Weekly Wrap: Copper Hits, Hydrogen Headlines - and our Next Investment is Close

Small-cap momentum builds with exploration wins and hydrogen headlines - but not without legal fireworks. Plus, our next investment is nearly here.

The new financial year brings fresh opportunities - and with it, Equities Club’s first investment of 2025 drops this week.

After months of small caps grinding sideways, this week finally delivered the kind of momentum that reminds you why patience pays off.

Between high-grade copper hits in Mongolia, the biggest natural hydrogen resource declared by any US-based company, and a long-awaited legal win that could finally unlock one of the world's premium lithium assets, investors were treated to an increase in liquidity and several price-sensitive announcements.

Our first investment of 2025 is about to be announced.

AZ9 with more high-grade copper and nickel hits.

Top End Energy with the biggest natural hydrogen resource in the US.

Toyota invested $14.5 million in a natural hydrogen company.

AVZ had a decisive legal win on the Manono project, but the story isn’t over yet.

Our First Investment of 2025 is Coming This Week

It’s been a while since we announced a new investment, and that’s because we haven’t seen anything that stacked up to our criteria:

Multi-bag potential

Low valuation

Commodity trending in the right direction

This week we're announcing a company that ticks all those boxes.

We don't want to give too much away (where's the fun in that?), but if you haven't subscribed already, you might want to. This has serious potential.

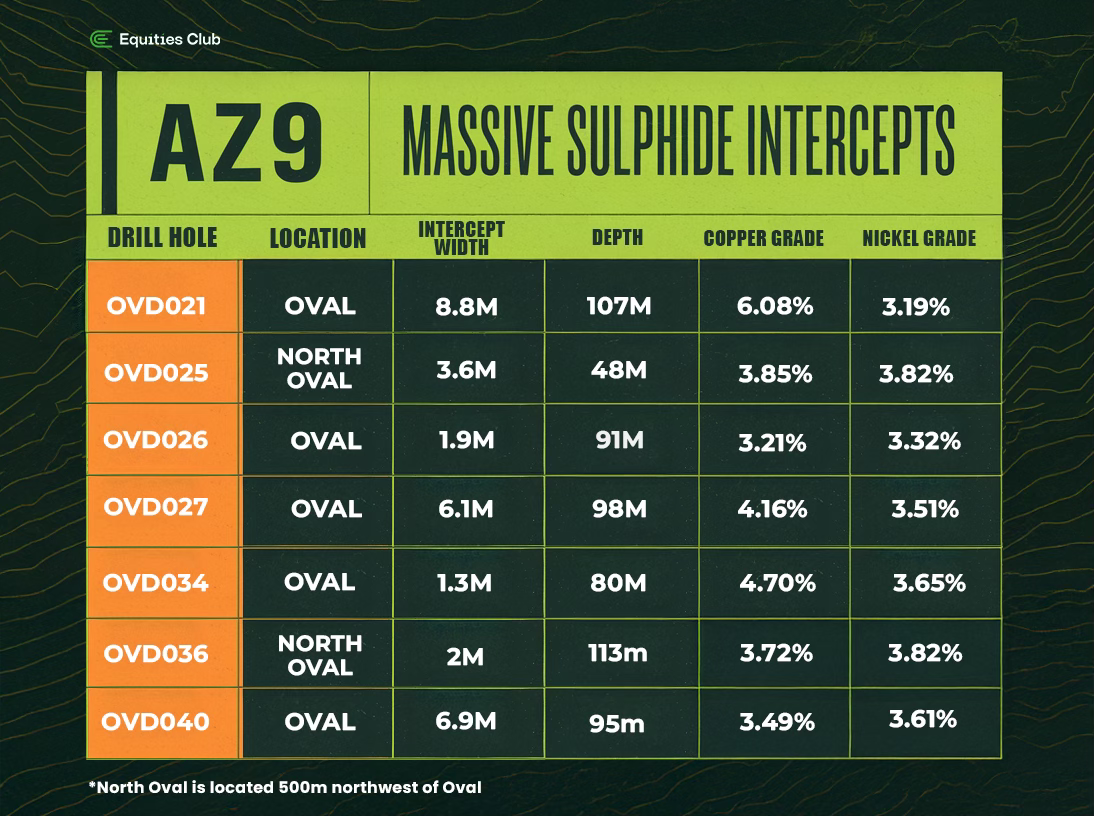

AZ9 Wraps Up Drilling at Oval With More High-Grade Hits

For investors who've stuck with Asian Battery Metals (ASX: AZ9), this week's final set of Phase 3 drilling assays was a welcome sight.

