Our 2025 Small-Cap of the Year

A million-ounce Victorian gold mine shut by water, not geology. Drills turning on listing day. A $12.9m market cap. Here’s why we picked our 2025 Small-Cap of the Year.

Black Horse Mining (ASX: BHL) lists today, and we’re calling it our Small-Cap of the Year for 2025. Yes, with a month to go. That’s how much we like this one.

We don’t hand that title out lightly. Each year, we look for a company that ticks the boxes that matter most: a commodity running hot, geology that’s already proven itself, a tight capital structure, and genuine upside for our readers if the drills deliver.

For 2025, BHL clears that bar more cleanly than anything else we looked at.

The company lists at 20c with a market cap of $12.9 million and $8 million in the bank. Its flagship asset is Mt Egerton, a historic Victorian gold mine that produced 1.29 million ounces at roughly 12 grams per tonne before water forced it to shut more than a century ago. (The gold didn’t run out, the old pumps just couldn’t keep up.)

And the cherry on top is that drills start turning today.

With gold trading near all-time-highs at more than US$4,200 an ounce, the mix of a small market cap, a funded balance sheet and a proven gold system that has never been tested at depth is a perfect launch pad for our Pick of the Year.

It’s a setup that can move quickly if early results land.

BHL initially set out to raise $8 million at 20 cents, but demand ran to around three times that figure. While oversubscribed IPOs certainly don’t guarantee success, they do suggest the register believes in the story from day one.

Mt Egerton: One of Victoria’s All-Time Producers

In Victoria’s long gold-mining history, only eight mines have ever produced more than a million ounces from hard rock underground.

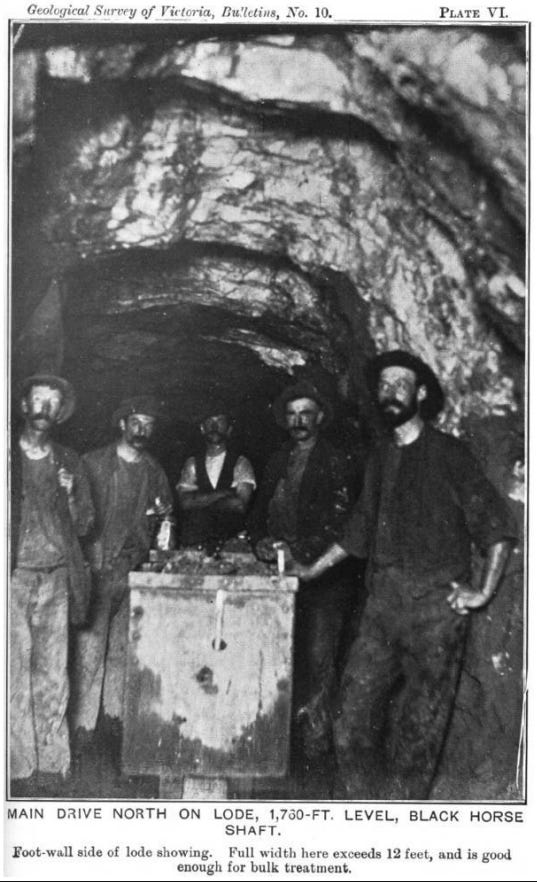

Not alluvial, not surface deposits. Proper underground mining. Mt Egerton is one of them, and renowned mining journalist Barry Fitzgerald wrote a detailed piece on BHL last week covering exactly why. You can find it here.

Mt Egerton was one of the truly big underground gold mines of its time, and only a handful of Victorian mines have ever managed to reach its level of production.

