AZ9 Delivers World-Class Recovery Rates

The lab results are in, and they're better than anyone expected. AZ9's Oval discovery just posted copper recoveries that the majors will love

Asian Battery Metals (ASX: AZ9) just delivered first-pass metallurgy results that put them in rare company.

With AZ9 trading at just 3.2c and a market capitalisation of $13 million, the market is yet to fully appreciate this copper-nickel discovery in Mongolia.

Metallurgy and recovery rates are usually the silent project killer in early-stage copper and nickel discoveries, but today’s results help solidify AZ9’s standing as a world-class deposit.

AZ9 now ranks among the world’s top copper mines (and hopefuls) in terms of recovery, placing this small-cap minnow in the headlights of many mining majors.

With several high-grade copper hits already in the bag and follow-up drilling underway, these recovery rates remove a major technical risk while the world scrambles for more copper.

The Numbers That Make or Break a Mine

Recovery rates are simply the percentage of metal you can actually extract from the rock and turn into a saleable product.

If a drill sample contains copper, recovery measures how much of that copper ends up in the final product once the raw dirt has been processed.

The 90%+ recovery rate that AZ9 has achieved means that nine out of every ten units of copper in the ground can be turned into something the company can sell. That's exceptional for first-pass testing.

Higher recoveries translate to more dollars in the door from every tonne mined and lower risk that the economics of a project fall over.

“These early results are highly encouraging, confirming that copper from Oval can be recovered at very high levels using a simple flotation process. This gives us confidence that Oval can generate a clean, marketable copper concentrate.”

