The Beetaloo Basin Now Has a Price Tag

Tamboran just paid US$169 per acre for Falcon. That makes every other Beetaloo player look interesting

A deal just dropped in the Beetaloo Basin that puts a real price on what’s been speculation for years.

Tamboran Resources (ASX: TBN) will acquire Falcon Oil & Gas for US$172 million, valuing Falcon’s ground at roughly US$169 per acre and handing Tamboran control of close to 2.9 million net acres - more than 90 per cent of the basin.

For years, companies have been drilling and talking up the Beetaloo’s potential as Australia’s next big gas province. Now we know how much sophisticated buyers are actually willing to pay for the ground.

Which brings us to ASX junior Top End Energy (ASX: TEE).

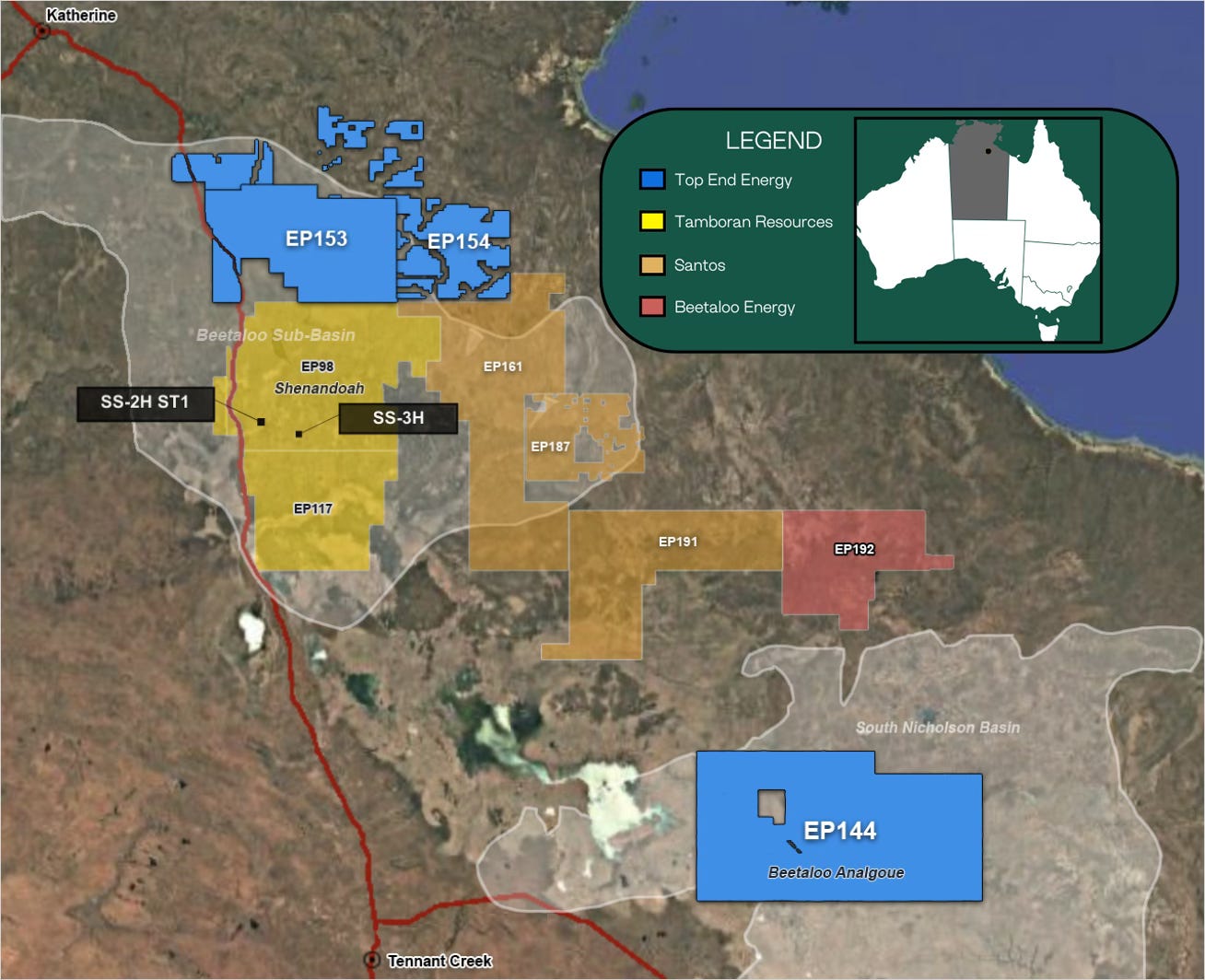

TEE holds 3.15 million acres in the same basin - one of the last significant positions outside Tamboran’s control.

