Drills Turn at Crosbie: Bubalus' High-Stakes Play Between Victoria's Gold Giants

Drills spin for the first time at Bubalus' Crosbie South project, targeting high-grade gold and antimony between two of Victoria’s richest mines as gold soars

The drills have now started turning at Bubalus Resources' (ASX: BUS) Crosbie South gold-antimony prospect. Nestled in the heart of Victoria's famed goldfields, this tiny explorer has timed its maiden drilling campaign perfectly - right as gold hits fresh record highs.

At just 16 cents per share and an $8 million market cap, BUS offers investors a chance to catch an early-stage story unfolding between two of Australia's most prolific high-grade mines.

Let's dive into why this campaign is a big deal, the potential upside on the table for Bubalus, and why small-cap gold explorers are suddenly back in the spotlight.

Drill Rigs Now Turning at Crosbie South

BUS announced today that the drill bit has officially hit the ground at Crosbie South, the moment shareholders have been waiting for.

The program consists of 4–5 diamond drill holes for about 1,000 metres total, targeting zones the company has methodically identified through months of groundwork. This isn't a random punt in the dark, these targets come from a combination of rock chip sampling and geophysical surveys.

The targets have been systematically built through surface sampling, returning up to 19.1g/t gold, strong antimony readings, and coincident geophysical anomalies, a classic recipe for Victorian goldfields success.

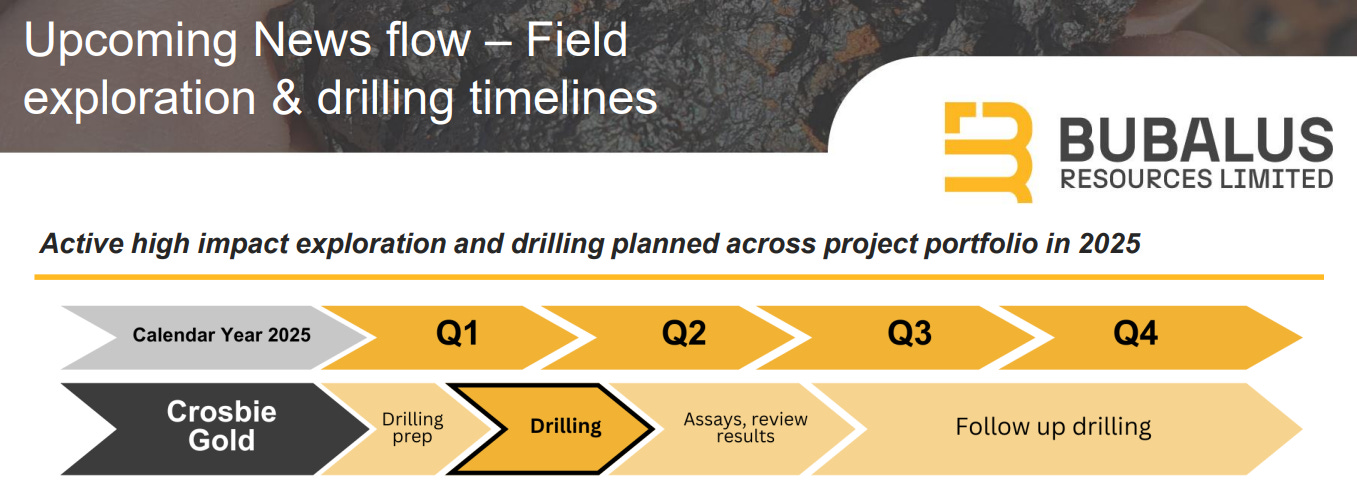

Drilling is expected to take 4 to 5 weeks, and we're hopeful of regular updates as assays come through.

Location, Location, Location: Why Crosbie South Matters

What excited us to invest in Bubalus is that the Crosbie South project isn't just well located; it's strategically placed.

The project sits within 20 kilometres of two operating mines:

Fosterville (owned by Agnico Eagle — NYSE: AEM) is one of the world's highest-grade, most profitable gold mines. Valued at USD 59.5 billion.

