Top End Energy's Texas Power Play

TEE is pivoting into AI data centre infrastructure - targeting land with power in Texas

With the US facing a US$2.6 trillion AI data centre buildout, Top End Energy (ASX: TEE) is pivoting into one of the fastest-moving infrastructure themes in the world.

The company is targeting the part of the value chain that’s rapidly becoming the real bottleneck: land with power attached.

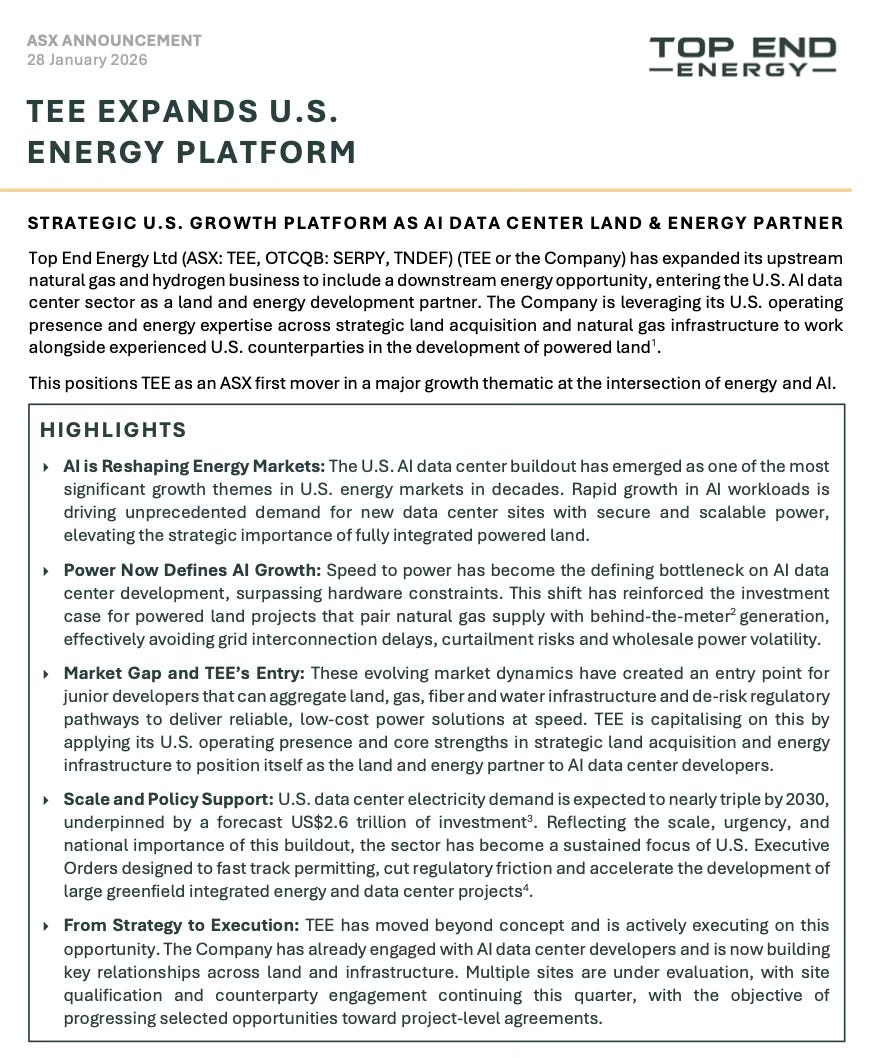

At a market cap of around $9 million, TEE sits at one end of a massive valuation spectrum. US-listed companies chasing the same theme (securing land and energy inputs for data centres) are already trading at hundreds of millions.

If TEE can make credible progress and partner with the right groups, that gap has the potential to close quick. The company still holds its natural hydrogen assets, which offer long-dated optionality if that market matures.

TEE is now targeting nearer-term opportunities in Texas where it can apply the land access and permitting skills it's already built in the US.

