Godzilla strikes: LNR announces massive lithium anomaly at Lady Grey

Lanthanein Resources is fast-tracking drilling after uncovering a massive Godzilla lithium anomaly with striking similarities to the giant next door. Could this be the next big lithium discovery?

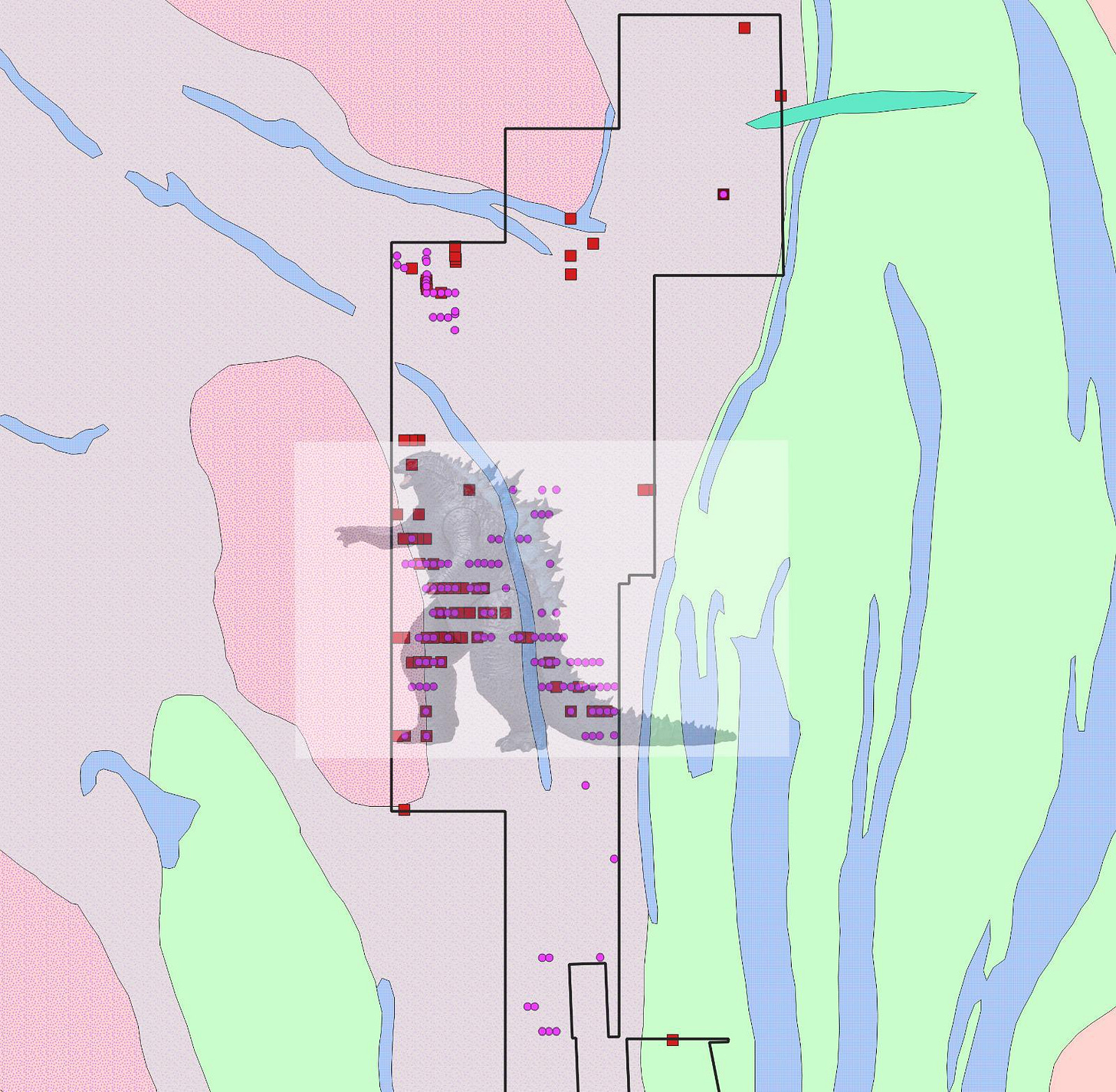

Lanthanein Resources (LNR) just unveiled a massive lithium anomaly dubbed Godzilla.

