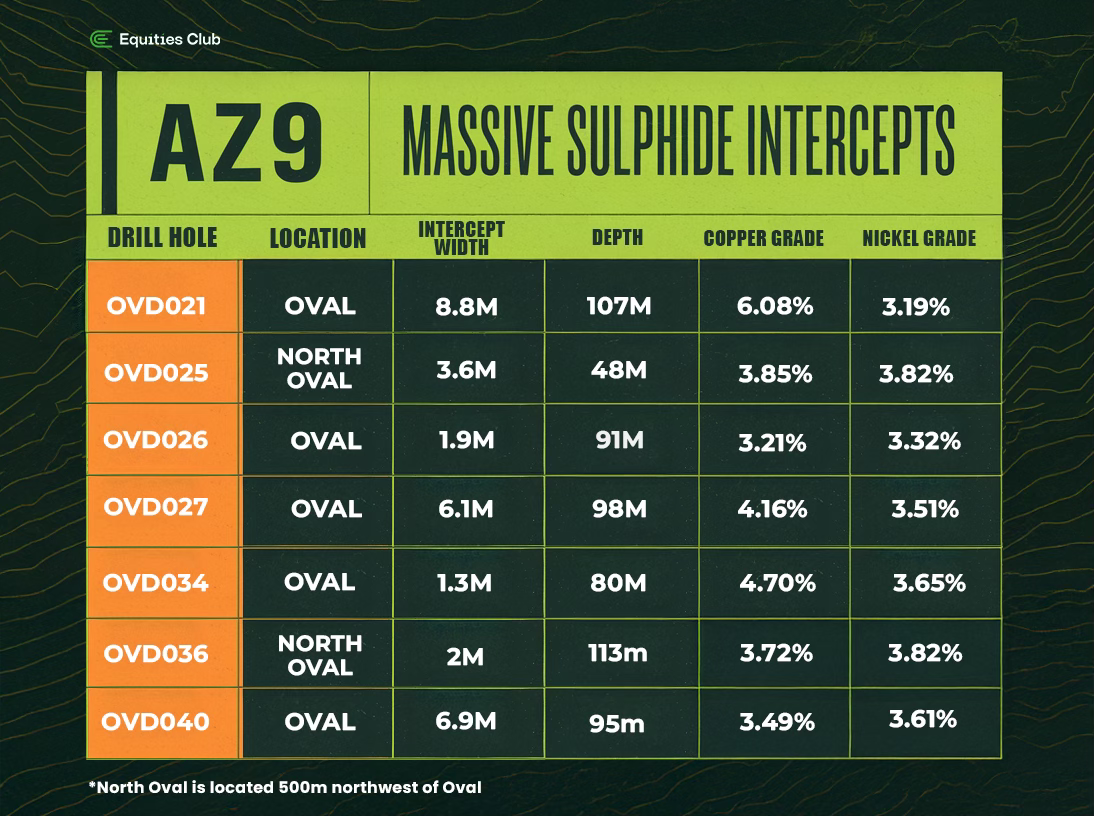

AZ9 has spent the past couple of years steadily proving that the Oval project is a serious copper-nickel find - seven shallow sulphide hits above 3% copper and 3% nickel, plus broad zones of bulk tonnage.

Adding Maikhan Uul next door gives them another project with an established licence and known mineralisation.

This also adds gold to the AZ9 story, with the potential to improve on previous drilling at Maikhan Uul very possible in the near term.

If drilling later this year validates those old numbers, it adds weight to the idea that Oval sits inside a bigger mineralised district.

New Ground to the South

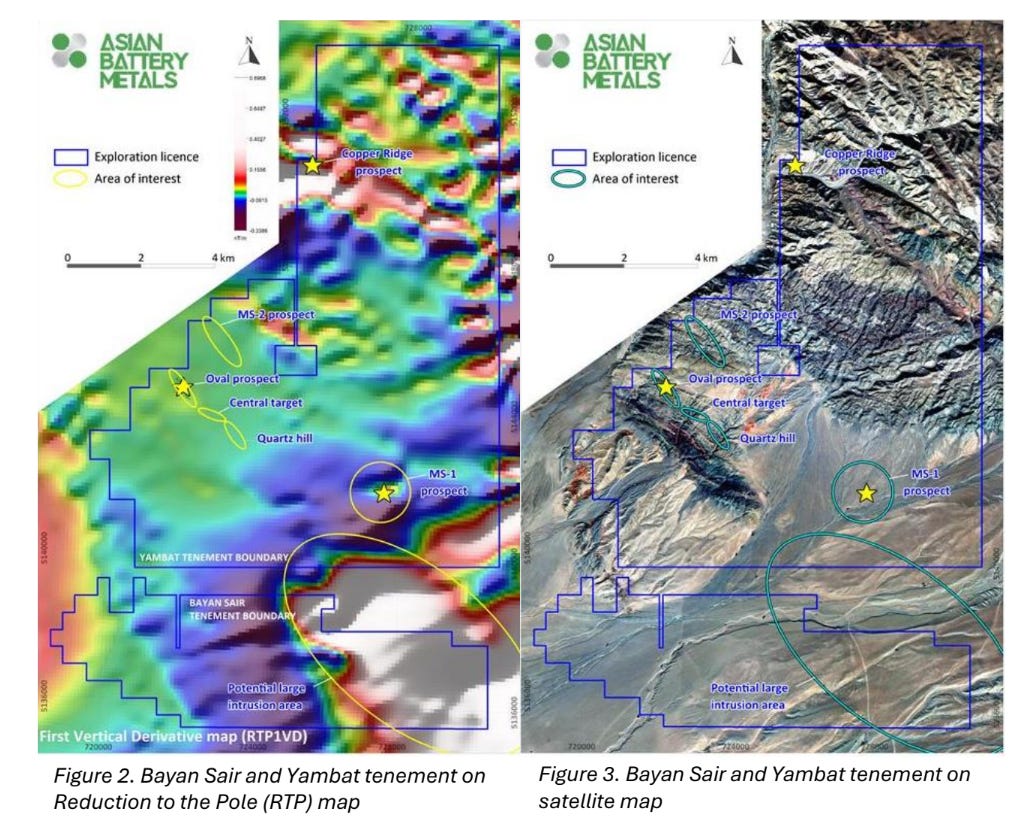

Alongside Maikhan Uul, AZ9 also secured a new 3,300-hectare exploration licence called Bayan Sair.

It covers a regional magnetic anomaly, which is the kind of geophysical feature that often points to more intrusions below surface. Basically, it’s another chance to find something big in the same neighbourhood.

First-pass geophysics is planned later this year to see what sits under cover.

Regional magnetic surveys suggest it could link into the same intrusive system that hosts Oval.

More ground, more targets.

Funded and Active

AZ9 is still sitting on more than $4M cash, plenty to move on all three fronts - continued drilling at Oval, due diligence at Maikhan Uul and early-stage exploration at Bayan Sair.

The deal’s set up so they only spend big if the first drilling looks good. $50,000 upfront for six months to kick the tyres, then $890,000 if they like what they see after drilling in Q3.

It’s a methodical build. Oval remains the headline act, but now there’s another copper-gold project with a long licence life, plus fresh ground waiting to be tested.

With copper markets tight and Mongolia right on China’s doorstep, AZ9 is stacking the odds in its favour by building a district rather than betting on a single hole.