Unprecedented divergence: A new chapter for ASX's small-caps in 2024?

Small-cap stocks are lagging despite a booming market for larger companies. When will the gap close?

In 2024, Australian equity markets are breaking new ground, signalling an unprecedented opportunity for small-cap investors. With large-cap companies thriving, history suggests smaller stocks are next in line for significant gains. This trend, favourable macroeconomic conditions, and a sector at a cyclical bottom may be the perfect recipe for significant small-cap stock growth.

You've likely heard of the All Ordinaries index, but what does it really tell us?

Think of it like the pulse of Australian equity markets. Comprising the 500 largest companies on the ASX, the higher their valuations, the higher the index. On the other hand, the Small Ordinaries index comprises companies 100-300 on the Australian market per the S&P 300 index and serves as the heartbeat for small-cap investments. Historically, these two indices have danced a closely choreographed waltz – the All Ordinaries leading the way, with the Small Ordinaries gracefully in step.

What’s changed?

As we stepped into the new year, the All Ordinaries index danced to the tune of record highs, while the Small Ordinaries index watched from the sidelines. As of February 2024 we are witnessing the most significant divergence between the two indices in history.

It's not that the Small Ordinaries index is falling; rather, the All Ordinaries index is reaching unprecedented heights. Day after day, we are seeing markets hit record highs as the big end of town does well.

It's as if we're witnessing a tale of two markets: one where the titans of industry soar to record highs, while the smaller players remain anchored at the same level they were in April 2006. There could be various reasons for this, including cost of living pressures, rampant inflation, and regular interest rate hikes, all of which have led to a decreased investor risk appetite. But it's the potential for what lies ahead that’s caught our eye.

On the last day of January 2024, the All Ordinaries reached an all-time high, and there was some welcome news: inflation had fallen to a two-year low. If inflation continues to fall, the pressure on the cost of living will reduce, and there will be a higher chance of interest rate cuts. If this narrative plays out in the second half of 2024, it will mean that Australians will have more money in their pockets. With more disposable income, risk appetite generally increases.

But how does history inform today's small-cap landscape?

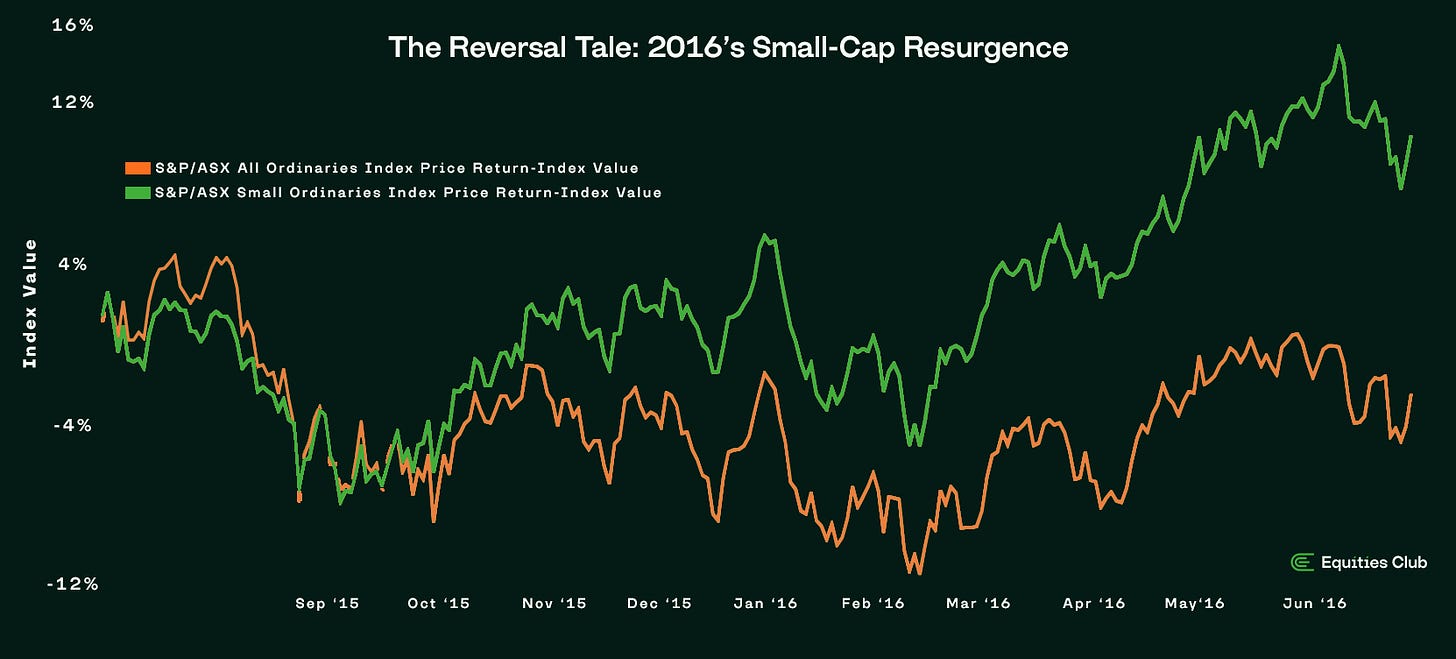

Let's take a stroll down memory lane to mid-2015. Back then, we witnessed a similar divergence between these indices. The breakaway was short-lived as over the 12 months to July 2016, the Small Ordinaries was up 12% (relative to the middle of 2015), helping bridge the gap, while the All Ordinaries were down 2.3%.

To give some real-life context to the small-cap space, Pilbara Minerals (PLS), the lithium juggernaut of today, was just an explorer trading at 11c in July 2015, and by July 2016 it was trading at over 60c. Today, we stand at a similar crossroads. With the big end of town having pulled away, we believe the stage could be set for a small-cap stock surge.

Who's who in the Small Ordinaries index?

Nearly 25% of the companies that make up the Small Ordinaries index are from the mining and resources sector. These sectors have recently felt the pinch of soft commodity prices, impacting company valuations. There's an old saying in the mining sector: "High prices fix high prices, and low prices fix low prices" In basic terms, the market will once again find balance somewhere in the middle. Suppose you believe in the cyclical nature of commodity prices as we do. In that case, the opportunity to invest at the bottom of a down market is apparent.

Social media is always a great indicator of market sentiment, especially in the small-cap space. In 2024, gone are the rocket emojis and bags of money; instead, we see increased frustration and anger as many smaller companies struggle to gain share price momentum. Last month's news of weak inflation struck a chord on the usual platforms, beating the drum for a potential cut in interest rates. If rates are cut, we believe this is the perfect recipe to see funds flow back into small-cap stocks; you only have to look back to the Covid times of 2020 to see the avalanche of funds that flowed into the market as interest rates were cut.

As risk appetites increase and cashed-up investors look for the next opportunity, the mining sector, a sector we believe is at a cyclical bottom, presents a golden opportunity to be the recipient of those funds. In the shadows of the booming big players, 2024 could be the year of the small-cap stocks on the ASX.