Weekly Wrap: Cape Town Buzzes, CSL Burns and 10X Joins the Portfolio

We tipped Exultant Mining from Cape Town, CSL down $70bn from its peak and its CEO in the same week, and nickel finally showed signs of life

Friday the 13th earned its reputation this week. The ASX 200 spent four days grinding higher, only for sellers to pile in on the close and wipe out half the week's work in a single session. Only the superstitious would’ve been spared.

Meanwhile, we were 8,000km away in Cape Town, walking the floor at 121 Mining and Indaba while the small-cap resources market started to wake up.

We tipped our first portfolio addition of 2026, nickel got a pulse, and gold forecasters are now throwing around numbers that would've got you laughed out of the room two years ago.

What caught our eye this week:

Exultant Mining becomes our first portfolio pick of 2026

On the ground at 121 Mining and Indaba in Cape Town

Trump pushes AVZ to sell its Manono stake to a US buyer

Nickel bounces as Indonesia caps production

Solstice hits serious copper width in WA

Gold forecasts creeping toward US$6,000/oz

CSL sheds $70bn and loses its CEO

Zinc inventories running low as the concentrate market tightens

WA lithium refinery shuts down while PLS locks in a price floor

Our Latest Investment: Exultant Mining (10X)

We tipped Exultant Mining (ASX: 10X) on Wednesday as our first investment of 2026. Gold, silver and copper have all run hard since the company listed in December, but the share price has drifted below its IPO price. That gap is why we're now on the register. You can find our full breakdown here.

The valuation is what pulled us in. A $7 million market cap, $4.3 million in cash, and only 37 million shares on issue. Strip out the cash and you’re paying $2.7 million for more than just greenfield assets.

