AZ9 Unearths a Copper Monster in Mongolia

Asian Battery Metals hits massive sulphide intercept at shallow depth, just as copper giants are scrambling for supply

Asian Battery Metals (ASX: AZ9) released something exceptional today - a globally significant copper discovery. This isn't just another drill result, this discovery is the kind that catapults a junior explorer’s share price.

Discoveries of this calibre are rare. We're talking once-a-decade type stuff.

The Numbers That Matter

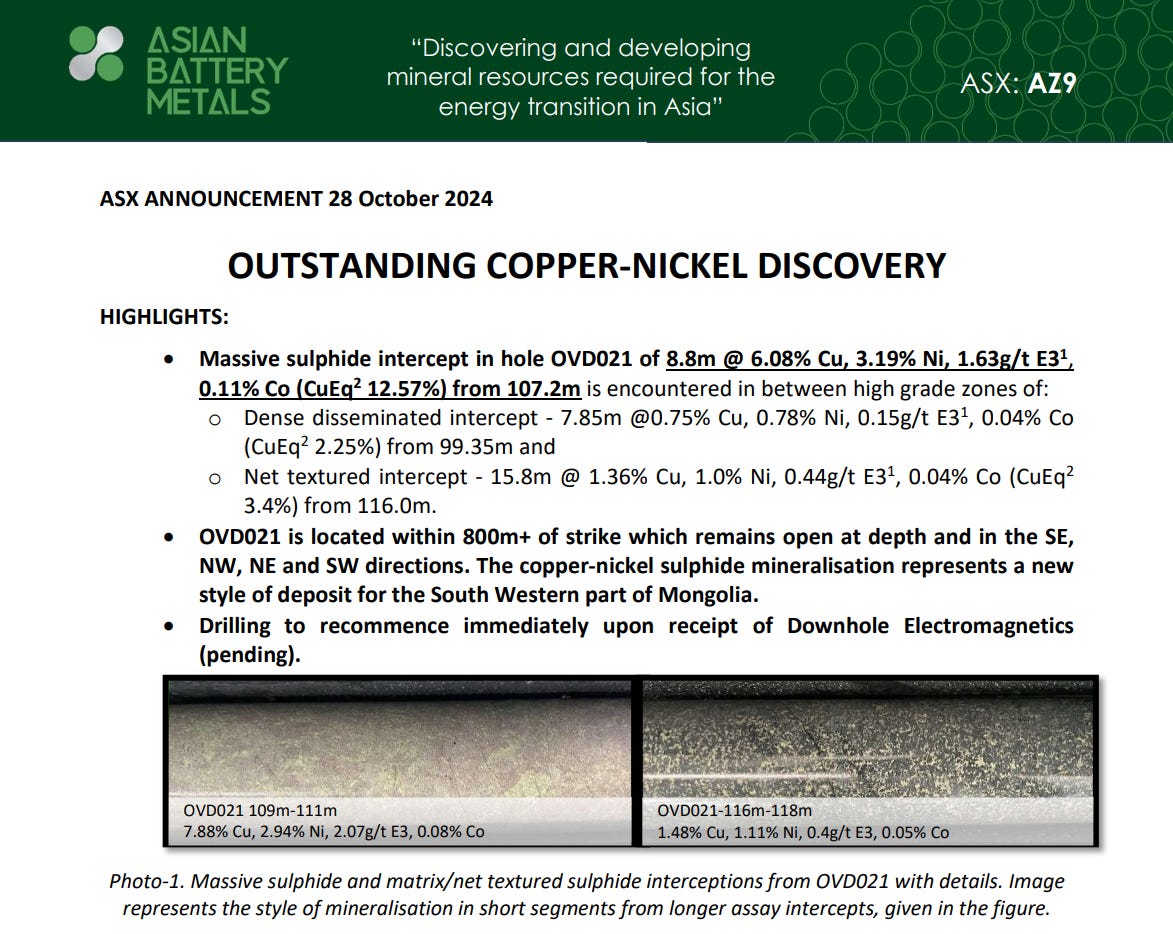

AZ9 uncovered 8.8 metres of massive sulphide at 6.08% copper and 3.19% nickel, with PGE’s from 107 metres deep at their Oval target in Mongolia.

The result is so rare that we scoured global exploration databases, these databases capture all drill results ever recorded, looking for intercepts similar to those of AZ9:

Copper grade above 6%

Nickel grade above 3%

Interval length over 8m

Drill depth less than 1000m (AZ9 is only 107m deep)

Nothing came close to these numbers. Not in the past decade, not anywhere in the world. It's one of the highest-grade intercepts ever recorded.

To put that in perspective, most copper mines are working with grades between 0.3% and 1.5%. This isn't just good; it's an absolute standout. These are grades and scale reminiscent of discoveries like Sirius Resources' Nova or Sandfire's DeGrussa – the kind of finds that made billion dollar companies out of junior explorers.

