Gold's Perfect Storm: War, Politics, and Market Jitters

Amid global tensions and economic uncertainty, central banks and everyday investors are turning to a familiar safe haven: gold. Is it time you did the same?

In a world that feels increasingly unstable, gold is once again proving its mettle as the go-to safe haven for investors. With geopolitical tensions simmering, economies wobbling, and inflation casting a long shadow, the yellow metal is having quite the moment.

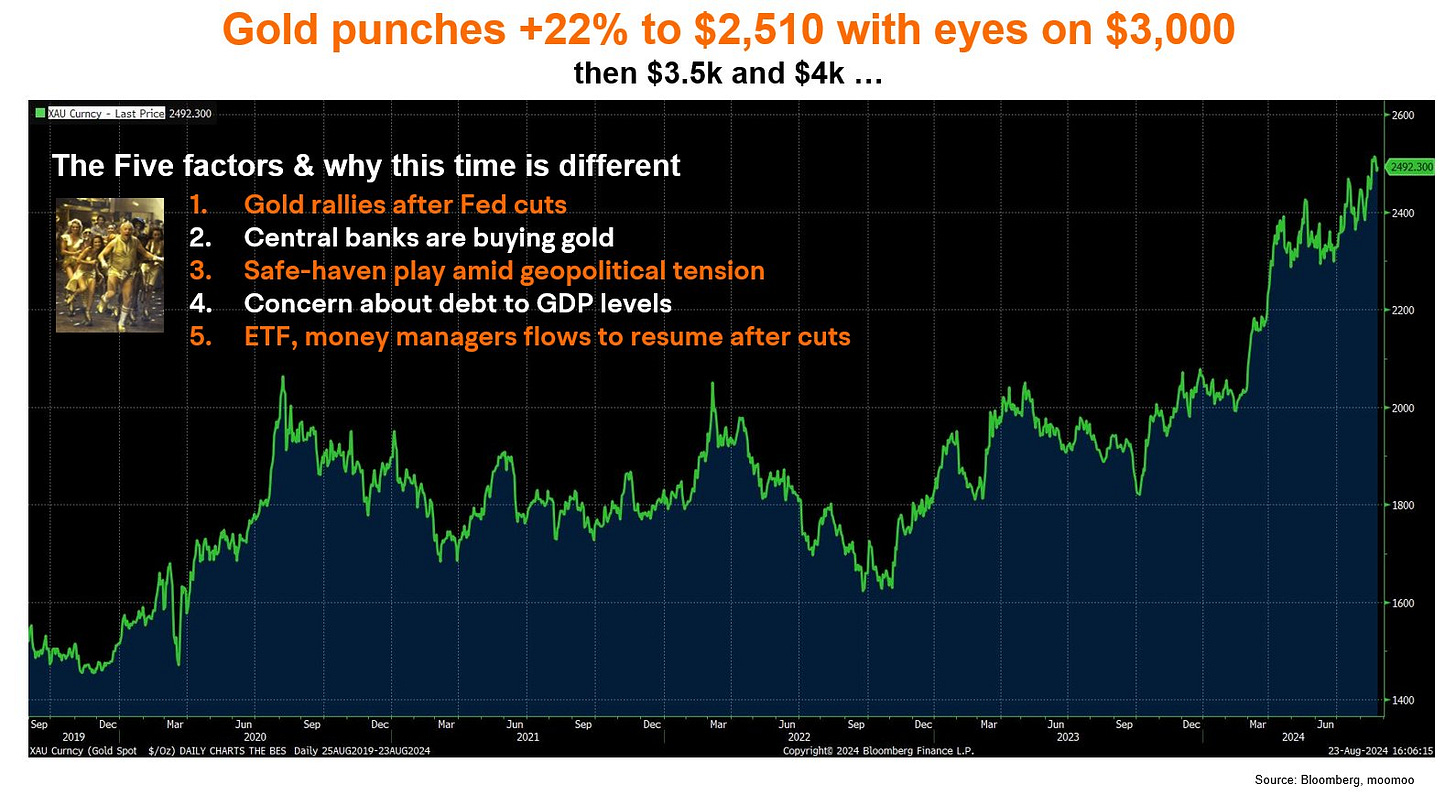

The Golden Run

With prices surging 30% this year, gold’s remarkable run stands in contrast to the broader commodity market.

