Mining Indaba 2025 Report: Gold, Gabon & Growth

What we heard from miners, dealmakers, and insiders at Africa’s biggest mining events. Our key insights from Indaba & 121 that could shape the mining sector in 2025 and beyond

One city, two conferences, three days. It's been a busy week, to say the least.

The Equities Club team is in Cape Town, South Africa, for Africa's biggest mining conference, Mining Indaba, and the 121 Mining Investment Conference.

Cape Town was buzzing with more than 8,000 mining professionals this year. The usual big names were there - BHP, Rio Tinto, Barrick Gold, and Newmont - along with energy giants Total Energies and Vivo Energy.

While Indaba draws the big end of town, 121 is where the real action happens for us. It's where ASX-listed juniors rub shoulders with fund managers and brokers, pitching their projects and chasing that next round of funding. These are the companies that can deliver those multi-bagger returns we love.

Our team spent our days moving between both conferences, and we've got some fascinating insights to share that could shape your investment strategy for 2025.

Gold Takes Centre Stage

Gold dominated discussions at Indaba, and with good reason. With prices holding near record levels and investor interest only growing, the attention was firmly on both producers and explorers.

Yet despite gold surging 40%, small-cap explorer share prices haven't caught up. This disconnect points to an opportunity, and we anticipate a "catch-up" effect on share prices.

The market is sleeping on junior explorers, but from what we heard on the conference floor, smart money is already positioning itself.

Finding gold in stable jurisdictions was a major theme. Mali's recent troubles reinforced what many already knew. When your CEO gets held for ransom (as happened to Resolute Gold), and militia groups start helping themselves to your gold (just ask Barrick Gold (NYSE: GOLD), it’s time to re-think investing in the country.

The funding landscape revealed some stark contrasts. Canadian-listed gold companies are struggling to raise money, with their market conditions described by some we spoke with as 'brutal'.

The ASX, on the other hand, remains the best place for junior exploration companies to access capital and push forward with exploration efforts. Maybe it's just us Aussies and our eternal optimism for backing the next big find, but our market remains open for business.

For ASX-listed gold explorers, this environment creates an interesting dynamic. With fewer companies actively drilling globally, those hitting good results are likely to grab headlines. In a market hungry for the next discovery, that attention typically flows through to share price movement.

Emerging Mining Hotspots: Zambia and Gabon

At Equities Club, we're always hunting for opportunities before they hit the mainstream. This year, we focused on identifying which African nations are positioning themselves to attract the next wave of mining investment.

Two countries stood out at both conferences: Zambia and Gabon. Each is making a strong case for mining investment, with the right mix of under-explored areas with untapped potential and favourable investment conditions.

Key opportunities:

Zambia: Prospect Resources (ASX: PSC) is leading the charge with their copper project. The country offers a mining-friendly government, improving infrastructure, and vast untapped potential.

Gabon: Apollo Minerals (ASX: AON), with their gold project and others in country. Positive investment conditions and quality projects make Gabon an emerging opportunity catching attention.

Conversely, and we hate to labour the point, Mali appears increasingly difficult to operate in. The troubles faced by FireFinch, Leo Lithium, Resolute Gold, and Barrick Gold paint a clear picture. After our discussions at the conferences, it is impossible for us to justify investment in Mali now.

As exploration and funding inevitably dry up in Mali, we expect other African nations to take note. Nothing kills investment faster than political instability and resource nationalism.

The Major-Junior Divide

The heavyweights dominated Indaba this year. BHP, Rio Tinto, Glencore and Barrick Gold were out in force, reinforcing their commitment to African mining operations.

Energy players made their presence felt, too. Total Energies and Vivo Energy were deep in discussions about power solutions for mining operations - a critical piece of the puzzle as major miners push towards decarbonisation.

The overall industry presence was remarkable, with a huge amount of people in what many would call a down period for commodities. There was a clear divide, though: the major miners are doing well, but the junior exploration space remains unloved.

Sentiment among smaller players was mixed, with optimism about the long-term potential of their projects but frustration at the current lack of market interest and funding.

Where Deals Get Done: Inside 121

While Indaba showcased the industry's biggest names, the 121 Mining Investment conference was where the real conversations about junior mining took place.

Comparing this to Indaba, 121 is less suits and ties and more roll up the sleeves and get your hands dirty discussions. There is no big picture here; more what's on offer.

Inside 121: What We Learned

Deals are still happening. Deal-makers are playing the long game, positioning themselves ahead of the market turn they see coming. Smart money knows the cycle will shift - it always does.

Gold projects lead the way. African gold projects dominated serious investor interest, particularly those with strong fundamentals. Even in this market, quality assets are finding support.

Strong projects find backing. Despite the broader market malaise, projects with solid fundamentals are still attracting attention and funding.

The ASX advantage we mentioned earlier was evident at 121. With Canadian markets still struggling, ASX-listed juniors are finding themselves at the centre of more deal discussions.

The funding environment on the ASX remains far more supportive, making it the go-to exchange for junior explorers looking to raise capital.

Market Cycles and Smart Money

One of the most intriguing undercurrents at both conferences was the prevailing sense that, despite current challenges, deal-makers and major miners are well aware of the cyclical nature of commodity markets.

Most agreed that the downturn in interest for junior explorers wouldn't last forever. If history teaches us anything about investing, the contrarian viewpoint on investing often pays off when times are tough. The real question is timing.

Trump's tough talk on tariffs could lead to inflation, in turn hurting commodity prices as projects become too expensive to build. For now, the money is still moving, but cautiously.

Many stated they expect the market to turn once there has been a sustained downturn in small-cap stocks. In our eyes, we are now closing in on two years of a downturn. There has been a lack of discoveries that will inevitably flow through to a lack of development-ready projects.

