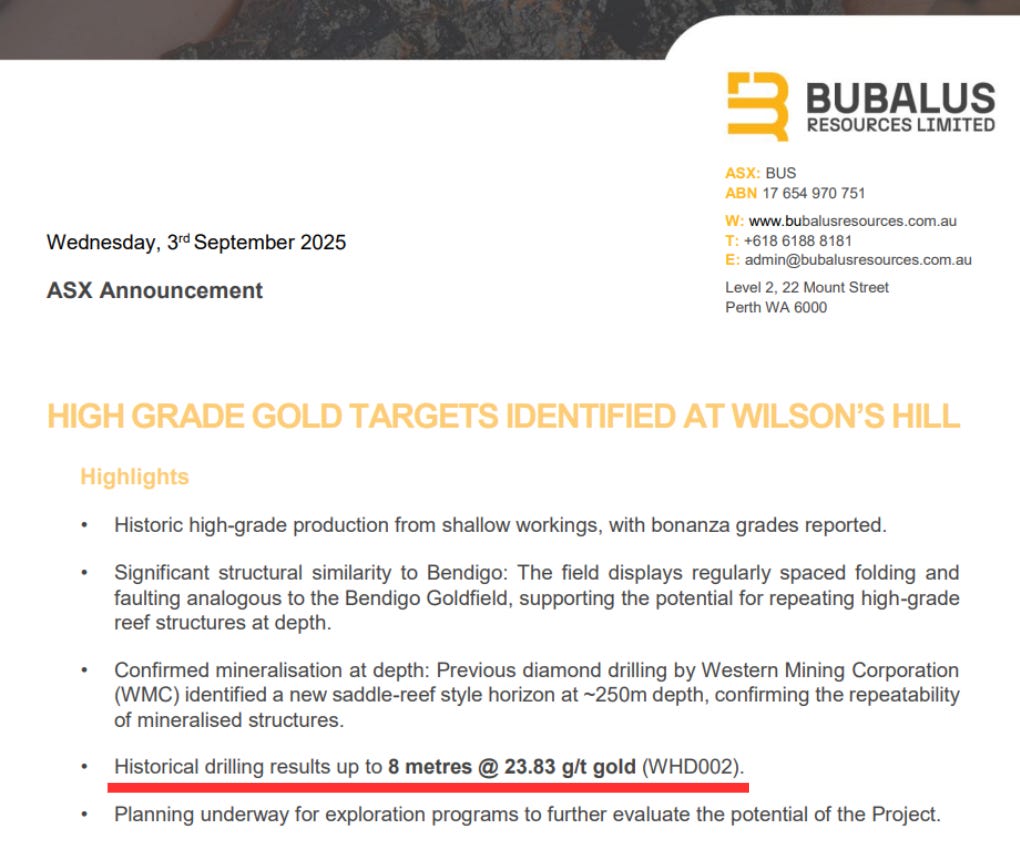

Bubalus Unpacks Bonanza Gold as Price Soars

BUS highlights Wilson’s Hill as gold hits record highs. Standout intercept of 8m @ 23.83 g/t gold suggests stacked high-grade zones remain untested

Bubalus Resources (ASX: BUS) has dusted off a forgotten gold project that could be hiding something special, just as the gold price hits all-time highs overnight.

