BUS Ramps Up Four-Project Victorian Gold Assault

At 12c with $4m in the bank, BUS has results due in July and multiple shots at a discovery lined up across four Victorian gold projects in Fosterville's neighbourhood

The Victorian Goldfields are buzzing. Mine expansions, world-class discoveries, and exploration are heating up across the region.

Bubalus Resources (ASX:BUS) dropped an exploration update this morning covering their four Victorian projects - all within 20 kilometres of Fosterville, where Agnico Eagle pulls some of the highest-grade gold ounces in the world.

With BUS' share price sitting near all-time lows at 12c, a $7 million market cap, and nearly $4 million in cash, any discovery in this gold market could send the share price rocketing.

BUS recently wrapped up one gold drill program at Crosbie South with results pending. Two more programs are lined up this year at Crosbie North and Avon Plains.

If you haven't paid attention to the company yet, we'll run through each gold target, why they're promising and when drilling will occur. And why we think this is one of the most exciting small-cap gold plays on the ASX right now, operating in one of the most promising gold jurisdictions globally.

Here's what's happening at each project.

Crosbie South: Drilling Complete Assays Pending

Crosbie South has already delivered its first material event, a completed maiden drill program. Five diamond holes (around 700 metres in total) were completed without any dramas, and results are expected in early July.

Gold's trading near all-time highs at USD$3,350/oz, so any decent intercepts would get a lot of attention and send the share price much higher.

If even a modest intercept comes back in line with the surface results, which were near 19.1g/t gold, Bubalus shifts from early-stage speculation into the same league as its regional peers.

July’s approaching fast and for anyone still on the sidelines, decent intercepts could change the investment case overnight.

Crosbie North: Right Next Door to Fosterville

Still within 20km from Fosterville, one of the highest-grade producers in the world, Crosbie North offers another serious shot at discovery.

BUS has already delivered promising surface results at Crosbie North, which included rock chips grading over 12g/t of gold. These weren't just one-offs either - they came from multiple spots across the prospect, suggesting there's real potential for something substantial sitting underground.

BUS will complete an IP survey that starts in June to help zero in on where to drill next. The goal is clear: define high-priority targets in time for a Q3 drilling program.

The pieces are falling into place at Crosbie North, and BUS is working the same rocks that have already produced one of the world's standout gold deposits.

This all points to a drill program in early Q3, right when we expect Crosbie South results back, two bites at the cherry? Yes please.

The timeline is shaping up nicely: Crosbie South results should drop in July, while the IP survey and targeting work at Crosbie North points to a drill program in early Q3. That gives BUS shareholders multiple chances at discovery news over the coming months.

For a 12c stock, that's the kind of news flow that can move mountains.

Avon Plains: Forgotten Gold, New Eyes

Avon Plains has one hell of a backstory. Back in the 1890s, newspaper clippings from the time describe assays of 2–3 oz/t (around 60–90 g/t) that miners were pulling from shallow shafts.

The old-timers hit high-grade ore just 34 feet below surface using nothing more than picks, shovels and basic shaft mining.

Then water flooded them out at 60 feet depth, and they simply walked away. Not because they ran out of gold - because they couldn't deal with the water inflow. No modern drilling has ever properly tested this reef, just some shallow aircore holes that also struggled with the same water issues.

BUS is preparing to drill beneath this historically mined high-grade gold reef that has never been properly tested with modern methods.

Avon Plains already produced gold and it was high-grade. The question now is whether that reef extends at depth or along strike. If it does, BUS shareholders could be onto something special.

The first-ever drill program at Avon Plains will kick off in early Q4 - and this could be the sleeper story of the year.