AI's power problem

Most people hear "data centre" and think servers in a warehouse. The reality is closer to running a small city.

A single large AI data centre can consume as much electricity as a medium-sized city. Thousands of chips running around the clock, generating enormous heat, all needing constant cooling.

One hyperscale AI facility can draw hundreds of megawatts - comparable to adding a new aluminium smelter to the grid overnight.

Multiply that by hundreds of facilities across the US and you start to see the problem.

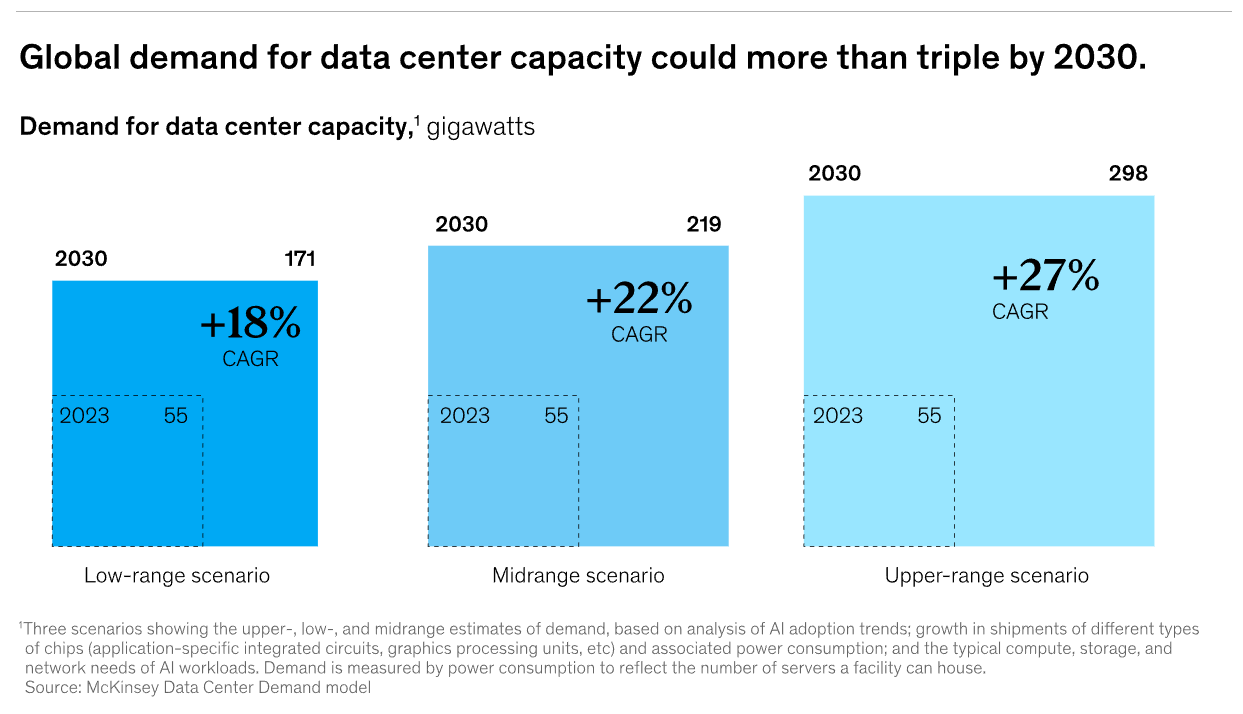

US data centre electricity demand is expected to triple by 2030, and an estimated US$2.4 trillion is expected to be spent on the infrastructure required to support it. This level of investment is needed for land, power plants, gas supply, cooling systems, transmission lines, and redundancy.

The US grid wasn’t designed for this kind of exponential demand growth, and that mismatch is creating opportunities for companies that can move faster than the utilities.

The grid can’t keep up

Connecting a large new load to the US grid can take four to six years. Sometimes longer.