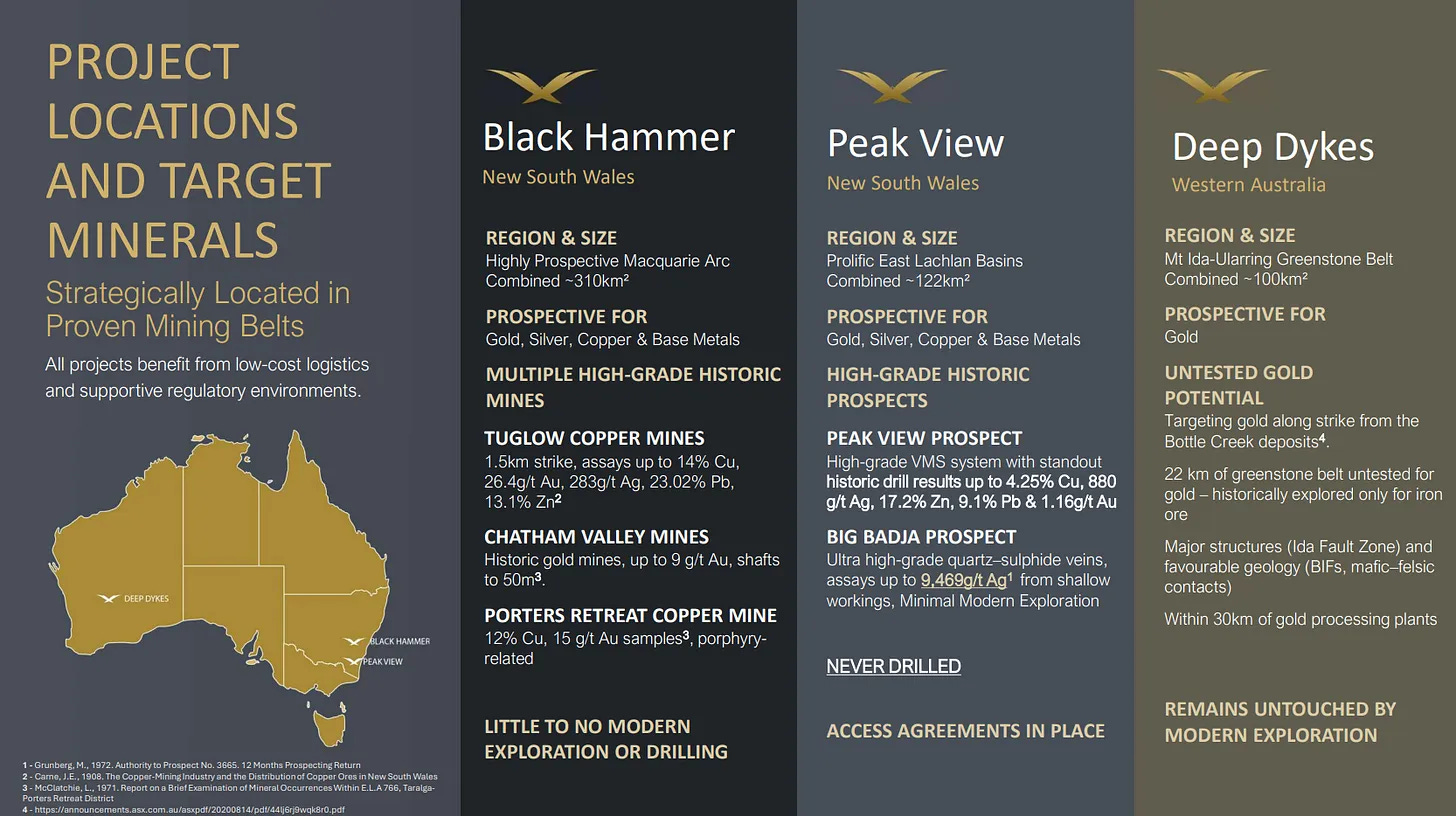

10X has three projects spread across NSW and Western Australia in mining belts with genuine discovery history.

Peak View: Historic drilling returned up to 4.25% copper, 880 g/t silver, 17.2% zinc, 9.1% lead and 1.16 g/t gold.

Black Hammer: Historic records show grades up to 14% copper and 26.4 g/t gold.

Deep Dykes: Untested.

Gold has more than doubled since the start of 2024. Silver has rocketed from just over $20 an ounce to around $80, and copper keeps grinding higher on electrification demand.

We wanted a way to play all three, and 10X is it. First drilling at Peak View is only weeks away. We’ll be watching closely.

Cape Town Conferences: 121 and Mining Indaba

We were in Cape Town this week for both the 121 Mining Investment and Mining Indaba. Both were packed.

121 was the busiest we’ve seen it. Every meeting slot full, conversations spilling into hallways, and international groups running diligence on companies they wanted to back.

North American funds, European groups, Middle Eastern capital and Japanese investment banks were all there looking to acquire, farm in or partner. Last year these meetings were just feeling things out. This year, people meant business.