Falcon’s ground is more advanced, but applying the same per acre price that Tamboran just paid implies a value of over US$500m (A$800m) for TEE’s acreage.

Against an $8m market cap, that’s roughly a 99 per cent discount.

The Beetaloo Basin: Why it Matters

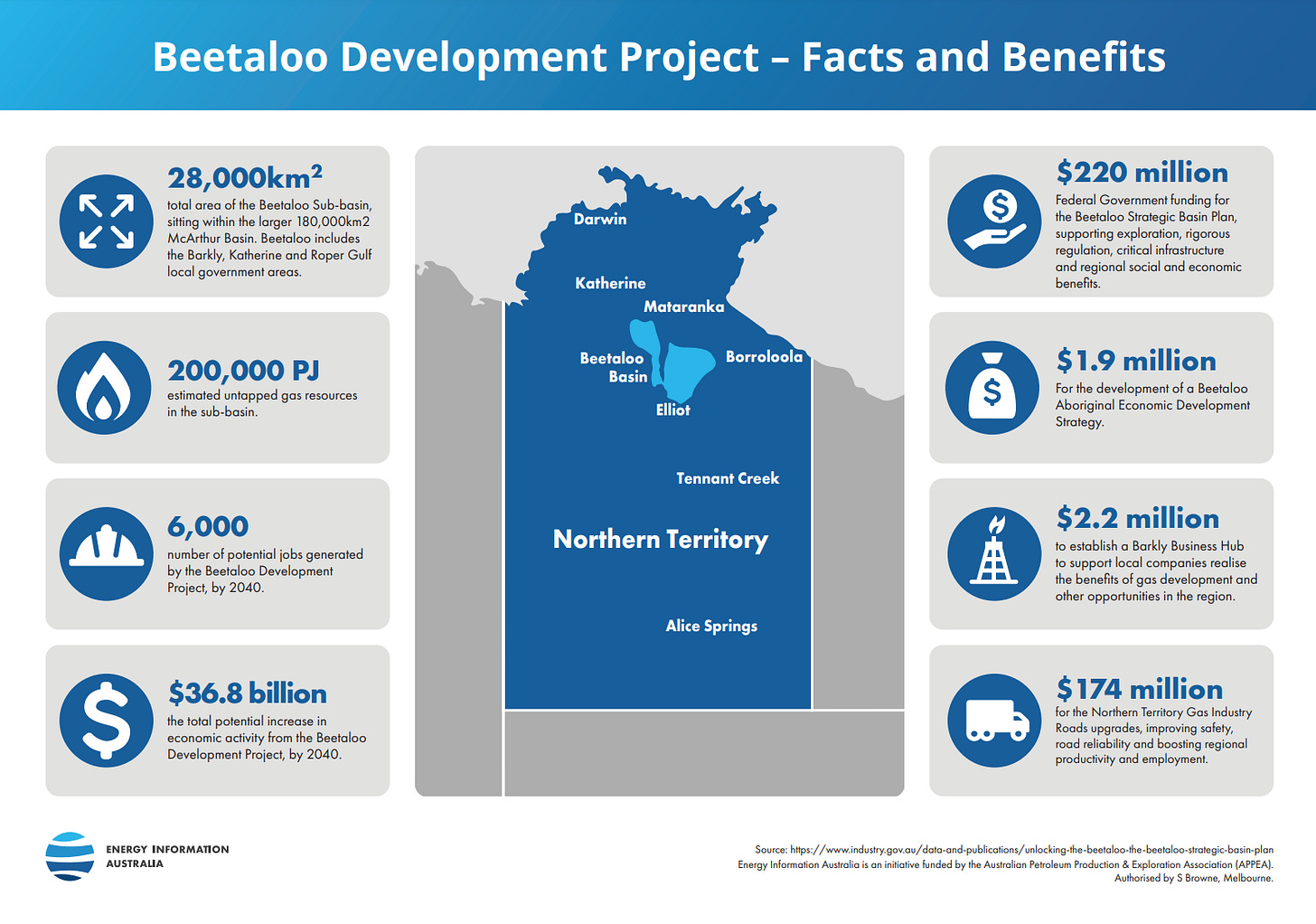

The Beetaloo sits 500km southeast of Darwin, stretching across 28,000 square kilometres of relatively flat cattle country. For decades, geologists knew it contained massive gas resources, but the question was always whether it could flow at commercial rates.

