Billionaires are Betting on Natural Hydrogen: Why Should You Care?

Gates and Bezos are investing big in an emerging type of hydrogen. Could it be the start of a new green energy narrative?

When billionaires like Bill Gates and Jeff Bezos start throwing huge amounts of money at an investment, it’s time to sit up and take notice.

That’s not to say everything these guys touch turns to gold (remember the Fire Phone, Jeff?), but given they’re 2 of the 13 people on earth with 12-digit net worths, their track record isn’t half bad.

So when we read they were investing heavily in natural hydrogen, we wanted to investigate further.

Green Hydrogen vs Natural Hydrogen

The Equities Club team is well-versed in green hydrogen, having backed Province Resources as it grew from a small-cap company to a $200 million-plus giant. Natural hydrogen, though, is a slightly different kettle of fish.

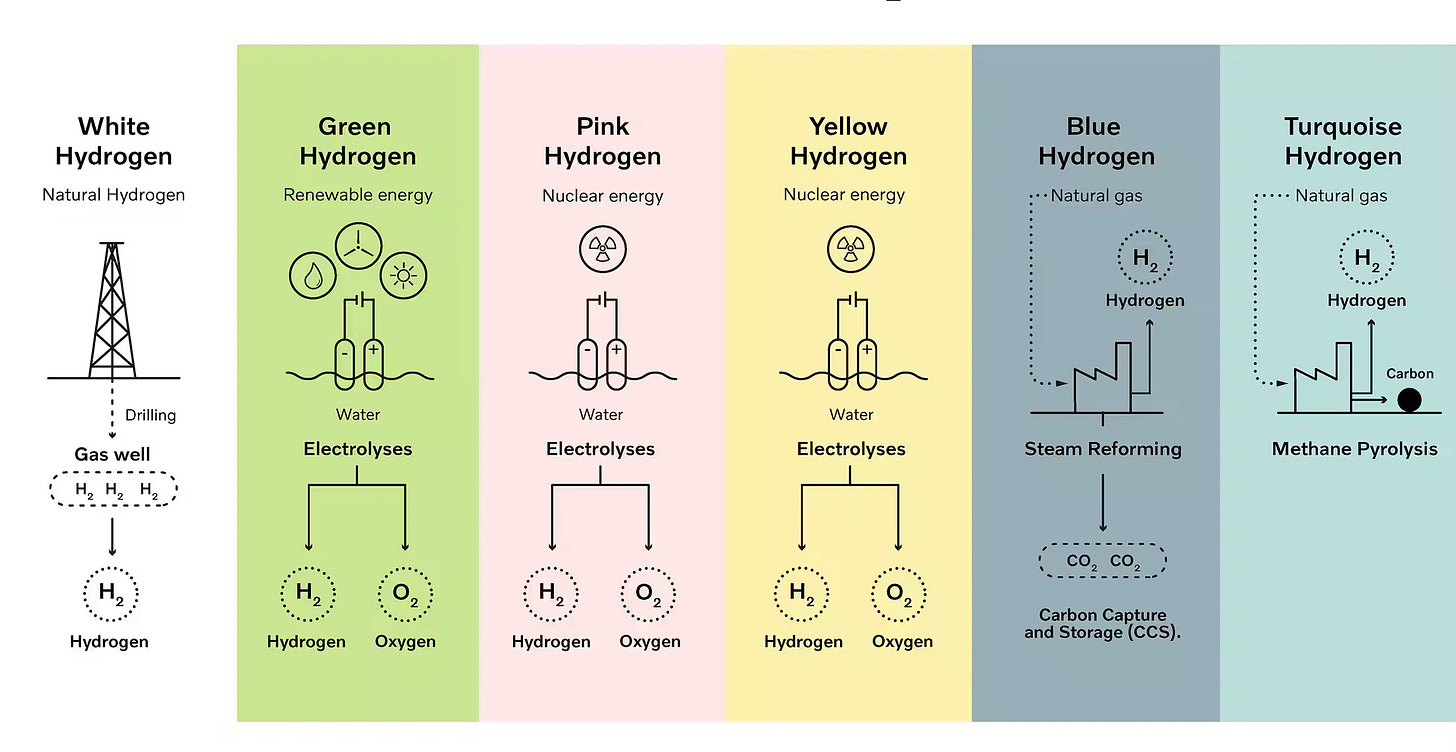

While green hydrogen is manufactured using renewable energy (like solar or wind) to split water, natural hydrogen occurs naturally within the earth’s crust. Think of it like the difference between lab-grown diamonds and mined diamonds – both are diamonds, but they’re made in very different ways.