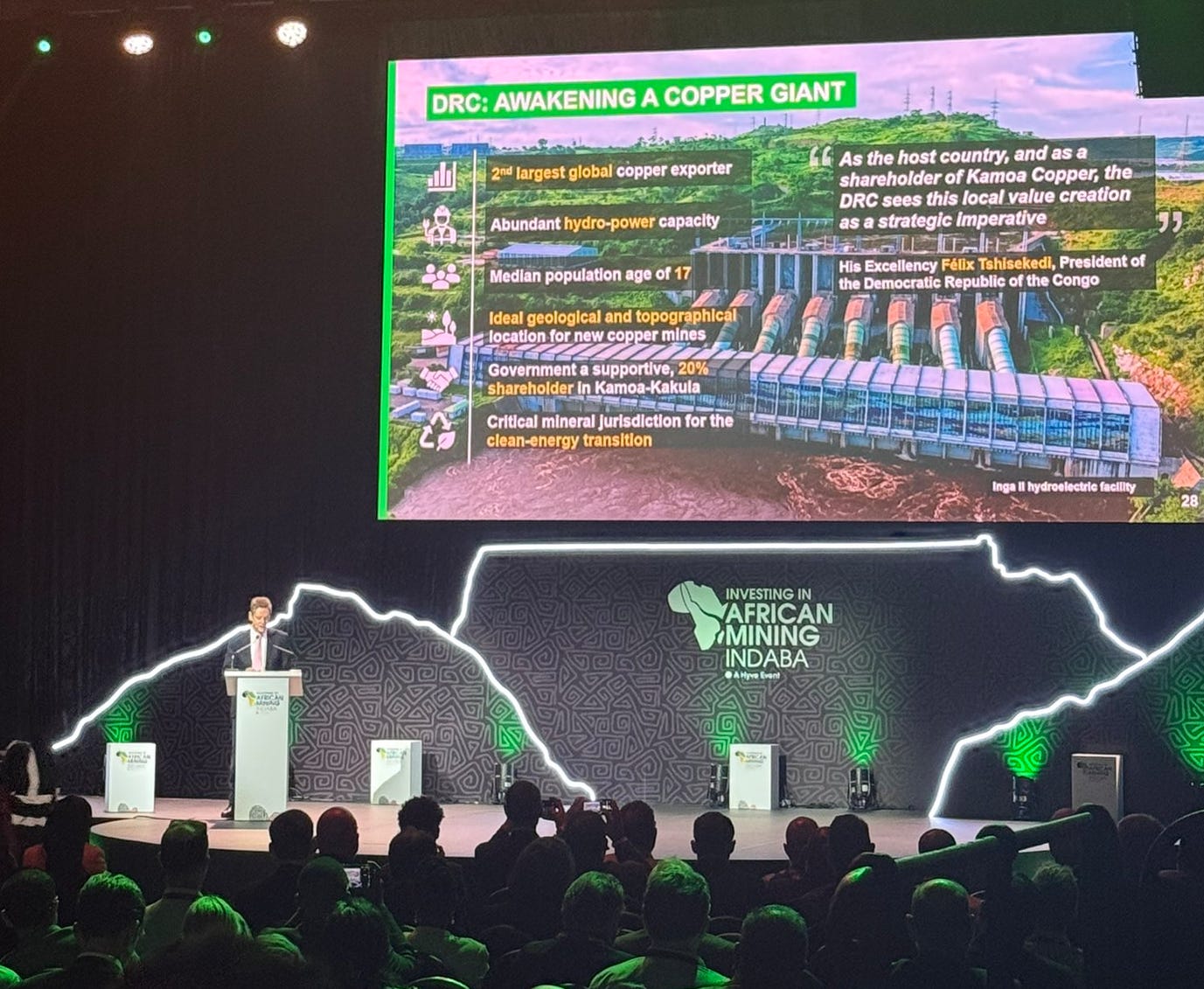

Mining Indaba logged its largest attendance in 32 years with more than 10,500 delegates. Government officials from the DRC, Angola, Zambia and Malawi were selling miners on why they should bring projects to their neighbourhood.

With gold around US$5,000/oz, every second meeting came back to ounces. The other half came back to copper and why nobody can find enough of it.

Among the names getting a lot of love at 121 were Fortuna Metals (ASX: FUN), West Wits Mining (ASX: WWI), Prospect Resources (ASX: PSC), Chariot Resources (ASX: CC9) and DRC Gold Corp (CSE: DRC).

Next stop is RIU in Fremantle. Conference season's just getting started.

