Copper's Big Year: AZ9 Maps Out Multi-Target Strategy for 2025

Copper prices are climbing fast, so we sat down with AZ9's Gan-Ochir Zunduisuren as they gear up for their most ambitious drill campaign yet, targeting new zones of high-grade mineralisation

With four massive sulphide hits already in the bank at their Oval discovery, Asian Battery Metals (ASX: AZ9) isn't wasting time in 2025.

The company has mapped out an intensive drilling campaign starting early March, with a clear plan to find what's feeding these spectacular copper-nickel grades.

The timing couldn't be better. Copper prices have surged 10% in recent weeks as global supply struggles to keep up with demand. For AZ9, trading at 5.5c with a $27M market cap, this sets up perfectly for their next phase of drilling.

This week, AZ9 unveiled its roadmap for 2025 with an investor presentation outlining how they plan to build on their string of high-grade discoveries from late 2024.

While Oval's proven high-grade zones remain the star attraction, the company has outlined a broader strategy across their entire Mongolian portfolio.

We sat down with Managing Director Gan-Ochir Zunduisuren to dig into their exploration plans. Beyond just following up on known mineralisation, AZ9 has identified multiple fresh targets they'll test throughout 2025.

2025: The Year of Continuous Exploration for AZ9

The management team of AZ9 has already delivered a string of impressive results, with four massive sulphide hits recorded in late 2024. Now, as 2025 unfolds, the company is set to ramp up exploration efforts significantly.

High-Grade Discovery at the Oval Project

October's discovery hole at Oval turned the market's attention to AZ9 - intersecting 8.8m at 6.08% copper and 3.19% nickel from 107m. This was a major turning point, confirming the presence of high-grade, massive sulphide mineralisation in what is shaping up to be a significant new system in Mongolia.

Since then, every successful massive sulphide drill hole at Oval has returned grades exceeding 3% copper and 3% nickel.

This consistency in grade is rare in early-stage discoveries and suggests AZ9 may have uncovered a highly mineralised intrusive system.

Oval also sits in an established mining region with ready access to infrastructure - a key advantage for any future development.

What’s Next for Oval in 2025?

March sees AZ9 back at Oval with three clear targets in their sights:

Testing the system at depth to find what's feeding these high-grade zones. Current intercepts suggest Oval could be part of a larger magmatic sulphide system, and deeper drilling should tell us more about its scale.

Testing DHEM (Downhole Electromagnetic) targets that sit below the known mineralisation. DHEM acts like a radar for underground sulphides, and several large conductive plates remain untested.

Expanding into the central and south targets within the broader Oval area, where geophysical surveys have highlighted additional prospective zones.

The next few months pack several potential catalysts for investors:

March-May: Deep drilling begins at Oval - targeting the source of high-grade mineralisation.

April: High-resolution magnetic survey at MS1, a target showing similar signatures to Oval.

May-June: New geophysical surveys at Copper Ridge to refine drill targets.

H2, 2025 potential: Planned maiden drilling at MS1 and deeper testing at Copper Ridge.

The systematic approach AZ9 has taken so far - from geophysics to targeted drilling - shows the hallmarks of an experienced team executing a well-planned strategy.

Beyond Oval: A Pipeline of Targets

While Oval has stolen the spotlight, AZ9 is not a one-project company. The team has outlined multiple additional high-priority targets that could add significant value in 2025.

Copper Ridge (Cu-Au): Sitting 8km north of Oval, this newly identified intrusive-related copper-gold system has already delivered scout drill results of 0.1–0.3% Cu over 140m. More drilling in 2025 should tell us what they're dealing with.

MS1 & MS2 Targets: These new targets are showing similar geological signatures as Oval in the early days with high-gravity, high-magnetic, and chargeability anomalies. These are all indicators of a possible mineralised system.

Quartz Hill (southern Oval region): Early surface work has identified mineralised gabbro outcrops, suggesting another potential zone of mineralisation.

Finding massive sulphides like those at Oval doesn't happen often. When explorers do strike them, share prices tend to move significantly north.

AZ9 now sits in an enviable position - one confirmed discovery at Oval plus multiple targets to test throughout 2025. This combination of proven success and fresh opportunities makes them one of the more intriguing copper plays on the ASX.

The Copper Market: A Defining Decade Ahead

The copper market is at a turning point.

With global electrification trends accelerating, renewable energy projects scaling up, and infrastructure demand surging, copper is emerging as one of, if not the most, critical metal of the decade.

Big miners are feeling the squeeze. They’re struggling to replace depleted reserves, and finding new deposits is proving challenging. That's why we're seeing moves like BHP's failed attempt to acquire Anglo-American last year for $75 billion - it's often easier to buy discoveries than make them.

The supply crunch looks set to intensify. Most forecasts point to a growing gap between copper supply and demand, suggesting prices could rise substantially in the years ahead.

This backdrop puts junior explorers with fresh discoveries in an interesting position. AZ9's success at Oval, plus their pipeline of new targets, could attract serious attention if they keep delivering strong results.

The Demand Forecast

Major investment banks are painting a clear picture of copper's future:

Goldman Sachs sees copper hitting US $12,000/t by 2026, up from today's US $9,240/t.