Iron ore billionaire Andrew Forrest is still vocally backing green hydrogen, but the need for critical minerals to produce wind turbines and solar panels will always make it a costly option.

To meet the world’s clean energy goals, we need a reliable source of power (called baseload power) that isn’t reliant on the wind or sun, doesn’t require us to completely rebuild our power networks, and produces the least amount of CO2 possible.

This brings us to the cheapest form of hydrogen - natural hydrogen.

With only a handful of companies in the natural hydrogen game for now, it could present a unique and early opportunity for investors. It's always good to get in on investing narratives or thematics early.

What is Natural Hydrogen?

Natural hydrogen, also known as white, gold, or geologic hydrogen, is produced naturally through reactions between water and iron-rich minerals underground.

As hydrogen is so light, it naturally rises to the surface. Sometimes, it gets trapped beneath the earth’s surface, forming pockets of pure hydrogen. But more often than not, it slips through the cracks and dissipates into the atmosphere.

Locating these hidden hydrogen reservoirs is key, as they represent a potential clean energy goldmine. Unlike fossil fuels, burning natural hydrogen only produces water vapour, making it a highly environmentally friendly energy source.

The challenge lies in finding these elusive hydrogen pockets, as natural hydrogen rarely exists in its pure form, preferring to bond with other elements. However, once discovered, these deposits can be tapped into much like natural gas, offering a self-replenishing source of clean energy.

Given its scarcity in pure form, any substantial discovery could be highly valuable.

Overcoming the exploration hurdle could revolutionise our energy landscape and accelerate our transition away from fossil fuels.

The Natural Hydrogen market

Deloitte forecasts that the clean hydrogen market will grow to US$1.4 trillion per year by 2050.

Its successful exploitation could lead to transformative changes across various sectors, including transportation, electricity production, and manufacturing, steering the world toward an eco-friendly and more sustainable path.

Of course, the market is still in its early days, but its potential is enormous.

Natural hydrogen companies

While we’re still actively scouring the market for potential gems, one company already stands out as a beacon in the natural hydrogen landscape: Gold Hydrogen (ASX: GHY).

Listed in January 2023, GHY has seen its share price skyrocket over 400%, hitting a valuation of $250 million. With successful drilling having recorded incredibly high grades of natural hydrogen and helium, Gold Hydrogen is proving that natural hydrogen isn’t just hot air.

The other notable company is Koloma, a private company backed by Gates and Bezos, which has raised half a billion Aussie dollars in the past year. Clearly, the big players are betting big on natural hydrogen.

In the small-cap space, Hyterra (ASX: HYT) is currently valued at $30 million, has just kicked off its exploration efforts and is gearing up for drilling in Q3 2024.

Just this morning $7 mil market cap junior Top End Energy (ASX:TEE) announced they will begin exploration to obtain necessary data to further identify natural Hydrogen and Helium prospectivity at their Northern Territory permits.

The Expert Opinion

Sam Matey, an environmental scientist and geospatial data analyst with a keen eye on emerging energy trends (check out his excellent newsletter here), has been tracking natural hydrogen ever since the world’s first “natural hydrogen well” was discovered in Mali in 2014.

Interest in this space went into overdrive last year when a massive deposit - potentially holding up to 46 million tonnes - was found in France.

As Sam puts it: “Natural hydrogen is particularly interesting as a source of clean energy that really, really closely resembles our historic fossil fuel industry, and thus doesn’t require major new technological breakthroughs to use.”

“The 2020s and 2030s may well see a wave of ‘clean drilling’ for geothermal and natural hydrogen; major new clean energy sources to help complement wind and solar and make the transition away from fossil fuels even faster.”

Where to from here

The natural hydrogen sector is in its infancy but is starting to gain momentum. With deep-pocketed investors like Gates and Bezos, funding doesn’t seem to be an issue.

The future of natural hydrogen is potentially huge. It’s abundant, affordable, and, most importantly, environmentally friendly. With billionaires backing it and exploration efforts ramping up, it's a space we’re keeping our eyes on as a potential new narrative.

We’ll keep you updated.