Next Door to a Rio-Backed Giant - Our New Addition

Rutile for robotics. Graphite for EVs. Both scarce - both part of our newest critical minerals play.

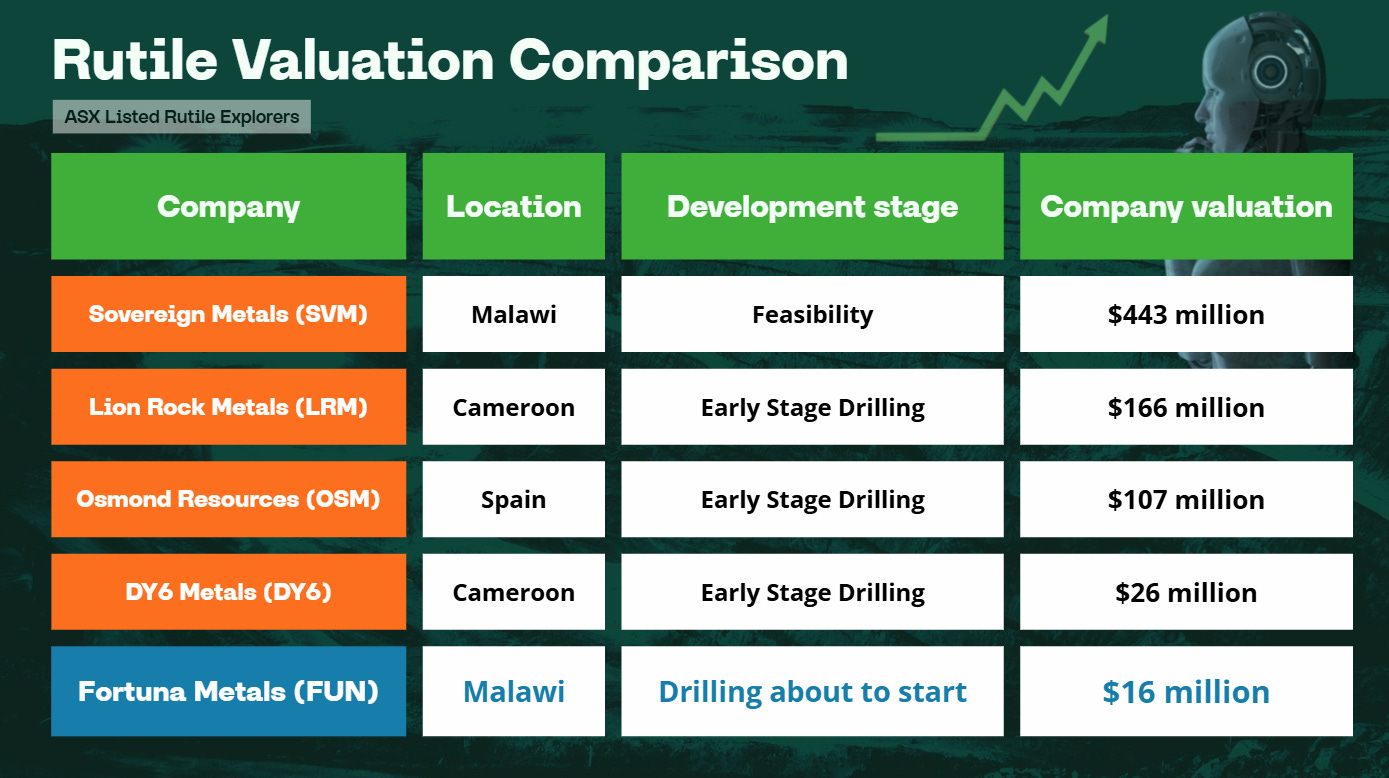

There's a $16 million ASX junior sitting on the exact same geology as a $443 million Rio Tinto-backed giant. Same rocks. Same minerals. Twenty-seven times cheaper.

Meet Fortuna Metals (ASX: FUN), our latest portfolio addition.

We’re backing FUN because it now holds prime ground chasing two things the modern world runs on - rutile and graphite. They’re both in short supply and critical for the industries shaping the next few decades.

Rutile is the cleanest natural source of titanium, it’s essential for aerospace, defence, and the coming robotics revolution (more on that later).

Graphite is the single largest raw material in every EV battery, and traditional deposits are depleting right as demand accelerates.

"Contemplating future global GDP before AI robots is like contemplating global GDP before electricity."

