It Begins: FMR Launches Chilean Drill Campaign

The moment FMR shareholders have been waiting for. Drill rigs are now turning at Southern Porphyry in Chile's proven copper belt

The wait is over. FMR Resources (ASX: FMR) has started drilling its monster copper target in Chile.

Drill rigs are turning at the Southern Porphyry target, and shareholders have front-row seats to what could be a company-making discovery.

The company is trading at 38c, giving it a modest $19 million market cap. Yet, it holds nearly $7 million in cash, meaning no raise is needed during this drill campaign.

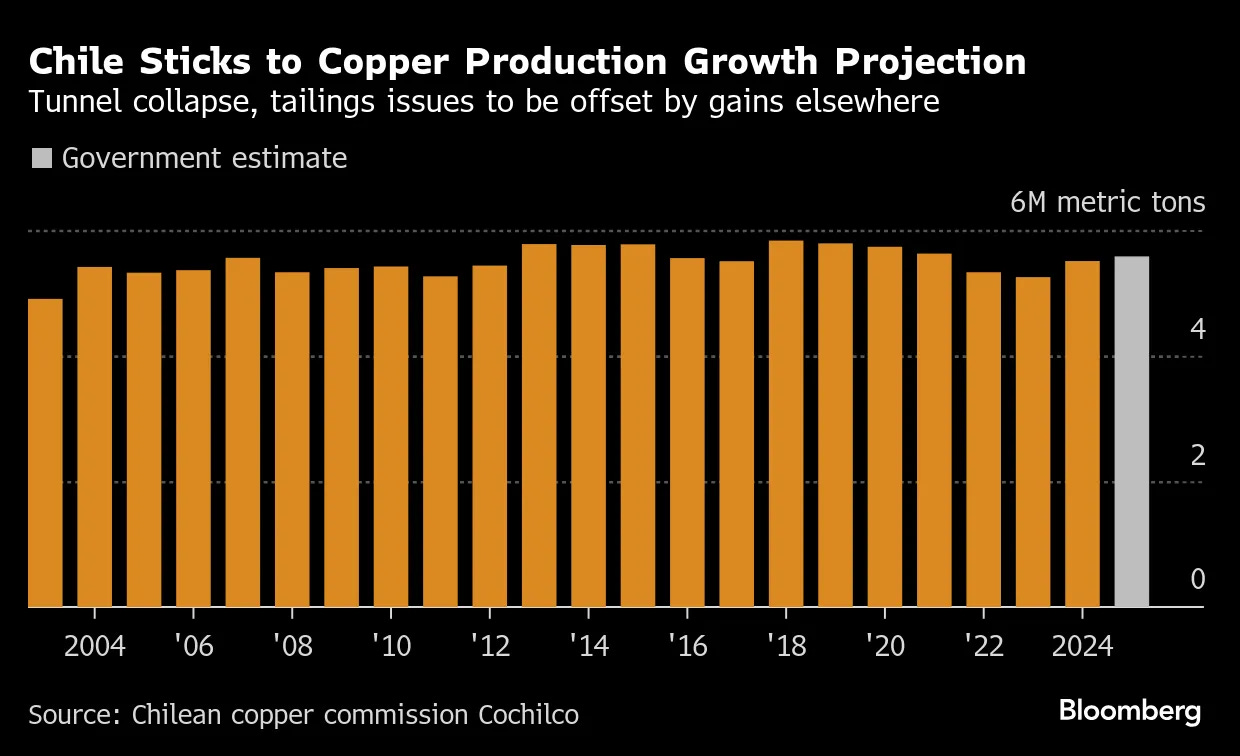

Copper is the metal of the future, needed for nearly everything from renewable energy, to AI, and construction. A significant discovery here could see FMR jump from exploration minnow to a company worth multiples of its current valuation.

