Bubalus Gets First Look Beneath 60-90 g/t Ground

Nineteenth-century miners pulled 60-90 gram ore before water shut them down. BUS is about to find out what's underneath.

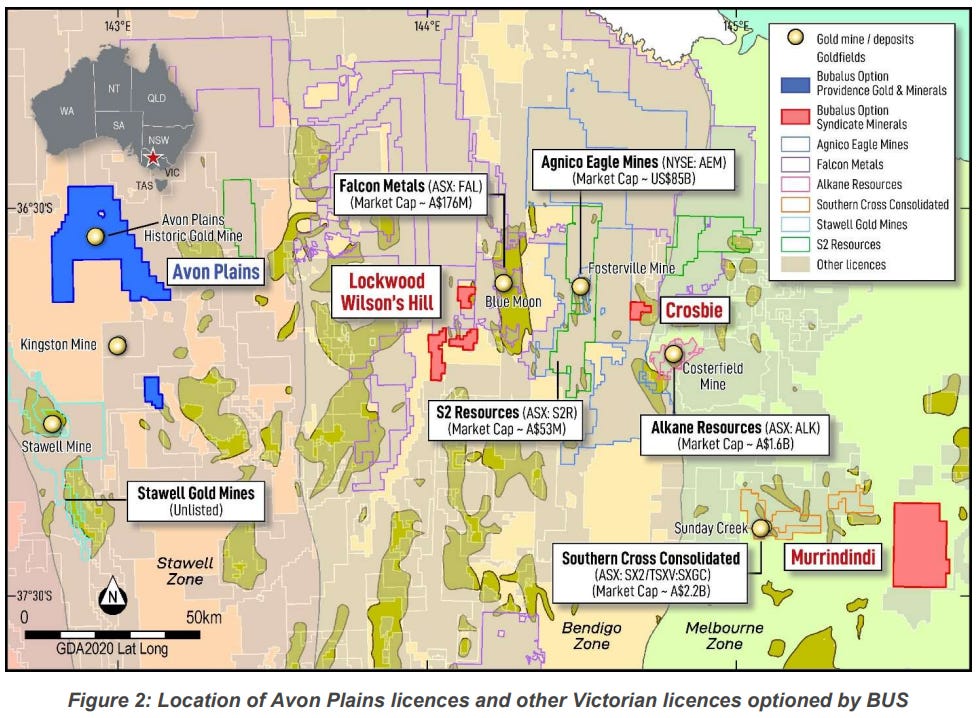

The rig is turning at Avon Plains, and Bubalus Resources (ASX: BUS) is about to find out what’s been sitting beneath a historic high-grade gold mine for more than a century.

