Weekly Wrap: Copper Crunch, Takeover Chat, and Our Best Pick Yet

Four portfolio companies dropped news, the banks can't agree on oil, and our Pick of the Year lands Tuesday

Equities Club Pick of The Year drops this Tuesday, make sure you’re subscribed to be the first to know about our highest conviction pick of 2025.

Four of our portfolio companies dropped news this week. AZ9 put up real grades, FMR inched closer to the target, BUS locked in approvals and FUN kept expanding. A tidy way to close out spring before Tuesday’s main event.

The stock tipping comp wraps on Monday too, with the $2,500 winner announced next weekend, so good timing all round.

Here’s what else caught our eye on markets this week:

Copper tightens as supply lags and juniors look well placed

Northern Star back in takeover chat as Agnico circles

Oil splits the banks (Goldman bullish, JP Morgan not)

BHP walks from Anglo after the US$49 billion pursuit stalls

Tin spikes on supply fears

Our Pick of the Year Lands Tuesday Morning

Tuesday we’re adding a new name to the portfolio, and it’s our highest-conviction pick for 2025.

The setup ticks a lot of our boxes:

A commodity with strong tailwinds and room to run

A cheap valuation with a truckload of cash

Ground in a proven region with real scale potential

Near-term catalysts that could move things quickly

Everything points the same way here, which is why it’s made the cut.

Full details, including our investment thesis and the milestones we’re tracking, go to subscribers first on Tuesday morning. If you’re not on the list yet, now’s the time.

