Monster Week: TEE Joins, AZ9 Strengthens, LYN Drills Begin

Top End Energy enters Kansas' hydrogen race, AZ9 reveals new massive sulphides, and LYN kicks off West Arunta drilling. Plus, our final 2024 investment lands this week

A monster week of news across our portfolio companies. We welcomed Top End Energy (TEE) to our portfolio, saw Asian Battery Metals (AZ9) strengthen their discovery potential with more visuals of massive sulphide hits, and Lycaon Resources (LYN) started their highly anticipated drilling program.

And we're not done yet - we've saved one final investment for 2024. This small-cap operates in a region with proven success, and we'll share the full story with our subscribers this week.

Missed any of the above this week? We've got it all covered below.

Top End Energy (ASX: TEE) Joins Natural Hydrogen Race

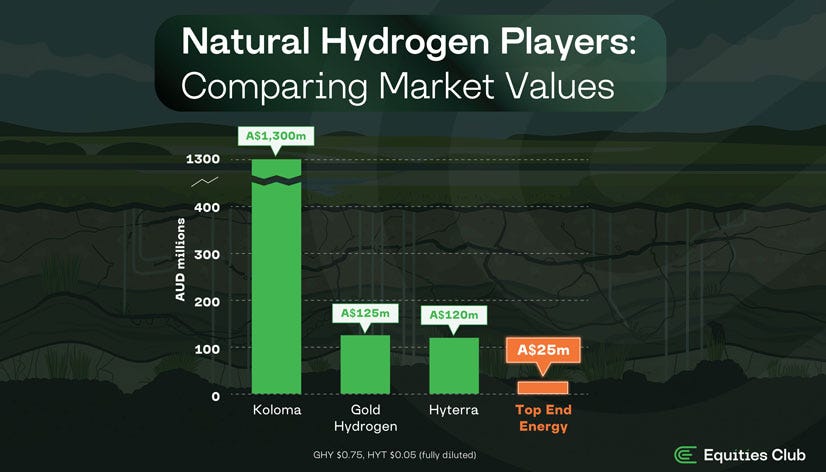

Our midweek addition of Top End Energy to the portfolio positions us in one of the most exciting emerging sectors in energy. At a fraction of the valuation of its neighbours, TEE offers early entry into the natural hydrogen space next door to heavyweight investors.

The company secured 20,000 acres of prime Kansas land in what's rapidly becoming the global hotspot for natural hydrogen development. This now positions TEE next door to projects backed by Bill Gates, Jeff Bezos, Mitsubishi and Andrew Forrest.

Luke Velterop joining TEE was another huge tick. As Serpentine Energy's founder, Luke built the Kansas position from the ground up. His decade-plus of energy sector expertise while building strong local relationships door to door mirror the approach that transformed early US shale explorers into energy giants.

With $6 million in fresh funding, TEE's 2025 objectives include:

Expanding their 20,000-acre position

Completing technical studies for drilling

Planning exploration programs

Exploring additional US state opportunities

Developing downstream partnerships

When chemistry professor and Breakthrough Energy's Technical Lead describes natural hydrogen as "the most important discovery in energy in our lifetime," we think it’s worth taking notice.

The Trump Effect on Natural Hydrogen

One of our readers, Matthew, raised a good question about potential Donald Trump-related hurdles for natural hydrogen.

As we said to Matthew, natural hydrogen isn't a typical green energy play - it more closely resembles traditional gas extraction, but with hydrogen as the target, and it's almost entirely private capital driving the sector rather than government subsidies.

The sector also aligns with several Trump priorities:

Oil and gas-friendly (Shell, BP, and Chevron are all researching natural hydrogen)

Profitable for his base (Kansas and Nebraska are deep red states)

Uses existing infrastructure

Add in Trump's pick of hydrogen backer Doug Burgum as Interior Secretary, and we believe Trump should, at worst, ignore natural hydrogen and, at best, throw some weight behind it.

Asian Battery Metals: Momentum Grows in Mongolia

Monday saw Asian Battery Minerals emerge from a trading halt with further impressive massive sulphide hits at their Oval project in Mongolia.

For AZ9, this latest 6.1m intersection marks their fourth significant hit, building a compelling picture of the project's potential.

The company's track record at Oval speaks volumes:

Discovery hole: 8.8m @ 6.08% Cu, 3.19% Ni, 1.63g/t E3

Second hit: 3.6m of massive sulphide (500m northwest of the discovery hole)

Third intersection: 1.9m of massive sulphide

Latest discovery: 6.1m of massive sulphide

At a share price of 5.8c, we think the market is yet to fully appreciate what's unfolding at Oval.

While we await assay results from the three most recent massive sulphide intercepts, the consistent success in identifying these bodies suggests we're looking at a fertile system with substantial exploration upside.

Lycaon Resources Begins West Arunta Drilling

The drill rigs are spinning for Lycaon Resources as they hunt the success of WA1 and ENR in the West Arunta.

The culmination of two years' worth of hard work means that LYN can finally drill their Stansmore anomaly target. This is the first time the Stansmore target has been drilled beyond a depth of 12m, previous drilling was done by BHP in 1982.

Key points about the program:

Secured EIS incentive scheme funding of up to $180,000

Preserves cash through government support

Well-funded with $3.5 million cash post drilling

The solid cash position means LYN can maintain momentum while evaluating next steps, regardless of initial results - exactly what we look for in early-stage explorers.

New Portfolio Addition Coming This Week

We've saved one last investment for 2024, and it's dropping this week. We think highly of the commodity, region, and people involved. Be sure to subscribe to be the first to know.

Thanks for the mention 👍