The under-the-radar African lithium explorer with massive potential

Can you feel the lithium market's pulse? It's getting stronger. In part two of our five ASX stocks to watch in 2024, we ask whether the market is sleeping on African explorer, First Lithium

Welcome back, members. Part two of our lithium series leaves Quebec's cold for Africa's blessed rains. We've uncovered an explorer with world-class results that make those exploration risks seem almost non-existent. All this while it trades at the same value as it was before drilling a single hole.

Looking at the broader lithium market first, investment bank UBS last week said lithium prices are turning as the lithium surplus shrinks. They predicted a long-term lithium price 40% higher than the current market price. Their thoughts were also echoed by Goldman Sachs. In short: A lithium price surge is looming.

With demand for lithium steadily rising and supply having been overestimated, we think the market is overlooking a hidden gem in Africa.

In the words of Toto: "Hurry boy, she's waiting there for you."

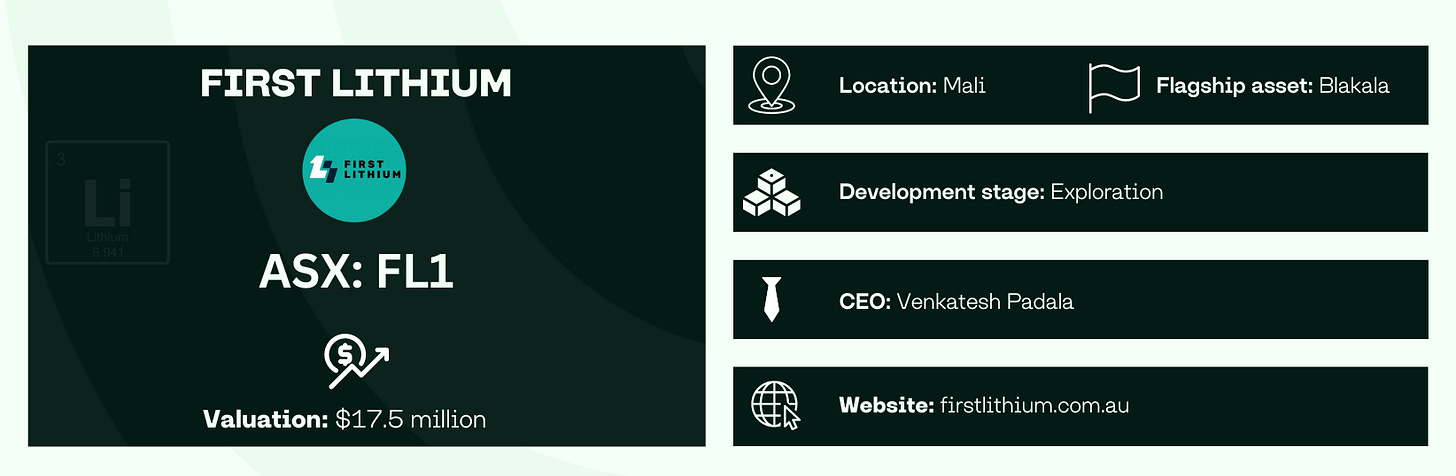

First Lithium burst onto the ASX last year, and its recent drilling campaign screams potential. The results from FL1's first campaign are world-class; it's hard to beat the size and grade of some of their hits. It seems anywhere they drill, they hit lithium. As FL1 powers through to their maiden resource, it has all the right characteristics to surprise the market.

The broader lithium downturn has definitely hurt FL1, but that could be considered good news for potential investors. You can gain exposure to a potential world-class resource at a bargain price. As the price of lithium turns, we anticipate FL1's stock will follow suit. Yes, Mali poses jurisdictional risk (We can already see our mentions on X) and it’s not for everyone, but with two lithium mines under construction nearby, a killer resource, and that tiny valuation, the Equities Club team thinks a re-rate could be imminent.

So what do we like about First Lithium?

Low valuation

Independent analysts estimate the lithium resource for FL1 at 50-60mt – a top-20 hard rock lithium deposit.

With a current valuation of around $20 million, FL1 presents what our team believes will be among the best valuation/resource metrics on the ASX. That is given the potential size of the resource, the dollar value per tonne of resource will be among the cheapest on the ASX.

To put FL1's potential into perspective: nearby developers like Leo Lithium and Kodal Minerals are valued a lot higher – roughly $500 million and $160 million respectively – even though they only own partial stakes in their projects (Leo 40% and Kodal 49%). This tells us FL1 is seriously undervalued, and that likely won't last long.

Nearby operations

Leo Lithium (ASX:LLL) and Kodal Minerals (LSE: KOD), FL1's neighbours, are proof that this area is a lithium hotspot. Once their projects are fully up and running, more than a billion dollars will have been invested. That means roads, power, water supply, everything a mine needs is already there or well on its way, making FL1's life a lot easier. Plus, there’ll be a skilled workforce in the region FL1 can leverage. The operational playbook in Mali has already been written not once but twice – success lies in following the blueprint.

Potential partners

Part of the beauty of FL1 is they're calling their own shots. No off-take agreements, no joint ventures – that keeps their options wide open. They could sell part of their deposit like others have done, or even go for a full buyout.

Drilling further into Leo Lithium and Kodal Minerals. They've got deals with Ganfeng, the biggest lithium producer out there, and Hainan Mining, part of $5 billion Hong Kong conglomerate, FOSUN. That shows how hungry investors are for lithium in this region.

FL1's potential will have big players knocking on their door, ready to deal. The beauty is that FL1 will likely have more than one option.

Historical exploration confirming size

A historical report from CSA Global ranked First Lithium Blakala pegmatite as a “Priority 1” target. The report labelled Blakala and LLL’s 211mt at 1.37% Goulamina deposit as the only “Priority 1” targets in Mali. The report also touched on the high recovery rates of lithium. High recovery means less processing to get the lithium, and it also noted the lithium returned from processing was of a high standard.

The point that piqued our interest was the CSA Global report highlighting Blakala's comparable size to Goulamina. Analyst estimates put Blakala's current resource at 50-60mt after just one drill campaign. This mirrors Goulamina in its early days – after LLL's first drill campaign, it was estimated at 15mt but went on to become a massive 211mt deposit, one of the top five globally. Could Blakala follow the same explosive growth trajectory?

The elephant in the room

We won’t sugarcoat it: Mali has its challenges. Even though mining is a major industry there, political instability is always a concern. Even though Mali is a proven mining jurisdiction with some of the largest gold and lithium companies now operating, it still poses significant risks. But here's the thing: mining there never stopped, even through coups and changes in power. Those in charge know it's a lifeline for the country.

Right now, FL1's price reflects that Mali risk – if it were an Australian company, it would be trading way higher.

We get that investing in Mali might not be everyone's cup of tea. But look at the upside: a potentially massive lithium resource, with big mines going into production nearby. Investing is all about risk vs. reward. Sure, Mali's risky, but the upside could be huge.

This region has seen world-class discoveries matched with billion-dollar partners, with the results we’ve seen from Blakala we think FL1 could be onto something big. Opportunity awaits the savvy investor.

Remember to subscribe to ensure you don’t miss out on of Equities Club releases.

Good insights here. Thanks.