Singapore summit: lithium, uranium, and the future outlook

Experts hint at a lithium rebound and uranium surge at the Future Facing Commodities Conference in Singapore

The lithium market might seem bleak right now, but Mr. Global Lithium’s Joe Lowry’s contrarian take at the Future Facing Commodities Conference in Singapore last week made us sit up and take notice:

“I've never seen sentiment this bad...this is an overreaction by the market.”

After a week on the ground talking with experts and analysts at the conference, here's the picture we got: while lithium may be at a cyclical low after a rough 12 months, the long-term outlook remains positive. A massive supply deficit and rebounding demand point to an eventual market correction.

Beyond lithium, the conference also highlighted other sectors. Uranium companies spoke of favourable market conditions and touted buoyant pricing, while green energy investments continue to gain momentum.

The three-day conference featured keynote speakers such as Benchmark Minerals’ Henry Sanderson, and representatives from The Australian High Commissioner to Singapore. Let’s dive into our takeaways.

The experts’ take

Throughout the conference, we spoke directly with a number of experts in the mining space, gaining their candid views on current market dynamics:

Scott Clements of Tribeca, an Asia-Pacific investment and advisory firm, kicked off day one. Scott acknowledged the challenges of tight capital markets and somewhat muted demand but underscored critical minerals' crucial role in achieving global decarbonisation goals. He emphasised the need to secure upstream (mine site) supply of a number of commodities and getting them through to production.

Hayden Bairstow, head of research at Perth-based investment house Argonaut, painted a bullish long-term picture for lithium. He predicts a structural supply deficit by 2030 and underscored the multi-phase process needed to bring discoveries into production: discovery, studies, financing, construction, and mining. It's a long and arduous journey that many companies begin, but only some finish.

Henry Sanderson of Benchmark Minerals, an author who has covered commodities and mining for the Financial Times in London for the past six years, was quick to point out how we are facing a continued east-vs.-west (China vs. the rest of the world) expertise and dependency battle. With initiatives such as the USA's Inflation Reduction Act, we are seeing Western governments invest heavily in an effort to catch up to China's dominance.

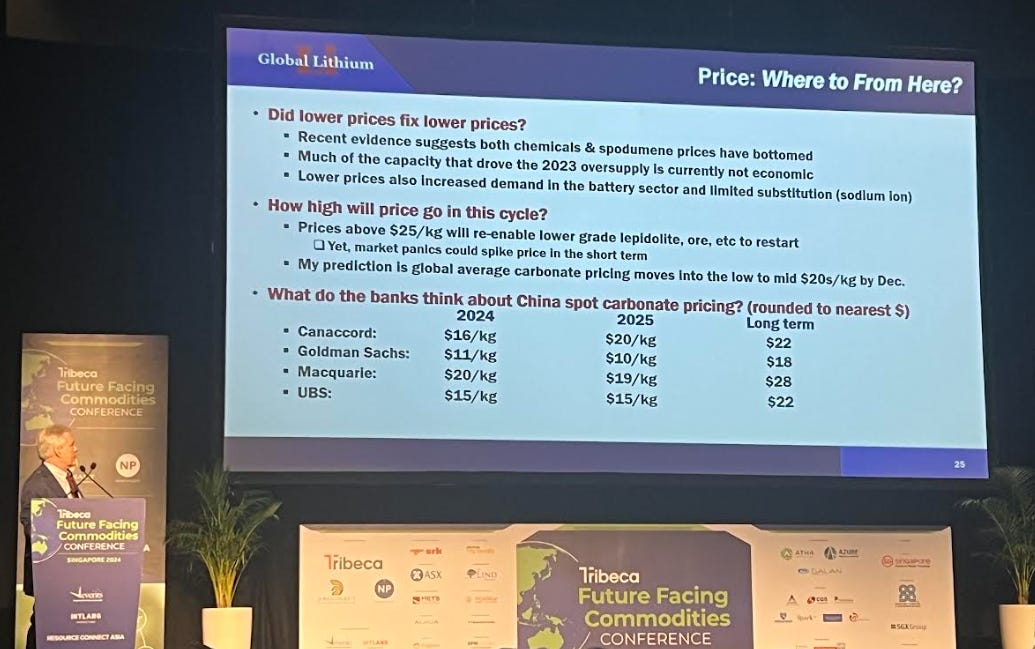

Joe Lowry, the industry veteran we mentioned above (who, as a side note, sold the first lithium to Sony back in the 1990s), predicts a persistent, long-term structural deficit in lithium supply. This, he believes, will drive a price rebound by the end of 2024. Joe also emphasised that there is not one lithium price, emphasising that the Chinese, Japanese, Korean, and emerging US and European markets operate with distinct pricing dynamics. Taking in just one lithium price can be detrimental to one's research.

Lithium: down, but not out

The question hung in the air at the conference: has the lithium slump bottomed out? While nobody made bold declarations, Joe Lowry and others hinted that if we have yet to see the bottom, it is very close.

Lithium pricing to the end of the year provided a lot of hope. Investment banks like Macquarie, UBS, and Canaccord are forecasting serious gains – think 15% to 50%. Joe's echoed this sentiment, with longer-term forecasts even expecting a 100% price increase from current pricing.

The sheer volume of lithium discoveries became apparent during the presentations. However, one key realisation emerged: securing financing remains a critical hurdle. You can find as much of it as you want, but if it’s not economical to get out at current pricing, who will fund you to build a mine?

Despite this challenge, the Equities Club team thinks lithium investing still has a lot of legs. As more money goes into exploration, we will make discoveries in areas that are either more economical or favourable for financing.