- Morgan Stanley's Adam Jonas

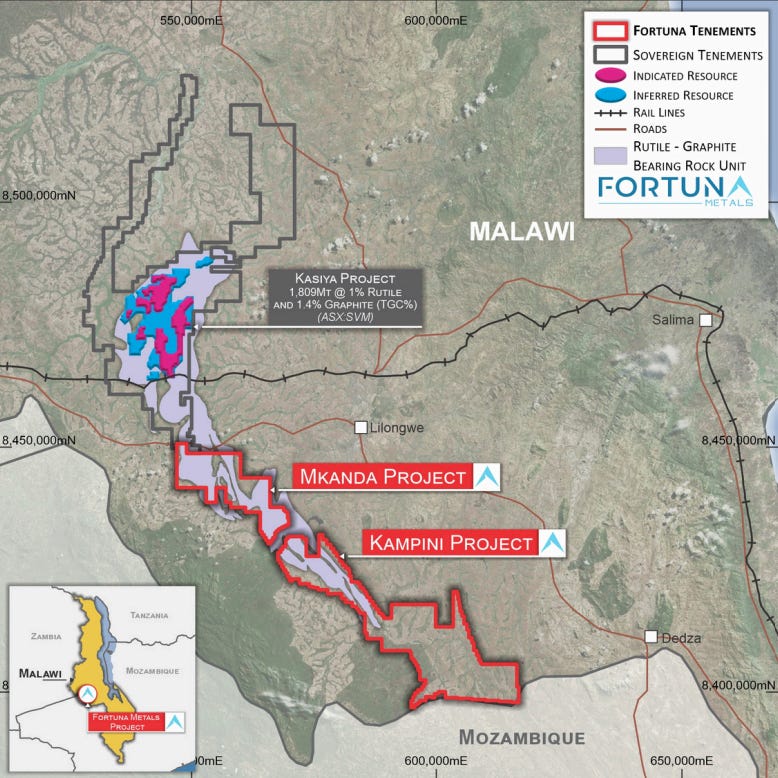

FUN's new 658 square kilometre tenement also sits right next door to Sovereign Metals (ASX: SVM), which has already proven Malawi hosts the world's largest rutile deposit and a world-class graphite resource.

Sovereign has notably caught the eye of Rio Tinto, which stumped up $60 million for a piece of SVM.

What turned our heads on Fortuna is that the mineralisation identified at SVM continues straight into FUN's ground.

It’s the same geology with the same potential, but at a fraction of the price, with FUN’s share price sitting at 7 cents with a $16 million market cap.

With $4.7M cash in the tin and an exploration program starting any moment now, FUN’s setup is right in our hitting zone.

One neighbour has already done the heavy lifting, and now the other is about to get started. Let’s dig into it.

Five Reasons we’re Tipping Fortuna (ASX: FUN)

1. Critical Minerals and the Rise of Robotics

Rutile and graphite are the backbone of industries driving the next few decades.

To understand rutile, you need to work backwards from the fact that the world’s about to need a lot more titanium than we've got.

