Humanoid robots still feel a bit like sci-fi, but the money piling into them says they’re coming a lot quicker than most people expect.

Tesla might be the loudest voice, but they are just one player in an industrial arms race. We are watching a massive convergence of big tech, auto makers and Chinese groups all driving toward the same goal of mass-produced humanoid labour.

And if even a fraction of the forecasts are right, the world will need a lot more titanium than it currently has.

Which brings us to Fortuna Metals (ASX: FUN).

FUN is a rutile explorer that just released results making it one of the most interesting early-stage plays on the ASX. Rutile is the cleanest feedstock for titanium, and FUN’s latest numbers from Malawi suggest they might be sitting on a monster system.

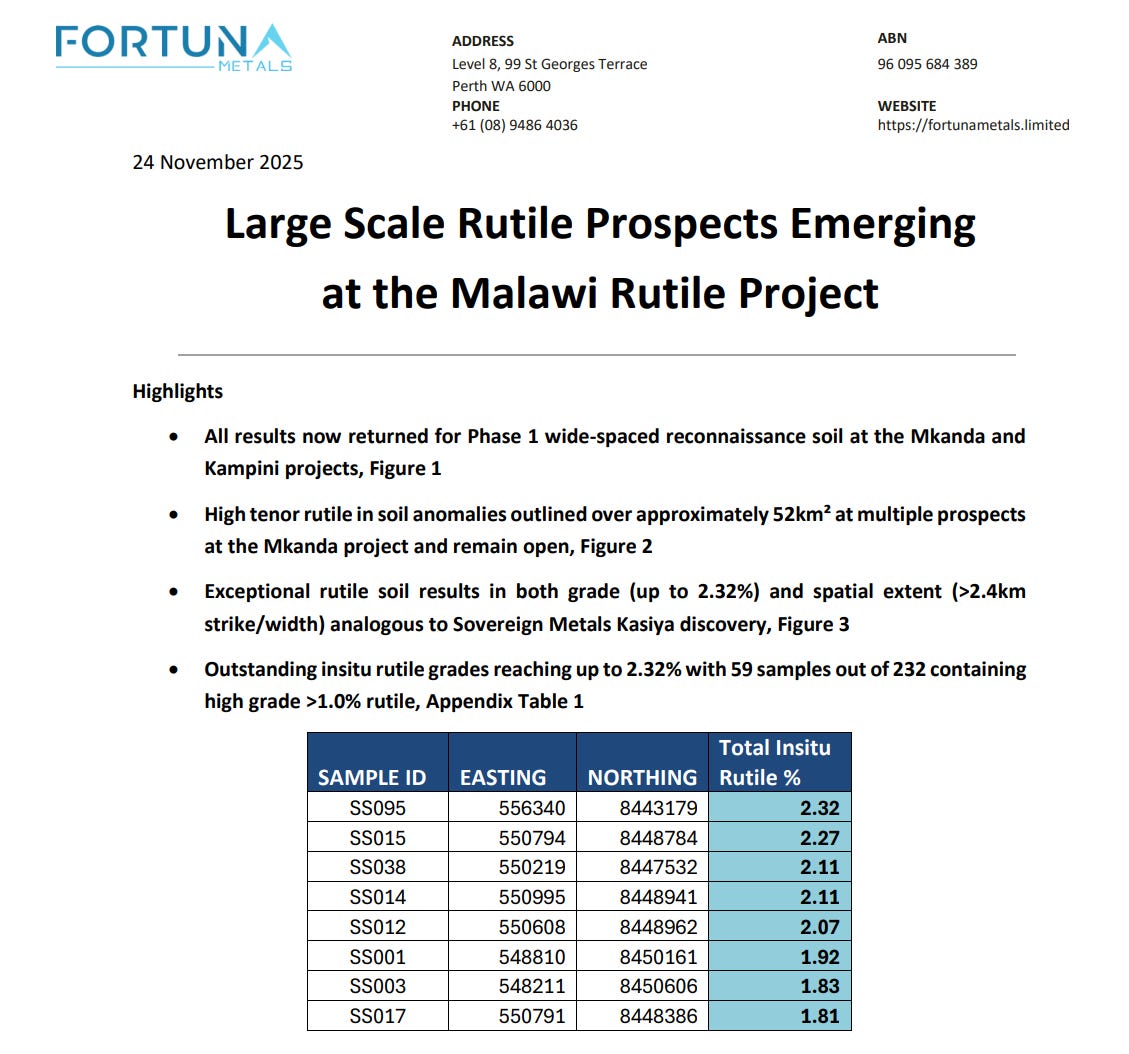

The company confirmed broad, coherent rutile anomalies across roughly 52 square kilometres at Mkanda, with grades reaching as high as 2.32% rutile and 59 samples above 1%.

FUN sits at a $28 million market cap, yet the numbers are starting to compare comfortably with its neighbour to the north, Sovereign Metals, which trades at more than 10 times FUN’s valuation.

Hand-auger drilling is moving quickly too. 309 holes have been completed at Mkanda and another 28 at Kampini.

First assays are expected from mid-December, with the rest flowing through the first quarter of 2026. It sets FUN up for a steady run of news into the new year.

Cast your mind back to four years ago, when Tesla unveiled a dancer in spandex and called it a robot. Now, Tesla is planning production runs in the tens of thousands and already has them working in its factory. China is moving even faster, and analysts are throwing around trillion-dollar market caps for the sector. It all underlines the pace this industry is scaling at.

Whether those forecasts land exactly doesn’t matter much. The direction’s set. More robots means more titanium, and more titanium means more rutile.

FUN heads into the next year with a big footprint, rising grades, incoming assays and a clear thematic behind it.

And betting against Elon has rarely been the winning side.

General advice warning

The contents of this document are intended to provide general securities advice only and have been prepared without taking account of your objectives, financial situation or needs. Because of that you should, before taking any action to acquire or deal in, or follow a recommendation (if any) in respect of any of the financial products or information mentioned in this document, consulting your own investment advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs. If applicable, you should obtain the Product Disclosure Statement relating to the relevant financial product mentioned in this document (which contains full details of the terms and conditions of the relevant financial product) and consider it before making any decision about whether to acquire the financial product. Whilst the Equities Club Pty Ltd (“Equities Club”) believes information contained in this document is based on information which is believed to be reliable, its accuracy and completeness are not guaranteed and no warranty of accuracy or reliability is given or implied and no responsibility for any loss or damage arising in any way for any representation, act or omission is accepted by Equities Club or any officer, agent or employee of Equities Club or any related company.

Neither Equities Club, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice.

Disclosure

The directors, authorised representatives, employees and associated persons of Equities Club may have an interest in the financial products discussed in this document and they may earn brokerage, commissions, fees and advantages, pecuniary or otherwise, in connection with the making of a recommendation or dealing by a client in such financial products. Equities Club owns 1,504,000 FUN shares at the time of publishing this article. Equities Club has been engaged by FUN at the time of writing.

Confidentiality notice

The information contained in and accompanying this communication is strictly confidential and intended solely for the use of the intended recipient/s. The copyright in this communication belongs to Equities Club. If you are not the intended recipient of this communication please delete and destroy all copies immediately.

Equities Club Ltd (CAR No. 001308139) is a corporate authorised representative of ShareX Pty Ltd, Australian Financial Services License (AFSL) No 519872.