TEE Drops Big Hydrogen Estimate in Kansas

Kansas hydrogen numbers are in, and Top End Energy’s resource ranks among the world’s densest

Top End Energy (ASX: TEE) announced today a maiden prospective resource estimate of 304 billion cubic feet (BCF) of natural hydrogen - the largest declared in the US by any listed company.

That translates to around 716,000 tonnes of hydrogen at its Serpentine project in Kansas.

There's also a high-case scenario of 629 billion cubic feet, but like all prospective resources, that depends on what drilling turns up.

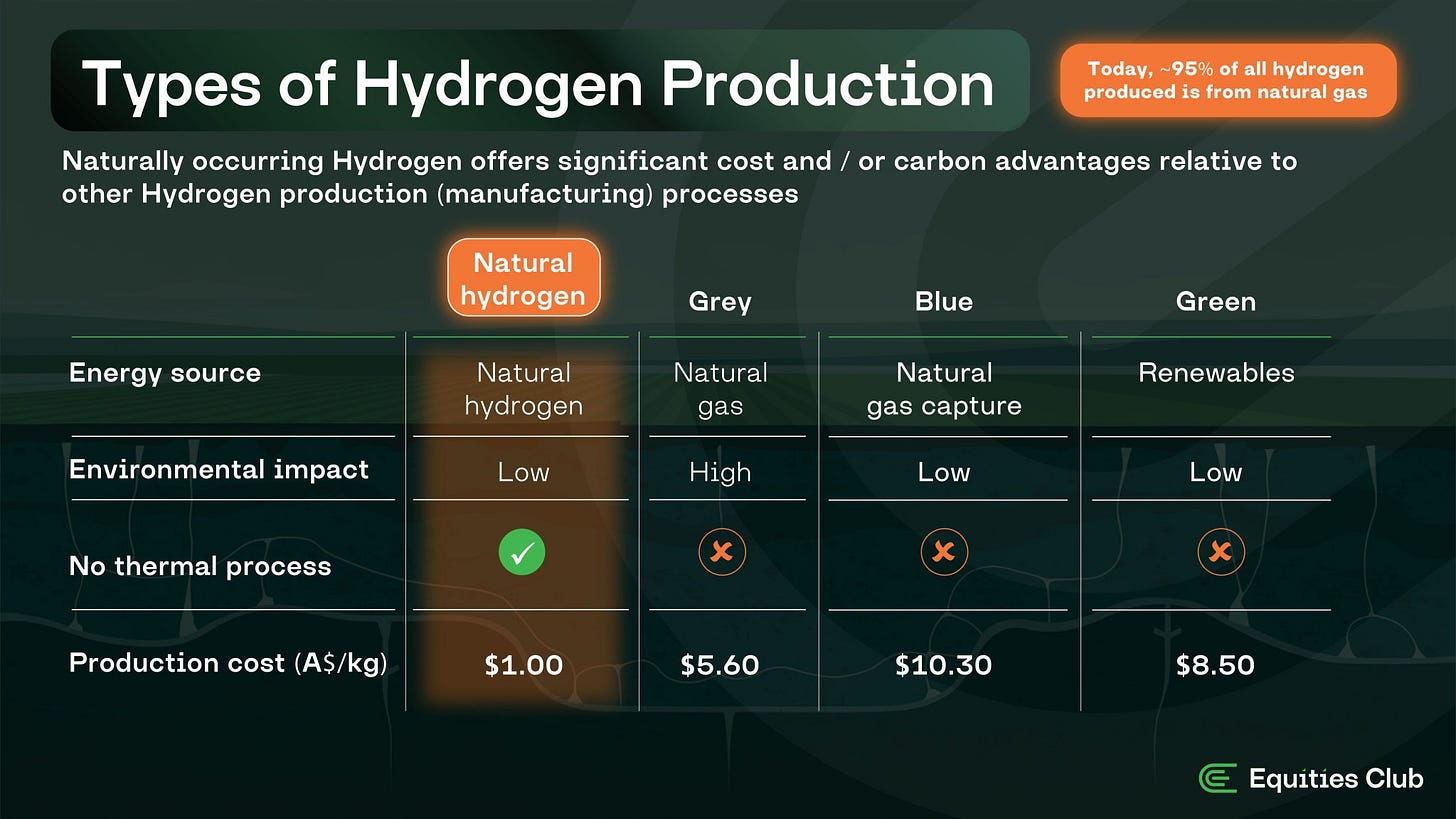

Natural hydrogen isn’t new to us, but it’s still under the radar for most of the market. It offers a cheaper path to clean hydrogen than manufactured alternatives.

