Diggers & Dealers 2025: Winners, Losers and Whispers

From the Super Pit to the Gold Bar - the deals, whispers and commodities that had everyone talking in Kalgoorlie this year

We swapped the screens for the Super Pit this week, heading to Kalgoorlie for the 2025 Diggers & Dealers Mining Conference.

Three days of presentations, coffee catch-ups, and the odd late night at the Gold Bar - plus the kind of side convos you’ll never get on an investor call.

Today’s wrap is a break from our usual market-wide recap. This one’s all about what we saw, heard and scribbled in the notebook while walking the floor. The commodities with momentum, the ones trying to get it back, and a few whispers that may or may not see daylight.

From a keynote speech that landed like a lead balloon to whispers of Northern Star catching Agnico Eagle's attention, here's what actually went down at Diggers 2025.

Kalgoorlie: Still the Mining Capital

Diggers has come a long way since it began in 1992, when a handful of mining execs and brokers traded war stories over a few pints in Kal.

Now it’s a polished, three-day fixture on the mining calendar - a trade show, corporate summit and reunion all wrapped into one. And it's still the best snapshot of where mining money's headed next.

While the conference once carried a reputation as a three-day booze-soaked pilgrimage to the Exchange Hotel, the tone has shifted.

These days, the centre of gravity is the Goldfields Arts Centre. Deals get made over conference tables as well as long lunches.

Today, the networking is still lively, but the focus is far more on presentations and deal-making.

And for those flying in, looking down from the sky over the Super Pit never gets old…

Attendance: Solid, But Down on Last Year

2,500 delegates came through over the three days, down from last year's record 2,700. Still a decent showing given how tight capital markets have been in some sectors.

The floor felt less frantic than the past couple years. Whether that's the market finding its level after the post-pandemic surge or something else, it’s hard to say. The usual faces were there, just with slightly smaller entourages.

Keynote: Nuclear Pitch Misses the Mark

This year’s keynote came from data scientist Aida Morrison and Canadian nuclear advocate Dr Chris Keefer. The headline was blunt: “Net Zero is Dead”, with a call for Australia to embrace nuclear energy.

It landed awkwardly in Kalgoorlie. Only months after a federal election where nuclear failed to gain traction (and with uranium mining still banned in WA), the pitch felt out of step with the audience.

In a year when gold was the undisputed king commodity, plenty in the room were left bemused. One broker we spoke to summed up the feeling: “Interesting, but not what we came here for.”

Gold: Still Wearing the Crown

To no one’s surprise, gold was the clear drawcard at Diggers this year. Presentations from Northern Star (NST), Genesis (GMD), Ramelius (RMS), Regis (RRL), West African Resources (WAF), and Ora Banda (ORA) all converged on the same point: the past 12 months of price strength have transformed balance sheets.

The current spot price has given producers breathing room, accelerated debt repayment and unlocked fresh capital for exploration.

We also noted that producers are kicking the tyres on small-cap gold explorers. That’s music to our ears given our investment in Bubalus Resources (ASX: BUS), whose neighbour Agnico Eagle Mines had a booth at the conference.

At the booths, gold companies made the most of the spotlight. The mood was a long way from the battery metals boom when they struggled for attention.

It's clear that the consolidation trend in the gold sector is far from over, with several directors privately noting that "the phones haven't stopped ringing."

Copper: Building its Case

Gold dominated conversations, but copper had plenty of interested parties as the next major thematic. The ASX still has surprisingly few actual copper producers, which leaves room for emerging players to fill the gap.

We caught up with FMR Resources (ASX: FMR) MD Oliver Kiddie, who was clearly energised after closing the company's copper acquisition in Chile this week.

The addition has brought Mark Creasy onto the register as a substantial shareholder, a name that in WA exploration circles carries weight. Creasy's track record of early-stage wins means FMR's next moves will be closely watched.

Kiddie made no secret of the fact that he wants to build scale quickly, and the Chilean ground is seen internally as a genuine platform for that growth. We look forward to FMR drilling their monster porphyry target in the coming weeks.