Managing Director - Gan-Ochir Zunduisuren

What AZ9 Actually Found

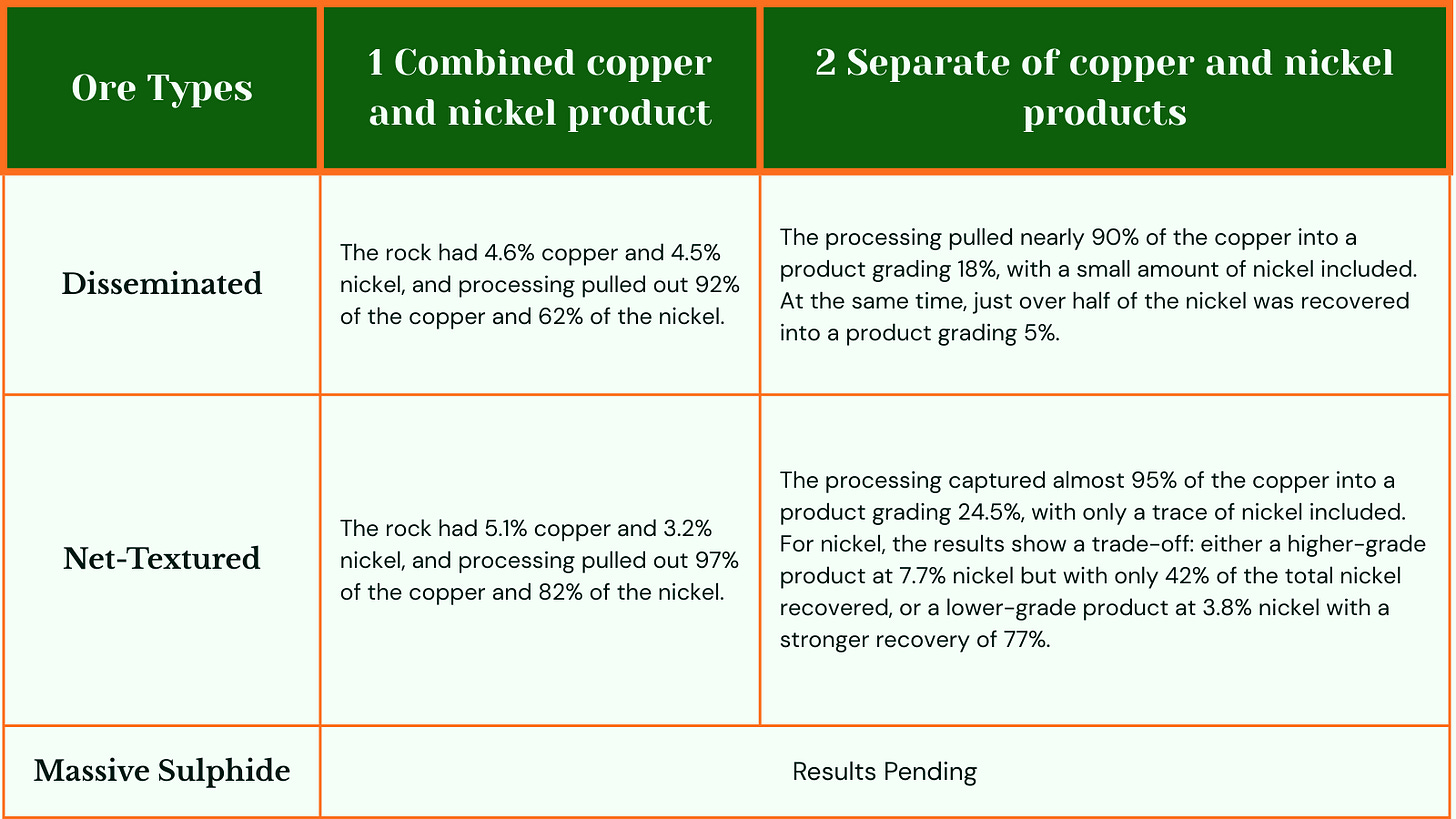

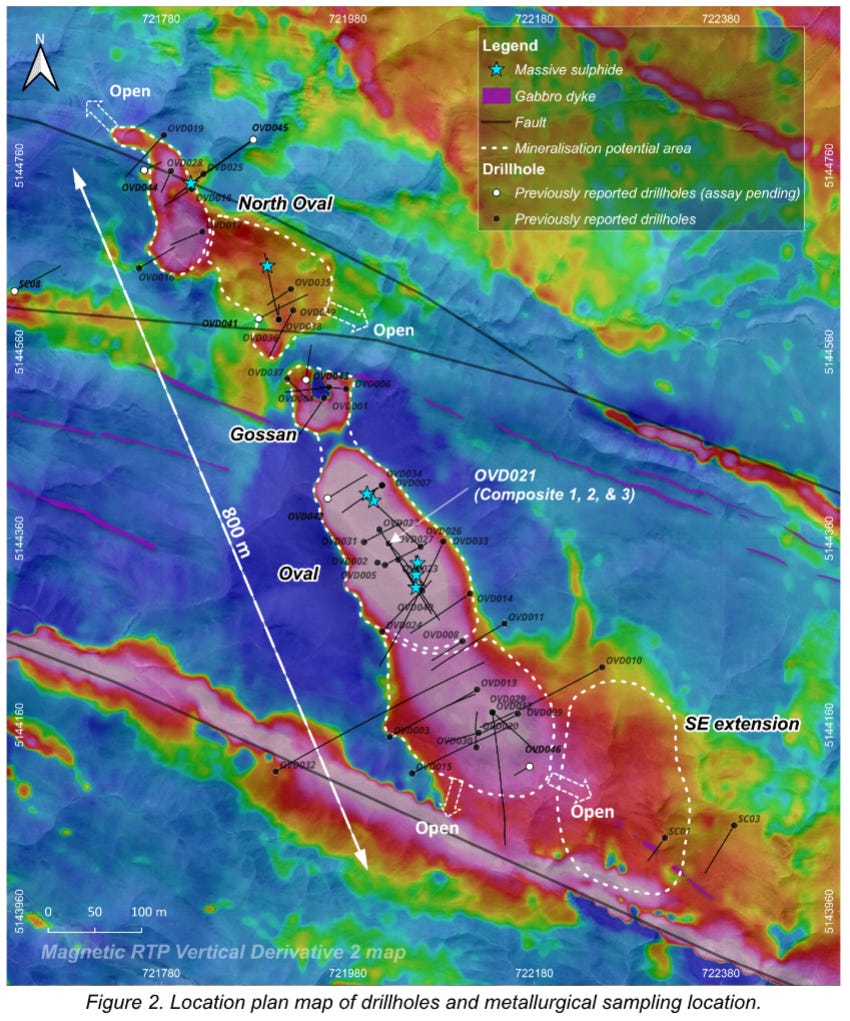

Over the past year of drilling, AZ9 has intersected disseminated, net-textured, and massive sulphide mineralisation - basically three different styles of copper and nickel in the rock at Oval.

The company sent three representative samples, totalling 112kg, from Oval in Mongolia to ALS Metallurgy in Perth for processing. The tests split the copper and nickel into two distinct products, with recovery rates for both.

