Fortuna Hits High-Grade Rutile in First Results

FUN’s first Malawi soil results carry world-class rutile grades, with more coming in December

Fortuna Metals (ASX: FUN) has just come out swinging, posting rutile grades you rarely see in early soil sampling.

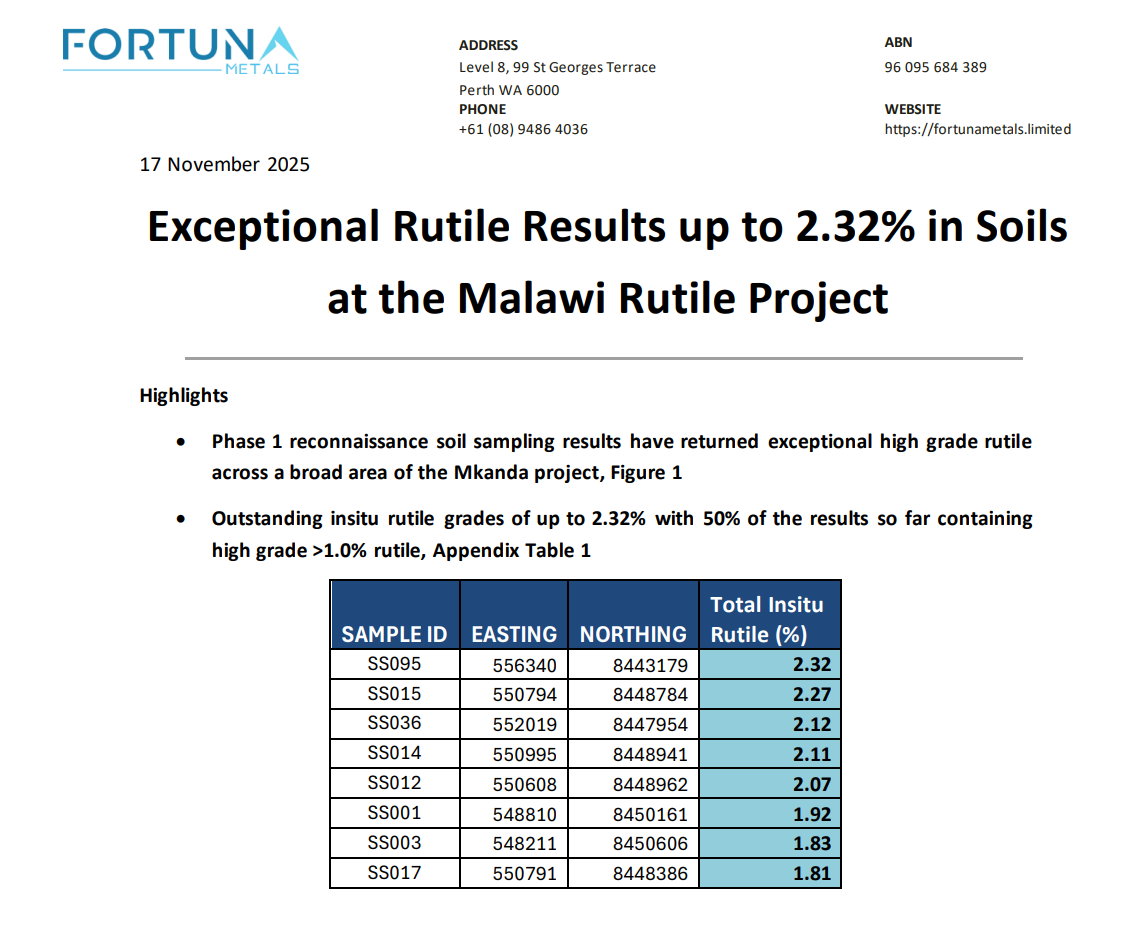

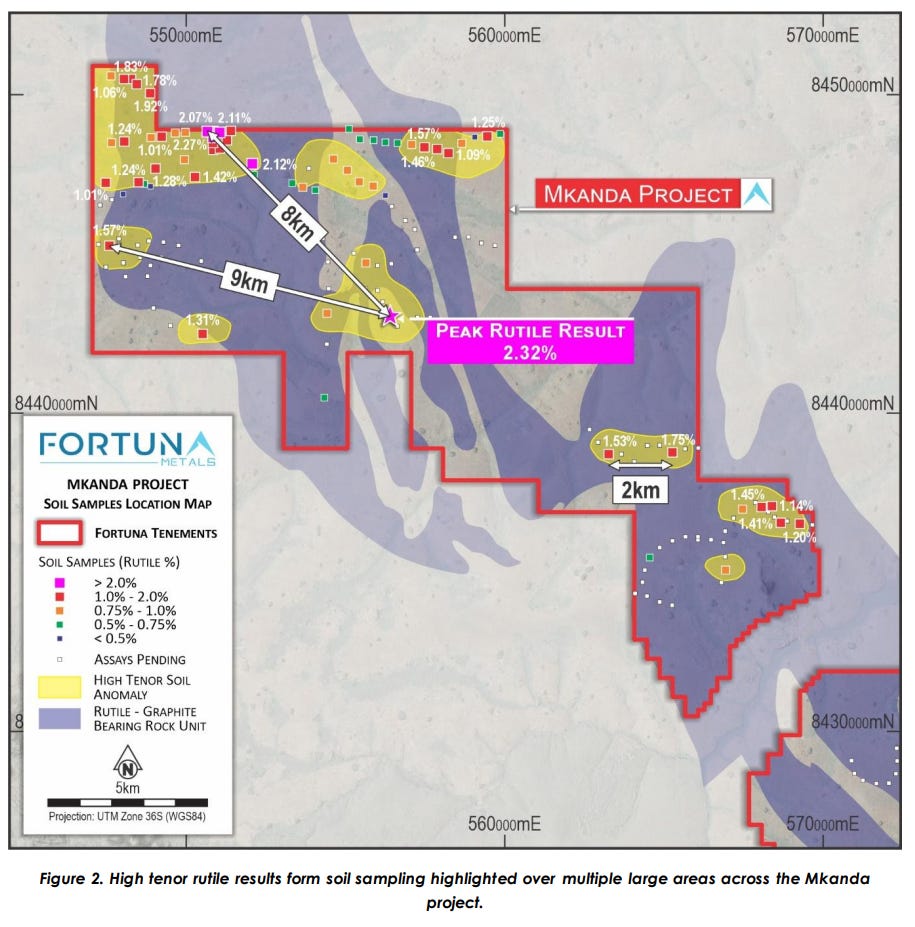