That argument has largely been settled after multiple wells showed deliverability.

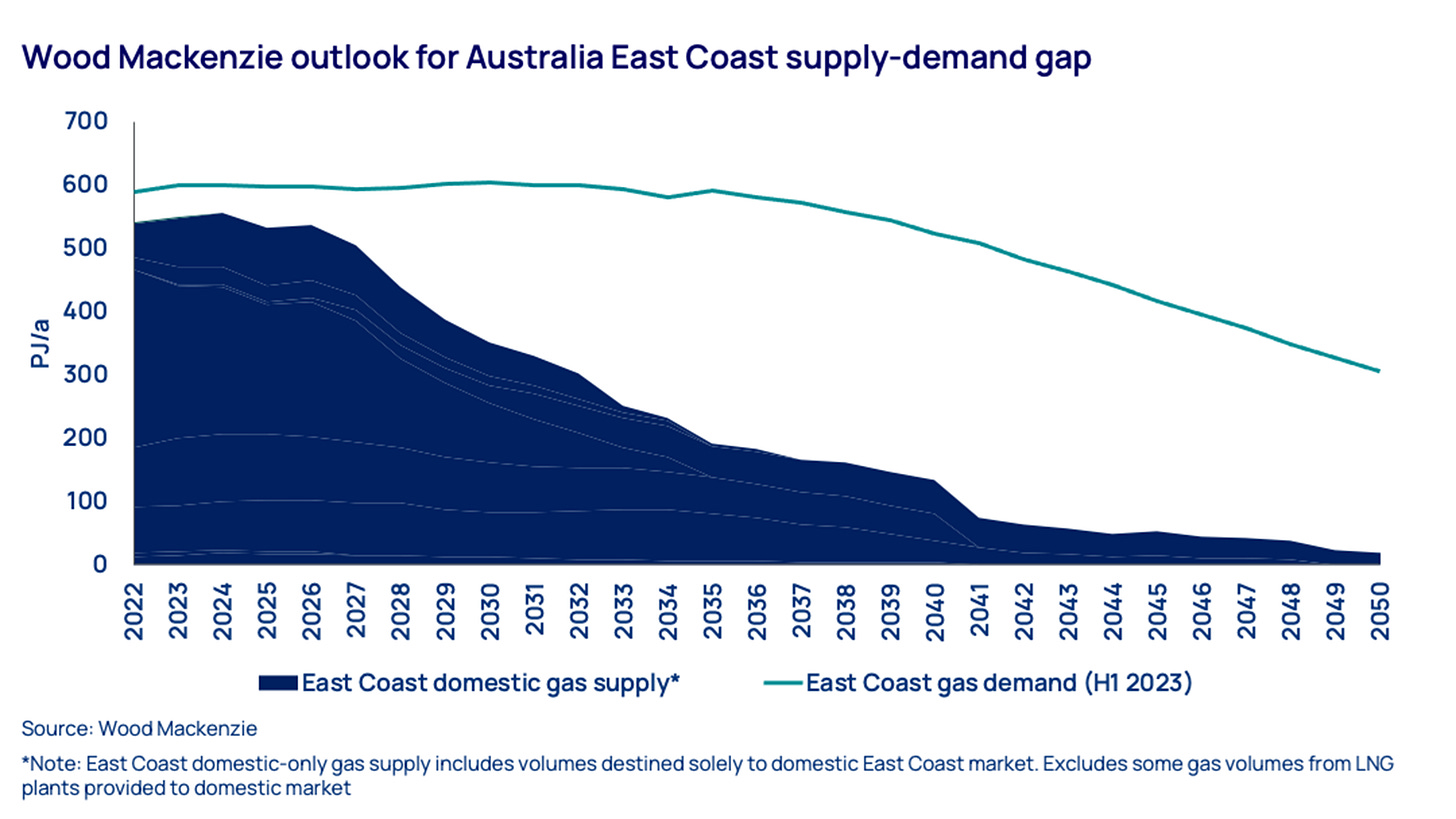

Australia now faces an energy crunch that’s arriving faster than most realise. The Bass Strait gas fields (which have powered the east coast since the 1960s) are in terminal decline. The ACCC warns of potential shortfalls by 2027, and the Australian Energy Market Operator projects supply gaps as early as 2028.