The AZ9 Story Just Got More Interesting

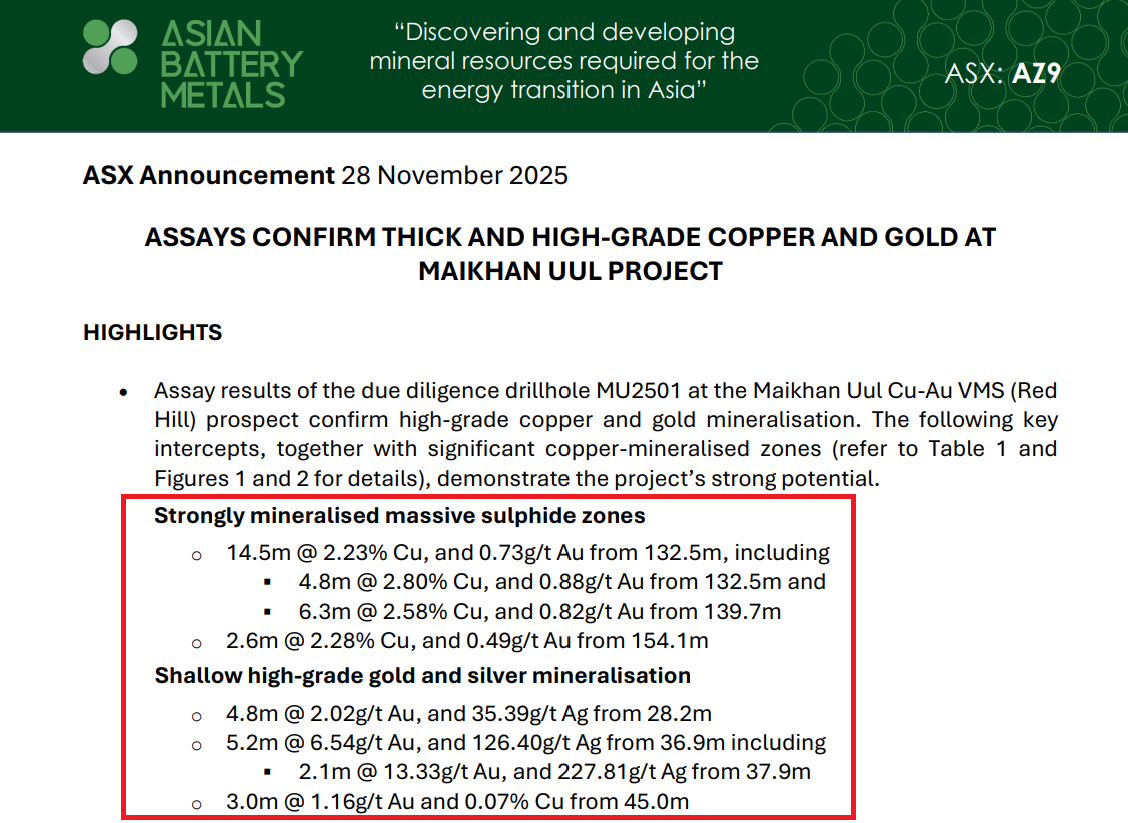

Asian Battery Metals (ASX: AZ9) dropped drilling results on Friday and it’s the clearest look yet at a copper-gold system that’s starting to feel real.

The headline interval at Maikhan Uul in Mongolia was an impressive 14.5 metres at 2.23% copper and 0.73 grams per tonne gold from 132.5 metres, including 4.8 metres at 2.80% copper and 0.88 grams per tonne gold.

Then there’s the shallower zone - 5.2 metres at 6.54 grams per tonne gold and 126.40 grams per tonne silver from 36.9 metres.

For a $17 million company, those widths and grades sit well above where you’d normally expect them. The numbers hint at early scale and decent continuity.

With copper and gold prices continuing to break new ground and silver rising off the back of stronger structural demand, this is when you want to be making these kinds of hits.

From here it’s about the remaining assays, the metallurgical work at Oval, and the final technical review. Once those land, AZ9 will be in a strong position to map out its 2026 drilling program.

These results have shifted sentiment around AZ9, and the setup heading into next year looks a lot stronger for it.

The share price finished flat on Friday, but the first few holes suggest this system has more to give once the rig returns.

FUN’s Rutile Story Meets The Humanoid Thesis

Humanoid robots still feel a bit like sci-fi, but the money piling into them says they’re coming a lot quicker than most people expect.

Tesla might be the loudest voice, but they are just one player in an industrial arms race. We are watching a massive convergence of big tech, auto makers and Chinese groups all driving toward the same goal of mass-produced humanoid labour.

And if even a fraction of the forecasts are right, the world will need a lot more titanium than it currently has.

Which brings us to Fortuna Metals (ASX: FUN).

