ASX Small-Cap Joins Gates & Bezos in Natural Hydrogen Race

The tech giants are pouring hundreds of millions into Kansas natural hydrogen. Now Top End Energy has secured prime land next door, trading at a fraction of the price

ASX small-cap Top End Energy (ASX:TEE) has joined the billion-dollar race for natural hydrogen, planting its flag in 20,000 acres of prime Kansas land right next door to Bill Gates.

The move makes Top End Energy an immediate serious player in what we believe will be the most sought-after commodity for years to come: natural hydrogen.

Natural hydrogen offers what the energy sector desperately needs - a cheap, naturally replenishing source of sustainable energy.

The parallels to the early-stage lithium exploration boom are striking - limited ASX exposure, growing institutional interest and technological demand.

At a time when tech giants like Gates and Jeff Bezos, alongside Mitsubishi, are fighting for land and position in Kansas, TEE's entry at 10c and a $25 million valuation presents a compelling opportunity.

While TEE has existing assets, this acquisition marks a clear focus on natural hydrogen as the company's future. The transaction is expected to close following shareholder approval in early 2025.

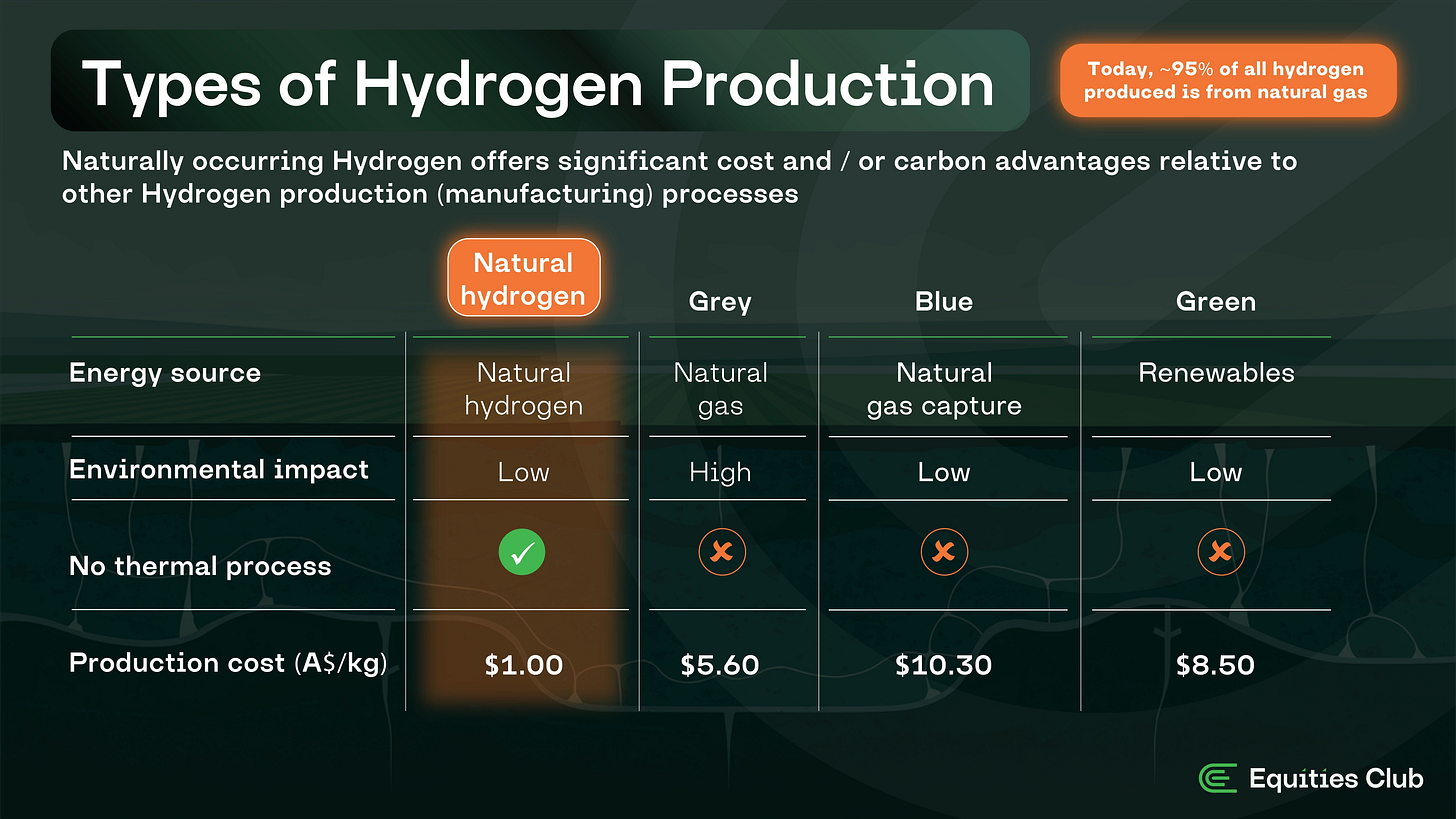

And before you ask, this isn't the green hydrogen you've heard about from Andrew Forrest and Fortescue. Natural hydrogen is different - it uses extraction methods similar to conventional gas, making it the cheapest form of hydrogen to produce.

Similar name, very different economics.

“Natural hydrogen is the most important discovery in energy in our lifetime, and probably the most important discovery in energy in our children's lifetime.”

- Dr Eric Toone, CTO of Breakthrough Energy

The Birth of an Energy Boom?

Last week, BNN Bloomberg compared natural hydrogen's potential to the 1901 Texas oil gusher that created generations of wealth. It's high praise, and it's clear why - recent indicators show this sector heating up:

High Plains Resources leading exploration activity in TEE's project area. Industry analysts and reports link High Plains to Koloma, the Bezos and Gates-backed natural hydrogen startup that's raised US$380 million over three years, with US$290 million of that coming in 2024 alone.

Koloma attracting investment from Mitsubishi, joining existing backers Breakthrough Energy, Amazon and United Airlines.

ASX-listed natural hydrogen explorer HyTerra receiving a significant endorsement when Twiggy Forrest's Fortescue acquired a 39.8% strategic stake.

The US Department of Energy committing US$2.2 billion to accelerate clean hydrogen development.

Top End Energy's entry into the Kansas natural hydrogen land rush is perfect timing. The sector and region have quietly attracted billions in smart money recently, and people are starting to notice.

