AZ9 Delivers Again With High-Grade Massive Sulphide Hits

Further high-grade copper-nickel hits for AZ9 as their Oval Discovery continues to take shape

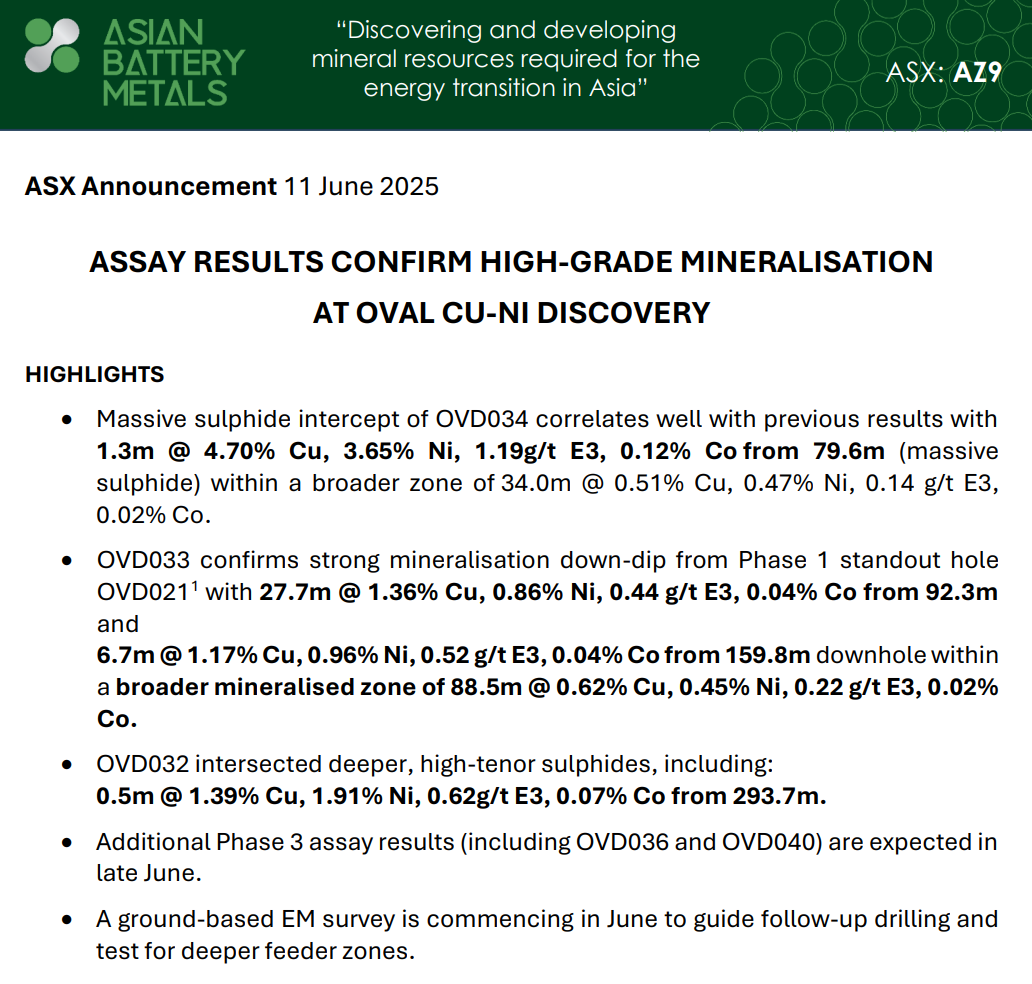

Asian Battery Metals (ASX: AZ9) dropped another round of strong assay results from the Oval copper-nickel discovery in Mongolia this morning.

For an $11 million explorer trading at 2.9 cents, the Phase 3 drilling results mark a meaningful step in de-risking what now looks like a large-scale, high-grade system.

These new hits show consistent massive sulphide zones, broader mineralised envelopes, and, crucially, early signs of a deeper source that could hold the real prize.

For a junior explorer with such a modest market capitalisation, these results represent the kind of de-risking that turns early-stage discoveries into something much more substantial.