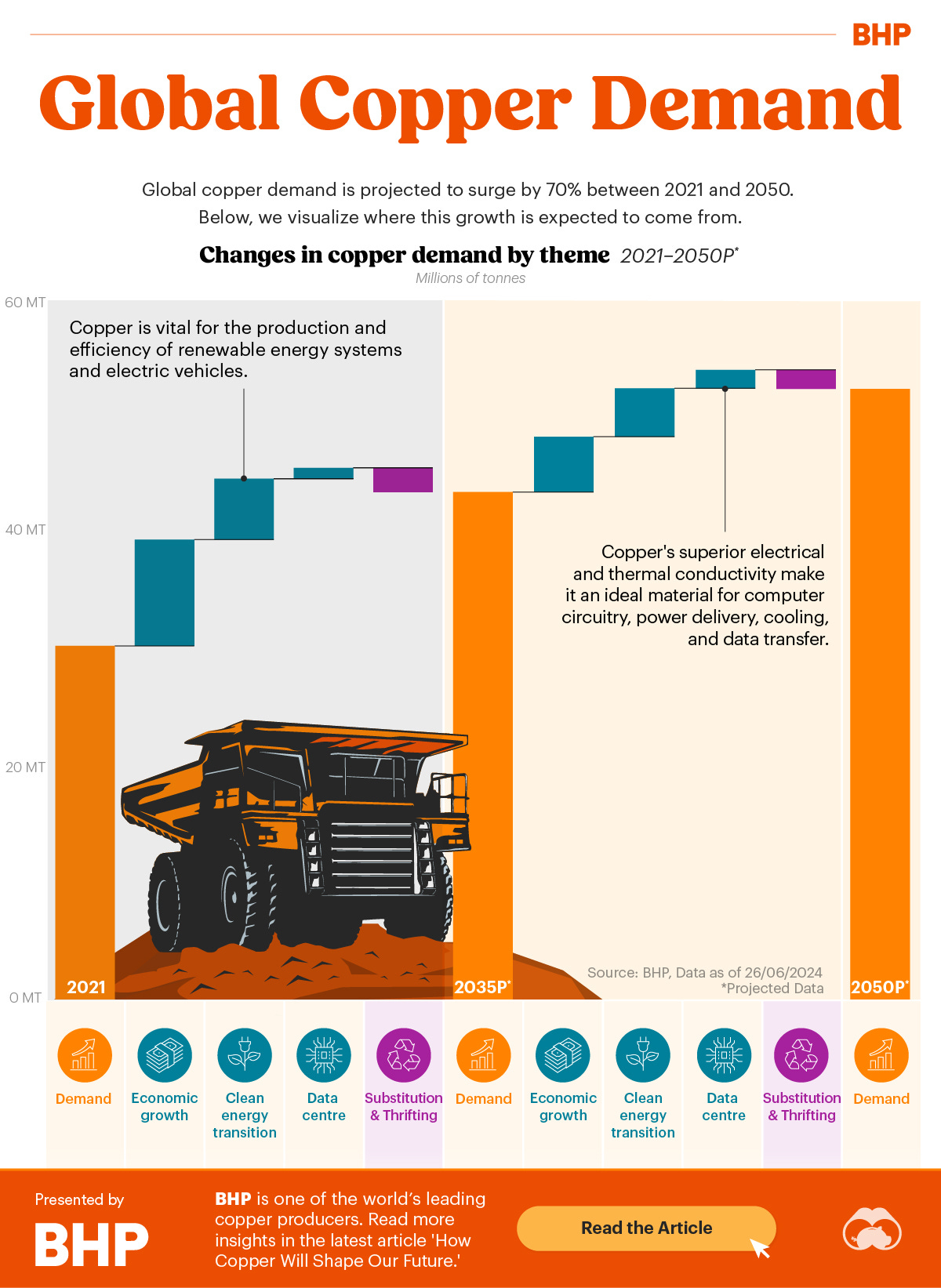

S&P Global predicts that global copper demand will increase by 50% by 2035, driven by the energy transition.

Wood Mackenzie projects a 75% increase in demand by 2050.

The Supply Challenge

Three key factors are constraining copper supply:

Declining Production: The world's major copper mines are yielding lower grades, reducing output.

Development Timeline: New copper mines can take 10-15 years to bring online.

Political Risk: Chile and Peru, accounting for 40% of global production, face mounting regulatory challenges.

Why Copper Junior Explorers Like AZ9 Stand To Benefit

The major miners are struggling to find new copper deposits despite spending hundreds of millions annually on exploration. This has led to a shift in strategy, with the majors turning to more nimble junior copper explorers.

In 2022, BHP, the world's largest mining company, set up its BHP Xplor program. This is a program funded by BHP that helps select juniors to drill and discover deposits.

This year's cohort is made up of nearly all copper juniors.

Mongolia's emergence as a major copper jurisdiction adds another layer to this story. We've already seen Rio Tinto invest US $12 billion in their Oyu Tolgoi copper mine here. More recently, Zijin Mining paid US $930 million for Xanadu Mining's Kharmagtai copper-gold project. Sharing a border with China, the world's largest copper consumer, gives projects here a strategic advantage.

AZ9, part of the inaugural Xplor program, could become an attractive acquisition target for BHP or any major miner if a large-scale discovery is made.

At 5.5 cents per share and a $27 million market cap, AZ9 offers significant leverage to exploration success. Both Oyu Tolgoi and Kharmagtai started as exploration plays before attracting major mining investment.

Final Takeaways

Our firm investment belief is that copper prices are set to rise this decade. The supply deficit shows no signs of easing, while demand continues to climb as the world electrifies.

AZ9 kicks off their most ambitious drill program yet this March. Between Oval's proven high grades and multiple untested targets showing similar signatures, there's plenty of potential for market-moving news.

With major miners desperate for new copper supplies and proven operators in charge, 2025 could put AZ9 on the copper map.