The Value Proposition

With land in Kansas next to High Plains/Koloma and HyTerra, Top End Energy presents a rare opportunity for investors to:

Get in at an enterprise value of just $19m ($25m valuation less $6m cash), while competitors are valued many multiples higher.

Own land next to Bill Gates and other billionaires.

Invest before most people even know about natural hydrogen.

Get positioned in a region that could mirror the US shale land rush, where values soared from $100 to $30,000 per acre.

Top End Energy now sits alongside billion-dollar backers in an industry poised to boom, yet trades at a fraction of its peers' valuations.

The rush into Kansas mirrors the early days of other resource booms. More than five exploration companies are now operating in and around TEE's project area, while oil and gas supermajors Shell, BP, and Chevron have joined a US Geological Survey consortium to study natural hydrogen. European investment funds dedicated to natural hydrogen are also emerging.

Early movers are quietly taking positions. The next great American energy story could be underway.

Near-term Catalysts

TEE has outlined several clear milestones as it accelerates its Kansas strategy:

Expanding the current 20,000-acre position.

Technical studies and geological evaluation in preparation for drilling.

Planning for exploration drilling.

Potential expansion into additional US states.

Targeting offtake or downstream joint venture partners.

The company's work program is fully funded following its recent $6 million raise at the last traded price.

What's particularly exciting is the drilling activity planned for the region. Multiple explorers are preparing drilling programs in and around TEE's project area. Success from any of these neighbours could create significant news flow and potential catalysts for TEE's valuation.

So, What is Natural Hydrogen and How is it Different?

First up, forget everything you know about hydrogen. It’s not about massive electrolyser plants or Twiggy's original green hydrogen dream, which required billions in infrastructure before seeing a cent of revenue. Neither is it the failed carbon capture that we've been promised for years.

Natural hydrogen (also called white, gold, or geological hydrogen) forms naturally underground through geological processes.

It represents the first new primary source of energy discovered in nearly a century, and it's both carbon-free and sustainable.

Think conventional gas exploration, but instead of hunting for methane, companies are looking for hydrogen pockets.

Most hydrogen today is produced by splitting it from natural gas, which leaves carbon dioxide as a byproduct. When released into the atmosphere, it becomes what we know as grey hydrogen.