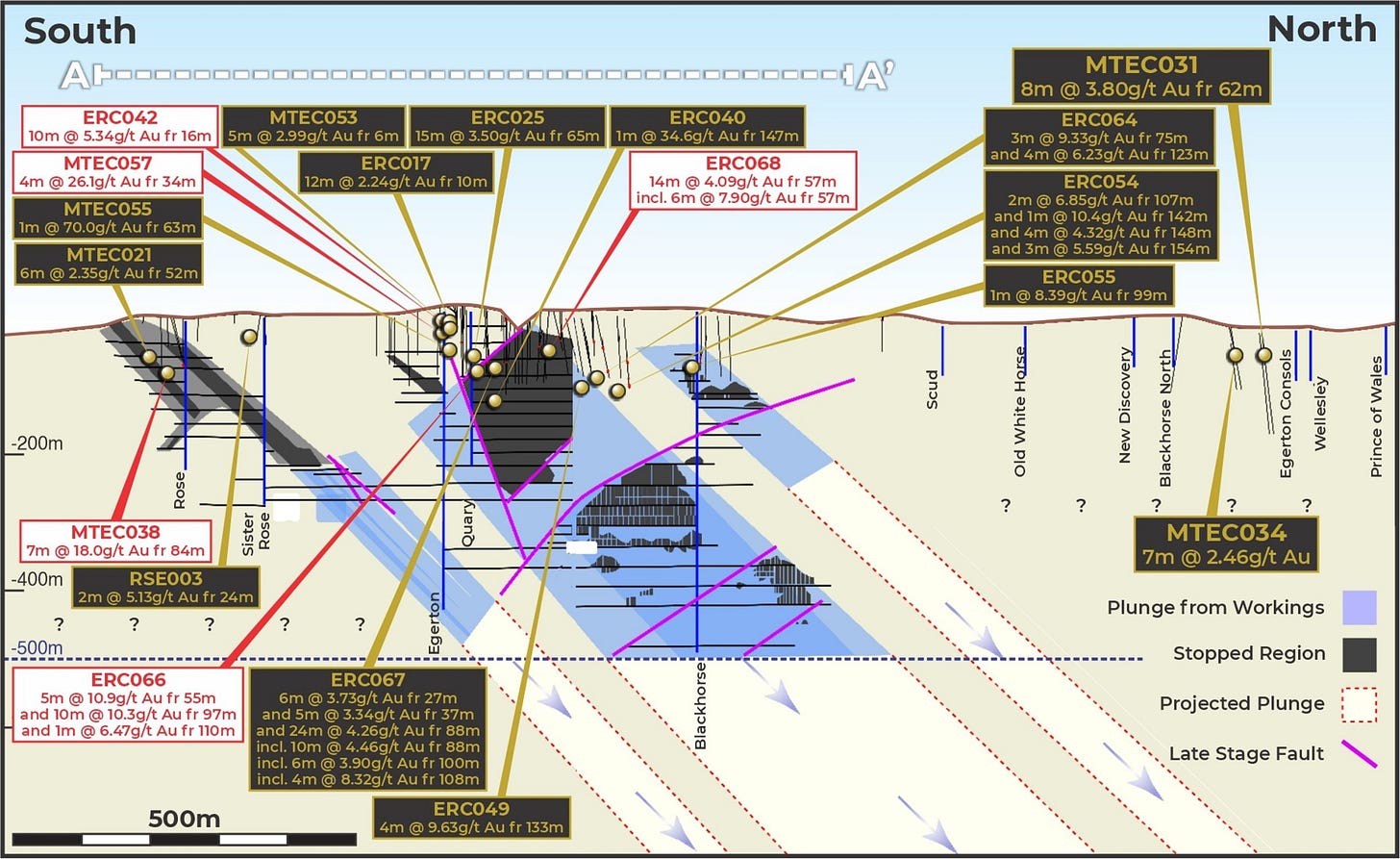

The mine shut in 1906 when water overwhelmed the old underground workings. The gold was still there, but the pumps of the day couldn’t keep up. The deeper parts of the system were left untouched.