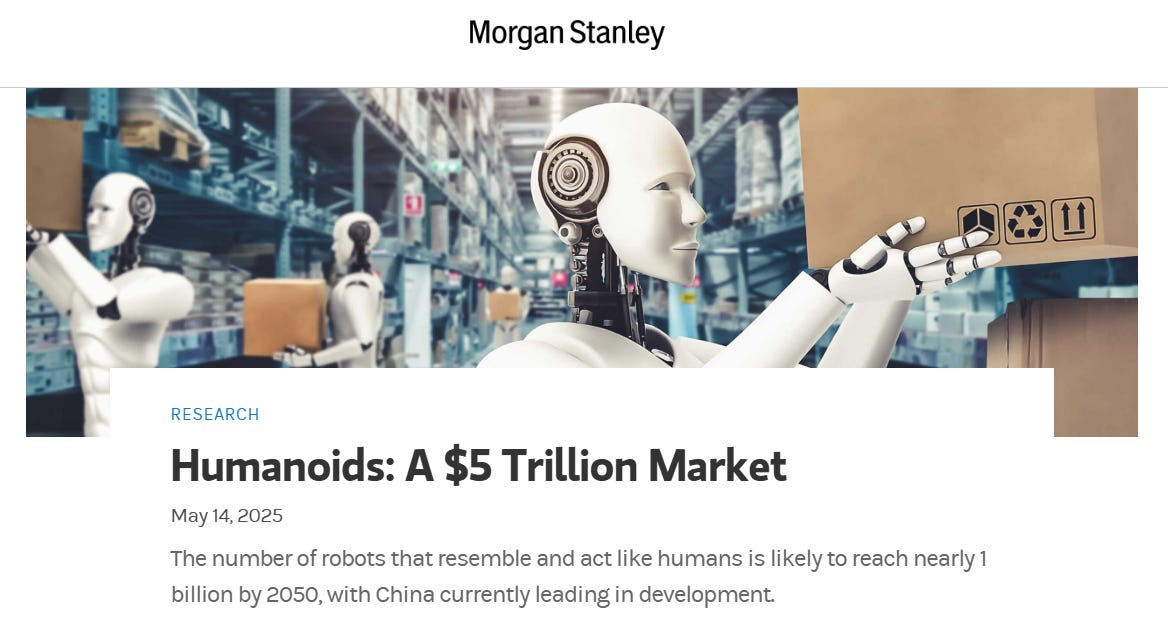

Titanium is needed everywhere that requires high strength and low weight - things like jet engines, defence hardware, industrial coatings, and most importantly, robotics… which Morgan Stanley values at a tidy $5 trillion market by 2050.

For those living under a Faraday cage, the robot helpers are not too far away from going from novelty to necessity as they scale alongside AI into our dystopian and slothful future.

Tesla's building Optimus, Amazon's deploying warehouse robots, while Google and Chinese manufacturers are all-in on the robots arms race. And this new tech war relies on a lot on titanium components.

So where does rutile fit into all this? Well rutile is how you get titanium the clean way. While most titanium comes from energy-intensive processing of low-grade ilmenite, rutile is naturally 95% pure titanium dioxide.

This means less processing and lower emissions (and therefore higher margins), which puts rutile in high demand. For those who prefer the cliff notes, more robots = more rutile.