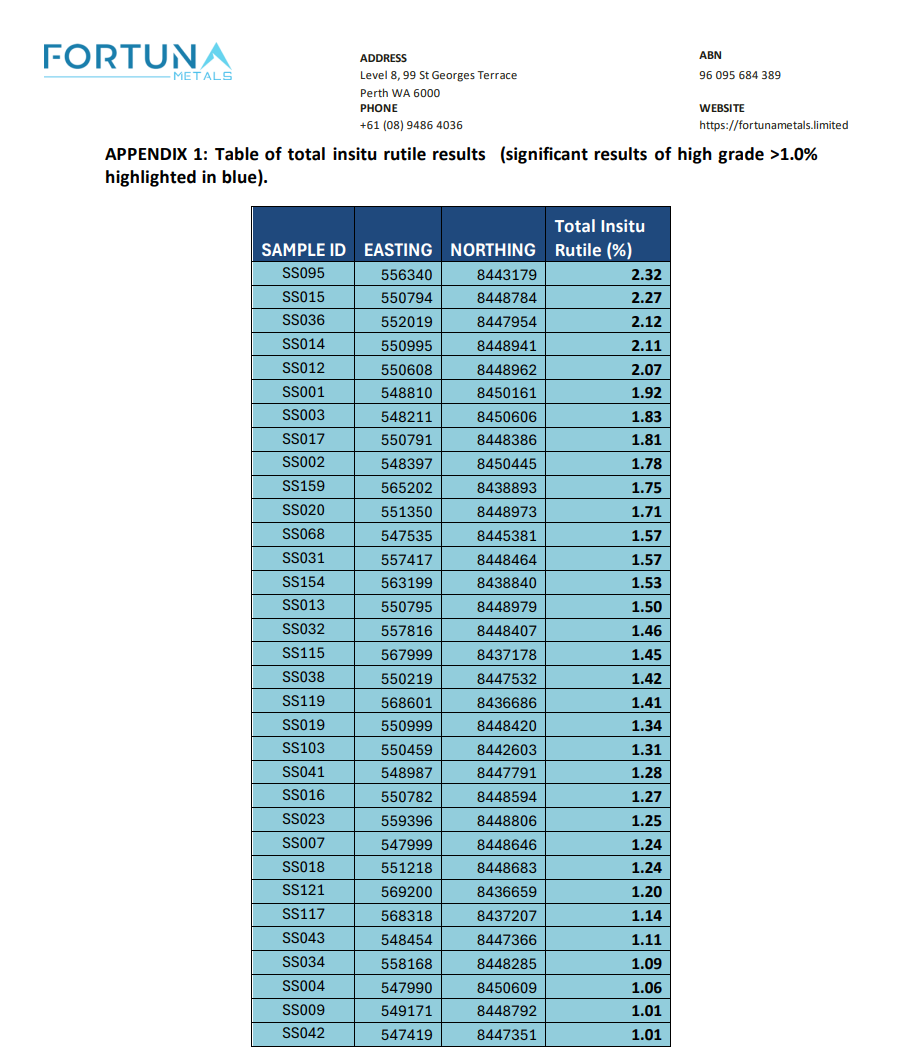

The standout numbers include a high of 2.32%, but the real story is the spread, with more than half of the samples reported so far sitting over 1%.

Grades at that level this early usually point to a system with real scale behind it.

And that’s with only 66 of the 232 samples in. Once the full grid lands, we’ll