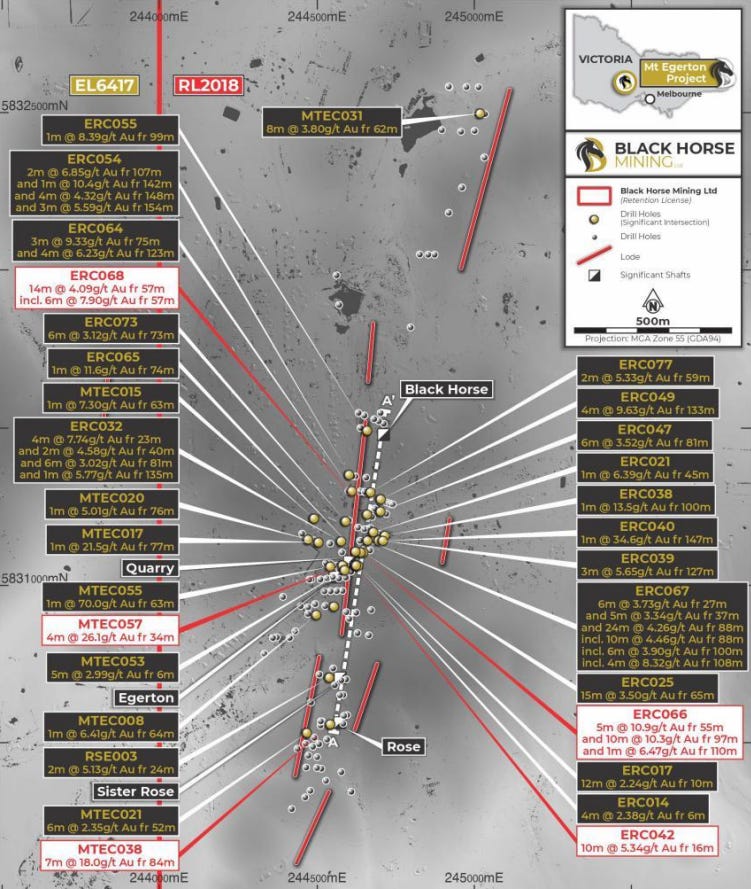

For Mt Egerton, the surface has barely been scratched. More than 90% of historical drilling stopped above 150 metres, yet even at those shallow depths the results were impressive: 7 metres at 18 grams per tonne and 4 metres at 26 grams.