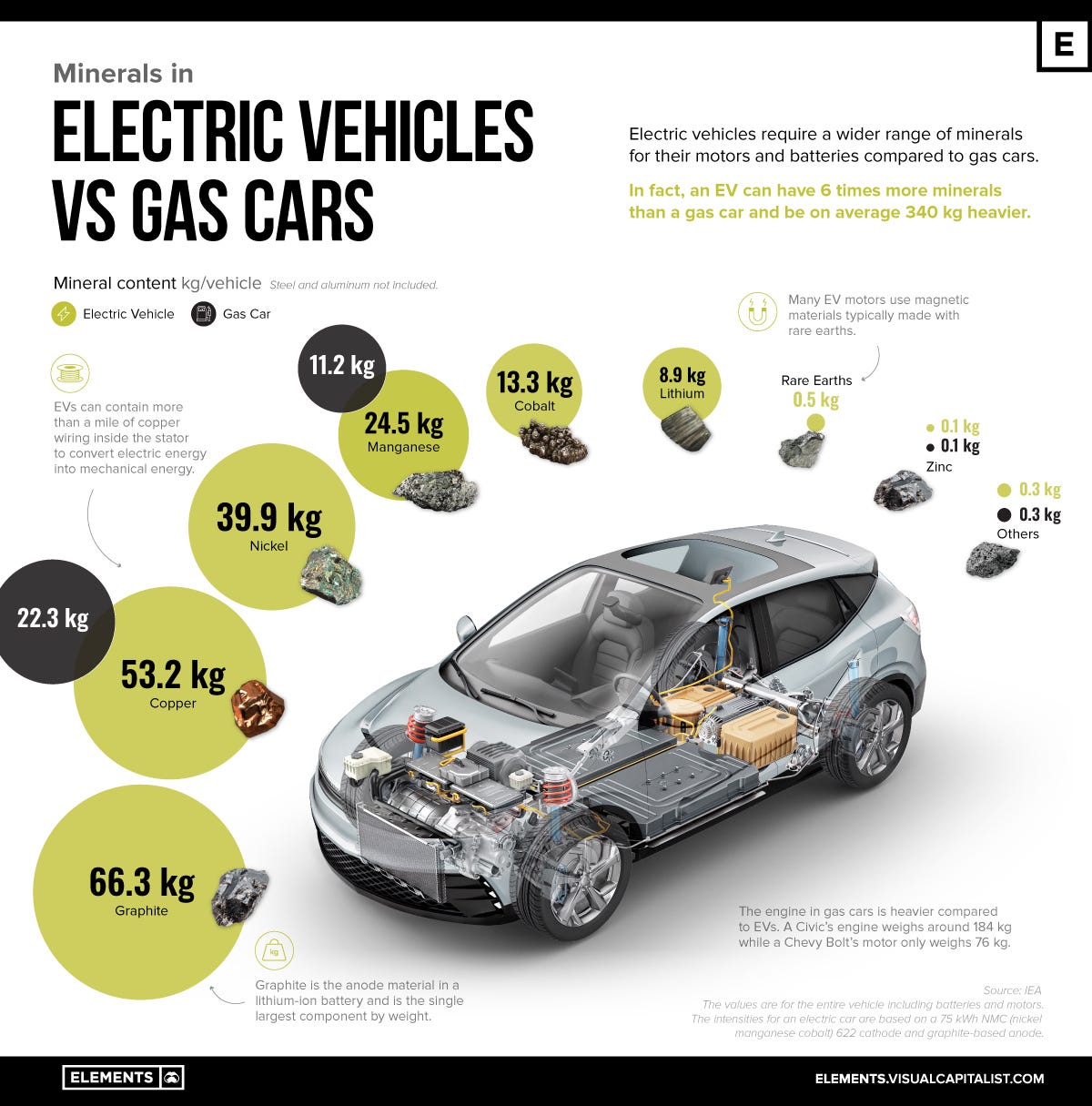

Then there's graphite. An EV battery contains 50-55kg of graphite versus just 8-13kg of lithium. Despite that, most people are focused on lithium while the graphite supply quietly tightens.

Adding further stress is the fact China controls ~70% of global processing in graphite, and they're not shy about using it as leverage.

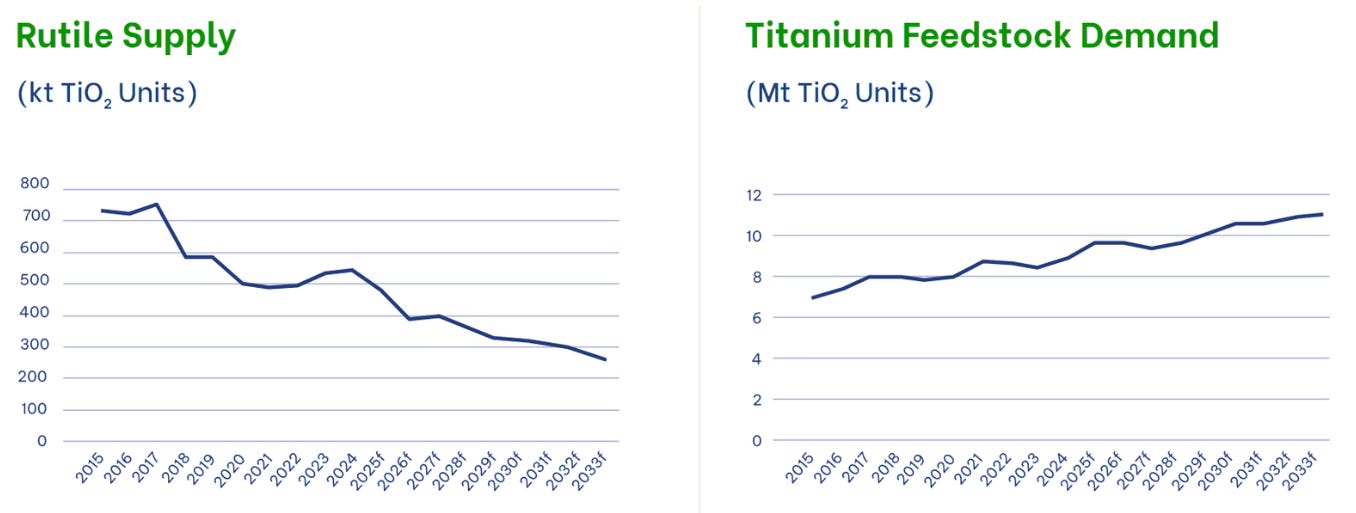

Graphite demand is forecast to increase by 140% by 2030, while rutile output is sliding just as industrial and tech demand ramps up.

So both minerals share the same problem: supply is drying up just as demand surges. Deposits are depleting and discoveries are rare, while the majors stopped exploring for them years ago.

That’s why FUN’s exposure to both commodities in one project, along strike from a proven world-class deposit, has got our backing.

2. Along Strike from a World-Class Discovery

FUN's Mkanda and Kampini projects cover 658 square kilometres of what geologists call "the same structural trend" as Sovereign Metals' Kasiya deposit.

In layman’s terms, it's the same rock system and it continues across property boundaries.