Efforts to produce cleaner versions to meet net-zero goals have so far focused on capturing and storing carbon emissions (blue hydrogen) or using renewable energy to power industrial-scale electrolysers to split hydrogen from water (Green hydrogen).

Only natural hydrogen passes the litmus test for clean energy in our eyes.

TEE, along with many of its wealthy neighbours, believes that beneath Kansas lies what could be the energy sector's next major resource revolution.

Top End Energy’s Man on the Ground

We met with TEE management and were impressed with their industry knowledge and experience.

Luke Velterop, who founded Serpentine Energy and built its Kansas position from the ground up, brings his deep experience as he joins TEE.

Luke embodies the kind of hands-on leadership that builds successful resource companies.

With more than a decade of oil & gas and natural hydrogen expertise, he's now firmly planted in Kansas, building relationships door-to-door with local landowners.

His approach mirrors the early pioneers who transformed the US shale sector from small-cap explorers into energy giants.

Now, with additional backing and resources, he'll continue the strategy that has already secured 20,000 prime acres in America's emerging hydrogen hub.

The parallels to the US shale revolution are notable. That sector rewarded early investors who spotted the shift before institutional capital poured in, transforming the entire American energy landscape.

"Imagine the potential of an underground factory fueled by nature

that generates a replenishing supply of clean, dispatchable energy.”

- Serpentine Founder and now Top End Energy VP, Luke Velterop

The Kansas project also offers direct access to existing gas pipelines, rail networks, and industrial infrastructure. This established energy hub could accelerate TEE's path from explorer to producer.

While TEE has existing assets, this acquisition marks a clear focus on natural hydrogen as the company's future. The transaction is expected to close following shareholder approval in early 2025.

With the acquisition of a heap of natural hydrogen land in the US, Equities Club took part in the latest raise. The price we paid was the last traded price, with no discount attached.

Five Reasons We’re Backing Top End Energy

Cleanest and Cheapest Form of Hydrogen

Right now, natural hydrogen outshines every other form of clean energy. No massive infrastructure required, no energy-intensive processes - just nature doing what it's done for billions of years.

The process is straightforward: hydrogen continuously generates underground, travelling through cracks and accumulating in natural reservoirs. TEE's role is to drill a well and let it flow to the surface.

Natural hydrogen is the best in many ways. It is the cleanest source of energy, as it is naturally occurring, and also the cheapest to produce. Unlike other forms of hydrogen, there's no splitting, capturing, or energy-intensive process.

Cheap Valuation to Natural Hydrogen Peers

When doing any comparative model, you want a few things in your favour as an investor. First and foremost, you want a cheap valuation. After that, you want the potential to match or exceed companies in the same sector. We believe TEE has both of those.

The valuation gap here is compelling. TEE trades at a fraction of its peers despite holding prime Kansas acreage right next to billion-dollar players.

The company's current $25 million market cap provides significant leverage for shareholders, especially considering the potential upside from future land acquisitions and successful drilling in a region with known natural hydrogen formations.

With land in Kansas next to Koloma and HyTerra, TEE is by far the cheapest entry into a red-hot region.

Kansas Is Leading the Natural Hydrogen Boom

Kansas is where the big boys are playing, with a land rush underway for natural hydrogen hot spots.

TEE has acquired 20,000 acres of prime exploration ground situated in an area where unique geology tells a story. The Midcontinent Rift, a billion-year-old geological phenomenon, created ideal conditions for hydrogen formation.

With five active explorers currently fighting for permits in Kansas, there are parallels to the Pilbara lithium rush of 2016 - but this time, the scale and the players involved are much bigger.

And the early signs are promising - natural hydrogen seeps were first documented in Kansas in the 1980s while drilling for other resources. However, finding big enough quantities requires dedicated exploration to map the deposits, which TEE is preparing for in 2025.

Success now depends on finding where nature has trapped these resources in concentrated pockets, much like early oil explorers did in the same region over a century ago.

The Money Flowing to Natural Hydrogen

Natural hydrogen is attracting billions in investments from some of the sharpest minds in tech and resources. Gates, Bezos, Vinod Khosla, and now Andrew Forrest are all betting big on this emerging energy play.

In the past 12 months, Koloma alone has raised nearly US$300 million. Major energy players are following suit, with Shell, BP, and Chevron joining forces to study the sector's potential.