Finding a company like AZ9 with strong management, in a proven mining jurisdiction, with significant exploration upside sitting on grades like this - all for 4.3c a share with a $25M market cap? That doesn't happen often.

The potential here is measured in billions, not millions. That's why we've invested.

“It is an exceptional result that shows the mineralisation system at Oval has potential for hosting a substantial deposit with a higher grade zone of copper and nickel.”

- AZ9 Managing Director Gan-Ochir Zunduisuren

Equities Club subscribers would already know of AZ9's potential. Back in July, we said it was ‘one of our top-watched small-cap stocks’, and included it as one of our '10 Must-Watch Resource Stocks' eBook for 2024.

At these early stages, you're not just investing in a discovery. You're investing in what it could become. Sirius Resources' Nova discovery led to a $1.8 billion takeover, and Sandfire's DeGrussa turned the company into a $5 billion copper juggernaut.

Copper’s Critical Moment

The timing of this discovery is perfect. Copper is facing a looming shortage that has the world's biggest miners scrambling - so much so that BHP just waved a $75 billion cheque at copper producer Anglo American.

Rio Tinto has also bet big on Mongolian copper, investing US$12 billion in their Oyu Tolgoi copper mine. That's where AZ9's story gets interesting - they not only share the same country but have direct links to Oyu Tolgoi, a connection that caught our attention early.

Why Copper Demand is Surging

The reason we're so bullish on copper is the energy transition; copper is the backbone of decarbonisation. Demand is surging and will only continue to increase:

An EV uses four times the copper of a conventional car

Wind turbines need three times more copper than coal-fired power plants

Copper is essential for power cables, construction materials, AI, data centres, machinery - the list goes on

Don't take our word for it. Bloomberg, CNBC, S&P Global, and every investment bank have stated this, and AZ9's drill hit today is full of copper.

Most commodity cycles give you time to react. Copper's different. We're staring at a structural deficit that's got the biggest miners in the world scrambling for assets.

The maths is simple but stark: by 2030, it's forecast we'll only be producing about 80% of what the world needs. We couldn't find a single piece of investment bank research predicting we would have enough copper in 2030. It made us sit up and examine the situation more closely.

BHP believes we may be facing a 10 million tonne per annum shortage of copper by 2035, given global copper production is currently 25 million tonne, that’s a big shortage.

AZ9: An Investment in the Future

Two things made us look closely at AZ9 in July this year:

Managing Director Gan-Ochir Zunduisuren’s deep connections in Mongolia's mining sector

BHP had already spotted something special, picking AZ9 for their exclusive Xplor program, which supports early-stage mineral exploration companies.

When they hit 8.8m of massive sulphide in recent weeks, we started buying. Companies with this level of backing and expertise don't often trade at these prices. We purchased our stock before our engagement with AZ9 was signed.

Today's results have confirmed what those massive sulphides promised. With more news flow ahead, we expect the market won't ignore this story for long.

“With the confirmation of high-grade massive sulphide intercepts, future exploration work at the Oval Cu-Ni discovery will focus on the extension of the high-grade zone understanding its size, true dip, and orientation. We will recommence drilling within two weeks.”

- AZ9 Managing Director Gan-Ochir Zunduisuren

Five Key Reasons We're Backing AZ9

1. Incredible Discovery Hole

A massive sulphide result at a shallow depth containing incredible grades of copper and nickel is a remarkable result for the company. Beyond anyone's expectation.

The mining industry spends billions each year searching for results like this. Finding massive sulphides can change a company's trajectory, but finding them with these grades isn't just a company changer - it's a company maker.

Degrussa and Nova come to mind as comparisons. Those discoveries turned junior explorers Sandfire Resources and Sirius Resources into billion-dollar companies, all on the back of a massive sulphide hit. We believe AZ9 could potentially be next off today's result.