How FMR Landed in Chile's Copper Heartland

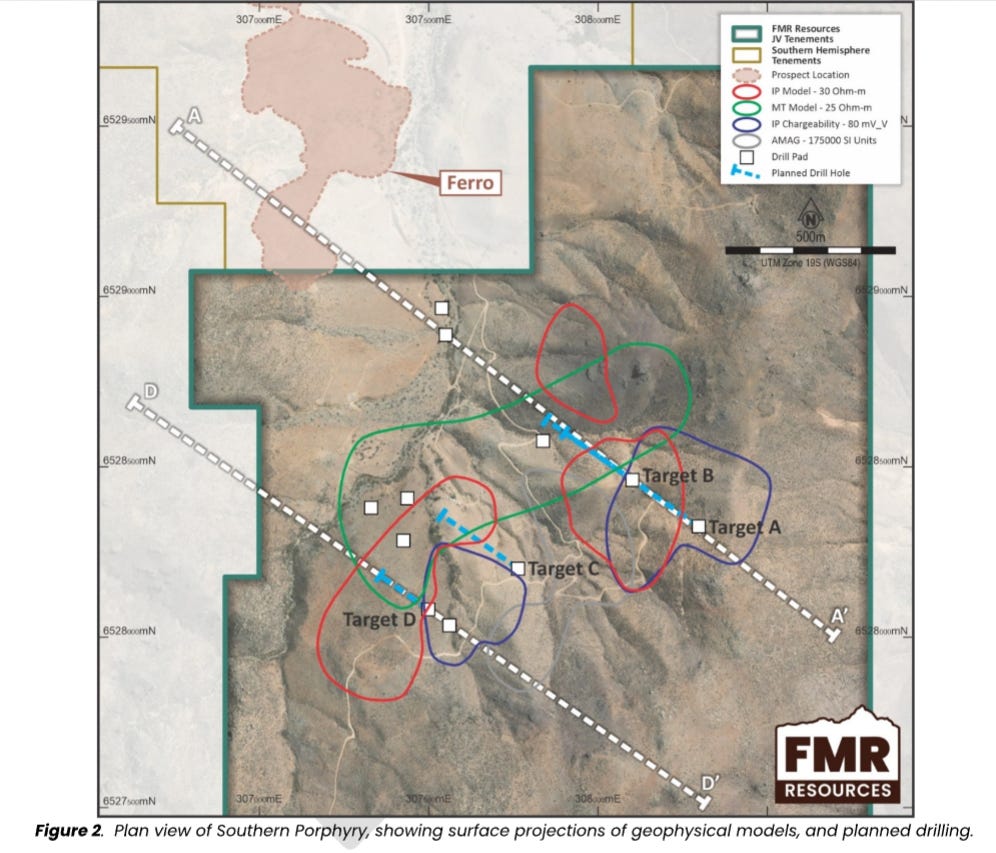

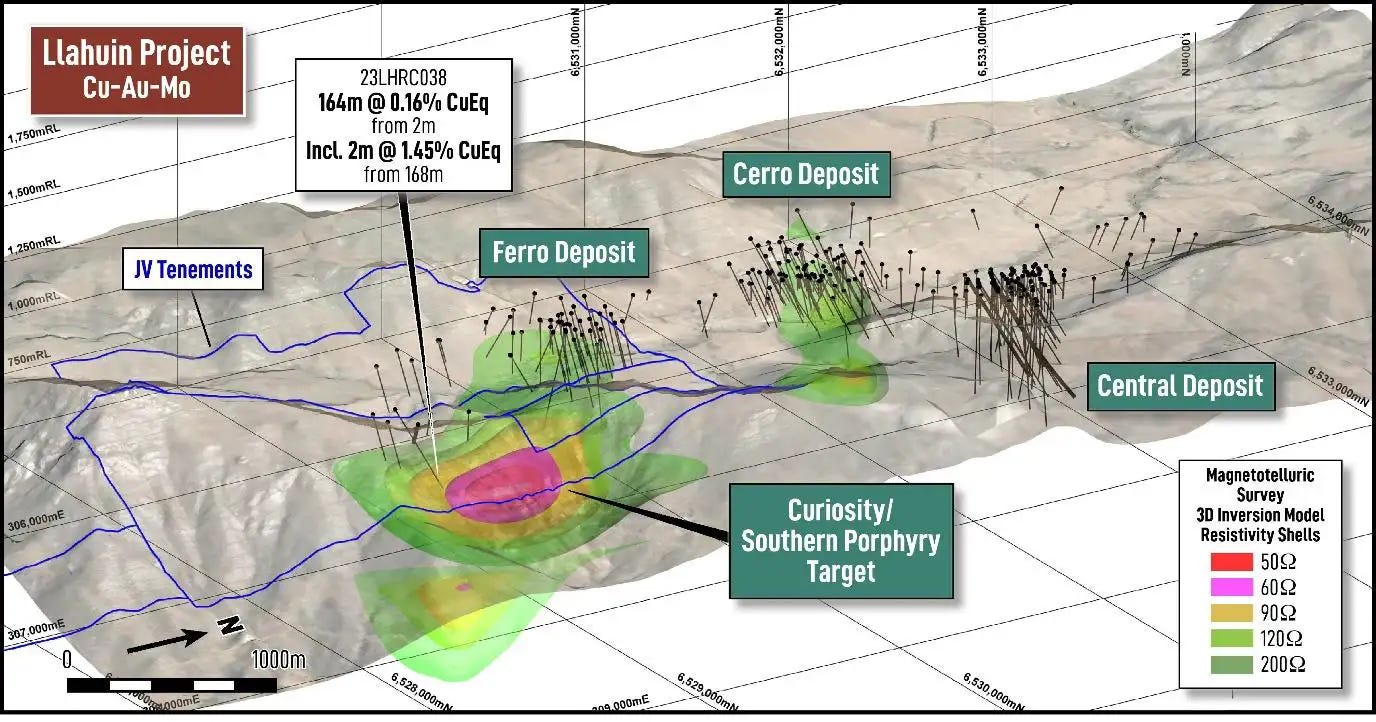

FMR picked up the Llahuin Project in Chile in late June this year. What they found was a Southern Porphyry target sitting in a corridor already known for copper, gold, and molybdenum mineralisation.

Early workings suggest FMR could be sitting on a large porphyry copper deposit at depth. The type of asset that can quickly change a company's fortunes.

The gap between FMR's current $19 million valuation and where it could trade on a discovery is enormous. Copper drives electrification, AI data centres, and the entire energy transition. Supply is tightening, with forecasts pointing to near-term shortages.

Backing this fast-moving strategy is a leadership team with proven credentials. Managing director Oliver Kiddie has built a reputation for leading exploration companies that go on to make real discoveries.