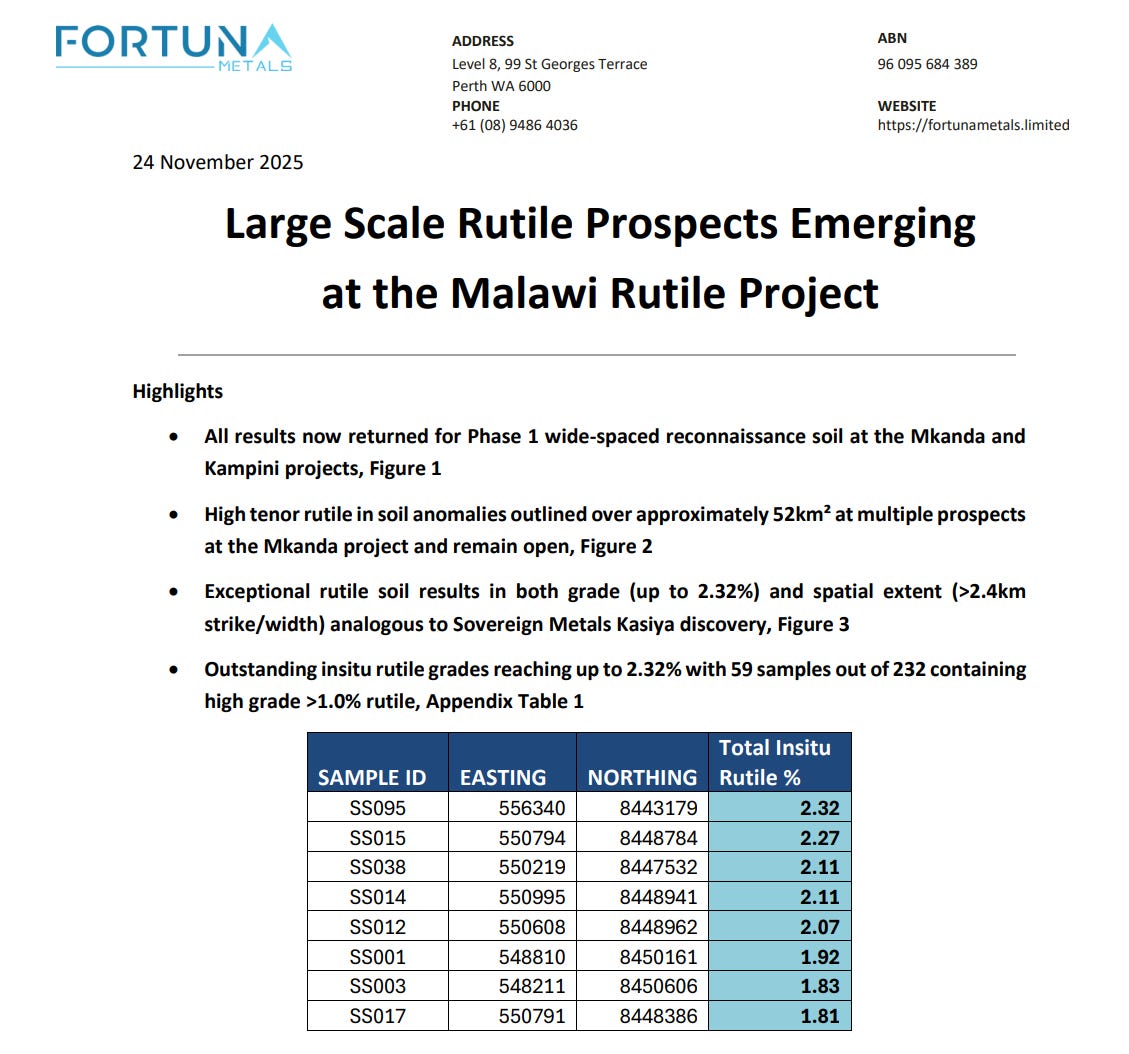

FUN is a rutile explorer that just released results making it one of the most interesting early-stage plays on the ASX. Rutile is the cleanest feedstock for titanium, and FUN’s latest numbers from Malawi suggest they might be sitting on a monster system.

The company confirmed broad, coherent rutile anomalies across roughly 52 square kilometres at Mkanda, with grades reaching as high as 2.32% rutile and 59 samples above 1%.

FUN sits at a $28 million market cap, yet the numbers are starting to compare comfortably with its neighbour to the north, Sovereign Metals, which trades at more than 10 times FUN’s valuation.

Hand-auger drilling is moving quickly too. 309 holes have been completed at Mkanda and another 28 at Kampini.

First assays are expected from mid-December, with the rest flowing through the first quarter of 2026. It sets FUN up for a steady run of news into the new year.

Cast your mind back to four years ago, when Tesla unveiled a dancer in spandex and called it a robot. Now, Tesla is planning production runs in the tens of thousands and already has them working in its factory. China is moving even faster, and analysts are throwing around trillion-dollar market caps for the sector. It all underlines the pace this industry is scaling at.

Whether those forecasts land exactly doesn’t matter much. The direction’s set. More robots means more titanium, and more titanium means more rutile.

FUN heads into the next year with a big footprint, rising grades, incoming assays and a clear thematic behind it.

And betting against Elon has rarely been the winning side.

FMR Clips The Edge, Main Target Still Waiting

FMR Resources (ASX: FMR) is drilling a large copper porphyry target in Chile, and this week’s update moved the story forward without landing the knockout punch (yet).

The rig drilled down to 1,469.1 metres and clipped the outer edges of the system, which means the main MT target is still untouched (that’s the one that matters).

The deeper sections logged biotite and potassic alteration, magnetite haloes and quartz-sulphide veining, which is what you’d expect to see on the margins of a porphyry system as you get closer to the core.

The hole skimmed the margins, but confirmed the broader geological model and now gives the team the context needed to guide the next collars into the heart of the anomaly.

Downhole testing comes next to tighten the model and line up Targets C or D, which sit closest to where the copper is most likely to be.