The Equities Club team has been keeping tabs on Lanthanein since they caught our eye during our 10-bagger hunt at the RIU Explorers Conference. Today's news could be the catalyst that transforms them from 'under the radar,' as we described them at the time, to a major player.

Let's break down today’s announcement and why it has the potential to be game-changing…

What jumped out at us

Huge lithium potential: LNR found a massive lithium soil anomaly measuring 4km long at their Lady Grey Project. This points to a potentially significant lithium deposit.

Goldilocks zone: Just 2.7km from Covalent Lithium's enormous Earl Grey mine, a high-grade globally significant 189Mt deposit owned by Wesfarmers and SQM.

Cheap valuation: Valued at $7 million, LNR is very cheap, considering 50% of the Earl Grey mine next door sold for over $750 million back in 2019.

Earl Grey similarities: Early analysis suggests similar geology with potential for lithium-caesium-tantalum (LCT) pegmatites – the favoured kind for lithium mining.

Impressive results: A peak of 454ppm Li2O from sampling. Put simply, they found high concentrations of lithium in the soil over a large area, a promising indicator of what may lie beneath.

Drilling ASAP: LNR is accelerating exploration and plans to start drilling by mid-year. All investors should applaud this - a team getting to work ASAP.

Why it matters

This Lady Grey announcement is a potential game-changer for Lanthanein Resources.

Up until now, they've been an explorer with promising ground. This announcement puts the wheels in motion for what may end up being a future world-class discovery. The timing couldn't be better, either, with a recovering lithium market and investors hungry for the next big Australian lithium story.

The investor insight

Interestingly, half of the Earl Grey mine next door sold for just over $750 million to Wesfarmers in 2019. Remember, this was before the lithium boom of 2021-2022. And as we said above, Lanthanein's initial analyses share striking similarities to the geology of the Earl Grey mine.

As the real estate agents say: 'location, location, location.’ This proximity to a known giant deposit owned by some majors is extremely encouraging. All the infrastructure, power, roads, and water are already there; you couldn't have a better location.

Of course, this early data doesn't guarantee a major find, but it certainly fuels the excitement around LNR and Lady Grey.

What they’re saying

“The discovery of such a large coherent lithium geochemical anomaly at the new Godzilla prospect leads us to believe that we may be in the early stages of a large lithium discovery … We will now accelerate our work programmes and approvals processes to be drilling these targets mid-year.”

- Brian Thomas, Technical Director of LNR

The Equities Club take

Equities Club previously covered LNR as an 'under the radar' lithium play with the potential to be a '10 bagger' for 2024. Today's announcement won't get LNR there overnight, but it's a significant step and further strengthens our belief in their potential to 'make it big' in a recovering sector.

RIU's Treasure Trove: Will the 10-Bagger Streak Continue?

The Equities Club team returns from the RIU Explorers Conference in, a key event renowned for its track record of uncovering '10 baggers' - the holy grail of small-cap investing. Here's who we think could be next

Today, they've taken a massive step in the right direction. But this is still early-stage stuff – lots of potential, with the usual exploration risks.

Encouragingly, Brian Thomas, the chairman of last year's '10-bagger', Azure Minerals, is also a Technical Director for LNR. Follow the money, as they say.

We suggest everyone keep a close eye on Lanthanein as they accelerate toward their drilling program. If those initial drill results confirm a major find at Lady Grey, this could become one of the hottest Australian lithium stories in years.

This article originally appeared on https://equitiesclub.com/lnrs-massive-lady-grey-lithium-anomaly/