Our other copper holding, Asian Battery Metals (ASX: AZ9), wasn't at Diggers but kept momentum with drilling resuming at the Oval project in Mongolia this week. Good timing if the results deliver.

With new targets to test across its copper-proven ground, AZ9 is well-positioned to see its share price move if the rigs deliver. We’ll keep an eye on results as they land.

With copper supply projected to tighten in the coming years, the smaller end of the market is shaping up as the place to look for bigger moves in the sector.

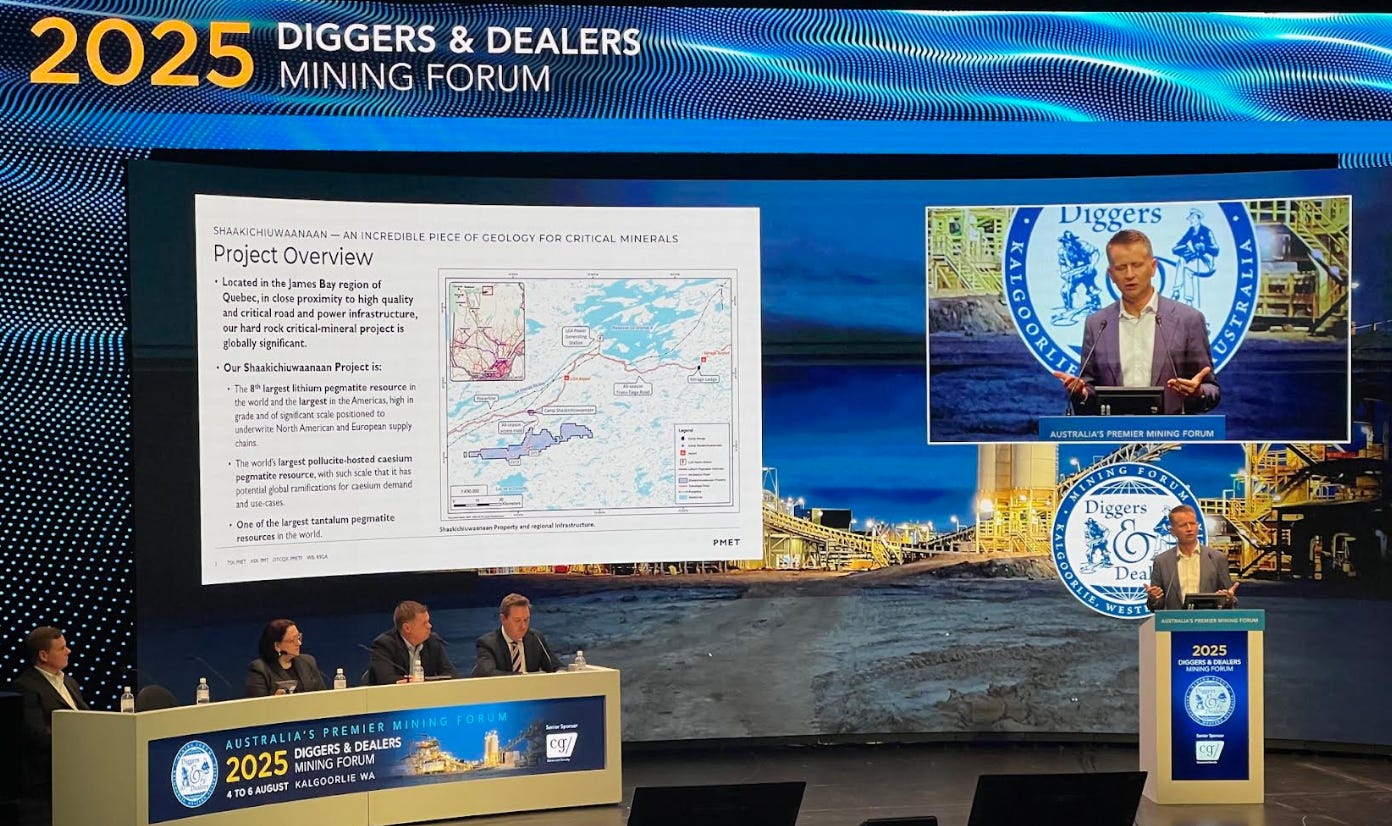

Lithium: On the Outer

Lithium sentiment remains… cautious. That’s about as polite as you can put it.