To get a ground-level view of this trend, we headed to this week's Australian Gold Conference in Sydney. This gathering of industry heavyweights offered insights into both the thriving large gold producers and the junior explorers finally getting their moment in the sun.

It comes off the back off the recent Diggers and Dealers conference in Kalgoorlie where gold was very much the belle of ball.

The Gold Price Surge

Unlike most commodities, gold's value isn't solely driven by supply and demand. Macroeconomic factors play a significant role, adding complexity to its market dynamics. Gold often serves as a hedge against inflation, with prices typically rising when currency values decrease.

Between ongoing wars, a presidential assassination attempt, federal banks looking to cut rates, and consumer buying of gold at record highs, we decided it was high time to take a deeper plunge into the gold market.

Insights from the Australian Gold Conference

The annual conference's importance lies in its ability to bring together key players and thought leaders to collaborate and shape the future of gold investment and mining in Australia.

As first-time attendees, we found the conference invaluable for gauging market sentiment. We tread the boards, chatting with gold mining companies, financial analysts, investors, policymakers, and industry experts.

Our discussions covered current market trends, investment strategies, the economic outlook for gold, and technological advancements in mining and exploration.

The consensus? Gold is flying, and large producers are printing money. It's never been a better time to be a gold producer. And the juniors are starting to ramp up as they finally get some love after being in the battery metals wilderness for the past few years.

Additionally, the conference addresses geopolitical factors (*cough* Regis Resources) and regulatory changes that could impact the market.

Our takeaway on the most notable junior gold stocks can be found below.

Factors Driving the Gold Price

Everyone has an opinion on why the bullish gold price is so high, so we’ve tried to narrow it down to a few key points.

Our research points to several key factors:

Central bank demand: Geopolitical tensions, including ongoing conflicts and US-China relations, are driving increased demand from central banks.

Consumer buying: For the first time, we're seeing significant consumer demand alongside institutional buying. Gold bars are even on sale at Costco. It’s estimated that Costco now sells up to USD$200 million worth of gold bars a month.

Interest rates and US dollar strength: Low interest rates and a weaker US dollar typically make gold more attractive to investors. With the US forecast to cut interest rates next month, the increase that would occur in the price of gold may already be factored in. We encourage everyone to proceed with caution.

US political landscape: The lead-up to presidential elections has historically supported the gold price, with recent events adding unease and reinforcing gold as a safe-haven asset.

For the first time ever, the traditional 400-ounce gold bar is worth $1 million at current prices, an incredible milestone.

Largest Gold Producers on the ASX

With gold's strong performance, it's worth looking at the largest producers on the ASX. The top five gold producers based on 2023 production were:

Northern Star Resources ASX:NST (1,555,588oz produced)

Evolution Mining ASX:EVN (651,155oz)

Perseus Mining ASX:PRU (479,696oz)

Regis Resources ASX: RRL (366,586oz)

BHP ASX:BHP (355,459oz)

Of course, this could change in 2024, but the list above is a snapshot of companies that are large gold producers that would benefit from a 30% increase in the gold price.

Junior Gold Stocks to Watch

While large producers are thriving, several junior gold companies on the ASX are also showing potential, given their cheap valuation and prospective projects.

Here’s what we have an eye on:

Lanthanein Resources (ASX:LNR): with a cheap valuation of just $8 million and next door to a historical gold mine that produced 1.3 million ounces in WA, LNR represents entry into a historical gold-producing region.

Waratah Resources (ASX:WTM): situated in one of the most prolific gold-producing regions in Australia, Cadia Valley, WTM has had exciting results to date and is looking to continue drilling.

Australian Gold and Copper (ASX:AGC): A NSW explorer that has seen great growth off exciting drill results. With more untested targets to be drilled, AGC could no doubt head north on good results.

Looking Ahead

It’s been a standout year for gold so far, and from our discussions and research it seems likely that gold will finish the year strong.

The ongoing global uncertainty is likely to continue driving gold prices higher, to the benefit of producers and juniors in the space.

The optimism around gold is something of a stand out in current commodity markets, a refreshing change dare we say it. We also don’t believe this is blind optimism either, strong gold prices look set to stay for the foreseeable future.

If you’re looking to invest and want a commodity that’s treated as a safe haven over time, look no further than gold. Whether it’s the biggest producer or a small explorer with potential, the gold sector caters to everyone.