On the board sit heavy hitters like Justin Werner, who built Nickel Mines into a billion-dollar success story. Behind the register you've got Mark Creasy (who backed Sirius and Azure before their billion-dollar buyouts), plus Tribeca and Inyati Capital.

The 4,000m Diamond Drill Campaign - Why Target A Matters Most

The Phase I program will total 4,000 metres of diamond drilling over the next three months, designed to provide the first genuine test of what FMR interprets as a large porphyry copper system in one of the world's most copper-fertile regions.

Target A is the primary focus of the campaign, with FMR committing to a single 1,600m hole with capacity for multiple holes off the same platform.

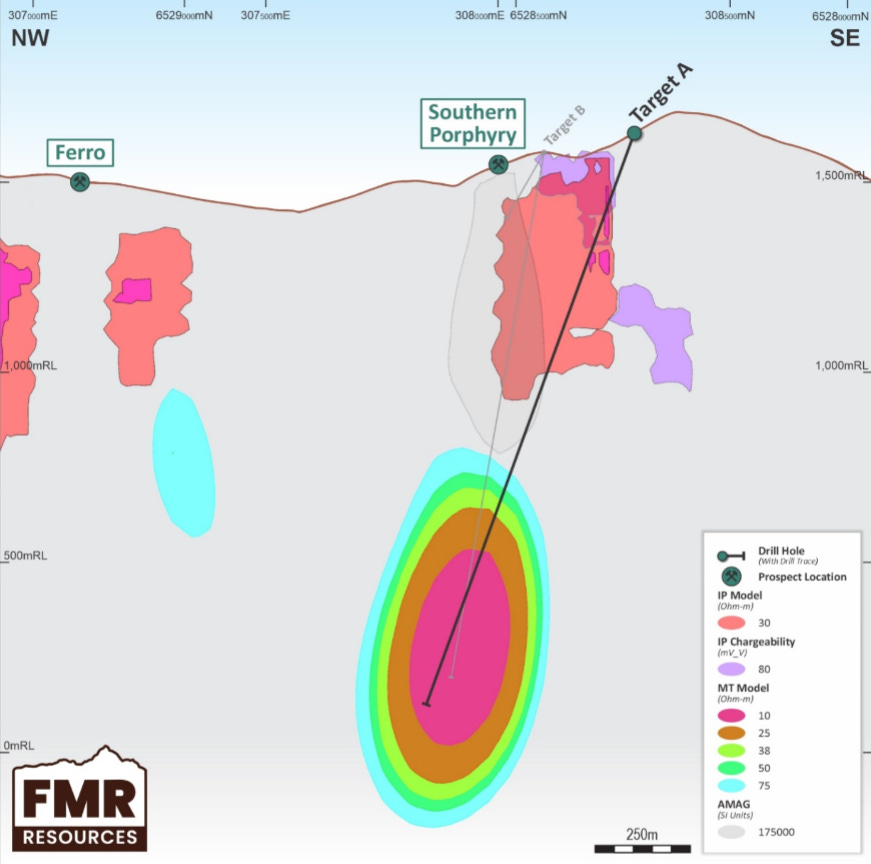

For those unfamiliar with deep drilling, a hole of that depth is both technically demanding and highly revealing, aimed squarely at cutting through the upper part of the targeted system and into the heart of the anomaly that sits below.