see the real scale and continuity of the surface rutile footprint ahead of drilling.

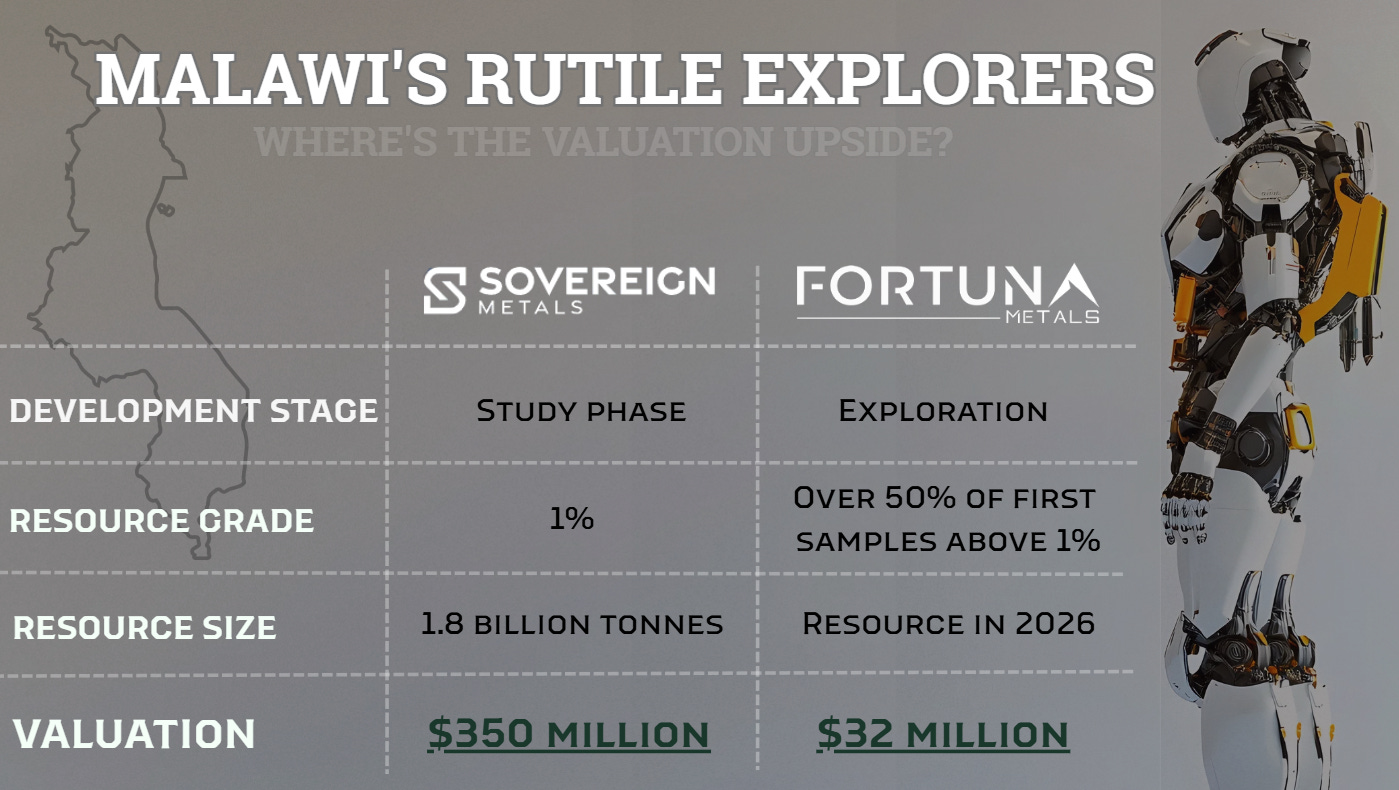

Fortuna’s Mkanda and Kampini projects sit on the same geological system as Sovereign’s Metals (ASX: SVM) Kasiya deposit. Yet, FUN is already matching or beating those grades before any aircore drilling has even started.