One thing was clear: across presenters, experts, and analysts, a consensus emerged: we will not have enough lithium by 2030; there is a significant shortage.

With prices at lows and expected to increase, a lack of financing in the market to bring supply online, and a structural shortage in the supply of lithium to meet 2030 demand, the Equities Club team sees many potential opportunities for small-cap companies to increase shareholder value upon discovery.

Uranium, yellow cake time?

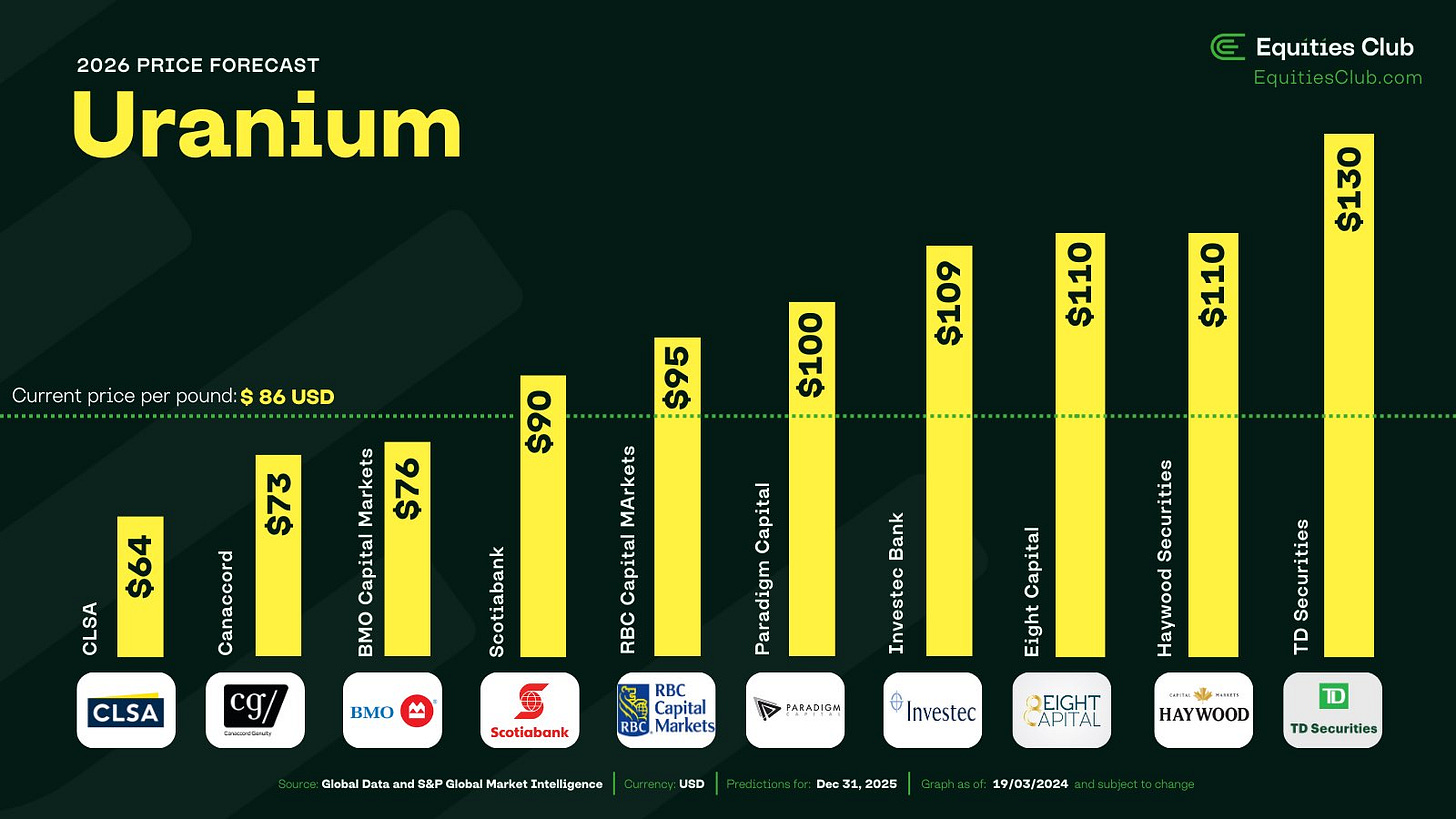

Unlike lithium, the market's buzzing for uranium right now. Demand looks set to skyrocket: China's on a nuclear reactor building spree, and Europe and the US aren't far behind. The hype is real, and it didn't matter where the uranium was – the USA, Canada, Africa, even Western Australia (where you can’t mine uranium currently). Everyone's bullish on pricing and demand.

Uranium's got something nickel and lithium can only dream of right now: shortages, expected soaring demand, and the investment banks singing its praises. With the USA the current largest producer of nuclear power and China hot on its heels, Equities Club sees a strong outlook for uranium. Picking the right uranium investment will be the key to longer-term gains.

So, where to from here?

Market downturns can be disheartening. But after a week in Singapore, talking to global experts, one thing's clear: this is just a bump in the road. The big picture – the world's shift to electrification and decarbonisation – that hasn't changed.

Things are looking up. Lithium shows signs of a comeback, uranium's bull run is just beginning, and green energy investments are here to stay. Companies with good-quality assets will do well.

Of course, investing always has its risks. But those companies focused on discoveries, managing their capital wisely, and steadily progressing their projects – they're the ones who should see the light at the end of the tunnel.

This article originally appeared on https://equitiesclub.com/ffc-2024-lithium-uranium-and-the-future-outlook/