AZ9 confirmed more shallow, high-grade copper-nickel sulphides at its Oval discovery in Mongolia, further strengthening the narrative that Oval could be much larger than initially thought.

The standout intercept: 8.7 metres at 2.44% copper and 1.52% nickel from about 113 metres below surface. Within that zone was a two-metre section of massive sulphide grading 3.72% copper and 3.82% nickel.

With all the lab results now back from Phase 3, AZ9 can step back and look at the bigger picture and plan for an aggressive second half of 2025. Drilling starts again next month, and investors will be watching closely to see if the company can step up to resource definition drilling.

AZ9 is trading at just 2.5c with a market cap around $10 million and over $5 million in the bank. That means AZ9 has enough cash to keep drilling for quite a while without immediate dilution, which is a rare luxury for a junior explorer.

AZ9 has been flying under the radar, but as more investors start looking for copper exposure tied to the energy transition, AZ9 could quickly become harder to ignore. The next few months will be crucial as management works to show just how big Oval might become.

Top End Energy Drops a Mighty Resource

This week, Top End Energy (ASX: TEE) announced a maiden prospective hydrogen resource, clocking the largest natural hydrogen resource ever declared in the US by a listed company.

It came in at 304 billion cubic feet of hydrogen (that's roughly 716,000 tonnes) at its Serpentine project in Kansas, with an upside estimate of 629 BCF.

For a company trading at 4.3c with a $10 million market cap and $4 million in the bank, those are pretty impressive numbers.

With the resource announced we firmly believe the market wants to see a farm-out partner brought in to help de-risk the project. If TEE can land a big name, that $10 million company valuation will quickly be a thing of the past (in our eyes anyway).

TEE isn't wasting time. The farm-out process has begun - that's where they shop the project around to bigger players who might want to partner up and fund the drilling. Updates should flow in the coming months.

Toyota Joins the Natural Hydrogen Race

The importance of TEE’s hydrogen resource was further underlined when Toyota Motor Corporation, along with Mitsubishi Gas Chemical and ENEOS, announced a $14.5 million strategic investment into Gold Hydrogen (ASX: GHY).

Toyota’s move validates the growing interest from big car and industrial players in natural hydrogen’s potential. At a market cap of $81 million, GHY is now firmly on the radar as Australia’s leading natural hydrogen name.

When comparing valuations, TEE is valued at a mere $10 million and looks the best value play in the sector. If TEE can land a strong farm-out deal or major partner, that valuation gap could close pretty quickly.

For small-cap investors looking for early-stage natural hydrogen exposure with large upside potential, TEE is worth watching closely.

AVZ Wins in Court, but it’s not Over yet

After years of frustrating legal battles and suspended trading, AVZ Minerals shareholders received a major boost this week.

For those unfamiliar with the AVZ story, strap in. This is one of the longest-running sagas in ASX history.

AVZ Minerals discovered what turned out to be the world's biggest hard rock lithium deposit in the Democratic Republic of Congo. The Manono project was once valued at billions, with major partners lined up and financing secured. Then everything fell apart.

Permits were withheld, partners disputed ownership, and eventually the DRC awarded the mining licence to a Chinese company - a move AVZ argues was unlawful. Shareholders have been trapped for years, unable to trade their stock.

This week, the International Chamber of Commerce (ICC) tribunal ruled in favour of AVZ’s subsidiary, confirming its legal acquisition of an additional 10% stake in Dathcom Mining SA under the 2020 share purchase agreement.

This brings AVZ’s legal holding in the world-class Manono lithium and tin project to at least 70%.

The tribunal also dismissed all claims from Dathomir Mining Resources, including attempts to nullify the transaction and seek additional compensation.

This decision strongly supports AVZ’s long-standing position and provides a clearer path forward to regain control over its Congolese asset, and potentially do a deal with the likes of the Bill Gates-backed Kobold Metals to exit Manono.

But just as things were looking up, there was another legal curveball. AVZ got hit with a writ from Locke Capital LLC in WA’s Supreme Court, claiming owed fees totalling US$1.2 million. While AVZ said it will defend itself against the new claim, it just goes to show that nothing's ever simple in this long-running saga.

For shareholders, many of whom have been trapped for over three years without any ability to trade on market, this week's arbitration victory is a big step forward. Here's hoping it leads to some kind of resolution for everyone involved.

The Wrap

A new financial year and it feels like the small-cap space is already cooking. This week brought more high-grade hits, large resource estimates and long-awaited courtroom outcomes.

The news flow in the small-cap space is gaining pace after what felt like a very slow start to 2025. We've also been working on our next investment, and we think this one could be pretty special.

Stay tuned.