FMR now heads into the new year with the main target still ahead and the cash to go after it.

BUS Firms Up The NT as High-Grade Gold Drilling Awaits

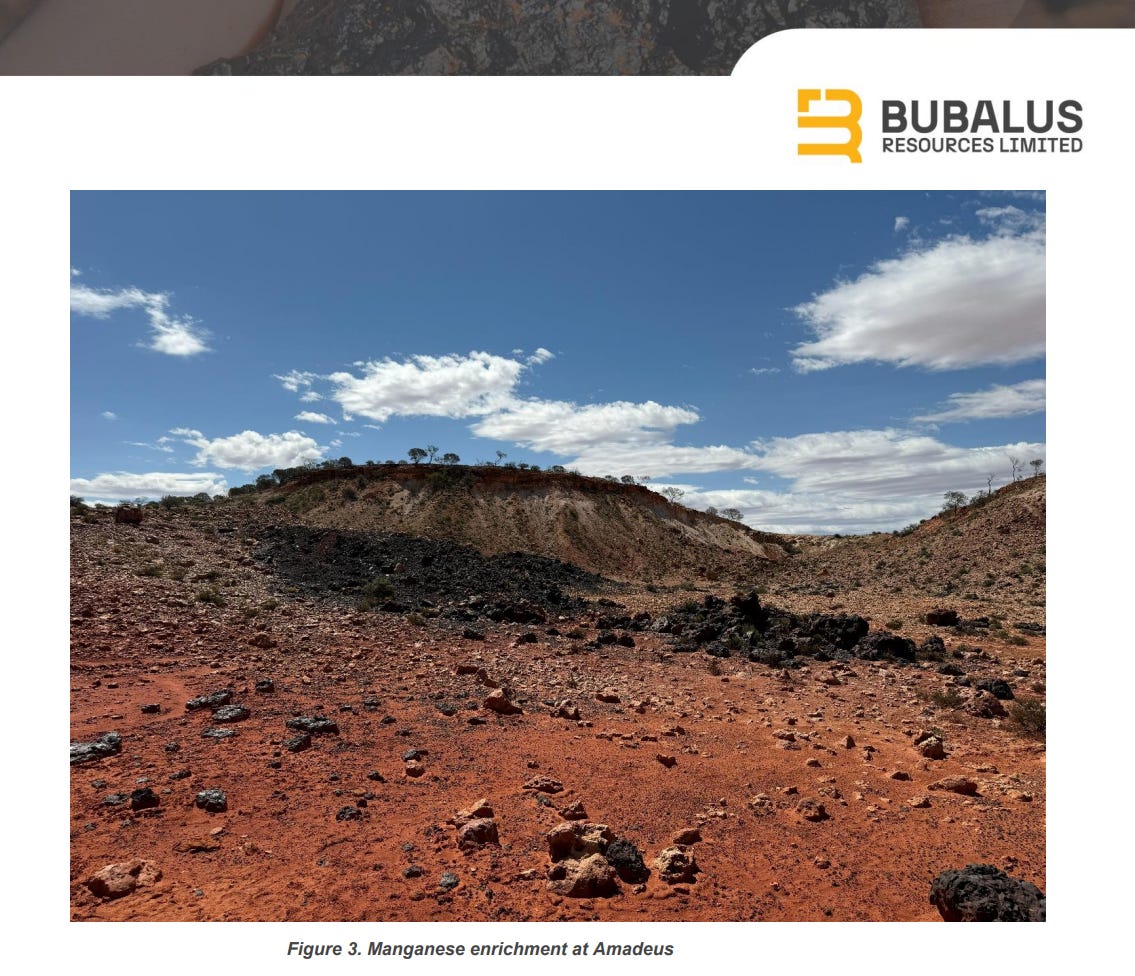

Bubalus Resources (ASX: BUS) turned its attention to the Northern Territory this week, while maiden assays from Crosbie North landed on Friday.

Amadeus and Nolans East in the NT have both been sitting quietly in the portfolio, but they’re carrying more weight than the airtime they’ve had so far.

