Narrow High-Grade Gold at Crosbie South. Flashes or the Start of a System?

Five holes, gold in every one, an encouraging technical foundation for targeting deeper and thicker zones next

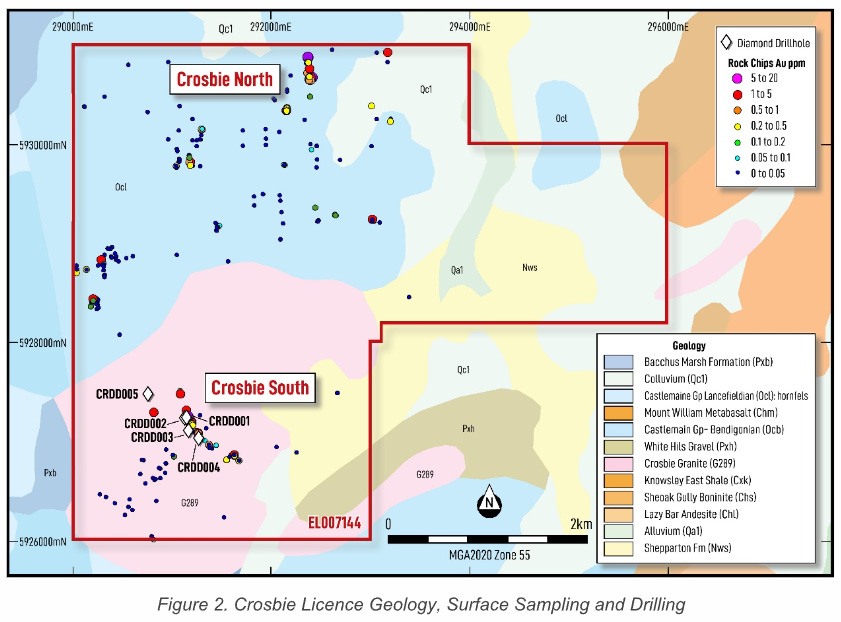

Bubalus Resources (ASX: BUS) has reported assays from its maiden drilling at the Crosbie South prospect in Victoria’s goldfields, marking the first real test of this never-before-drilled ground.

The company’s headline number of “50 g/t gold over 0.2 metres” is eye-catching, but as always, context matters. While the hits are narrow, they confirm a live mineral system, with gold in every hole and strong pathfinder elements.

The results show there's something worth chasing – potentially thicker or higher-grade zones along strike and at depth in future drilling.