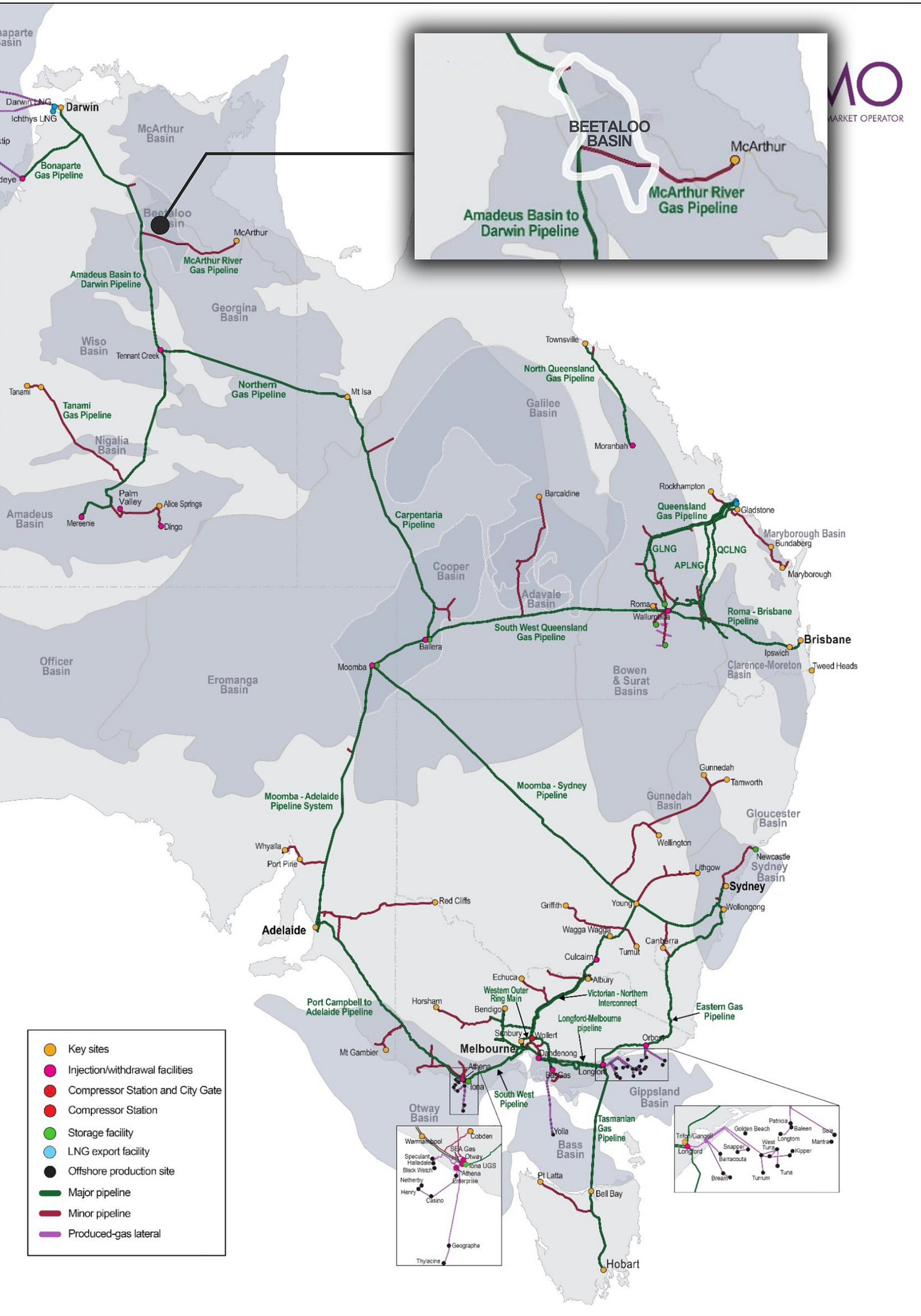

That puts the Beetaloo at the centre of Australia’s energy strategy. And unlike remote basins that need billions in new infrastructure, it already has the Amadeus Gas Pipeline running through it, linking directly to Darwin’s LNG facilities and the east coast grid.

The pipes are there, multiple wells have proven the rocks can flow, and companies from Origin to Santos, Beetaloo Energy and Tamboran have already committed serious capital.