TEE is perfectly positioned - surrounded by heavyweight investors but still independent. Any future partnership or investment will be on TEE's terms, maximising value for shareholders.

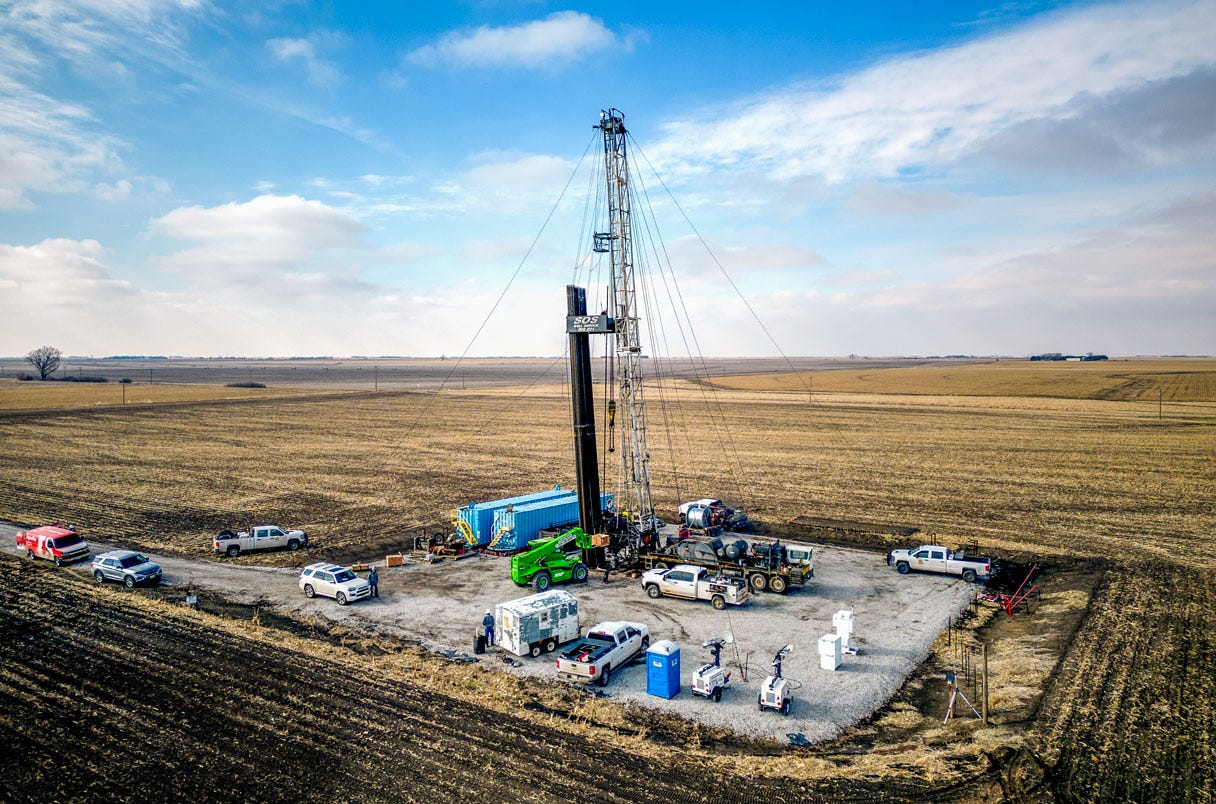

How Natural Hydrogen is Extracted

The beauty of natural hydrogen lies in its simplicity.

When drilling for natural hydrogen, think of conventional gas exploration. This is a tried and tested method with more than 150 years under its belt. When drilling for natural hydrogen, you use the same drill rigs you would for oil and gas, so they’re not reinventing the wheel.

The wells typically extend to depths of around 2km+ (6000ft), shallower than the conventional oil and gas exploration wells which go as deep as 6km.

Shallower wells = cheaper drilling = better economics. A huge tick in our eyes.

While many investors are still mixing up natural hydrogen with Twiggy's green hydrogen play, we've found what we believe is a standout on the ASX in TEE.

The equation is simple: New resource theme + Limited ASX exposure + Best land available + Billionaire backers nearby = Something worth watching.

We believe we've invested in what could be the start of the next great American energy story.

Love your work folks! What about the Trump factor (i.e the likelihood of him putting up hurdles for green energy pursuits like this)?