AVZ, Manono, and the US Angle in the DRC

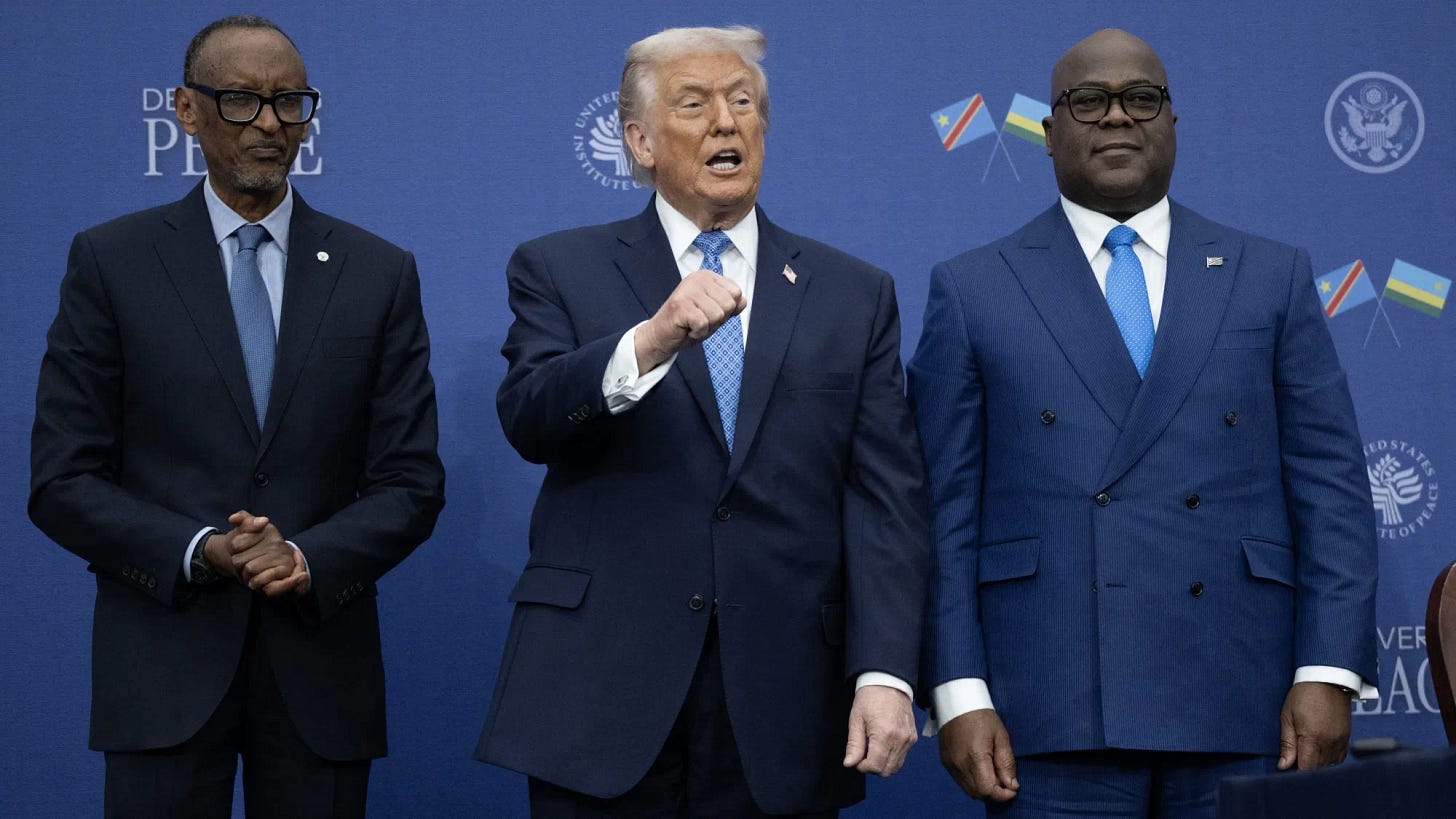

Manono is the largest undeveloped hard rock lithium deposit on the planet. It's been stuck in politics and legal fights for years.

We've covered the AVZ saga in painstaking detail before. The short version reads as follows: ASX darling finds the world's biggest lithium deposit, gets tangled in disputes over ownership, allegedly loses its licence, spends years in arbitration, and gets delisted in 2024 at a $2.4 billion valuation. Shareholders haven't been able to trade a single share since.

This week, the AFR reported that the Trump administration has urged AVZ to sell its stake to a US company, with a meeting reportedly taking place in Washington on January 21.

The US wants a seat at the table on critical minerals supply chains, and Manono is the biggest prize going. That kind of pressure isn’t comfortable for management trying to work toward an outcome for holders who’ve already been through plenty.

But serious Western interest in the DRC would likely mean cleaner deals and more credible partners down the track, which the country desperately needs.

AVZ holders have been patient for a long time. There's still a lot to play out here, and we'd be watching closely rather than jumping to conclusions.