Both sides of politics also back the basin. Albo says gas remains crucial “through to 2050 and beyond,” while the Libs are equally supportive.

When both major parties line up on an energy project, it strips out a lot of the usual regulatory risk.

Tamboran’s Falcon Play - Why it Matters

The acquisition gives Tamboran control over the basin’s development trajectory.

With 2.9 million acres under its belt, Tamboran can now push ahead with its Phase 2 development area, where its interest will climb to over 80 per cent post-deal. They’ll now be the key driver of how the basin is developed.

This deal also sets a clear benchmark for Beetaloo valuations.

By paying US$172 million in cash and stock for Falcon, Tamboran has set the market price at US$169 an acre - slightly below its own traded acreage multiple of US$176 an acre, but still a serious premium to what many juniors are being valued at today.

We now have a real transaction between sophisticated parties putting hard dollars on the table. The market has spoken on what Beetaloo acreage is worth.

The Beetaloo has shifted to a basin with clear, transaction-backed valuations. That matters for every company with exposure to the area.

Running the Numbers for Top End Energy

TEE’s position in the Beetaloo covers 12,750 square kilometres, which works out to around 3.15 million acres.

Put side by side with Falcon’s 1 million acres, it’s clear that TEE holds a serious land package, even if it remains earlier stage. Now let’s apply the same yardstick Tamboran just paid:

Falcon’s 986,803 acres valued at US$172 million → about US$169 per acre

TEE’s 3.15 million acres × US$169 = ~US$530 million implied value.

At today’s exchange rates, that’s over A$800 million.

Against an $8 million market cap, TEE is trading at around 1 per cent of the implied acreage value being set by Tamboran’s deal. Even allowing for Falcon’s more advanced development and Tamboran’s operational muscle, the gap is extraordinary.

The market is essentially valuing TEE’s Beetaloo exposure at zero, despite now having a clear, cash-backed benchmark from the Tamboran deal.

Why TEE’s Ground Isn’t Just Speculative

What makes this more than a simple paper exercise is the location of TEE’s permits.

EP 153 and EP 154 directly border Tamboran’s EP 98 licence, where commercial flow rates have already been demonstrated. TEE sits right next door to where Tamboran has proven the rocks can flow.

EP 258 sits further south in the basin. It’s targeting different types of gas deposits - the simpler kind you find in regular rock layers rather than shale, and it’s earlier stage, but another way to win if it comes good.

Together, these three permits cover 12,750 square kilometres (around 3.15 million acres) of Beetaloo ground.

TEE also holds natural hydrogen prospects in Kansas, giving it multiple shots on goal. While that narrative hasn’t played out as quickly as we’d hoped, investors are now getting Beetaloo acreage at cents on the dollar while also picking up exposure to an emerging energy theme.

Sometimes the best opportunities come from unexpected places.

TEE’s Strategic Options

Tamboran’s consolidation move puts TEE in an interesting position. The company has three clear paths forward:

Hold and develop the assets as the basin matures and economics improve.

Farm out to a player looking for Beetaloo exposure without paying Tamboran’s premium.

Sell some or all of the acreage while consolidation is hot and buyers are active.

All three options look better now that Tamboran has set a clear market price for Beetaloo acres.

The flexibility to choose the best path as the basin develops is what makes TEE interesting at these levels.

What’s Coming Next

The Beetaloo is about to get busy with results flowing through from multiple operators.

Beetaloo Energy (ASX: BTL) completed stimulation of their Carpentaria-5H well mid-year, and results from their IP30 flow testing are due soon. Tamboran has wells underway, with results expected late 2025 into early 2026.

Every successful well in the Beetaloo adds weight to the argument that this basin can deliver commercial gas at scale. With multiple operators active and results flowing through, the narrative is building momentum.

For TEE, each positive result from other operators strengthens the case that their ground has real value, and the market cap becomes harder to justify as more wells prove up the basin.

Final Takeaway

Tamboran’s US$172 million acquisition of Falcon has redrawn the map of the Beetaloo. It values acreage at nearly US$170 per acre and cements the basin’s status as a cornerstone of Australia’s energy future.

TEE’s 3.15 million acres have a back-of-envelope value of more than US$500 million using Tamboran’s multiples, yet the market continues to price the company at just $8 million.

In a basin where consolidation is clearly underway, Top End Energy offers investors one of the cheapest, purest leverage plays left on the table.