Rutile Rush: Fortuna Moves Fast on Malawi Ground

Fortuna Metals ramps up rutile drilling in Malawi’s rich titanium belt, exploring near Sovereign Metals’ world-class deposit

Fortuna Metals (ASX: FUN) has wasted no time putting boots on the ground in Malawi, moving from acquisition to active drilling in just a few months as it pushes ahead in a world-class rutile province.

We took a position in FUN after its recent rutile acquisition, since then the share price is up around 240% (from 4c to 13.5c), with a current company valuation of $25 million.

Rutile’s the purest titanium feedstock around and is used in jet engines, defence, and an expanding robotics industry hungry for lightweight materials.

It’s a tight market, and we think it’s only going to get tighter.

The share price increase might seem big, but FUN still sits miles behind neighbour Sovereign Metals (ASX: SVM) to the north, which trades at 71.5 cents with a company valuation of $450 million. Rio Tinto’s already on their register, backing the same geological system FUN now controls further south.

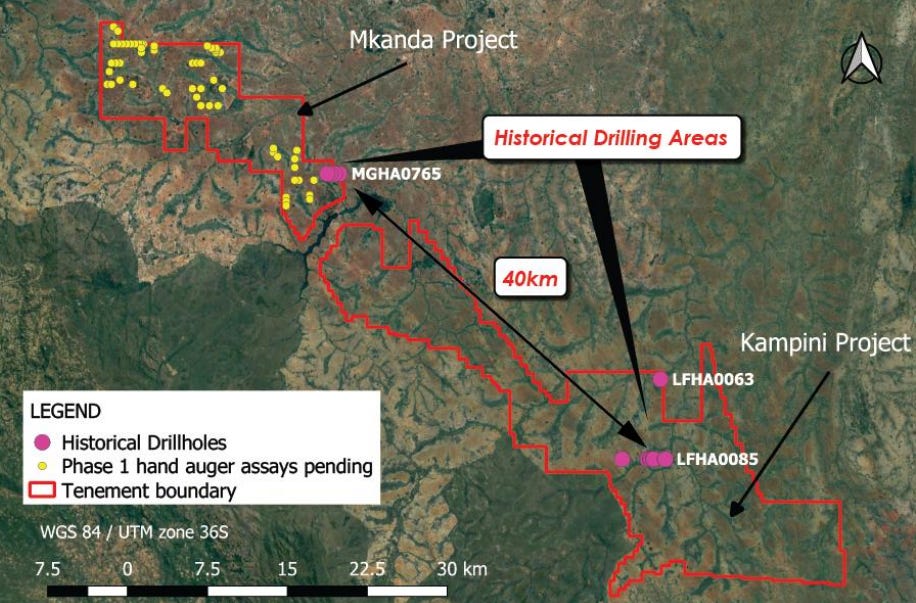

FUN sits along the same geological belt as SVM, where the rocks have been naturally weathered to concentrate rutile close to surface. Just last week, FUN released historical drill holes on its ground, confirming high-grade mineralisation from surface.

Since entering Malawi, FUN has mapped, sampled, and confirmed visible rutile from surface, and now drilling’s underway.

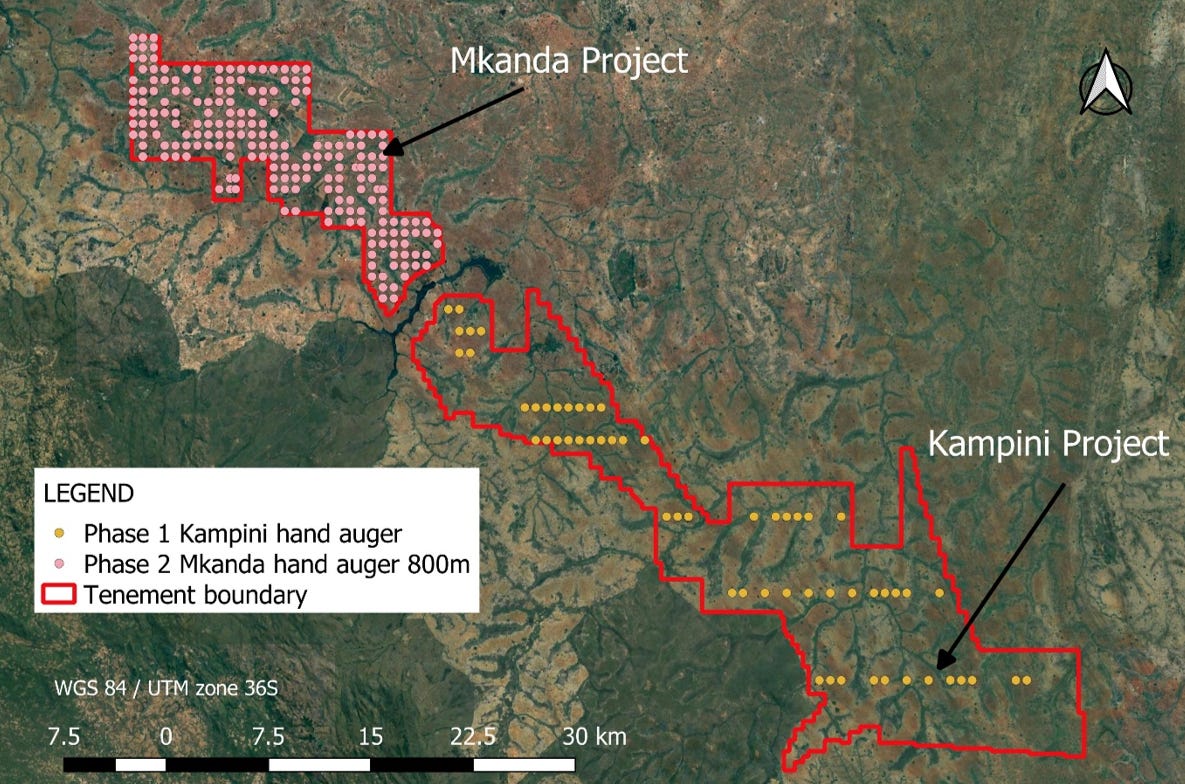

Today’s announcement is another step forward in a market HOT for critical minerals. With more than 300 drill holes planned across two projects roughly 40km apart, FUN’s campaign is now in full swing.