Solstice Minerals Copper Discovery in WA

Solstice Minerals (ASX: SLS) dropped a copper hit at the Nanadie project last week that made us do a double take.

The headline intercept was 62m at 1.55% copper and 0.66 g/t gold, with a second zone of 97m at 0.73% copper and 0.32 g/t gold. They stand out in both grade and thickness.

Most WA copper plays are narrow and low grade. Widths like 62 metres at 1.55% copper can support bulk mining economics if the continuity stacks up across strike and depth.

The job now is repeating those results and figuring out how big this thing actually is. One drill hit doesn't make a mine, but we like what we're seeing this early on.

The share price is up more than 100% over the past two weeks, even with a pullback of around 20% this week as the initial rush faded.

Holders who got in early have done well. The question from here is whether the next round of drilling can back up hole one.

Nickel Finally Gets a Pulse

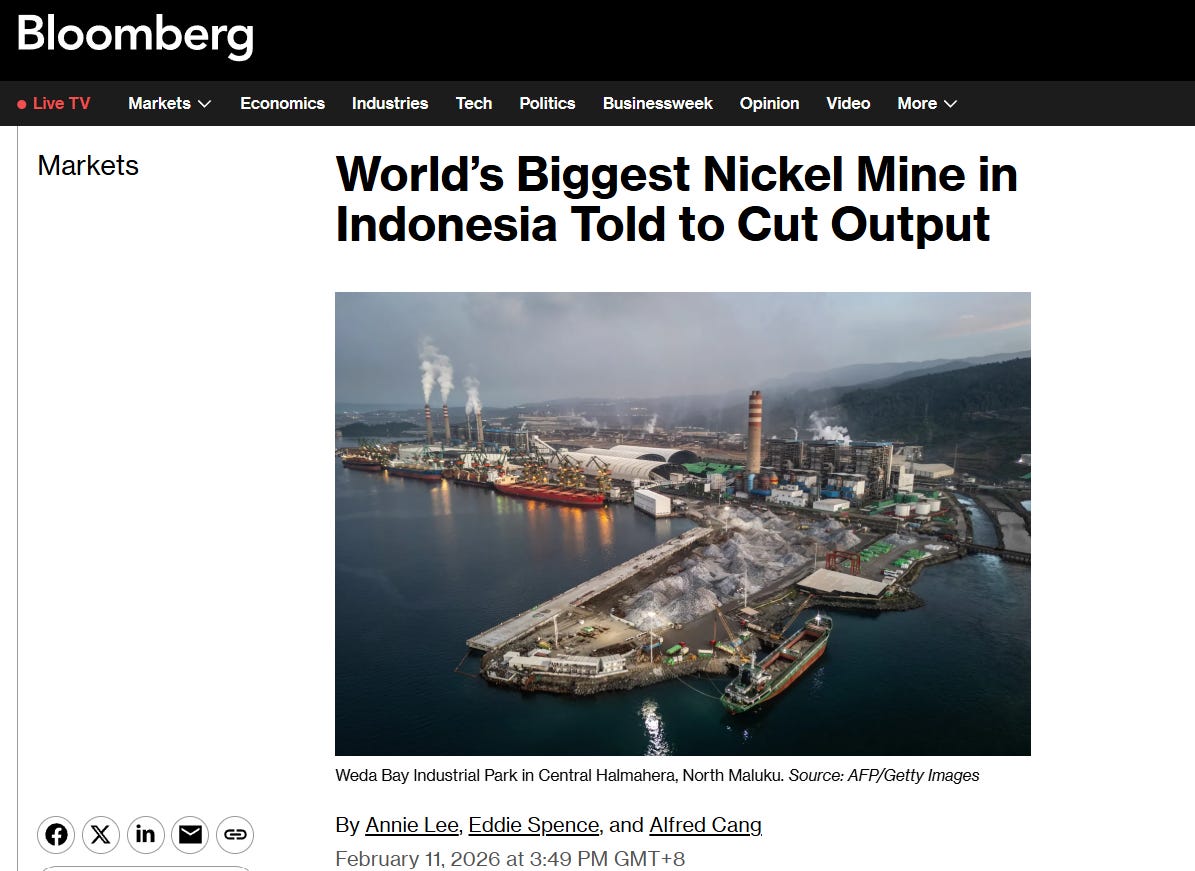

Nickel’s been hammered for the better part of three years. Indonesia flooded the market with cheap supply, prices tanked, and mines across the world went into care and maintenance because the numbers weren’t stacking up.

