Cape Town Mining Conferences 2026: The Money Is Back

Last year we flagged PSC and AON - up 360% and 175%. This year the mood was even stronger. Gold, copper, rare earths and a FUN update from the ground.

The 2026 mining conference season is underway, and if you want a live read on where capital is heading, you don’t sit behind a screen. You get on a plane.

This week, Equities Club had boots on the ground in Cape Town for 121 Mining Investment and Mining Indaba. Two conferences running side by side, thousands of delegates, and corridor catch-ups between every scheduled meeting.

Gold around US$5,000 had every fund manager in the room chasing ounces. Copper explorers with decent intercepts were fielding back-to-back meetings. And our portfolio company Fortuna Metals kept coming up in conversations we weren't expecting.

We ran into plenty of familiar faces. ASX-listed juniors we cover, fund managers we’ve shared a beer with in Kalgoorlie, and brokers doing the rounds between booths. A few international groups quietly admitted they’ve been watching the ASX small-cap space more closely than most people realise.

Conference season has always been about the side conversations as much as the formal presentations. The “been busy I see” chats over a coffee, the tone in the room between meetings. And the tone this year was noticeably different from twelve months ago.

The tyre kickers have moved on and capital is actively looking for a home in mining again. We’ve got both conferences covered, plus a few small-caps generating strong interest.

121 Mining Investment Conference

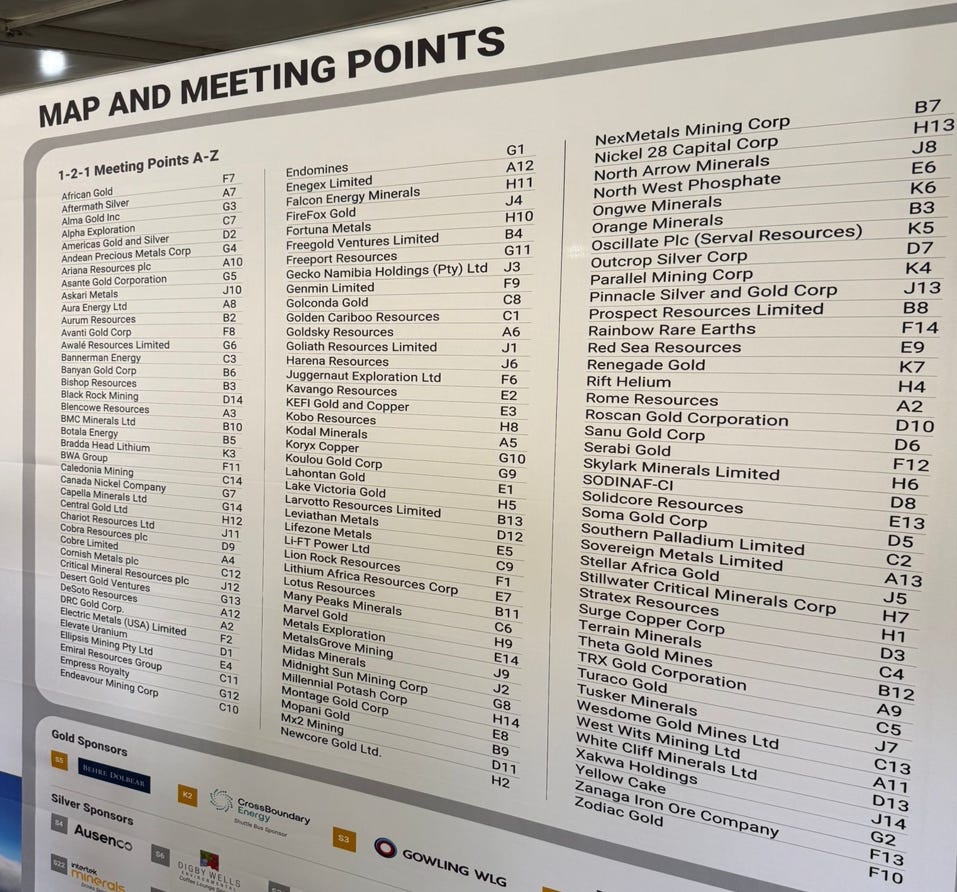

121 Mining Investment Cape Town is built around one thing: pre-booked, one-on-one meetings between capital and projects.

This year was the busiest we've seen it. Back-to-back meetings, full schedules, overflow conversations spilling into hallways and coffee lines. The whole format is built around decision-makers sitting across from project teams for 30 minutes at a time (and every slot was full).

The international interest stood out. North American funds and European groups were there alongside Middle Eastern capital and Japanese investment banks. These groups were running active diligence, looking to acquire, farm in or partner with small-cap mining companies.

When global capital flies into South Africa specifically to meet ASX-listed juniors, it tells you how the mood has shifted from a year ago. Last year these meetings were more tentative. This year, people had mandates.