Transmission lines, substations, and approvals were all built for incremental growth over decades. Nobody planned for this kind of demand arriving all at once.

For an AI developer racing to get compute online, waiting five years for a grid connection is commercially unacceptable. That’s why the industry has pivoted hard toward behind-the-meter power.

Behind-the-meter simply means generating power on site, directly feeding the data centre, rather than relying on the public grid. It’s the equivalent of a factory building its own power station because the local grid can’t support the load.

It gives operators speed, reliability, and control over long-term energy costs. What started as a workaround is now standard practice in US AI infrastructure planning.

Where TEE fits

Power generation alone isn’t enough. You also need the right land, in the right place, with access to gas, water, fibre, and a realistic permitting pathway.

Private land matters because it removes friction. Fewer competing land uses, fewer stakeholders, more flexibility to design infrastructure properly. It’s the difference between trying to renovate a terrace house in a dense suburb versus building on a clean block with utilities already running to the fence.

TEE’s strategy is to sit at that intersection. Secure land, secure energy inputs, progress approvals, and bring in the partners that actually build and operate the data centres.

TEE isn’t trying to become a hyperscaler. The play is to control the scarce input the big players need and can’t wait years to access.

US-listed companies pursuing similar strategies are being valued on speed-to-power, not megawatts on a slide deck. That’s the same logic TEE is banking on.

TEE has done this before

The company’s US experience is worth highlighting here. TEE’s work on natural hydrogen leases in Kansas required navigating US land access, permitting, and stakeholder management.

Those are the same skills needed to secure data centre sites in Texas.

Negotiating land contracts in the US is genuinely difficult, particularly for foreign companies. You need local relationships, an understanding of how permitting works state by state, and the ability to move quickly when opportunities emerge. TEE has already built that capability through its hydrogen work.

The plan now is to apply those networks and that experience to a sector where the demand is more immediate.

Natural hydrogen remains a long-term opportunity, but the data centre buildout is happening right now, and TEE is positioning to capture a piece of it.

The valuation gap

At around $9 million, TEE is firmly a small-cap. That comes with risk, but it also creates asymmetry.

US companies pursuing powered-land and energy-linked data centre strategies are already trading at 20x, 30x, or more than TEE’s valuation. They’re being valued on the inputs they control, not operational data centres.

New Era Energy & Digital (NASDAQ: NUAI) started out in helium before pivoting into energy-backed digital infrastructure. The company secures land with power attached for AI data centres, offering behind-the-meter supply that bypasses grid delays. NUAI now trades at a market cap in the hundreds of millions.

TEE doesn’t need to replicate those businesses to justify re-rating. It needs to demonstrate credible progress on a site, a power pathway, and a partner relationship that de-risks execution.

The risk factor

We first covered TEE about a year ago on the natural hydrogen thematic. The stock is down since then, and the hydrogen story has been slower to develop than we expected.

The data centre angle gives TEE a nearer-term opportunity, but this is still a $9 million company in the early stages of executing on a new strategy. It depends on securing the right land, lining up power supply, and finding a partner willing to back the project. Those pieces take time to fall into place.

There's also timing risk. The AI infrastructure buildout is moving fast, and TEE is up against larger competitors. That said, the company has stated it's already engaged with AI data centre developers and has multiple sites under evaluation in Texas. The groundwork is underway.

What we’re watching

The near-term catalysts revolve around site selection and partner discussions in Texas.

TEE has the US experience and networks from its hydrogen work, so the question is whether it can convert that into a deal that moves the needle.

Progress on approvals, any indication of serious partner interest, or evidence of land being secured would all be material. We’re watching for the building blocks rather than finished infrastructure.

Natural hydrogen remains in the background as long-dated optionality. If that market matures, TEE still has exposure.

We hold TEE, so we're backing the thesis. At a $9 million market cap, TEE doesn't need much to go right for the stock to re-rate.