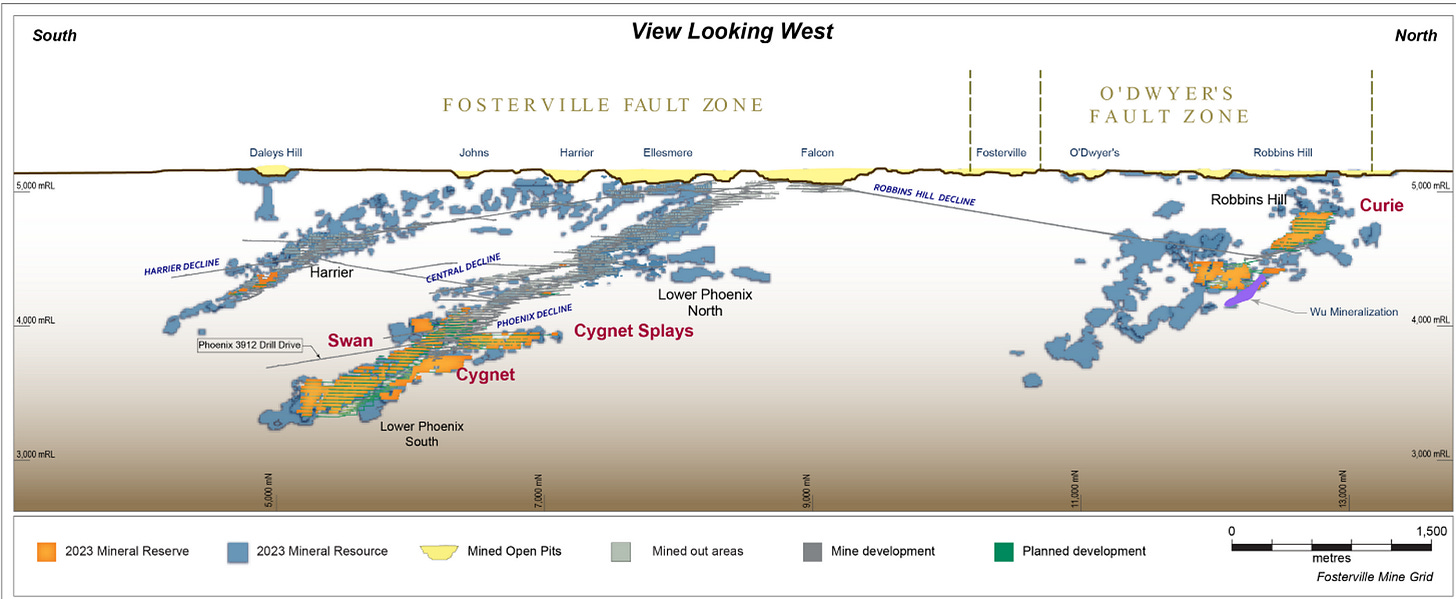

To put that in context, Fosterville is one of Australia’s highest-grade gold mines.Its ultra-high-grade Swan zone(the one that turned it into a cash machine) wasn’t found until drilling pushed past 800 metres. Mt Egerton has never been drilled anywhere near that depth.

If the Mt Egerton system strengthens below (as Victorian gold systems often do), the upside from here could be huge.

Leading Black Horse is CEO & managing director David Frances, who brings 30 years of experience discovering and developing assets across Australia. Having someone at the helm with David’s experience matters when you’re trying to revive a project that’s been dormant for over a century.

BHL will own 51% of Mt Egerton on listing, increasing to 80% once they’ve spent $4 million on exploration.

Given the program they’ve mapped out, we expect that threshold to be hit fairly quickly. And as BHL proves up more of the system, their slice grows and shareholder leverage increases with it.

Rigs Turning on Listing Day

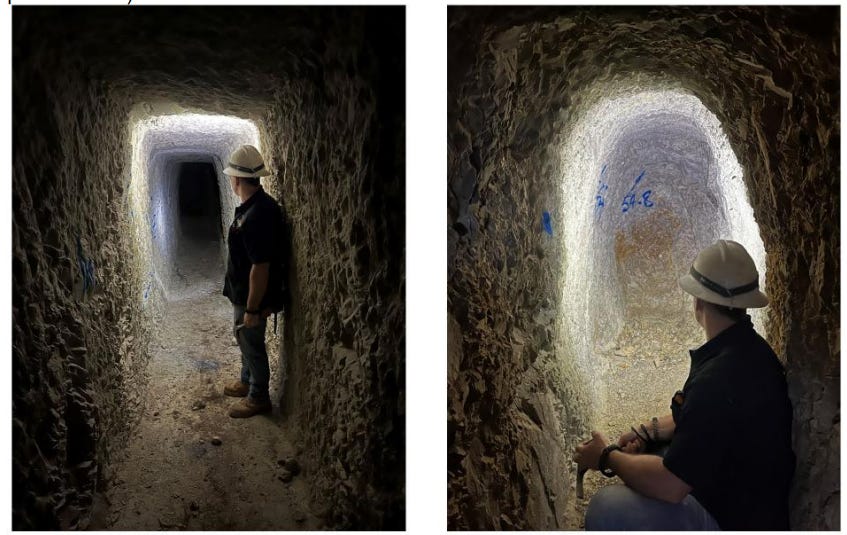

Black Horse announced today that drilling has already begun at Mt Egerton, targeting the historical high-grade zones where the old timers found serious gold. The rig is on the ground and the first holes are pointed straight at proven positions.

By going after known high-grade areas first, BHL gives itself the best shot at delivering early results that actually move the needle. With gold prices flying and showing no sign of slowing down, even a hint of continuity at those grades will get the market’s attention.

The team has also kicked off ground work to map exactly where the old workings sit. Some shafts have already been found well off their recorded locations, which matters when you’re trying to thread drill holes into century-old structures.