Unlike traditional hard-rock deposits that need drilling, blasting and crushing, Malawi's rutile and graphite were formed through tropical weathering over millions of years.

The process naturally concentrated these minerals near surface, meaning nature essentially did the processing work already. This makes it cheaper and easier to extract.

Sovereign has already spent years and tens of millions of dollars proving this system works. Their feasibility study, backed by Rio Tinto's technical team, confirmed shallow mining depths (typically 5-10 metres), simple processing and robust economics even at conservative commodity prices. And Rio liked it enough to put down $60M for an 18.5% equity stake in Sovereign.

Those same weathered rocks that host Sovereign’s 1.8 billion tonne resource continue directly into FUN’s ground. Meaning, instead of hoping for a brand-new discovery, FUN is testing whether the known mineralisation extends as expected.

If it does, the upside compared to Sovereign’s $443M valuation is obvious.

3. Immediate Catalysts

FUN is starting exploration this month with $4.7m in the bank and more than enough to fund their entire Phase 1 and Phase 2 programs.

Soil sampling and hand auger drilling will kick off immediately, targeting the most prospective areas where the mineralisation should continue from SVM's ground.

The beauty is these don’t need to be deep holes, and will be closer to 10-metre hand augers that can quickly test near-surface mineralisation.

First assay results are expected before year-end, which will be the first real confirmation point on whether the mineralisation continues as the geology suggests.

From there, expect some steady news flow:

Geophysical reviews

Target generation

Further auger drilling

Infill drilling

Follow-up drilling through 2026.

A maiden inferred resource is targeted by Q1, 2027, setting up multiple re-rating events over the next 18 months.

In this style of deposit, simple auger drilling can define resources just as effectively as expensive diamond drilling, and those of us familiar with small-cap land will know that every positive result de-risks the story.

At a $16 million market cap, FUN doesn't need to find another Kasiya to multibag. Even proving up a fraction of what SVM has could transform their valuation.

4. Strategic Infrastructure and Jurisdictional Advantage

Malawi is quickly emerging as one of the world's most important rutile provinces, and the infrastructure is already there.

Most importantly, Malawi is stable politically. They have a democratic government with a common law system, and the mining code is straightforward with the government actively wanting investment.

FUN's ground sits near grid power - there’s clean hydroelectric from Lake Malawi, and a sealed road runs through the project area, connecting to regional centres and existing supply chains.

A high-quality rail line links directly to Nacala, one of Africa’s deepest ports on the Indian Ocean. That gives FUN a clear export route without the cost blowouts common elsewhere in Africa.

And the clean hydro power is a massive ESG tick. Miners and end users of all products are under increasing pressure to secure low-carbon supply chains. FUN can offer that from day one.

For a junior explorer, the combination of existing infrastructure, stable politics and major backing next door removes many of the usual African mining concerns.

In Malawi, FUN can stay focused on exploration without the distractions and worries that can pop up in unstable jurisdictions.

5. Management and Execution

FUN has paired the Malawi acquisition with a leadership refresh to match its new direction.

Tom Langley has stepped in as CEO, bringing corporate and project development experience across small-caps. His appointment came with clear performance milestones tied to exploration outcomes. This is a structure we like, because it aligns management rewards with shareholder value.

“With our licences covering the continuation of the geology observed at Sovereign, I believe this acquisition is an exceptional opportunity that presents compelling exploration upside”

- Fortuna CEO Tom Langley

Local geologists who know Malawi will be running the technical side, which is a detail that matters more than most investors realise.

The capital structure is tight, with ~$4.7M cash funding Phase 1 and 2 exploration. That gives management room to deliver real results before the company needs to consider raising again.

The Bottom Line

No other junior sits beside the world’s largest rutile deposit at this valuation.

FUN gives us two shots on goal with one exploration program for rutile and graphite, which are both in structural shortage.

Sovereign, valued at $443M, has already proven the geology and attracted Rio Tinto. FUN now gets to follow that playbook on untested ground where the mineralisation continues across the property boundary.

FUN has a world-class address, proven geology next door, immediate catalysts, tight structure, and management aligned with shareholders through performance milestones.

As we often say, early-stage exploration always carries risk. The mineralisation might not extend as expected, grades could disappoint, or timelines could slip - that’s the nature of small-cap investing. But at this valuation, with this geology and team, the risk-reward stacks up for us.

We’re backing FUN because juniors exploring along strike from world-class discoveries rarely stay valued at $16M - especially once the drills start turning.

So until our robot overlords rise up and enslave us, we’ll be watching with interest.