The first sign of relief came from Indonesia, of all places, this week. Reports indicate that their largest nickel producer, Weda Bay, will cap their ore production quota at 12m tonnes this year (compared to 42m tonnes previously). National quota adjustments are also being flagged. That’s a big cut from the country that controls most of the world’s nickel supply.

For context, quotas directly influence how much ore can legally be produced and sold, so any reduction can tighten supply.

Nickel prices responded with a rise of around 2% to roughly US$18,000 per tonne.

It’s early days, and one quota adjustment doesn’t undo years of oversupply. But if Indonesia’s serious about pulling back, the Aussie nickel names sitting in care and maintenance might start getting a second look.

If nickel keeps climbing, the obvious ASX names in the frame are BHP (Nickel West), IGO (Cosmos) and Panoramic Resources (Savannah).

Will the Gold Price Keep Going? Some Think So

Gold continues to bounce around the US$5,000/oz mark, which in itself would have sounded absurd a few years ago. After a run that dragged bullion into mainstream news and work lunch conversation, a consolidation phase is healthy.

BNP Paribas says US$6,000/oz is on the table if central banks keep stacking gold.

Beyond that, some forecasters are building cases for even higher numbers, mostly anchored to sovereign debt blowouts and the idea that currencies keep losing ground against hard assets.

We're not building a portfolio around any single bank target, but the consensus seems to be that gold holds steady or goes higher, and that backdrop keeps us interested in small-cap gold plays.

Even if the metal chops around US$5,000 for a while, juniors with ounces in the ground are in a good spot.

Gold Juniors in our portfolio include: Black Horse Mining (ASX: BHL), Bubalus Resources (ASX: BUS) and our latest addition, Exultant Mining (ASX:10X).

CSL Gets Barbecued

We spend most of our time on companies with sub-$50m valuations, so volatility comes with the territory. We actually enjoy it, in a weird way. So when a blue chip like CSL (ASX: CSL) falls nearly 17% in a week and more than 40% over six months, even our interest is piqued.

CSL's half-year result landed with a thud this week. Net profit after tax fell 81% year on year to $401m, with revenue down 4% to $8.3bn. Management pointed to restructuring costs and asset impairments, but the market wasn't buying it.

The one-off items they pointed to made investors question what's actually "one-off" about them, and the sell-off was swift.

The soft result was followed by CEO Paul McKenzie departing effective immediately, with an interim replacement stepping in. When a $70bn company loses its CEO overnight, you know it’s going to be rough going as a shareholder.

It’s a reminder that even the biggest names on the ASX can get crunched when earnings disappoint and leadership walks out at the same time. We see it in small-caps, but at this end of town it tends to hit harder because nobody expects it.

Zinc Quietly Tightening Up

Zinc hasn’t been getting the airtime that gold, silver and copper have, but plenty is going on underneath.

Zinc concentrate, the raw material miners produce before it gets refined, is getting harder to come by.

Global zinc stockpiles have been edging lower. When inventories shrink, prices can move faster if demand improves even slightly.

Zinc, the fourth most consumed metal on the planet, is mainly used to coat steel to stop it rusting, so it tracks closely with construction and infrastructure activity.

If supply stays tight and prices keep firming, the ASX zinc explorer with real projects and a path to production could start getting attention again. It doesn't take much for attention to swing back when the fundamentals line up.