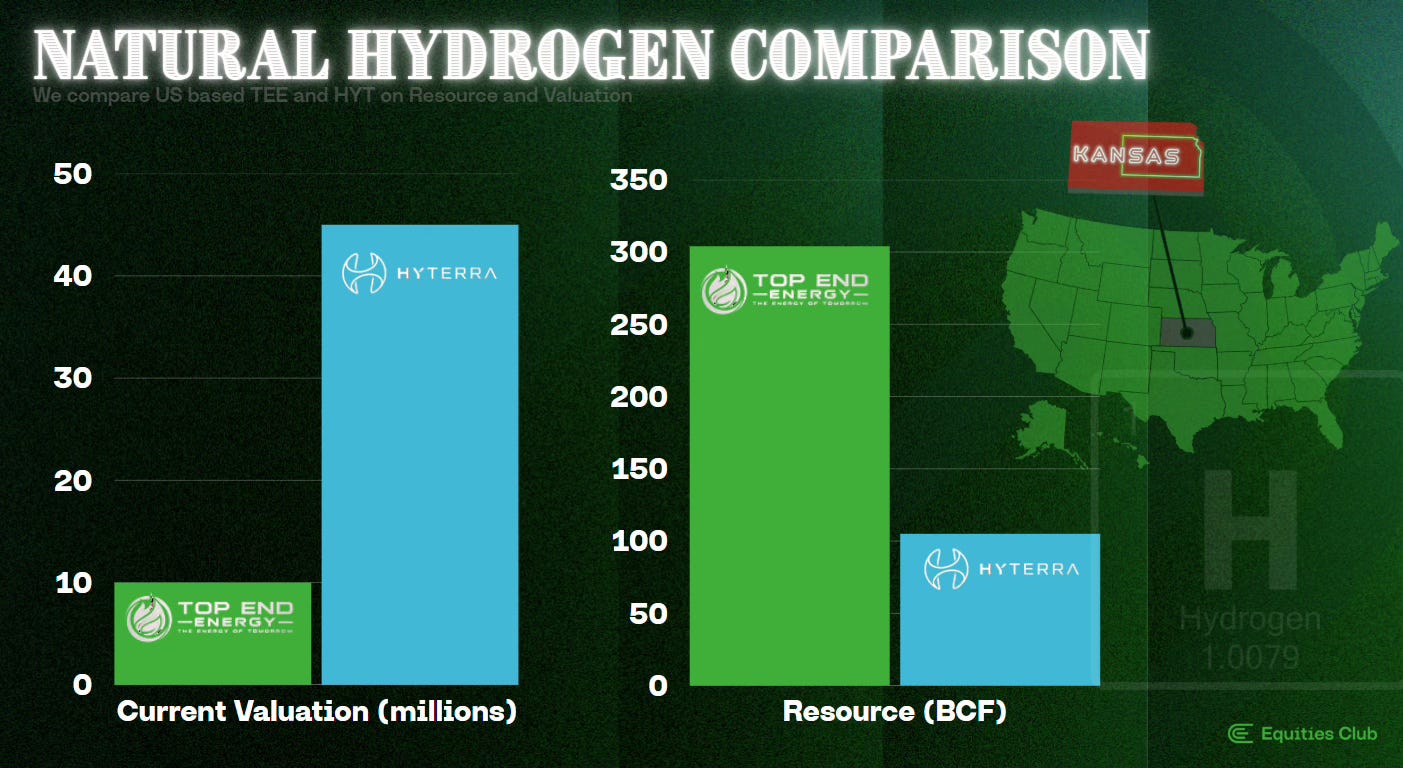

TEE trades at 4.2c, with a $10 million market cap and $4 million in the bank. That’s cheap compared to next door neighbour HyTerra (ASX:HYT), which holds a smaller 102 BCF declared resource and trades around a $45M valuation.