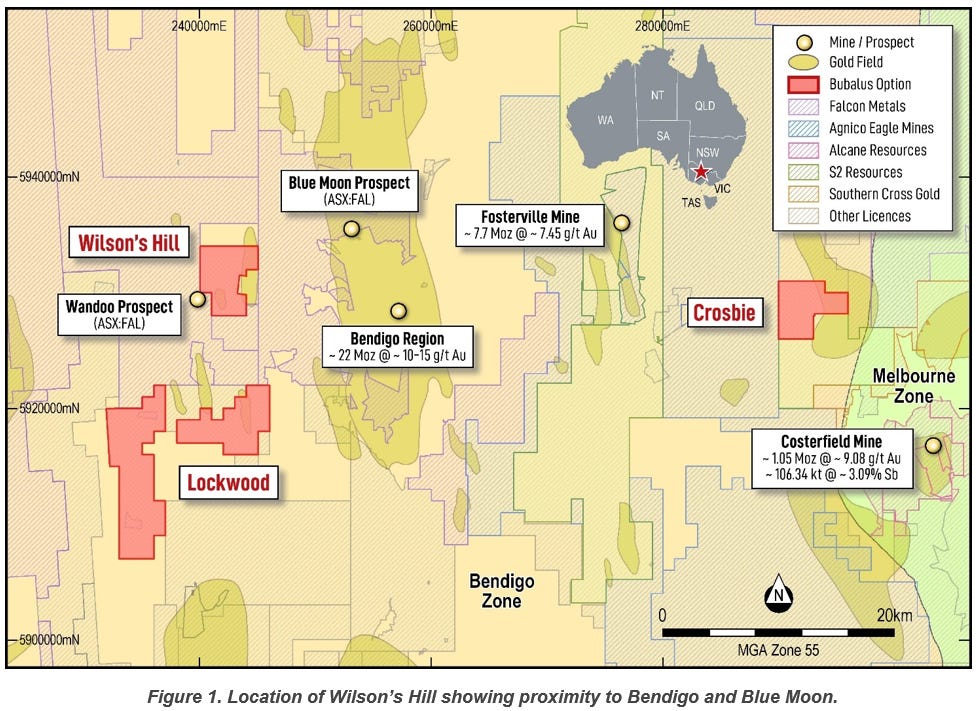

Ignored for 40 years, Wilson’s Hill sits beside the Bendigo Zone, one of Australia’s most productive gold belts.

A fresh review of historic work points to bonanza-grade gold and the same structural patterns that made Bendigo famous. Wilson’s Hill also happens to be surrounded by some of Victoria’s highest-profile discoveries.

Trading at just 11c with nearly $4 million in cash and a $6 million market cap, BUS sits near shell value despite advancing multiple gold exploration programs - and doing so at a time when gold is reaching record highs smashing through US$3,500/oz.

The company has a busy few months ahead with drilling already lined up at:

Crosbie North in a matter of weeks. This target has geology that mirrors Fosterville, one of Australia’s highest-grade gold mines.

Avon Plains, a historical high-grade gold mine in early Q4. 1890s newspaper reports include standout assays of up to 3 ounces per tonne (around 90 g/t gold)

Wilson’s Hill now joins the list of active targets. For a junior with several near-term catalysts, the market has yet to appreciate the potential in BUS’ growing portfolio.

Historical Results Hint at Big Potential

The Wilson’s Hill Gold Project lies just west of Bendigo in a region that has historically produced more than 60 million ounces of gold.

In the late 1800s, small-scale miners worked a 1km strike at Wilson’s Hill, pulling high-grade gold from shallow reefs down to about 50 metres, with a handful of shafts reaching around 170 metres. These early workings barely scratched the surface.

We’ve done some digging and found historical records that show Wilson Hill produced 10,450 ounces of gold from 22,016 tonnes of ore between 1871 and 1880, with an average recovered grade of ~14.8 g/t gold.

If that grade of gold were mined today, it would place Wilson’s Hill as the highest-grade gold producer in Australia.