Massive Sulphides Still Hitting

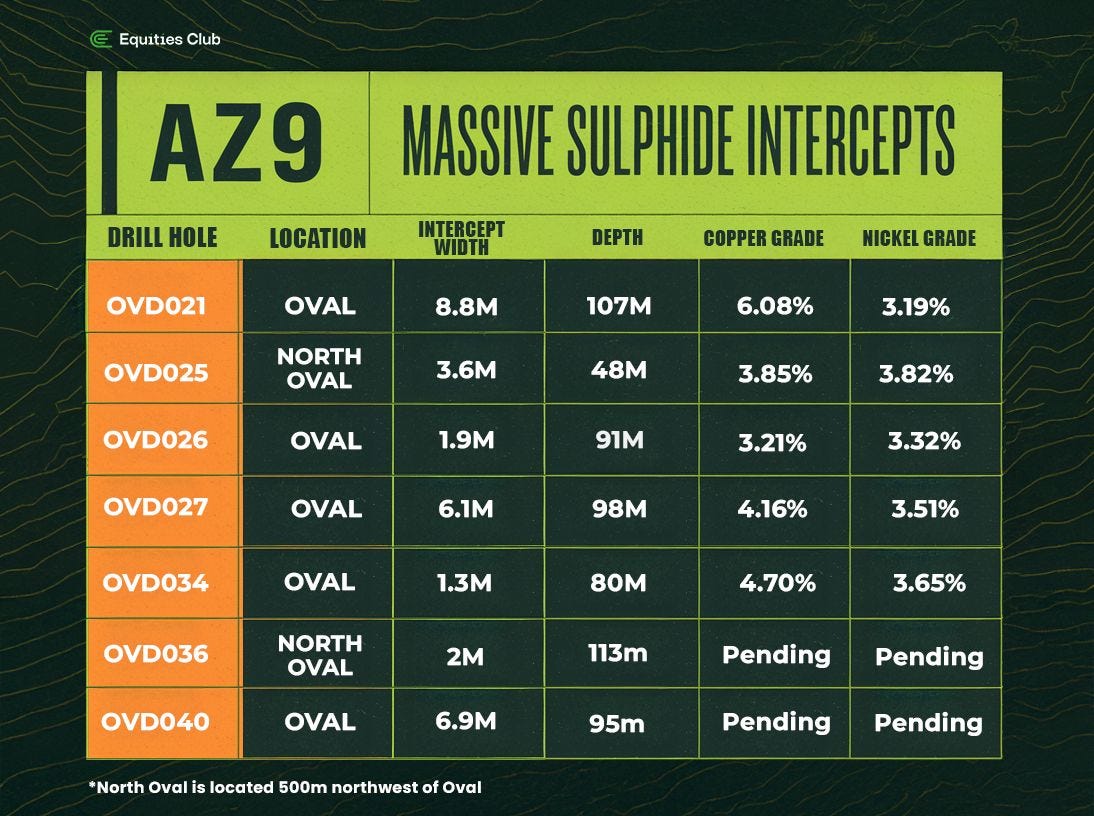

Standout result: OVD034 intercepted 1.3 metres of massive sulphide grading 4.70% copper and 3.65% nickel from 79.6 metres within a 34m zone averaging 0.51% copper and 0.47% nickel.

This lines up with OVD026’s earlier hit, confirming the northern extension of the system.

The consistency of these massive sulphide hits, rich in chalcopyrite and pyrrhotite, copper bearing metals across 500 metres is a big deal. These dense, metal-rich zones are what explorers dream of.

For those unfamiliar with mining terminology, massive sulphides represent the holy grail of copper-nickel exploration.

Unlike disseminated mineralisation, where the metal-bearing minerals are scattered throughout the rock, massive sulphides are essentially solid chunks of metal-rich minerals with minimal waste rock in between.

This makes them exceptionally valuable because they can be mined efficiently and processed easily, leading to high-grade concentrates that command premium prices from smelters.

Thick Zones Highlight System Scale

OVD033 delivered something different but just as interesting: 88.5 metres at 0.62% copper and 0.45% nickel from 79 metres, with several high-grade intervals like 27.7 metres at 1.36% copper.