As 2025 progresses, this downturn will become more and more evident. The market will respond with an increase in capital raisings and funding among junior explorers.

2025 Commodity Outlook: Where We See Opportunity

Gold's Momentum

We believe gold will continue to have a strong year, and this sentiment is echoed by investment banks such as Bank of America, Goldman Sachs and UBS. A break above US$3,000/oz could trigger serious buying in junior gold explorers.

Lithium's Reset

Lithium will likely lift as the year progresses. With exploration at a standstill and projects mothballed, supply constraints are building. When prices turn, all lithium juniors should benefit from renewed interest.

Copper's Complex Picture

With copper, it's always tricky; there have been many indicators that the price is set to run, only to pull back. The bottom line is that copper is needed for the electrification journey, meaning we require more copper than we are currently producing.

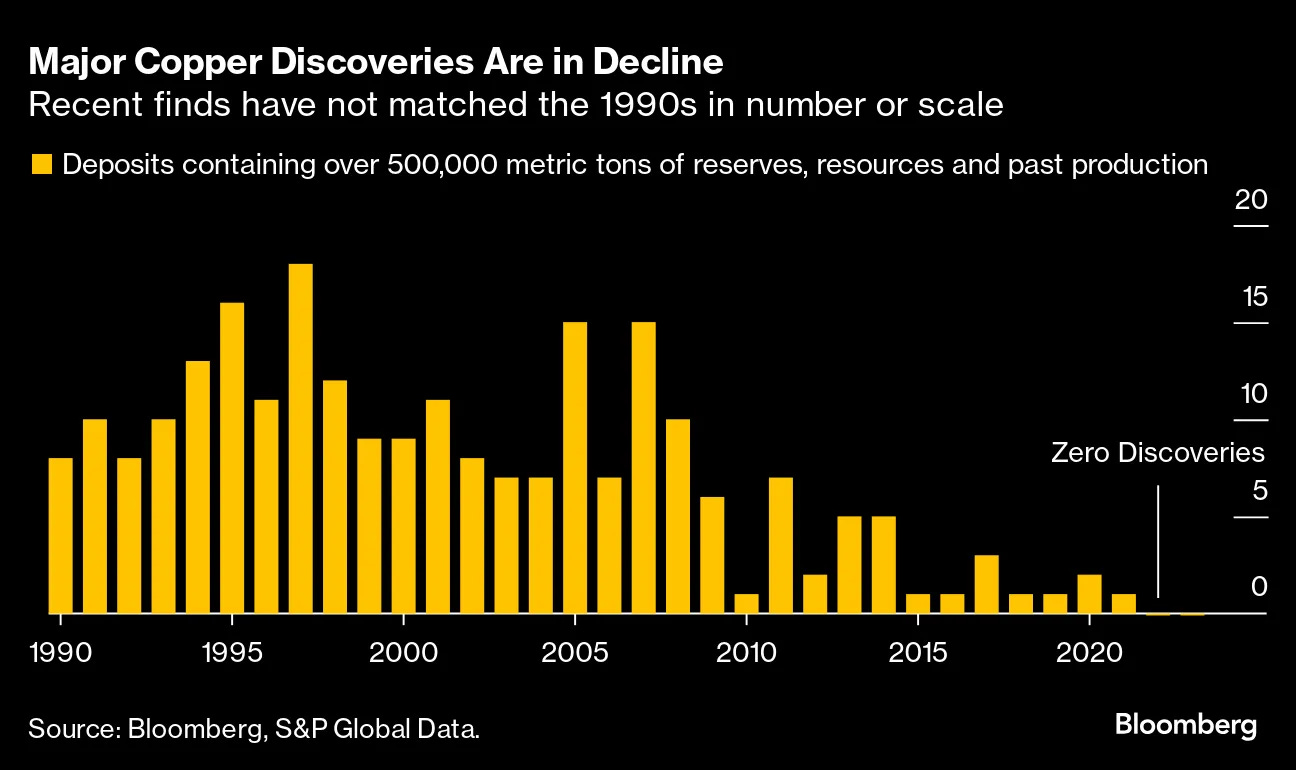

Like other commodities, there has been a lack of copper discoveries in the past five years. Anything that has been found is not yet of the size to make a dent in future supply.

Chile highlights the supply challenge. While the world’s largest copper supplier increased production in 2024, ongoing issues with water access, resource nationalism, and declining grades paint a concerning picture. As these challenges accelerate, global demand for copper continues to rise.

The Numbers Tell the Story

The head of metals and minerals analysis at Trafigura, a global commodities trader, noted that copper demand is set to surge nearly 30% over the next decade. Also noted was global data provider Wood Mackenzie mentioning that almost US$20 billion needs to be spent on copper mine expansion to keep up with demand.

For investors, this spells opportunity - particularly in copper juniors making significant discoveries in stable jurisdictions.

Across all commodities, we're watching for major M&A activity to signal institutional money's return to junior exploration.

Key Takeaways: What Investors Need to Watch

Gold remains king, with strong investor interest in grassroots projects and developing project pipelines across Africa.

Zambia and Gabon stand out as attractive jurisdictions, while Mali looks near uninvestable.

ASX junior explorers continue to have the best access to capital, unlike their Canadian counterparts, who are struggling.

Major miners and energy companies are active, but the love for juniors is still lacking.

Deal-making continues, particularly at 121, and serious investors are positioning themselves for the next market upturn.

While sentiment remains challenging, history shows these periods often present the best opportunities. Savvy investors are taking note and planning their next move.

We'll continue tracking trends and companies preparing for the inevitable market rebound. Finding those life-changing small-cap opportunities isn't easy, but we're committed to helping keep you ahead of the curve.

For more in-depth analysis of ASX-listed small caps and market insights, make sure you're subscribed to and following Equities Club.