We added FUN to our portfolio based on its potential, and the early numbers justify the call. For a company at 13c with a $32 million valuation and more than $7 million in cash, this kind of early momentum can often be the start of a large re-rate.

“These high-grade rutile results are our first step in defining what could be the next major rutile discoveries in Malawi. With more results to come and our drilling programs expanded we are rapidly advancing with a high confidence of the rutile and graphite potential within our projects”

Fortuna CEO, Tom Langley

The Results and Why They Matter

The numbers here are strong enough to shift this from an early-stage curiosity into something with genuine discovery potential.

The standout results include grades of 2.32%, 2.27%, 2.12% and 2.11%, and they’re turning up across wide areas of FUN’s ground rather than as isolated spikes. At these levels, it’s squarely in world-class territory.

More than 50% of reported samples exceed 1% in-situ rutile. For context, Sovereign Metals’ world-class Kasiya deposit is defined at around 1%.

When early soil and auger samples already match or exceed the grades of a globally significant resource, the exploration upside begins to look very real.

The rutile at Mkanda and Kampini sits on the same weathered gneiss of the Lilongwe Plain that hosts Sovereign’s Kasiya. This style of mineralisation forms when tropical weathering strips out the lighter, more mobile minerals, leaving behind a concentrated layer of heavy minerals like rutile.

The company is essentially sampling the top of a system that has undergone natural pre-concentration over millions of years.

For those wanting the simple version: it means the geology does much of the work for you. And when near-surface grades are this strong, deeper drilling usually impresses rather than disappoints.

Next Steps and Why FUN Looks Undervalued

The next few months should deliver a steady stream of assays from Fortuna. Late November brings the rest of the soil results, mid-December the first batch of hand-auger assays, then consistent reporting continuing through Q1 2026.

The current work program is still first pass in nature, using hand augers to pierce the weathered profile before the water table limits the depth. The real shift comes next dry season when aircore rigs arrive, punching holes 20 to 30 metres deep to the saprock boundary.

That’s the depth where Sovereign Metals’ Kasiya resource definition was unlocked, and it’s where FUN will look to show scale, thickness and continuity.

The valuation gap between the two neighbours is hard to miss. FUN sits at around $32 million with more than $7 million in cash, while Sovereign Metals commands a valuation of $350 million.

Both are exploring the same geological system. Both are generating grades around 1% rutile. Yet FUN trades at less than a tenth of its neighbour despite soil grades that already stack up, and in plenty of cases, exceed them.

If FUN keeps hitting 1–2% rutile as it moves into deeper aircore drilling next year, the market will have to decide whether it still prices FUN like an early-stage explorer or starts closing that gap.

The next six months of results will go a long way to answering that, and we are backing the management team at FUN to close that gap.

Humanoid - The Coming Titanium Demand Wave

It is worth stepping back from the drilling for a moment because the long-term demand picture for rutile is changing faster than most people realise.