Of course, conference interest and actual cheques are two different things. We've seen enough of these events to know that some of these meetings will lead nowhere. but the intent felt real this time with a number of groups running structured due diligence.

The Commodities Everyone Was Talking About

You can read all the broker reports you want, but nothing beats walking a conference floor to get a feel for where capital actually wants to go.

At last year's Indaba we highlighted Prospect Resources (ASX: PSC) and Apollo Minerals (ASX: AON) as the two African picks to watch. PSC is up over 360% since, while AON is up 175%. The themes we picked up on the ground twelve months ago played out, and this year the signal was even stronger.

Four commodities dominated conversations in Cape Town.

Gold - With the price sitting around US$5,000/oz and Africa home to some of the highest grade deposits on the planet, gold was the loudest conversation at both events. Every jurisdiction was in play. Everyone was chasing the next big find, and from what we saw, gold juniors with any kind of story will have no trouble raising capital. Many were doing so at levels that would have been unthinkable two years ago.

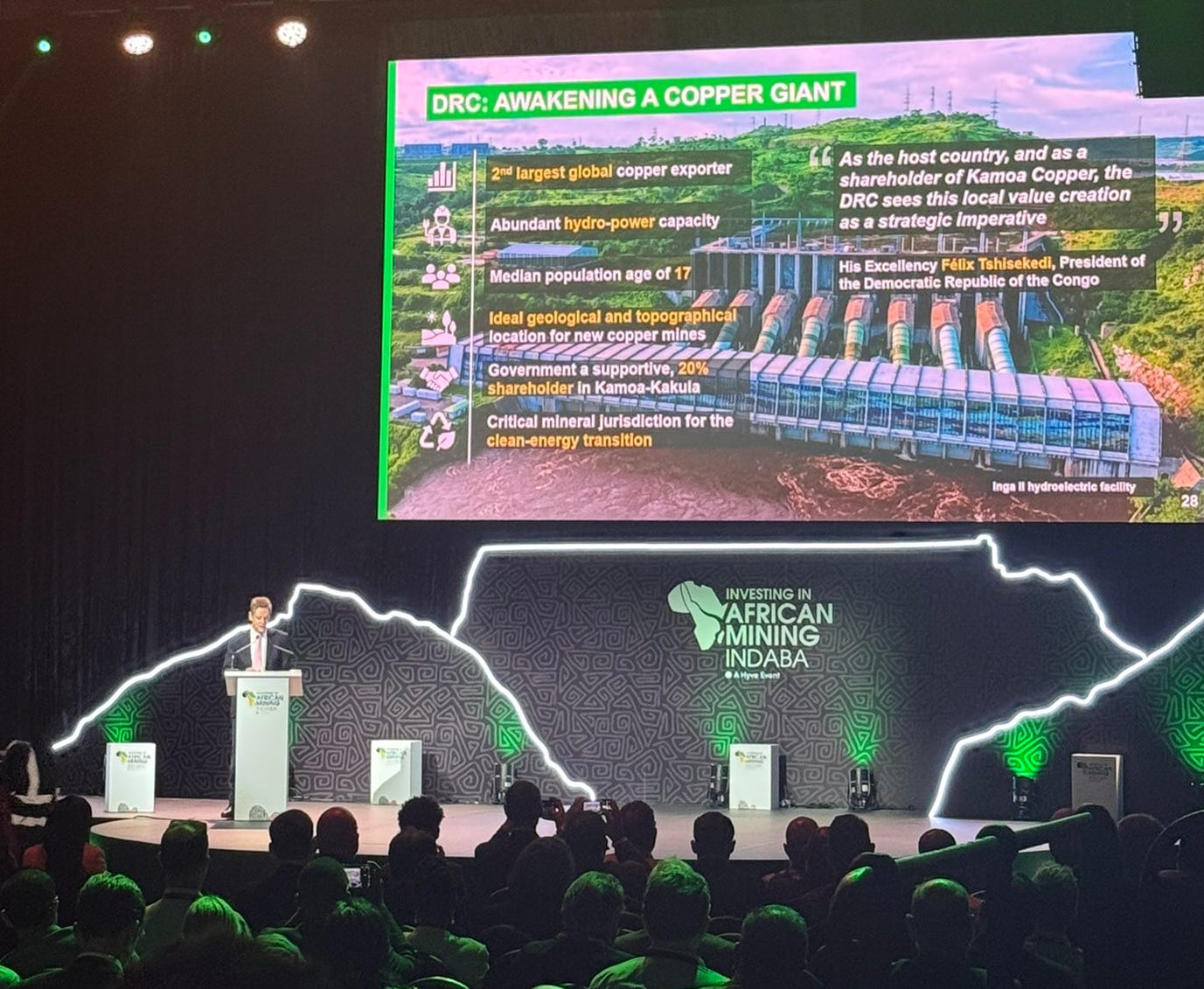

Copper - Everyone wants it, but finding it is a different story. There's a lot of money flowing into copper exploration right now, set against a pretty thin pipeline of actual discoveries. Zambia and the DRC dominated the discussion, Zambia for its untapped potential and the DRC for its proven world-class deposits. If you're a small-cap copper play with some decent intercepts in hand, funding is there for the taking.