Costerfield (owned by Mandalay Resources — TSX: MND) is a globally significant gold-antimony producer. Valued at CAD 486 million.

Both operations have confirmed what geologists have long known: this belt of rocks in Victoria can host exceptionally high-grade, highly profitable deposits.

What's particularly interesting is that Bubalus' ground shares similar geological features, including signs of a well-developed magmatic-hydrothermal fluid system (in plain English: the kind of plumbing that delivers high-grade gold and antimony).

The rock chip samples and geophysical signature suggest Bubalus may be tapping into the same style of system as what's made the neighbouring mines such success stories.

A Company With Room to Move

At a share price of just 16 cents and an $8 million market capitalisation, Bubalus is still flying under the radar.

Any exploration success here could completely transform this company.

To put things into perspective:

Fosterville's discovery success took Kirkland Lake Gold from a small-cap player to a $10+ billion takeover target that Agnico Eagle couldn't resist.

Mandalay's Costerfield operation pumps out serious cash flow year after year, despite the technical challenges that come with narrow-vein Victorian gold deposits.

To be clear, Bubalus is still early days, but that sub-$10 million valuation gives tremendous upside leverage if the drill bit delivers. With gold trading at record highs, that leverage is amplified even further.

The Tailwind of a Strong Gold Market

Gold, to put it bluntly, is on an absolute tear.

As we covered in yesterday’s Weekly Wrap, bullion keeps notching up fresh all-time highs, driven by a perfect storm of persistent inflation concerns, geopolitical uncertainty, and central banks loading up their vaults at unprecedented rates.

Key points from the current gold market:

Gold is trading comfortably above US$3,300/oz.

Central banks (particularly China and other emerging markets) are buying physical gold at rates we've never seen before, treating it as insurance against growing economic instability.

Against this backdrop, small explorers with exposure to genuine high-grade gold targets are particularly well-positioned to attract attention.

In simple terms, it's a better time to be drilling gold than almost any time in history.

A Look Back: How We Got Here

Bubalus isn't new to the Victorian goldfields; it's just hitting a significant milestone.

The Crosbie licence has been built up over time with methodical groundwork:

Surface sampling identified gold up to 19.1g/t, with strong antimony results.

Geophysics picked up areas underground that could contain sulphides - the types of rocks often linked with gold and antimony.

Geological mapping found rock structures and changes that often show up near rich gold and antimony deposits.

What impresses us most is that management isn’t just "drilling and hoping".

Instead, they've taken a disciplined, technical approach that maximises their chances of success.

What to Watch in the Coming Weeks

With drilling now underway, several potential share price catalysts are lining up that could drive renewed interest in Bubalus and push the share price north:

Drill progress updates - Bubalus has indicated it will update the market as the program progresses.

First assay results - Early signs of mineralisation could generate excitement well before the whole program is complete.

Gold price movement - Continued strength in bullion prices would amplify any exploration success.

Given the tiny market cap, these catalysts could have an outsized impact on the share price in the short term. Small companies don't need massive fund flows to see significant re-ratings, just a handful of interested investors can move the needle.

Final Thoughts

Drilling is where theory meets reality in exploration. Where all the desk work, sampling and theorising finally get tested. It's also where discoveries happen.

Discoveries, even in their early stages, can instantly rewrite the valuation of small companies like Bubalus Resources. We've seen it countless times in the resources sector.

With a project sandwiched between two world-class mines, early signs of high-grade gold and antimony mineralisation, and a bullish gold market behind it, Bubalus enters its maiden drilling campaign with the wind at its back.

While exploration always carries risk, the rewards on offer for success in the Victorian goldfields, especially at Bubalus' current valuation, make it near impossible to ignore.

Investors seeking exposure to early-stage gold stories in a rising gold environment will want to keep a very close eye on Bubalus Resources in the weeks ahead.

Our recent chat with Brendan Borg below sheds more light on the Crosbie story. It’s worth watching while we all anxiously await those first cores to come up from Victorian soil.