This is the sort of bulk tonnage that underpins long-life operations. That kind of consistency is key for miners designing efficient operations.

What’s encouraging here is the continuity. When you’re seeing mineralisation across this kind of thickness, it suggests multiple pulses of metal-rich magma have contributed to build up this extensive zone. The higher-grade zones at different depths indicate there’s enough complexity and metal here to justify detailed resource drilling.

The fact that higher-grade zones occur at different depths within this broad envelope indicates the system has sufficient complexity and metal endowment to support detailed resource definition drilling.

Deeper Drilling Hints at the Source

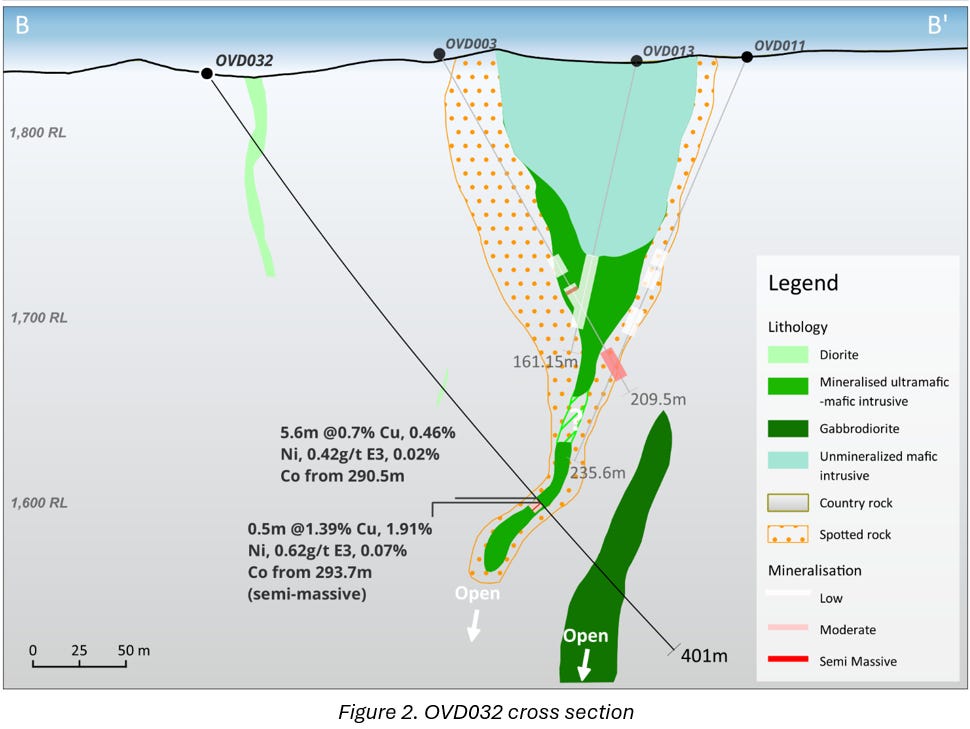

The most intriguing result from this batch comes from the deepest hole in the program, OVD032, which intersected sulphide mineralisation from 290.5 metres depth, including a standout 0.5-metre interval grading 1.39% copper, 1.91% nickel.

This deeper mineralisation could be part of a feeder system – essentially the plumbing that supplied all the metal-rich magma to the main Oval intrusion above.

Feeder systems are particularly valuable in copper-nickel exploration because they often contain the highest-grade mineralisation and can extend to significant depths, providing the potential for much larger mineral resources than the main intrusive bodies they feed.

If confirmed, this feeder could house the highest grades and the bulk of Oval’s metal endowment. It’s now a top priority for follow-up drilling, potentially unlocking a much larger system than previously scoped.

Systematic Approach Paying Off

AZ9’s methodical approach to exploring Oval keeps delivering, with each new round of drilling adding pieces to the geological puzzle while confirming the scale and consistency of the mineralised system.