Rare Earths - This one caught us off guard. There's genuine appetite to invest in African rare earth projects, but most groups we spoke with are sitting on their hands waiting for drilling confirmation and resource size. Once a couple of projects deliver results, we'd expect that to change quickly.

Lithium - After two years in the wilderness, lithium was back as a talking point. The tone was cautious though. A lot of people got burned in the last lithium winter and aren't rushing back in. The funding freeze is starting to thaw, particularly for assets with near-term production potential, and those projects were fielding plenty of meetings.

Companies that caught the attention of many at 121 Capetown:

Fortuna Metals (ASX: FUN) - Rutile in Malawi

West Wits Mining (ASX: WWI) - Gold in South Africa

Prospect Resources (ASX: PSC) - Copper in Zambia

Chariot Resources (ASX: CC9) - Lithium in Nigeria

DRC Gold Corp (CSE: DRC) - Gold in the DRC

Fortuna Metals: Malawi Turning Heads

We caught up with Fortuna Metals’ (ASX: FUN) managing director, Tom Langley, between what felt like an endless run of meetings. He was flat out.

Tom flagged strong interest from multiple international groups, particularly those scanning for quality projects in stable African jurisdictions. FUN kept coming up in our conversations too, often from people we weren’t expecting to mention it. The proximity to Sovereign Metals’ Kasiya rutile project to the north was a recurring talking point.

FUN’s project sits in the same geological setting as Kasiya, yet the market has it priced at a fraction of Sovereign’s valuation. That gap caught a few groups off guard. Several admitted they hadn’t properly understood the scale of FUN’s ground before the recent updates.

On Monday, FUN released its latest shallow drilling results from Mkanda. Of 96 hand auger holes assayed at the 0-2m interval, 36 graded above 1% rutile, with the best hitting 1.78%. The mineralised footprint now covers more than 25 square kilometres and remains open in most directions, with three broad high-grade zones emerging across strike lengths of 5 to 10 kilometres.

Aircore rigs are expected from around May to test deeper ground on a tighter 200 by 200 metre grid. Sovereign’s saprock boundary at Kasiya sits at 20-30 metres, so there’s a lot below what FUN has sampled so far.

More assays are due throughout Q1, and the company is also reviewing samples for rare earth and graphite potential following Sovereign’s recent heavy rare earth recovery at Kasiya 20km to the north.

When international groups start circling early-stage assets before a full re-rate, that can accelerate a story. It’s part of why we have FUN as a portfolio company.

FUN is still early in its exploration timeline though. Conference buzz is encouraging, and the interest we saw in Cape Town was real, but the investment case comes down to what comes out of the ground. We’ll be watching for results.

Indaba: Biggest Ever, But Changing

Mining Indaba is still Africa’s biggest mining conference. This year it posted its largest attendance in 32 years, pulling in global majors, mid-tier producers, government delegations and financiers.

Government officials were everywhere, particularly from the DRC, Angola, Zambia and Malawi. They weren’t just showing up. They were actively pitching investment frameworks and competing for capital.

The countries that make it easiest to do business are clearly the ones attracting the most attention, and that message came through in every panel and private meeting.

The format is shifting though. Bigger booths, more corporate branding, energy suppliers and equipment groups taking up floor space. It increasingly feels like a trade show running alongside a mining conference.

The serious deal-making has moved toward focused formats like 121, where you're sitting across from decision-makers with a specific agenda. That's probably a natural evolution for an event this size. It still matters for setting industry agendas and getting face time with government, but for investors looking for actionable leads, the smaller formats are where the real work gets done.

Whats Next From Here

African countries are more open to mining investment right now than at any point in the past few years. The ones that follow through on that (rather than just talking about it at conferences) will benefit.

More so than any time in the last few years, the majority of African countries we spoke with are open and actively looking to attract mining investment. The ones that follow through on that, rather than just talking about it at conferences, will be the ones that benefit.

The continent has no shortage of quality deposits. The question has always been governance and execution.

This week backed up our investment in FUN. The project is progressing and it’s starting to generate interest from outside parties, which is what you want to see when you’re invested in a small-cap at this stage.

Next week we’ll be at the RIU conference in Fremantle as conference season kicks off in Australia. RIU is a solid event with a big range of junior explorers. If you’re on the west coast and can get along, it’s well worth the trip.

Twelve months ago, people were asking whether the money would come back to small-cap mining. This week in Cape Town, it was already in the room.