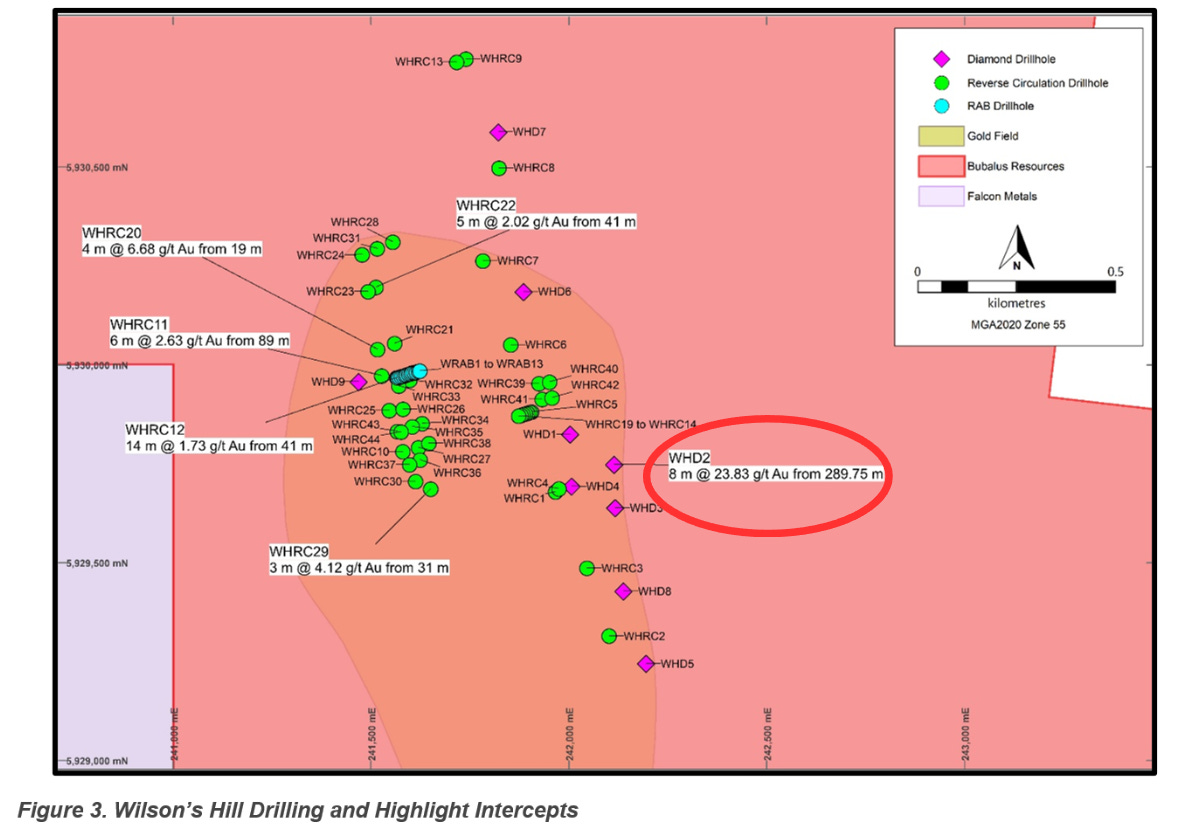

In the 1980s, Western Mining Corporation tested the ground for Bendigo-style repeating reef systems. Their work delivered standout results:

8m @ 23.83 g/t gold from ~250m depth, with visible gold recorded

Multiple quartz vein sets intersected over a 350m strike, confirming broader mineralisation.

Later modelling suggested stacked mineralised horizons between 200m and 800m, consistent with Bendigo-style folding frequency.

This matters for BUS because the geology indicates multiple high-grade zones that repeat at depth. Meaning Wilson’s Hill could host several stacked gold-bearing layers deeper than what the old-timers ever reached.

The Neighbourhood Matters

Wilson’s Hill sits in the centre of the Bendigo Zone, a goldfield that built fortunes and put Victoria on the global mining map.

Ordovician rocks have been folded and faulted here for millions of years, creating structural traps where gold-bearing fluids tend to accumulate. The same rocks that made Bendigo famous run straight through Wilson’s Hill.

This same setting hosts several world-class deposits:

Fosterville (Agnico Eagle): +2.3M ounces of gold produced at ~50 g/t gold from the high-grade Swan Zone

Sunday Creek (Southern Cross Gold, ASX: SXG): An emerging high-grade discovery, with SXG trading from 20c at IPO to over $6 in four years