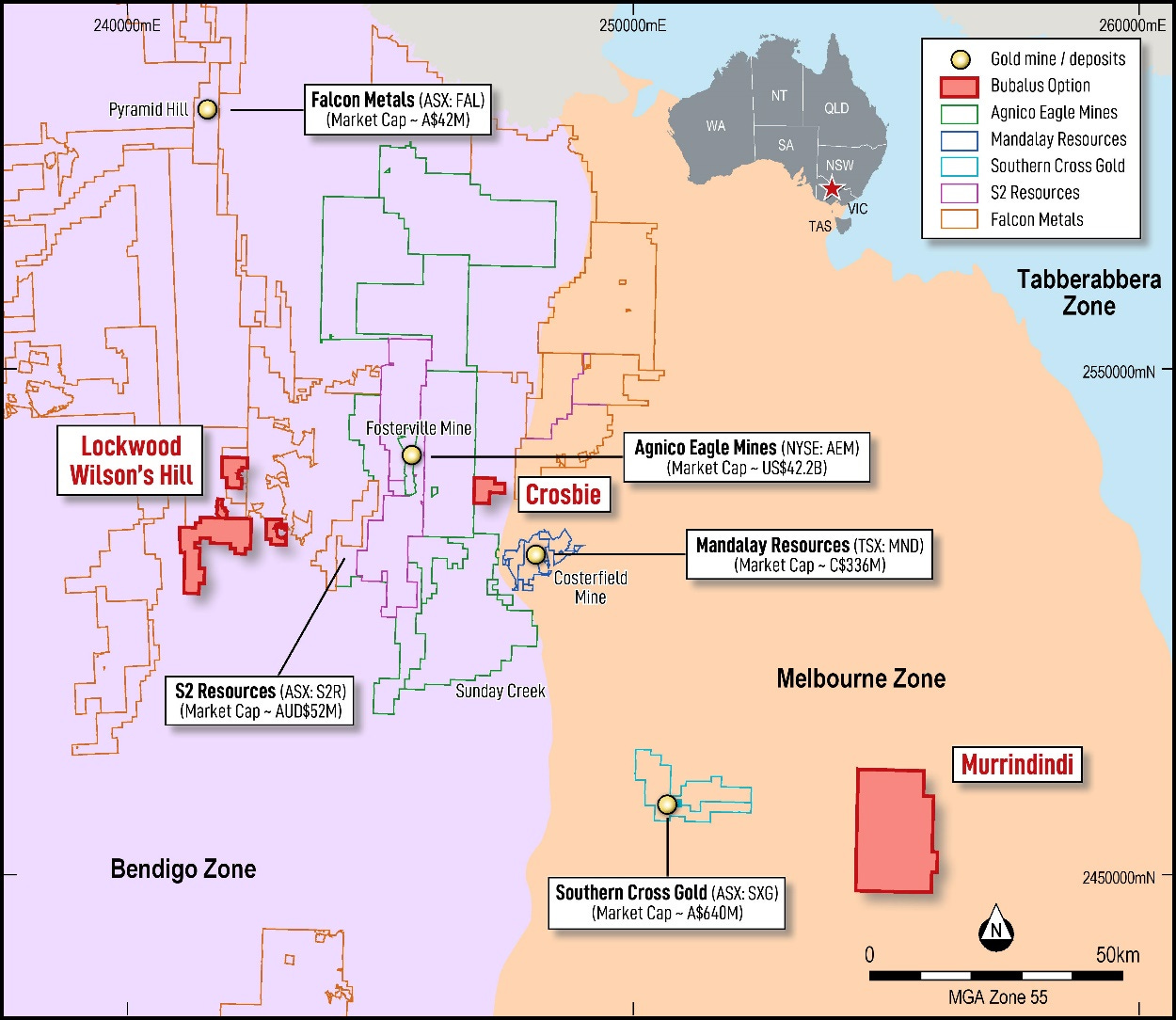

These results are from the first of three Victorian gold drill programs Bubalus will complete in 2025, and many have been watching closely to see whether this play might mirror the celebrated success stories at nearby Fosterville or Costerfield.

At a 10 cent share price, Bubalus sits at a $6 million market cap and is backed by $4 million in cash, giving it plenty of money to keep drilling. With drilling at Crosbie North starting this quarter and Avon Plains in Q4, the company isn't tied to one target.

Bubalus offers a well-funded, multi-project Victorian campaign, giving investors multiple shots on goal without the usual all-or-nothing swing.

Today’s Results

Bubalus drilled five holes (about 700 metres in total) and found gold in every one, which is a strong early sign. Most of the gold sits in quartz veins inside granite rock altered by heat and fluids over time.

These veins also contain a mix of other elements like antimony, silver, bismuth, molybdenum, and tungsten.

This combination is typical of what geologists call an intrusion-related gold system, suggesting there could be a larger mineral source underground feeding these veins rather than just scattered patches of gold.

Key intercepts included:

CRDD002: 1.1 m @ 9.4 g/t gold (including 0.2 m @ 50 g/t), plus silver and bismuth.

CRDD004: 6.6 m @ 0.4 g/t gold and notable antimony values.

CRDD003: 0.3 m @ 6.3 g/t gold with high molybdenum.

The mineralisation remains open at depth and along strike, suggesting the potential for a larger system. At this stage, high grades have been intersected only over narrow widths.

What Does This Mean for Crosbie South?

So they've found gold, but what does it actually mean?

The results confirm a mineralised system is present, but it’s too early to know if this will lead to a continuous, economically viable ore body or remain as scattered high-grade zones

The mix of elements found in the drilling suggests there is a real, connected mineral system underground, rather than just small, random patches of gold. So far, the intercepts are narrow and variable, which makes it hard to call a discovery yet.

The gold didn't just appear out of nowhere. The question is whether there's a sweet spot with the right thickness and grade to support future economic development.

That’s what phase two drilling will aim to confirm.

Key Takeaways and Next Steps for Crosbie South

We’ve broken this down into three points that matter based on the results.

Positive signs: Consistent presence of gold and pathfinder elements, and mineralisation open in all directions.

Challenges: Intercepts are still narrow. No clear thick or continuous zones yet.

Next move: Assay the remaining core, revisit the geophysics, and sharpen the targeting ahead of phase two drilling.

The Broader Bubalus Story

While Crosbie South grabs today's headlines, it's just one of four Victorian gold projects in Bubalus' portfolio - all within 20km of Fosterville and Costerfield.

Crosbie North, scheduled for Q3 drilling, has already returned surface samples over 12g/t gold. Avon Plains, set for Q4, has 1890s newspaper clippings documenting miners pulling 60-90g/t gold from shallow shafts before water flooded them out - it's never been properly tested with modern drilling. Murrindindi is currently undergoing surface sampling to generate drill targets.

With multiple chances at discovery across proven gold country, Crosbie South represents just the opening act.

Funding and Leverage

Bubalus is sitting at around a $6 million market cap, backed by a healthy $4 million in cash. At this level, the company is well-funded and lightly valued, which is why we recently added to our position.

With Crosbie North to kick off towards the end of Q3, and Avon Plains coming in Q4, the risk profile is low given the valuation and cash position.

BUS is fortunate enough to not be betting on one project and a single hole to change its fortunes.

With further drilling Crosbie South may evolve into a coherent system, and if that happens, the upside would be substantial given Victoria's track record of highly valued gold projects.

Bottom line

This is a classic Victorian gold story in its earliest innings.

Bubalus has confirmed mineralisation and shown there's something real in the ground. These holes weren't dusters, and that's encouraging.

However, they still have work ahead to turn this into a genuine discovery. It’s not a Fosterville or Costerfield twin yet, but it’s certainly not a dud either.

With Crosbie North to come, Avon Plains, and potentially more drilling at Crosbie South, BUS still offers investors one of the cheapest leverage plays into a proven gold region in Australia.