Murrindindi: The Sleeper Play

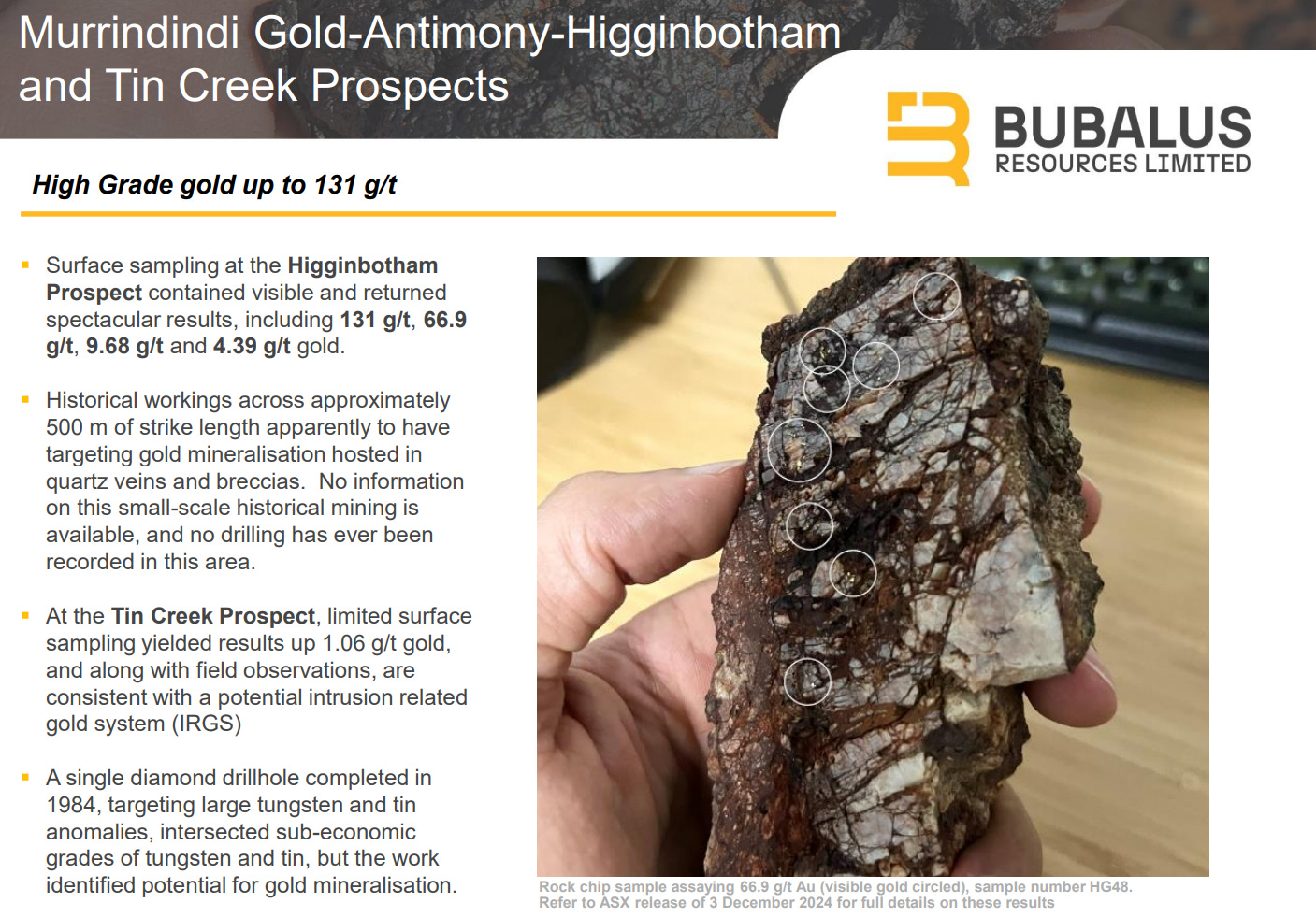

While most eyes are on Crosbie and Avon Plains, BUS has been getting on with work at its fourth Victorian gold project, Murrindindi.

Geochemical sampling is now underway, with early efforts focused on the Tin Creek prospect in the southeast corner of the licence. It’s still early days, but the strategy is clear: complete surface sampling to generate drill-ready targets.

Murrindindi isn't making headlines yet, but that could change. Any decent geochemical results here would add more weight to BUS' Victorian portfolio. At this market cap, any sniff of a target will add a fourth leg to the story.

Bubalus: The Big Picture Breakdown

With all these targets, the macro picture looks pretty attractive for Bubalus.

Gold is trading at record highs at US$3,350/oz, and investors are increasingly looking for exposure to juniors that can offer potential tier-1 location leverage to a discovery. BUS ticks the boxes:

Low share price of 12c with a market cap of $7 million

Nearly $4m in cash

Multiple gold prospects in a proven gold jurisdiction

Promising historic and current gold sampling results

First drill results due in in early Q3

Drilling further gold targets in Q3 and Q4

For a stock this size, that's a lot of moving parts all pointing in the right direction.

The Fosterville region has proven it can deliver multi-million ounce systems with exceptional grades. BUS is working in the same rocks, with early signs already pointing to a structurally complex and mineralised environment.

Bubalus, The Shiny Spec In The Sand

Bubalus Resources is doing the right things without much fanfare, but that won't last forever.

For a 12 cent stock with $4 million in the bank and a $7 million market cap, any success will go straight to the valuation.

In a gold market breaking records, BUS offers the kind of upside that's getting harder to find - multiple shots at discovery in proven ground, all funded and ready to go.

We’re invested and haven’t sold a share.

Any concern with the current Victorian government, increasing costs involved getting in the way of hindering the BUS timeline?