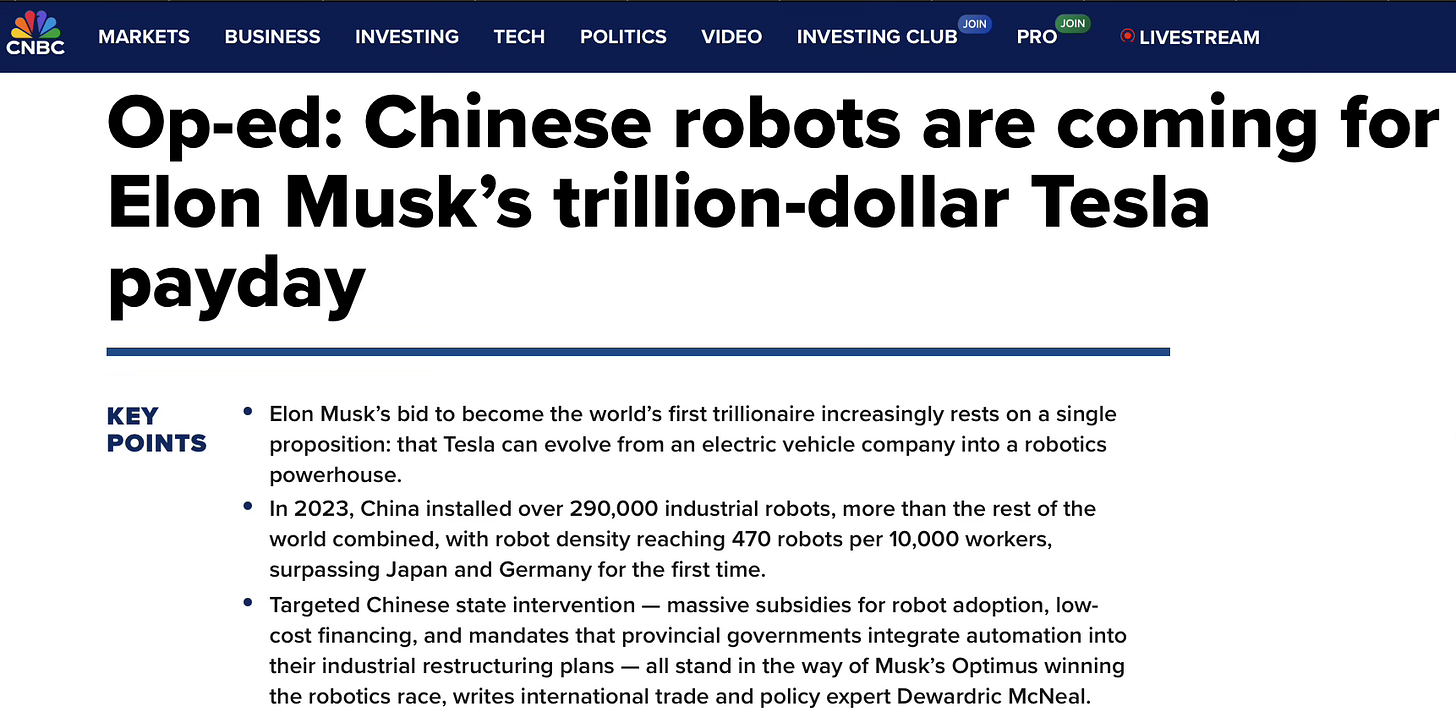

Scroll Elon’s X feed and you’ll see humanoid robots everywhere, and he’s been blunt about where he thinks this goes. He’s called humanoids “bigger than cell phones, bigger than anything” and says tens of billions could be in use one day.

Elon has a habit of saying something outrageous and then making it real, and very lucrative.

Tesla is already valued (in the trillions) on the assumption it becomes a robotics company, not just an EV manufacturer.

And it’s not just mad genius Elon betting big on robots, China’s already putting them to work on manufacturing lines, backed by massive state support and a push to dominate robotics.

This is where rutile comes in.

Rutile is the primary source of titanium metal, and titanium is quickly becoming central to the global push into humanoid robotics.

Any robot built to walk, lift, twist and repeat movements all day needs titanium alloys in its frame, joints, load-bearing structures and high-wear mechanical components.

Titanium is light, extremely strong and corrosion-resistant, which is why aerospace, defence and now robotics rely on it.

Humanoid robots need titanium, and titanium comes from rutile. As production shifts from hundreds of units to tens of thousands and eventually millions, titanium demand ramps hard.

Projects capable of supplying high-grade rutile into that pipeline stand to benefit, and Malawi already hosts some of the best rutile grades on the planet - the same geological system FUN is now drilling into.

The Way Forward

The early results from FUN are the start of something that could build quickly.

The combination of 2% rutile in soils, a geological setting shared with one of the world’s largest rutile deposits, and an exploration program now moving into systematic drilling gives investors a clear sense of direction.

The market hasn’t caught on that FUN might be sitting on the southern extension of Kasiya. The robotics story and ensuing titanium demand hasn’t been factored in either, despite Elon telling everyone who’ll listen that Tesla’s robots will be “an infinity money glitch”.

We backed FUN at 4c, it’s 13c today, and the next stretch of drilling will show just how far this system runs. So far, the grades justify the attention.

With soils, auger assays and aircore drilling landing over the next six months, FUN is heading into a sustained run of news and key catalysts with numbers that already stack up against a 350 million dollar neighbour.

If this trend holds, the valuation gap has room to close, and that’s where the upside sits for early investors.