Weekly Wrap: AZ9's Copper Plans, Antimony's Quiet Rise & Gates' French Play

Small-cap stocks are heating up fast. We unpack AZ9's copper plans, antimony's rise, Gates' latest hydrogen bet, and prepare for RIU Explorers

If you haven't been watching the small-cap space, now's the time. Momentum is building.

With many companies laying out their plans for 2025, we're seeing some movement in the junior exploration space. At the same time, commodity prices are strengthening.

This week, the price of copper, gold, and antimony all rose, which has direct implications for our portfolio. We also saw further investment from Bill Gates in the natural hydrogen sector.

We've got a lot to unpack:

AZ9's copper exploration strategy and why it signals long-term upside.

The antimony price surge, what it means for our investment

Natural hydrogen gains momentum with more backing from Bill Gates.

We preview the RIU Explorers Conference and how it relates to junior explorers.

AZ9’s Copper Ambitions Laid Out

AZ9's newly released 2025 exploration roadmap caught the market's attention, sending its stock up 10% to 5.1c.

The investor presentation detailed plans to advance massive sulphide exploration at its Oval project in Mongolia. We spoke with Managing Director Gan-Ochir to unpack what lies ahead for 2025. See our interview below.

With copper prices projected to remain strong for years to come due to demand from renewables and electrification, AZ9 is well-positioned to capitalise on any large-scale discovery.

Investors looking for exposure to copper should be closely monitoring AZ9 as it moves through its next phase of exploration and development. In 2025, this junior explorer could turn into something much bigger upon drilling success.

Gold and Antimony Prices Are Soaring

It's hard to think of a commodity that's had a better run than gold lately.

But while gold has been stealing the spotlight with its recent price surge, antimony is quietly emerging as a highly valuable commodity.

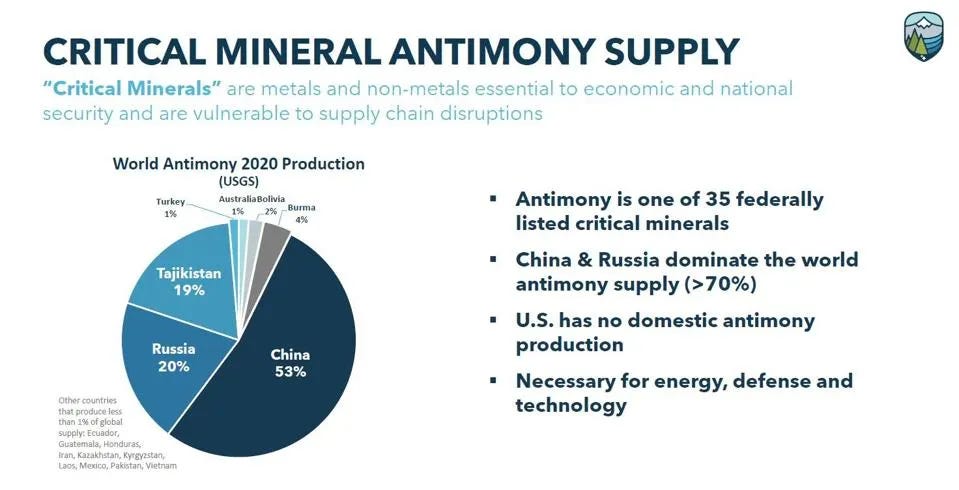

Once called "The Most Important Mineral You Never Heard Of," antimony is a strategic critical mineral that is used in all military applications. It is the key element in the creation of tungsten steel and the hardening of lead bullets, two of its most crucial applications during World War II.

Antimony prices have surged from US$13,000/t in early 2024 to US$50,000/t today, a nearly 400% rise.

While gold's 40% rally toward US$3,000/oz has dominated headlines, antimony remains under the radar. China's September 2024 export ban, citing national security concerns, has further tightened supply.

Analysts at Fawkes Capital Management predict prices could reach US$100,000/t, given historical trends.

Our readers may be aware of our investment in Bubalus Resources (ASX: BUS) as a gold exploration play between two of Australia's highest-grade gold mines in Fosterville and Costerfield in regional Victoria.

Gold's rally has us excited, and we expect its momentum to continue in 2025. What we haven't drawn much attention to previously is the antimony production in the region.

The Costerfield gold mine is also a significant antimony producer, further strengthening the strategic importance of Bubalus' location. The Fosterville mine also produces antimony as a by-product of its gold production.

With Bubalus set to begin drilling between the two mines mentioned above within the next two months, targeting high-priority zones, our team is very excited about the potential for a gold or antimony discovery.

Bill Gates’ Invests More In Natural Hydrogen

Bill Gates has placed another bet on natural hydrogen, this time backing French startup Mantle8's €3.4 million seed round. The company's goal is to find 10Mt of natural hydrogen by 2030 using AI-powered geological tools.

The investment through Gates' Breakthrough Energy Ventures signals more confidence in natural hydrogen's potential to deliver clean energy at a fraction of current costs.

For our investment, Top End Energy (ASX: TEE), which closed up 22% on Friday, this further validates what we've been saying since December.

TEE is advancing its own natural hydrogen exploration efforts in Kansas - a region Bloomberg says could create a 'Spindletop moment,' referring to the 1901 Texas oil gusher that created generational wealth.

TEE’s acreage sits next door to Koloma, another Gates-backed venture that's raised US $380 million.

The tech billionaires, which include Jeff Bezos and Twiggy Forrest among the natural hydrogen believers in Kansas, aren't throwing these kinds of numbers around for fun.

With significant newsflow expected throughout 2025 as TEE advances its exploration efforts, we see substantial upside from current levels. While the majors fight over billion-dollar private plays, TEE offers ASX investors ground-floor exposure at a tiny market cap.

RIU Explorers Conference Days Away

The Equities Club team heads to Fremantle next week for the RIU Explorers Conference, where hundreds of small-cap miners will lay out their plans for 2025.

After a mixed 2024, we're keen to gauge sentiment on the ground. RIU often signals where money will flow in the months ahead as companies, brokers, and investors fund managers gather to kick off the year.

We'll bring you our key takeaways next week, focusing on the opportunities we spot before they hit mainstream radars.