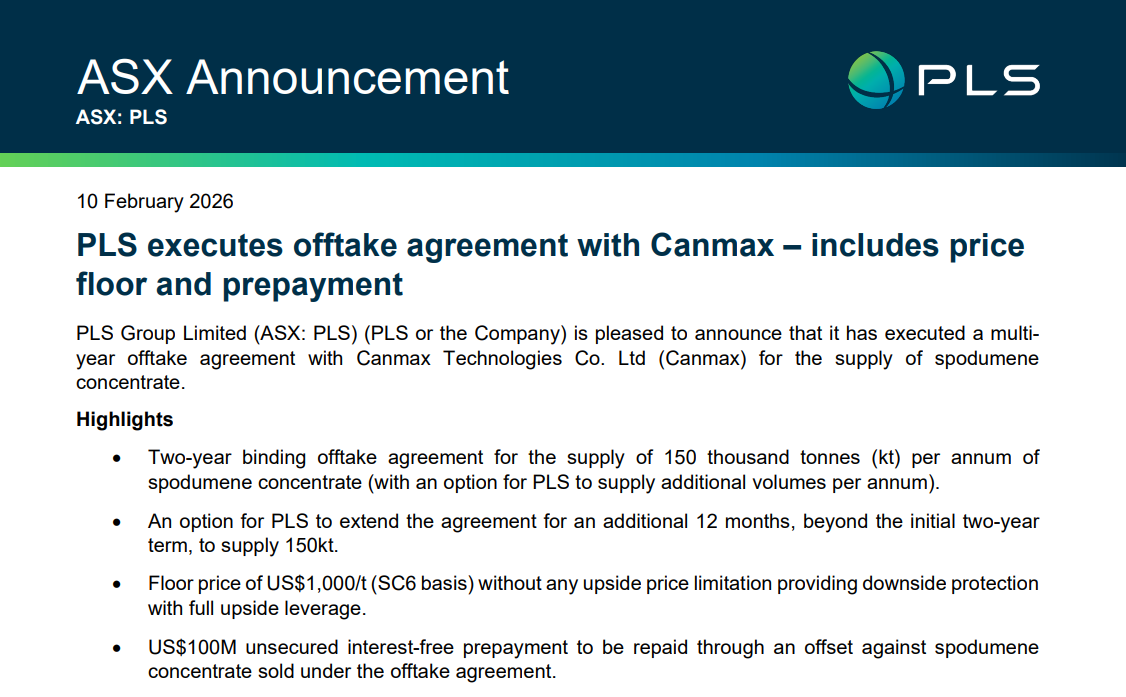

WA Lithium Refinery Closure and the Pilbara Contrast

Albemarle, one of the world's biggest lithium producers, is shutting down the last operating line at its Kemerton refinery in WA.

The plant takes raw spodumene concentrate and turns it into battery-grade lithium hydroxide. It’s a reminder that downstream processing doesn’t automatically turn a profit just because the commodity is strategic.

Jobs are going as the plant moves into care and maintenance, with the company citing cost pressures and market conditions despite recent green shoots in lithium pricing.

Producing lithium hydroxide from spodumene is capital intensive and energy heavy. Margins depend on the spread between raw concentrate prices and the realised hydroxide price, and that spread has been volatile.

Compare that to Pilbara Minerals (ASX: PLS) new offtake agreement with Canmax that was announced this week. The offtake includes a floor price of US$1,000/t for spodumene and a US$100m unsecured, interest-free prepayment.

PLS gets a price floor and $100m upfront with no interest. They keep the upside if prices run. That's a strong deal.

The two stories side by side tell you something about the lithium chain right now. The miners digging up the rock can hedge their downside and still ride the upside. The processors turning it into battery-grade product are wearing the margin squeeze. Where you sit in the chain matters as much as the commodity price itself.

A Busy Week to Come

Plenty moved this week, and it feels like we're only warming up.

We add the first stock to our portfolio of 2026, and the commodity mix of gold, copper, nickel and zinc news is a good set up heading into the back half of Q1.

Cape Town was buzzing, and we’re backing it up with RIU Explorers in Fremantle this week.

Till next week.

The White House effectively telling an ASX player to sell their DRC stake to a US buyer is a massive wake-up call. It's no longer just about the rocks in the ground; it’s about who’s holding the geopolitical leash.

If the US starts strong-arming critical mineral supply chains like this, is the “free market” for lithium officially dead, or just under new management?