Presentations from Liontown, Core Lithium, Patriot Battery Metals, Pilbara Minerals and Wildcat Resources all carried the same hope that prices have finally found a floor and stabilisation will bring projects back to life.

The mood was a long way from 2022's lithium euphoria (a constant reminder never to get ahead of yourself). This year, the talk was about discipline and cost control, rather than rapid expansion or exploration.

Rare Earths: Drawing a Crowd

Rare earths had a decent crowd around them, helped along by fresh US policy moves and a swirl of reports about possible Australian government intervention.

The most notable chatter was around a proposed floor price for rare earths to protect domestic producers. We spoke with Lynas Rare Earths (LYC) and Arafura (ARU), who were both in support of a floor price.

Our view remains unchanged: Artificial price support is a short-term fix at best and risks dulling competitiveness. If a company needs a floor price to survive, the ground under it is already shaky.

The Brokers: Puffer Jacket Swagger Subdued

The big-name brokers - Canaccord, Euroz Hartleys, Shaw and Partners, Morgans, Argonaut - all showed up, but the headcount felt lighter.

The smaller outfits, especially from the east coast, were even harder to spot.

It could mean one of two things. They’re either flat-out back in the office with a rising market, or they decided the trip to Kalgoorlie wasn’t worth it this year.

Maybe the market’s busy enough to keep them chained to their desks. Or maybe Kalgoorlie didn’t make the cut for the 2025 travel budget.

Either way, the days of rolling in with an entourage and a fresh puffer looked to be on pause this year.

Takeaways: The Good, the Bad and the Whispered

From an investor's standpoint, this year's Diggers confirmed a few things.

Gold is still the safest bet right now, but don’t expect another big leg up without a fresh macro driver.

Copper is shaping up as the next battleground for capital, with early-stage explorers offering leverage for those willing to stomach the risk.

Policy-driven commodities like rare earths will offer opportunities, but government intervention is rarely a sustainable long-term strategy.

Northern Star is supposedly in the sights of the world’s biggest gold company by market cap, Agnico Eagle Mines.

Gold majors are sniffing around juniors with strong targets.

We’re not a fan of companies rattling the tin for government handouts - in a capitalist market, only the strong should survive.

Small-cap presence was light this year. The event leans heavily towards mid-tiers and majors, but the small-cap tent could use a revamp.

The conference also served as a reminder that sentiment cycles are alive and well.

Wrapping Up Diggers 2025

Another Diggers & Dealers in the books for the Equities Club team.

It’s still a fixture in the Australian mining calendar - part corporate summit, part reunion, part piss-up - and it isn’t going anywhere.

The style has shifted from the days when the biggest deals were done over a long lunch, but the core remains the same. It’s still the best snapshot of where the industry’s collective head is at, and where the money might flow next.

This year felt more measured than 2024. In the view of many (and ours), gold, copper and rare earths are the place to be in the short to medium term.

Back to our regular weekly wrap next week.

Till next time.

If, politically, it makes sense to break China's dominance of the rare earths market, then doing something to protect non-Chinese rare earths producers is a no-brainer.

For those of us with longer memories, we recall the behaviours or Qantas and Ansett and later Virgin when a new player tried to enter the market. The established companies used anti-competitive behaviours to prevent the new entrants from being able to establish themselves in the market.

It is highly likely that the Chinese government would subsidise Chinese producers if there was any meaningful competition to China's dominance. Arguing against the price floor on the basis of 'competition' seems to be arguing perfect world theory over real world fact.

Also, as we see in the US, the government is buying stakes in rare earths companies. How would Lynas (for example) be able to compete with Chinese and US companies that are protected/subsidised/owned by the Chinese and US governments? Hardly a level playing field.