Fine-tuning collar positions with real-time data should improve BHL’s hit rate from the go. A clean strike near surface can put a stock like this on radars well beyond the usual exploration crowd.

Top 5 Reasons we’re backing Black Horse Mining ASX: BHL

With every new investment we like to break down the key reasons we’ve put our own money behind it. With BHL, we could have listed almost a dozen, but these five capture the heart of the story.

1. Record Gold Prices Make Every Drill Hit Worth More

Gold is trading around US$4,250 an ounce. When the commodity you’re exploring for is at record prices, any half-decent drill result can spark a reaction, and genuine discoveries tend to get rewarded quickly.

High-grade Victorian gold already turns heads, and a junior listing into this kind of gold backdrop gets the benefit of every tailwind going. And BHL comes to market fully funded with drills already turning.

The outlook supports it too, with most major investment banks forecasting gold to push higher through next year, with some calling for US$5,000 an ounce by late 2026. That’s another 20% from here.

When sentiment runs this hard toward gold, capital tends to chase juniors with scale, and Mt Egerton’s million-ounce history puts BHL firmly in that conversation.

2. A Million-Ounce Mine With Grade… and the Depths Untouched

We’ve mentioned it already, but it’s worth restating: Mt Egerton produced 1.29 million ounces at roughly 12 grams per tonne. That puts it in the top tier of Victorian historic mines.

That’s damn impressive in its own right, but the real story is the reason it shut. The mine did not run out of gold, it couldn’t handle the water flowing into the old workings. That single detail is pivotal to our investment thesis on upside potential.

That also leaves the deeper parts of the system untouched, and in Victoria the better gold often sits deeper. Fosterville, Costerfield, Sunday Creek… the pattern repeats across the state.

You have a proven system with real ounces, genuine grade, and untouched depth potential. Combine that with a record gold price and a company that’s funded and drilling, and you start to understand why BHL ticked a lot of our boxes.

It’s a high-grade field that delivered in the past, was left idle for a century, and is now being revisited at a time when the gold cycle is running hot.

3. Historical Drilling Barely Scratched Below 150 Metres

Most of the drilling at Mt Egerton was very shallow. More than 90% of the old holes stopped above 150 metres, yet they still pulled up strong numbers. That tells you the system had strength close to surface.

BHL’s plan is to hit the shallow targets first. The thinking is the old timers may have missed high-grade lodes in what was once a crowded goldfield with dozens of operators working on top of each other.

After that, the focus shifts to drilling below the old 550 metre level where the real upside lives, it’s ground that has never been properly tested.

We mentioned Fosterville’s Swan zone earlier for a reason: it wasn’t found until drilling pushed past 800 metres, and that discovery turned Fosterville into one of the most profitable gold mines on the planet.

Mt Egerton has never been drilled anywhere near that deep.

It gives BHL room to deliver wins early, while still carrying a genuine swing at something bigger once deeper drilling begins.