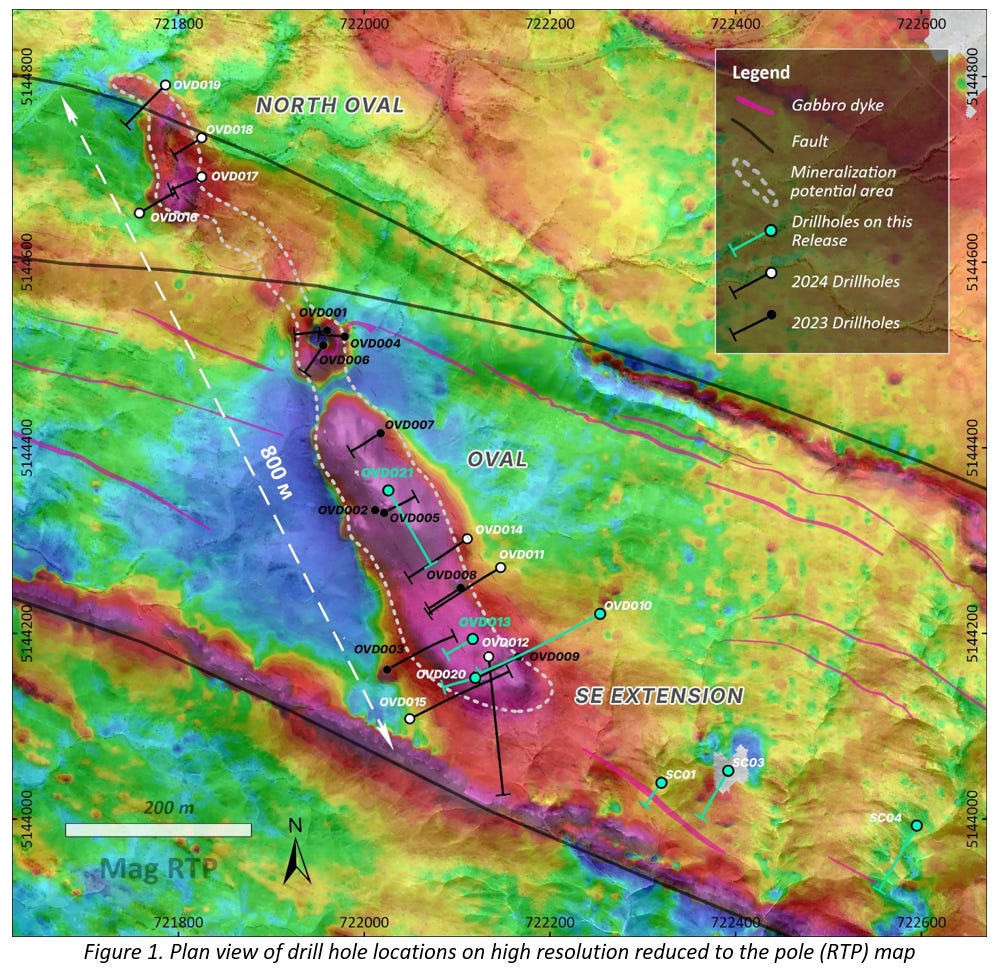

2. Large Exploration Potential

The drill cores tell one story, but the geophysics hint at something bigger. AZ9's target zone stretches over 800m and stays open in every direction (SE, NW, NE, and SW). Plus, we're still waiting on the results of their downhole EM survey.

This means the share price catalysts should keep coming.

Today's results could be the start of something much bigger, marking the potential of a globally significant copper-nickel-PGE discovery.

AZ9 also isn't waiting around. They have a drill rig on site ready to go, with the next campaign expected to start within weeks.

3. Valuation Upside

Discoveries of this nature provide blue sky potential for investors.

We had to go back over a decade to find comparisons. The last comparable finds were Sandfire's Degrussa and Sirius' Nova. Both transformed into billion-dollar companies.

We wanted to know what happens to company valuations after hits like this, searching globally for similar massive sulphide hits. The share price moves of the companies we found six months after similar discoveries were eye-watering.

Now, throw in today's grades, massive exploration upside, and a copper market screaming for supply - AZ9 could really run.

4. Management Expertise

Managing Director Gan-Ochir Zunduisuren's resume speaks volumes. His experience working within Mongolia's finance and mining sectors with some of the world's biggest mining companies is invaluable.

Gan-Ochir was a director of Rio Tinto's US$12 billion Oyu Tolgoi project, representing the Mongolian government's interest in it.

The BHP Xplor program's selection of Gan and AZ9 adds another layer of validation. Remember that BHP is hunting for copper assets. AZ9's direct link through Gan could prove invaluable.

It's pretty simple - having someone who's helped steer a $12 billion copper project in-country gave us a lot of confidence to pull the trigger here.

5. Strategic Location: A proven mining district

Mongolia is a mature mining jurisdiction, with billion-dollar mining companies Rio Tinto and Zijin in the country.

As of 2023, Mongolia's mining sector made up 28% of the country's GDP and 93% of its export revenue.

Here's a bonus - Mongolia shares a border with China, the world's biggest copper buyer and Mongolia's largest trading partner. You can't get a better position than that.

The Oval Target's location is equally strategic - just 70km from the closest airport and 35km from power. This infrastructure access will be crucial for keeping capital costs down.

Today feels like the start of something special. The kind of discovery that gets written into copper exploration folklore.

The evidence is everywhere - BHP waving billion-dollar cheques around, Rio Tinto pouring money into copper projects. The majors know what's coming. We might have spotted something they missed. For now.

Nothing is ever guaranteed in exploration, but today's result, the overall market dynamic, and the pending copper shortage meant we had to act.

We'll be covering AZ9 in depth over the coming months. Every drill hole, every survey result could bring news that moves the needle as this story unfolds, so please share this article with those who might find it valuable.

This could be day one of the most significant discovery story in years. We can't wait to see what comes next.

I linked to your post for my Monday EM links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-october-28-2024 IF I recall correctly, Mongolia was a "hot" frontier market mostly for speculative mining plays maybe a decade ago BUT then was sort of forgotten about while the ETF closed some years ago...