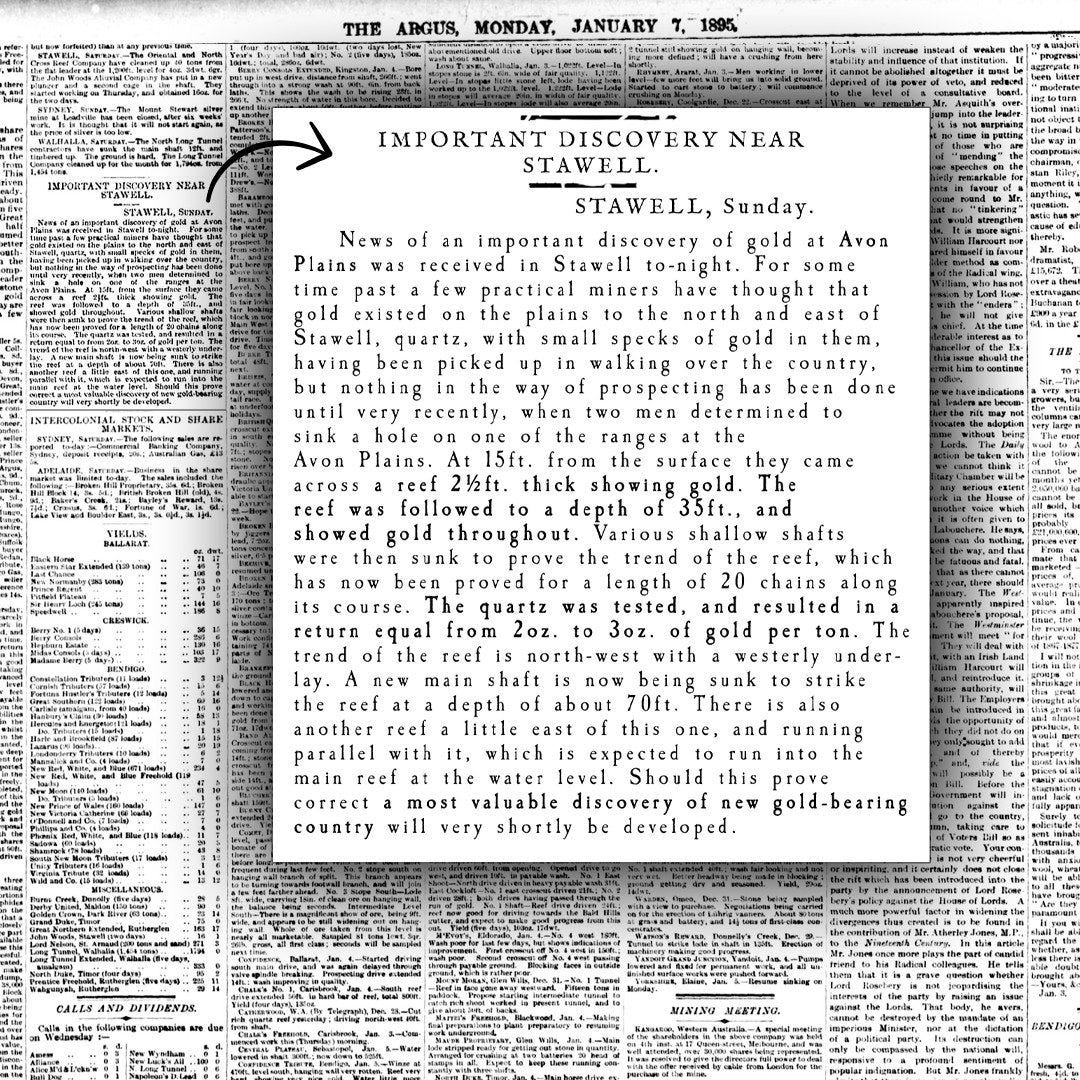

This is the first time anyone has tested the ground below nineteenth-century shafts that reported 2-3 ounces per tonne (roughly 60-90 grams per tonne) along with repeated 12-15 gram reefs, before the workings flooded.

Those numbers put Avon Plains in rare territory for Victoria, especially given they came from shallow ground the old water pumps couldn’t keep ahead of.

Projects like this usually come at a much higher price tag or with a lot of previous drilling baggage. Avon Plains has neither.

BUS has now kicked off at least 1,200 metres of RC drilling to get a proper read on the quartz reef behind those historic grades. The team has two weeks on the rig before assays start landing in early February.

BUS sits at 15 cents and a market cap of $10 million, which is wild when you consider they’re drilling beneath reported 60-90 gram ground that nobody has ever put a modern rig into.

We increased our position in Bubalus by a third this week. If those grades carry into fresh rock, the reaction could move fast.

A Gold System That Has Been Waiting for a Modern Test

Avon Plains has always looked like a much larger gold system than the early miners could uncover.

They followed visible gold through shallow workings with the limited tools of the nineteenth century, reaching only the easiest ground before water inflows forced them out.

The scale of the system beneath those early workings has never been tested. High-grade historic fields aren’t common in Victoria, and most have been drilled extensively by now. Avon Plains hasn’t seen a single modern hole.

Today’s drilling will show how the system behaves at depth, where many Victorian deposits start to strengthen. It will also reveal whether those early high grades were the surface expression of something far more substantial.

Why the Old Workings Ended Where They Did

Mining halted in the early 1900s for one reason: water. Once the shafts reached around 60 feet, the pumps of the era could not keep up.

There is no evidence the grades weakened or the system closed out. The work ended because the technology could not meet the geology.

Since then, the deeper positions have stayed untouched. No RC. No diamond drilling. Nothing that shows how the reef behaves once you push past the old workings.

“As far as we know, this mine has been lost in the Victoria online database system,” Bubalus managing director Brendan Borg told us.

“It doesn’t appear on any of the online databases, we think anybody who was doing exploration in that area … has focused more on mineral sands.

“We just think it’s been forgotten.”

A historic high-grade system sitting under shallow cover in a proven corridor can reveal a whole lot the moment modern equipment goes in.

What the Drill Program Is Testing

The team, led by Brendan Borg, is drilling angled reverse circulation holes that cut across the quartz reef to map its dip and strike (the direction it runs and how steeply it sits in the ground).

If gold continues past the historic mining, BUS will have a much larger search window to work with and the next phase of drilling could scale up fast.

Avon Plains sits inside the Stawell Zone, a Victorian gold belt with a long mining history where deeper lodes are common. Many of the state’s modern discoveries only showed their scale once explorers got beneath the shallow workings of earlier operators.

With the old shafts limited to shallow depth, these first holes will test the untouched positions to understand how the reef carries at depth.

A Small-Cap With Real Leverage to the Drill Bit

Gold is sitting near record highs around US$4,200/oz. At that price, even moderate drill results can move a small-cap quickly.

BUS is 15c per share with a market value of roughly $10 million, which is modest for a company drilling a documented high-grade gold system in one of Australia’s strongest gold corridors.

The market is not yet pricing in the possibility that the historic grades at surface could connect into something larger at depth.

What Comes Next

Two weeks of drilling, then assays in early February.

A $10 million market cap for a company drilling beneath 60-90 gram historic ground leaves a lot of room for the market to reprice if the grades hold.

We’ll be watching closely when assays land.