4. Geological Parallels With The Big Boys

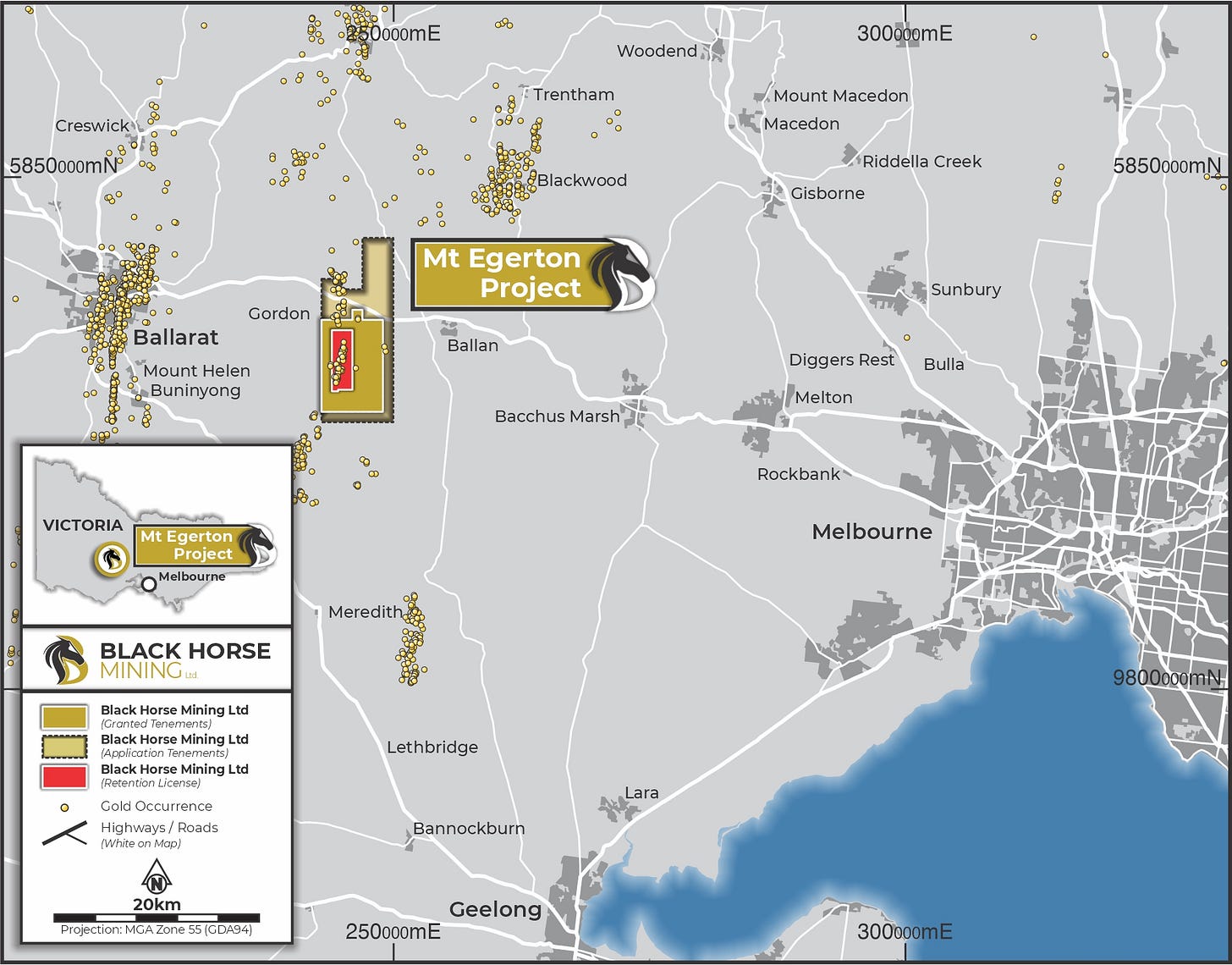

Mt Egerton sits in the same Bendigo to Ballarat gold corridor that has produced Fosterville, Costerfield and Sunday Creek. These are some of the highest-margin gold systems on the planet, and the geological similarities are hard to ignore.

Let’s do a quick valuation check:

Fosterville - Owner Agnico Eagle - Valued at $133.5 billion

Costerfield - Owner Southern Cross Gold- Valued at $2.11 billion

Sunday Creek - Owner Southern Cross Gold- Valued at $1.41 billion

Mt Egerton - Owner Black Horse Mining - Valued at $12.9 million

The corporate presentation BHL released shows long sections that look exactly like the early stages of those major deposits. Just without the price tag.

When a project sits inside a structural corridor that has already delivered multiple modern discoveries, the geology is de-risked before the first hole goes in.

If Mt Egerton behaves anything like its neighbours, the upside for a $12.9 million company could be multiples of its current valuation.

5. Multiple Targets Across a Much Larger Goldfield

Mt Egerton is the anchor, but there’s more ground to explore than just the historic mine.

The broader field shows diggings, trenches and past activity spread well beyond the main corridor.