With this resource now in hand, TEE has something real to put in front of potential partners.

Farm-out talks are about to start, where the company could look to bring in a partner with deeper pockets.

If they land someone serious, it’s hard to see the share price staying at 4c for long.

The best leverage play into Natural Hydrogen?

The US natural hydrogen market has only two significant ASX players in our view, HyTerra and TEE, both positioned in a region where Bill Gates and Jeff Bezos' private outfit, Koloma, is quietly snapping up acreage and progressing exploration.

Put side by side, TEE's numbers stack up well against HyTerra. HYT’s declared resource at its Nemaha Project comes in at a mean estimate of 102 BCF.

TEE’s maiden resource at Serpentine is more than double that on a mean basis, and roughly twice the high-side case too.

The valuation gap is hard to ignore. HYT trades on a roughly $45 million market cap, while TEE sits around $10 million despite the larger declared resource.

716,000 tonnes of hydrogen, and a market that values each kilo at $3 to $4. If the resource holds up, this could be a serious asset.

Broader hydrogen market backdrop

TEE’s progress at Serpentine comes as natural hydrogen starts to draw serious interest globally. As we mentioned earlier, Gates and Bezos are already involved.

Closer to home, we’ve all watched Twiggy Forrest go hard on green hydrogen with his big vision (and even bigger spend). That wave has started to lose steam, with more and more projects quietly shelved.

Natural hydrogen is a different beast. It’s cheaper. It’s cleaner. And for those that pay attention, Twiggy’s now backing that too.

He’s invested in HyTerra - the one we mentioned earlier - working the same Kansas fairway as TEE. Between Forrest, Gates and Bezos, there’s now real capital circling that patch of ground.

Of course, none of this guarantees anything. But for a small-cap like TEE, it puts them in a rare position among some heavyweights, and now with something that might just draw one in.

From resource to partner: what’s next for TEE?

Now that TEE has a declared resource, the focus shifts to landing the right partner to help develop it, someone with the funding and appetite to help move the Serpentine project forward.

Farm-out talks are already underway. The technical data room will open this month, giving potential suitors a proper look at the geology, the commercial potential, and what might lie ahead.

Our project ranks among the highest globally for natural hydrogen density. This sets a strong foundation to engage development partners.

- Luke Velterop, Top End Energy CEO

Any partner would likely tip in funding for drilling and could also help secure commercial agreements if hydrogen is found in quantity. And if a deal lands soon, it could certainly be a share price catalyst.

If drilling proves it up, TEE won’t be starting from scratch. Kansas has pipelines running through the region and industrial demand on its doorstep. It’s one of the few places where a discovery doesn’t mean a large capital outlay to become commercial.

The US Department of Energy puts the odds of commercialisation in Kansas at around 70%, should hydrogen be discovered.

Unlocking the Kansas subsurface

TEE’s Serpentine Project sits in Kansas, spread across more than 31,000 acres of leased land in the Fairway - a competitive patch that’s getting harder to lock down.

The resource estimate presented today indicated that TEE's potential resource appears to be well-trapped underground, meaning the hydrogen is effectively sealed in place, reducing the risk of loss to surface.

TEE management is in the process of refining the geological model using further data, and believes that the tightly trapped hydrogen and its large volume could pave the way for lower development costs down the track.

Another trick up TEE's sleeve is that the estimated resource only counts hydrogen below 1,500 feet. If shallower traps exist above that line, there’s a shot this resource grows even bigger.

The key take aways

TEE now holds the largest reported natural hydrogen resource of any listed company in the US - and sits in a region backed by Gates, Bezos and Forrest.

The share price has been hammered with tax-loss selling, and some collateral damage from green hydrogen’s well-publicised struggles. Fair enough, it’s been messy. But natural hydrogen is a separate story, with very different economics.

With a declared resource now in hand, and farm-out talks underway, TEE is now in the box seat to capitalise on a future partner who wants exposure to the cheapest and cleanest form of hydrogen.