Disseminated Sample

This sample produced a copper concentrate grading 18.2% Cu at 89.3% copper recovery, alongside a nickel concentrate grading 5.3% Ni at 55.4% recovery.

In plain terms, AZ9 pulled nearly 90% of the copper out of lower-grade disseminated rock into a product strong enough to sell, while also recovering about half of the nickel.

Net-textured Sample

This sample returned a copper concentrate grading 24.5% Cu at 94.9% recovery, with nickel concentrate ranging from 7.7% Ni at 41.6% recovery to 3.8% Ni at 77.2% recovery.

AZ9 captured nearly all of the copper in the net-textured rock into a product around 25% pure. The nickel showed they could either produce less volume at higher grade or more volume at lower grade, depending on what the market wants.

Massive Sulphide Sample

Still under test and results are expected in Q4 2025.

How Oval Stacks Up Globally

Metallurgy is best understood by comparison, and Oval’s results already sit in the same ballpark as some of the most established mining operations globally.

Oval’s copper recovery is already at the top end of the peer group, yet its valuation remains only a fraction of projects that are further behind in the development pipeline.

We dug a bit deeper and if AZ9 was to put these results in a feasibility study, the 95% copper recovery rate would rank it in the top 10 reported copper deposits globally.

Oval’s copper recovery rates of up to 95% put it alongside the best in the business for a discovery of this size and stage.

Why This Matters

Today's interim metallurgy tells you whether this deposit has legs.

If the early signs are poor, the odds of improvement later are slim. If they're strong, history shows the numbers usually hold or improve as the process is refined.

AZ9 now has confirmation that Oval's copper mineralisation responds well to a simple flotation circuit. This is the same process used by most sulphide copper mines globally, which means no exotic reagents, no untested technology, and no major processing curveballs.

Simple, effective, and cheap – meaning a potentially cleaner path towards scoping, feasibility work, and hopefully, production.

And for the technical crowd, smelters want copper grades above 20%, and AZ9 has already hit that mark with strong recoveries, meaning more copper converted into cash.

The nickel still needs fine-tuning, but lab work can improve both its purity and recovery. The main product here, the copper, is already well above target.

The Upside From Here

Many early test results understate a deposit's final potential, so there's room to improve on already strong numbers. Grind size, flotation time, reagent suite, and cleaning stages are all levers to pull.

For those wondering what that means: the lab can tweak dozens of variables to squeeze out better recoveries. Think of it like tuning a car, you're adjusting settings to get optimal performance.

Copper's already excellent, so the main upside lies with nickel. The outlook is positive, with any tweaks likely to push the recovery rates higher.

What History Tells Us

The legendary Nova discovery improved nickel recovery significantly once they dialled in the processing after starting production.

In Canada, Voisey’s Bay achieved consistent recoveries only after tailoring circuits to its ore domains.

AZ9 is working on a mineralogy study to understand how the copper and nickel minerals are locked in the rock. This will guide how the processing can be fine-tuned to lift the already impressive recoveries.

What Happens Next

AZ9 has plenty in the pipeline over the next few months, giving investors a steady stream of potential share price catalysts:

Mineralogy results – The detailed look at how copper and nickel minerals are locked in the rock.

Metallurgical testing – Further lab work with refined settings to lift recoveries and concentrate quality.

Drill assays – New results from the current drill campaign at Oval.

Geophysics – Further work to help guide future drilling at Yambat and Bayan Sair.

Due diligence – Ongoing review of the recetly acquired Maikhan Uul VMS copper-gold project, which could add another feather to AZ9’s portfolio.

Metallurgy is a value lever, not a risk

The biggest takeaway from today is that metallurgy is no longer an unknown for AZ9.

First-pass copper recoveries of 89–95% and concentrate grades of 18–25% Cu put Oval in the same league as global majors.

At a share price of just 3.2c and a market value near $13 million, the market isn't pricing in any credit for this technical de-risking. The geophysics, the drilling success and the metallurgy results show a well-executed exploration program from management.

With rigs turning and assays due, the metallurgy results give investors a strong foundation of confidence that Oval can grow into a development-ready discovery without processing risk pulling the rug out later.

The market might still see AZ9 as a 3.2c spec, but today's results put them in conversation with deposits worth multiples of their current valuation. Sometimes the best opportunities are hiding in plain sight.