Recent mapping confirms that prospectors were chasing gold across the wider district, not just around the original underground mine. There are signs of mineralisation to the north, east and south, which point to a system bigger than what was mined a century ago.

“Mt Egerton sits within one of the world’s most prolific gold provinces, a region that has already produced more than 80 million ounces of gold. The historical mining records, which confirm extensive production at very high grades, give us exceptional confidence in the geological endowment of this district. Together with the encouraging high-grade drill intercepts and multiple untested targets identified through historical exploration, we see a compelling opportunity to rapidly build a significant gold story.”

- CEO & Managing Director David Frances

BHL gets a proven high-grade mine with a 1.29 million ounce history, plus a suite of satellite targets that give the project multiple shots at a discovery. In a strong gold market, companies with only one target can stall if that target disappoints.

Companies with a broader goldfield beneath them, like Black Horse, can build momentum quickly.

Mt Egerton: From 1853 to Today

We dug into the archives to map out Mt Egerton’s history. It helps explain why this project sat dormant for so long, and why we believe this timeline still has a lot of legs to run.

1853 - Gold first discovered at Mt Egerton

Prospectors and early mining punches into high-grade quartz reefs that deliver the kind of visible gold that built Victoria’s reputation. Word spreads fast and Mt Egerton becomes one of the state’s early goldfield standouts.

Late 1800s - The district grows into a serious producer

Through the second half of the 19th century, mining accelerates and the field establishes itself as one of Victoria’s elite primary gold producers. Shafts deepen, new lines are opened and the system keeps delivering.

1906 - Water shuts the mine, not the geology

This is the turning point investors should pay attention to. Mt Egerton shuts because water overwhelms the old workings. The lodes weren’t exhausted, the pumps just couldn’t keep up, and the deeper parts of the system were left behind.

1907 to mid-1900s - The system sits idle

For decades the mine sits untouched. Technology moves on, Victoria shifts into new cycles, and Mt Egerton becomes one of those well-known “old-timer” fields no one has the tools to revisit properly.

1975-2001 - Western Mining, Carpentaria and St Barbara poke the edges

A series of majors and mid-tiers drill around 160 mostly shallow holes. They confirm high-grade zones near surface, but none of these campaigns drill into the deeper zones beneath the old workings.

2001-2013 - Tailings retreatment proves gold still sits in the system

Reprocessing of old tailings recovers around 6,600 ounces of gold at an average grade of 2.5 grams per tonne. Even the waste rock contains payable gold, showing the original system’s strength.

2013-2024 - A lost decade under private ownership

The ground ties up privately with minimal modern work completed.

Meanwhile, discoveries like Sunday Creek take off across Victoria, while Mt Egerton stays locked away.

2025 - Black Horse takes control

For the first time in more than a century, the project is finally in the hands of a listed, and funded team focused on exploration. BHL maps a broader regional trend with hundreds of undocumented workings that extend far beyond the historic mine.

2025 onwards - The modern era begins

BHL plans deeper drilling and structural mapping, alongside re-opening historical shafts to reach positions no one has tested since 1906. Mt Egerton now has its first proper modern test, and a real chance of becoming Victoria’s next major underground gold discovery.

Our Pick of the Year

BHL steps onto the market today with the sort of launch pad we spend all year trying to find.

A historic mine with 1.29 million ounces of production at 12 grams per tonne, shut by water rather than geology, barely tested below 150 metres, sitting in a structural corridor that’s already produced Fosterville, Costerfield and Sunday Creek.

Add a record gold price, $8 million in the bank, and drills turning on listing day. Plus a capital structure that gives every chance to re-rate quickly.

Very few juniors get to list with this kind of foundation, and even fewer get to do it with an asset as proven as Mt Egerton.

Mt Egerton has been waiting more than a century for a proper second act, and BHL is the first team with the balance sheet, drilling plan and structural understanding to go after the parts of the system the old miners never reached.

The shallow work already proves the system carries grade. The deeper positions are where the real story could open up.

BHL lists today at $12.9 million. We think that number has a lot of room to move.