A review of historical work at Amadeus pulled up some serious numbers from earlier rock chips, which is now feeding into a systematic program to rank the highest priority drill targets.

Nolans East has heritage and environmental approvals locked in with land access the last hurdle. Once that clears, the rig can move in.

On Friday, BUS delivered maiden assays from Crosbie North and confirmed a gold-bearing system, with results up to 1.32 grams per tonne gold. Next steps include drilling targets that were inaccessible in this first pass.

All roads now lead to Avon Plains in Victoria. It’s the historic high-grade gold mine untouched for 120 years and the one target most investors are waiting to see drilled.

The Copper Crunch Keeps Building

The banks, the forecasters and the biggest copper miner on the planet are all saying the same thing now - copper supply is falling short and prices are heading higher.

UBS lifted its copper forecasts again this week, noting that supply disruptions, mine closures and falling inventories should keep the market tight well into 2026. Fresh estimates are now pushing prices higher across every quarter next year.

Cochilco, Chile’s state copper commission and one of the most influential forecasters in the sector, raised its 2025 and 2026 price targets to record levels. It reinforces that the supply side of the market is struggling to keep up.

It’s also becoming apparent in warehouse stocks, treatment charges and the widening deficits forecast for the next two years. The world’s biggest miners are betting on a much stronger copper market through the back half of the decade.

When copper markets tighten like this, genuine discoveries move quickly up the food chain. Juniors with real systems in play tend to get attention fast, because new supply is scarce and the big end of town needs it.

Explorers with active rigs and credible targets walk into a much stronger environment than they did a year ago.

Agnico Circling Northern Star?

Northern Star Resources (ASX: NST) found itself in the takeover conversation again this week after fresh reports linked Agnico Eagle to a potential move.

We heard whispers about this at Diggers and Dealers back in August, but now it’s picking up steam.

Northern Star makes sense as a target once you lay their portfolio out. Hemi (from the De Grey acquisition) brings real scale, Kalgoorlie gives it the backbone, and the work already underway stretches the production life far enough for a global buyer to see a clear runway. Agnico, sitting up near US$87 billion, already knows the Australian scene through Fosterville.

Strong gold markets love a rumour cycle as we know. Whether anything happens is anyone’s guess, but Northern Star is firmly in the conversation now.

The Banks Can’t Agree on Oil

Goldman and the IEA reckon oil demand stays strong. JP Morgan reckons prices could halve.

Their analysts released a note this week arguing that oil supply is set to grow faster than demand, with the US doing most of the heavy lifting outside OPEC. That kind of surplus makes it hard for prices to stay elevated unless OPEC cuts deeper.

It is a big contrast to what we covered two weeks ago, where the IEA flagged long term structural demand and Goldman was saying that producers still look like a good place to be.

When the biggest banks disagree like this, volatility usually follows. So if you’re in oil, it’s time to pick a lane.

BHP Walks Away from Anglo

BHP’s US$49 billion pursuit of Anglo American is dead. The company confirmed this week it’s no longer considering a takeover after discussions didn’t move far enough to justify a fresh proposal.

It was one of the most watched mining deals of the year and would have been the biggest sector transaction in more than a decade.

The timing is important for Anglo shareholders, who are now preparing to vote on the Teck merger. With BHP out of the picture, that deal looks far more likely to clear.

For BHP, it means the company’s focus shifts back to its existing portfolio rather than a transformational acquisition.

Tin Hits Three-Year Highs

Tin pushed to its strongest level in more than three years this week, hitting US$38,760 a tonne after reports of transport issues around the Bisie mine in the DRC. Bisie produces roughly 8% of global supply, so any hiccup there has significant ripple effects.

Tin doesn’t have the same depth of supply as copper, nickel or aluminium, so any disruption tends to move the price quickly.

The tin market is already thin and inventories remain low. Tin also still sits at the centre of the electronics and solder supply chain that most people never think about.

You only need one or two things to go wrong for it to tighten in a way that draws investor interest back into the smaller end of the market.

A rising price, a fragile supply base and real industrial demand tend to bring attention back to early-stage projects faster than people expect.

The Wrap

Tuesday. New pick. Be there.