Target A is being prioritised because the modelling shows a convergence of features that often define the "engine room" of a porphyry system.

Near surface, the hole will cut through the Santa Maria epithermal vein system, where quartz veining and alteration hint at mineralising fluids. Deeper down, they're aiming straight at a large high-amplitude MT anomaly - potentially the porphyry core.

In simple terms, this means the drill is designed to slice through the top of the system and continue into the main body where copper may be concentrated.

Hit mineralisation and they can step out laterally with follow-up holes from the same pad. It’s one setup, with multiple shots at discovery.

Think of Target A as the keyhole into the deposit. Near surface you see the ‘smoke’, deeper down you test for the ‘fire’.

A strong hit at Target A validates everything - the geophysical models, the broader Southern Porphyry system, the entire six-kilometre mineralised corridor. That's when things get properly interesting.

That would immediately elevate the project from a conceptual target to a live large-scale discovery with potential, something the majors are actively chasing in Chile.

The Underground X-Ray Vision Guiding Every Drill Metre

Every drill program needs a model, and FMR's built a beauty. They've pulled together magnetics, magnetotellurics, induced polarisation, and gone back through old drill cores with fresh eyes. It's thoroughness you want to see before someone starts burning through drilling budgets.

For those less familiar, think of geophysics as underground x-rays - showing where the rock changes, where structures bend and break, and crucially, where mineralisation likes to hide.

All the modelling, all the data, all the prep work leads to the moment of truth when theory meets a diamond drill bit grinding through Chilean bedrock.

Each hole will also run downhole geophysics, including IP, conductivity, and gamma logging.

All this technical jargon means that FMR is adding value to the drill hole as it helps refines the 3D model as they go, tightening up where to drill next and helping identify new targets. It's smart and helps manage costs efficiently.

Christmas Assays Could Deliver the Ultimate Present

The first hole should take about five weeks to drill, with assays four to six weeks later.

If they hit something meaningful, that's a very different New Years for anyone holding FMR shares. Then the assays from follow-up holes start rolling in.

The assays will provide the hard numbers, such as copper grades, widths, and whether any other minerals, like gold, were intersected. The first assay could be the catapult that turns FMR from an explorer into a serious contender in the region.

Eight kilometres away sits copper-gold project El Espino, where Resource Capital Funds recently invested US$90 million for just a 23% stake. Los Pelambres, owned by $18 billion Antofagasta, runs 65km down the road with over 5 billion tonnes at 0.53% copper.

This is proven copper country where discoveries get developed and juniors get taken out. When you hit meaningful mineralisation in ground like this, the market moves fast.

Why Smart Money Is Already Positioned

When a junior like FMR commits to drilling a 1,600-metre hole into a porphyry target, they're swinging for the fences. These deep holes cost serious money and take serious conviction.

Get it right and FMR could be sitting on the kind of extensive copper system that makes careers and fortunes in mining. Chile's one of the best mining jurisdictions on earth, with established infrastructure and a stable government that wants mines built.

Even before results, the calibre of the team, the presence of big-name shareholders, and the fact that the company is well-funded all reduce the downside risk that often plagues juniors.

The copper market itself adds another layer of leverage with strong prices and supply gaps looming, and majors prowling for projects and making moves on anything with scale.

FMR knows what they're hunting for, and more importantly, they know who'll come hunting if they find it.

The Drills Are Turning - Here's What Happens Next

The rigs are turning at Southern Porphyry, and the plan is simple: drill deep, use advanced geophysics to sharpen the picture, and deliver assays in short order.

At 38c a share, capped at $19 million, and backed by $7 million in cash, the valuation leaves significant room to move on a potential discovery.

This is still ASX small-cap speculative territory, there’s no sugar-coating that. But with copper where it is and FMR drilling where they are, the risk-reward stacks up nicely.

The ground's exceptional, the team knows what they're doing, and the backing from Creasy, Tribeca and Werner tells you the smart money's already positioned.

By Christmas, we'll know if Target A delivers. In a tight market with copper heading higher, one good intercept could change everything.

That's the opportunity here - and why we're watching every update that comes out of Chile.