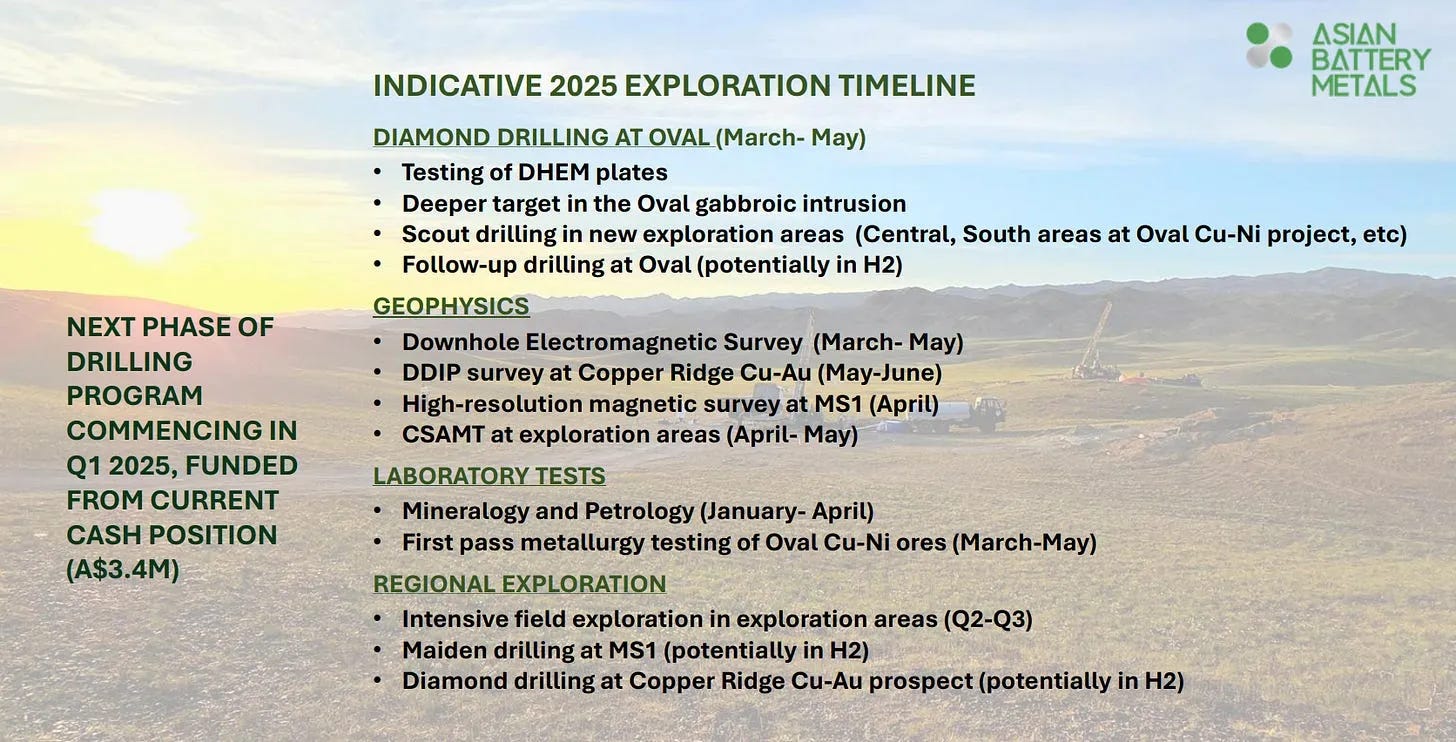

With 16 diamond holes drilled to a total of 2,940 metres, downhole EM on all of them, confidence is growing. The next step is a Samson EM ground survey to map broader conductors, guiding the next round of targets with greater precision.

With funding in place through 2025, there’s no pressure to rush. Instead, the team can focus on smart, incremental exploration that adds value with every metre drilled.

As investors, we love this.

Momentum is Building

The timing’s cherry ripe for a discovery of this calibre, with copper prices remaining strong due to supply constraints and growing demand from the global energy transition, while nickel prices have stabilised after the volatility of recent years.

Mongolia’s got established mining infrastructure and sits right next door to China – the world’s largest consumer of these metals. That gives AZ9 serious advantages compared to discoveries in more remote locations.

Technical success, decent market conditions, and strategic location are the foundation for what could become a company-making discovery as the exploration program continues to deliver results through the remainder of 2025.