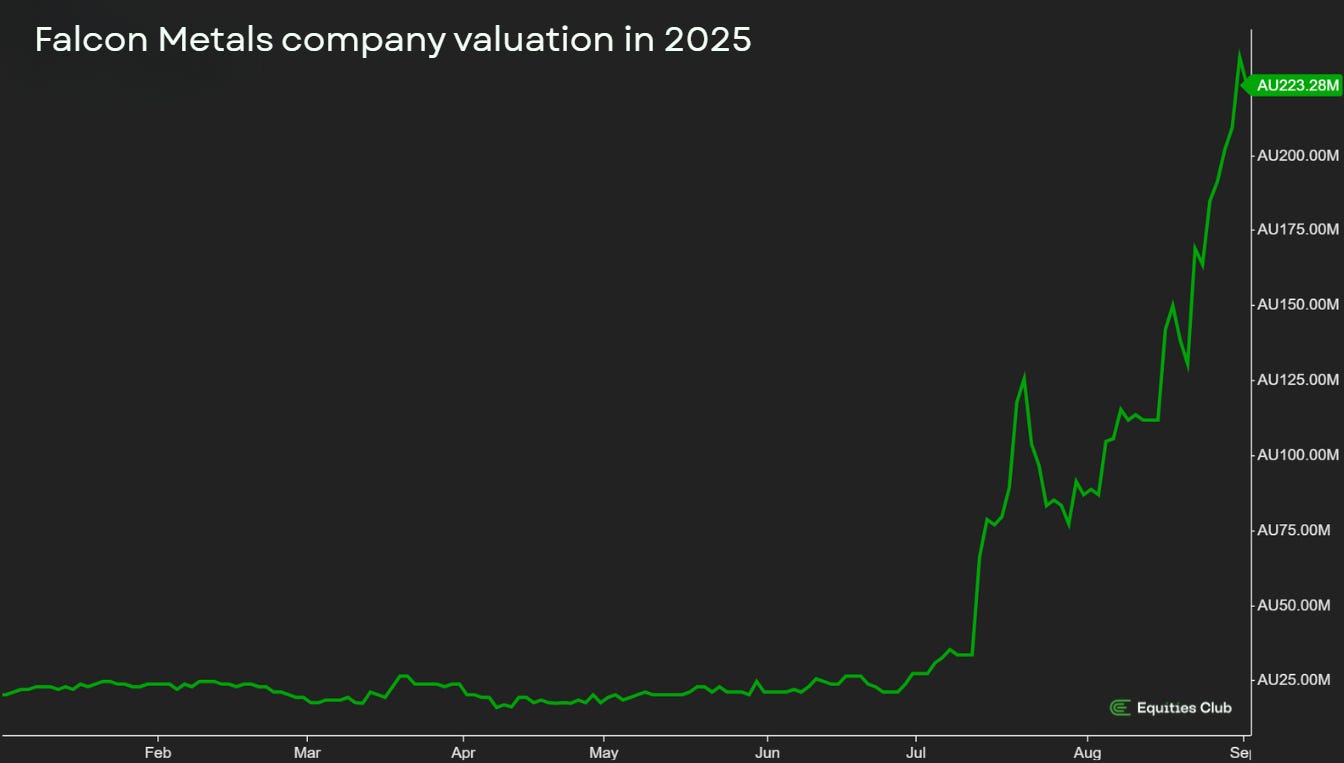

Blue Moon (Falcon Metals, ASX: FAL): High-grade hits including 1.2m @ 543 g/t gold and 2.8m @ 17.7 g/t gold, driving Falcon’s market cap from $20m to $223m

For BUS, the relevance is clear:

The same folded Ordovician rocks.

Similar structural make-up with fold hinges and saddle reefs.

Untested potential at depth, leaving large areas unexplored.

Yet BUS trades at $6 million while Falcon sits at $223 million. That’s a 35x gap for projects on the same geological trend.

That leverage is baked into Wilson’s Hill, and the market hasn’t priced it into BUS’ valuation.

Next Steps at Wilson’s Hill

Wilson’s Hill is about to get the modern treatment. BUS is preparing a targeted exploration program to test the area properly for the first time in decades.

Immediate priorities for the company include:

Compiling and validating historical drilling datasets.

Running modern geophysics and geochemical sampling to refine drill targets.

Securing land access across freehold and Crown holdings.

Planning a drill campaign aimed at testing stacked saddle-reef horizons at depth.

With nearly $4 million in cash, BUS can execute these programs without placing significant financial strain on the company.

Wilson’s Hill has the data, the model, and now the funding to be adequately tested for the first time in more than 40 years.

Multiple Shots on Goal

BUS has assembled a portfolio that most juniors would kill for.

Crosbie’s drilling in weeks. Avon Plains follows in Q4. Now Wilson’s Hill enters the mix with its bonanza-grade history and could be the sleeper of the trio.

It sits in a proven goldfield, shows strong geological similarities to nearby world-class discoveries, and boasts historic drill hits.

At 11c, the market’s valuing this like a shell company with a dream. But BUS has cash, drill-ready targets, and with gold at record highs, any significant intercept from any drill campaign could shift the valuation of BUS in an instant.

Historical miners at Wilson’s Hill pulled 14.8 g/t gold from shallow workings. Western Mining hit 23.83 g/t at depth.

The geology says there could be more where that came from.