If FUN can confirm what we think is there, the share price won’t stay at 13.5c for long.

No Time To Waste: Fast-Tracked Exploration

Historical work shows rutile mineralisation across two key projects - Kampini and Mkanda - roughly 40 kilometres apart.

Forty kilometres between them could point to something bigger - potentially a continuous mineralised corridor connecting the two projects.

The results below detail the prospective nature of the land holding:

10m @ 1.35% TiO₂ (Mkanda Project)

7m @ 2.19% TiO₂ (Kampini Project)

8m @ 1.46% TiO₂ (Kampini Project)

7m @ 2.14% TiO₂ (Kampini Project)

8m @ 1.60% TiO₂ (Kampini Project)

7m @ 1.85% TiO₂ (Kampini Project)

7m @ 1.77% TiO₂ (Kampini Project)

8m @ 1.57% TiO₂ (Kampini Project)

Up north, Sovereign Metals’ Rio Tinto-backed Kasiya deposit averages around 1%.

We can’t say that FUN will exceed 1%, but based on the historical drilling reported mentioned above, it looks promising.

Fortuna holds the majority of the most prospective geology extending over 70km of strike south from Kasiya, the world’s largest rutile and second-largest flake graphite resource held by Sovereign Metals.

- Fortuna Managing Director Tom Langley

Drilling has been split into two clear phases:

Phase 1 (Already off and running)

At Kampini, drilling has now begun with 58 holes expected to be wrapped up by the end of October.

Over at Mkanda, 63 holes are already complete and samples have been sent off for assay.

The first results are due from late November through to January - a steady stream of news through what we hope we can soon refer to as the summer of FUN.

Phase 2 (Lining up next)

Once Phase 1 wraps, work at Mkanda will step up again with around 205 holes planned on an 800-metre grid, kicking off in early November.

The aim is to define an inferred resource, giving the market a first look at the potential scale. This data will also help attract new funding and potential partners once the results are in.

The Regional and Surface Advantage

This is the kind of blistering pace we like to see as investors. They already completed drilling at Mkanda, where 63 holes averaging 9.2 metres depth were logged and sampled.

Historical work in the region confirmed strong rutile grades across multiple holes, giving FUN a solid foundation to build from.

Importantly, hand auger drilling is both fast and low-cost, which is ideal for testing widespread surface mineralisation, such as rutile. The same approach helped SVM rush from first-pass exploration to a world-class resource.

If the assays line up with what the visual logging suggests, Fortuna Metals could be on track to define Malawi’s next major rutile discovery.

Rutile in this region forms through tropical weathering of gneiss. This natural concentration process leaves the heavy minerals sitting within the top few metres of soil. This means no deep drilling and no expensive earthworks, plus fast sampling.

FUN’s project is also just 20 kilometres from Malawi’s capital, Lilongwe. The capital already has rail, power lines, and water access in place, which is a significant advantage for future development.

The US Push for Critical Minerals

There’s a global race on to secure the raw materials that power modern economies, and Trump and the US are leading the charge.

The global scramble is to secure the raw materials that keep modern economies humming, and Trump and the US have taken the lead.

Trump’s focus on supply chains has put rutile, the purest titanium feedstock, firmly on the radar. It’s essential for everything from defence and aerospace to robotics and AI-era manufacturing.

That focus led to the formation of the Minerals Security Partnership (MSP), a coalition of 14 allied nations (including Australia and Japan) banding together to form a sort of Rebel Alliance for critical minerals. They’re focused on funding and fast-tracking critical mineral projects that sit outside China’s orbit.

Australia has SVM and FUN operating in Malawi, while Japan has committed to a US$7 billion investment in mining and infrastructure projects in East Africa.

At last year’s UN General Assembly, Rio Tinto’s CEO and SVM’s Chairman shared a panel with US bigwigs to discuss rutile’s role in strengthening Western supply chains.

The message was clear: the West needs new, stable sources, and Africa is central to that plan.

Since then, the US has expanded its support through export and development finance agencies to back projects in frontier jurisdictions, such as Malawi.

Malawi’s one of the outliers in Africa that ticks the boxes of stable government, improving infrastructure, and an alignment with Western investment principles, making it an attractive candidate for future MSP funding.

Private capital’s following suit, with J.P. Morgan’s US$1.5 trillion Security and Resiliency Initiative including targeted investments in materials such as titanium. It’s another nod to how critical these metals are becoming for defence, manufacturing, and robotics.

This is an opportune time for FUN as governments and financiers hunt for alternatives to China, and shallow rutile deposits in stable African countries are suddenly strategic assets rather than just exploration plays.

Final Thoughts

It’s been a busy couple of months for FUN, having moved fast since securing its Malawi projects.

From acquisition to desktop work and straight into two back-to-back drilling phases, the company is showing intent and capability in a space dominated by major players, with early exploration success likely to be quickly noticed by the market.

At a $25 million market cap, FUN’s chasing a globally strategic commodity in a proven geological region at a fraction of the price of its peers.

With assays due before year-end, and a second phase already locked in, this is one of the most active and undervalued critical mineral stories on the ASX right now.