Weekly Wrap: Copper Tightens, Gold Rebounds, Rare Earths and the Robot Uprising

Gold climbs, copper tightens, TEE taps US advisors, and rare earths get a weird robot twist

One trend is becoming increasingly difficult to ignore: the world’s appetite for copper is growing faster than supply can keep up. This week, copper’s long-term outlook sharpened further as multiple analysts warned of a looming global deficit.

Meanwhile, gold bounced back strongly, buoyed by renewed fiscal jitters and new tariff threats. And in a more speculative corner of the market, rare earths are back in the spotlight thanks to Elon Musk and the future $5 trillion humanoid robot market potential.

Here’s what caught our attention this week:

Global copper demand will outstrip supply significantly.

Gold price rebounds after brief dip, as safe haven buying continues.

Top End Energy appoints US based advisor.

Humanoid robotics means Rare earths are going to be big business

Quick note before we dive in - we're launching our first competition this week. Keep an eye on our social pages to take part.

Copper’s Critical Moment is Here

Copper is fast becoming the world’s most irreplaceable commodity. As the global push for electrification accelerates, demand for copper, used in everything from EVs and solar panels to data centres and power grids, is forecast to more than double.

S&P Global estimates the industry needs to find $2.1 trillion between now and 2050 to keep up with forecast demand. Not to get ahead. Just to keep up.

Three overlapping megatrends are driving that shortfall:

The electrification of transport, housing, and industry.

A chronic underinvestment in new copper mines and exploration.

Declining ore grades at existing major copper operations.

Mercuria (one of the world's largest independent commodity traders) echoed similar concerns during LME Week, stating that copper prices could surge to record highs due to entrenched structural deficits.

The International Energy Agency (IEA) is also waving a red flag, pinpointing copper as a key bottleneck in the energy transition.

Unlike lithium or nickel, copper has no scalable substitutes in high-voltage applications. Put plainly, there is no electrification without copper.

Several credible groups, including BHP, believe we are entering a multi-year period of constrained supply. According to the IEA, if current investment trends continue, the copper market could fall short by up to 6 million tonnes annually by 2035.

That’s unprecedented and for ASX investors, and the implications are significant:

Small-caps exploring for copper are highly leveraged to discovery upside.

Projects with scale, supportive infrastructure, and serious backers could see serious re-rates on drilling success.

Merger and acquisition (M&A) interest is already building, with majors increasingly unable to fill their forward copper books internally.

Timing matters in resources, and copper explorers are well positioned to benefit from this supply crunch.

Gold Back on its Merry Way

After taking a breather last week, gold has swiftly returned to form. Up over 3% this week and the catalyst for it reads like a doomsday prepper's shopping list.

Trump's new tariff threats got the ball rolling, but it's the US debt situation that's really got traders sweating.

CNBC reported gold heading for its best week in over a month, while Kitco analysts reaffirmed that this is the beginning of a new bull cycle.

Some are calling it the perfect storm:

U.S. government debt has crossed $36 trillion, with no resolution in sight.

Treasury yields remain volatile, pushing institutional investors back into gold.

Central bank buying continues at record pace, especially in China and India.

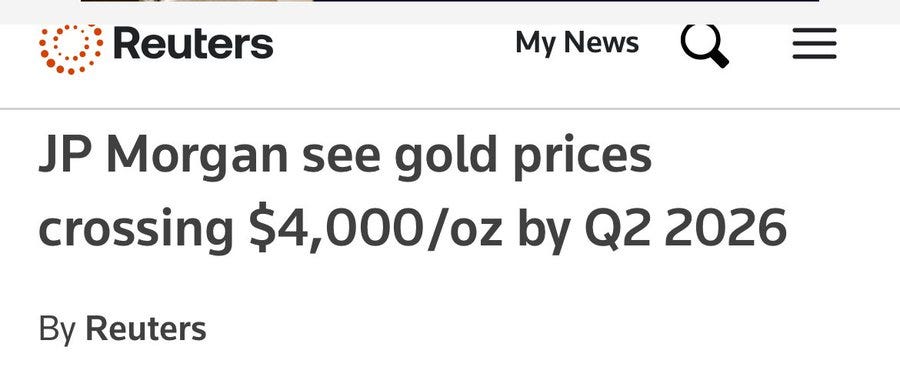

JP Morgan went so far as to forecast a US$4,000 gold price within a year, citing heightened geopolitical risks.

Closer to home, the rebound is a strong signal for ASX-listed gold explorers, many of which have lagged the underlying metal.

With exploration drilling ramping up across the country, the backdrop for junior gold stocks is as supportive as it’s been in years.

Keep an eye on those with:

Clean capital structures with supportive management.

In regions known for gold mineralisation and nearby mines.

Upcoming drill results and existing follow-up targets.

We’ve backed Bubalus Resources (ASX: BUS) and believe the company has all three dot-points mentioned above. Drilling results could be the catalyst for a re-rate of 13c per share gold explorer in a tier-one location. And those results aren’t too far away.

Top End Energy Goes Global

Top End Energy (ASX: TEE) this week announced its strategic push into North America, appointing New York-based Amvest Capital as corporate advisor.

With US roadshows planned and a clear intent to access deep pools of energy-focused capital, TEE is looking to capitalise on the growing international interest in natural hydrogen.

The company’s Serpentine natural hydrogen project in Kansas recently surpassed 30,000 acres, a critical mass milestone in one of the most advanced and proven natural hydrogen exploration hubs globally.

HyTerra (ASX: HYT) added to the Kansas momentum this week, announcing outstanding results of over 96% natural hydrogen and 5% helium from their nearby project.

With TEE and HYT both advancing exploration in a geologically prospective jurisdiction, global investor interest is expected to accelerate.

The Rise of the Robot and Rare Earths

Morgan Stanley dropped a note this week that sounds like science fiction but might actually be worth paying attention to. They're calling humanoid robots a $5 trillion market by 2050.

Once a sci-fi movie talking point, the rise of humanoid robots is here, and global investment bank Morgan Stanley predicts it will potentially be a $5 trillion market by 2050.

As absurd as it may seem, robots that can walk, carry objects, and handle factory tasks are predicted to be working alongside humans within 2-3 years. Long-term they’re predicted to replace manual labour across industries including logistics, healthcare, manufacturing, and defence.

Tesla's already showing off Optimus (see below), and the Chinese are throwing serious money at their own versions.

Here's where it gets interesting for resources investors. Every one of these robots needs a lot of rare earths. Particularly neodymium and dysprosium for the motors, sensors, and all the bits that make them move. One decent-sized humanoid robot probably uses more rare earth magnets than your average EV.

This matters because China controls over 85% of global rare earth processing capacity. The opportunity for investors lies in projects outside Chinese supply chains – something the US, Australian and European governments are actively supporting.

Lynas Rare Earths (ASX: LYC) is the only significant producer of separated rare earths outside China. This month, LYC started first production of dysprosium oxide from its Malaysian facility, a milestone years in the making.

The robot angle might be a decade away from really mattering at scale, but the strategic value of non-Chinese rare earth supply is here today. For investors with a long horizon, junior explorers with exposure to rare earth assets could be sitting on future strategic assets.

Just don't bet the farm on robot butlers quite yet.

The Wrap

Three themes this week, all worth watching. Copper could be heading for a serious supply crunch – the kind that makes fortunes for those positioned early. Gold's back doing what it does best when fiscal policy goes sideways. And rare earths might get interesting again thanks to our future robot overlords.

ASX investors looking to outperform should watch the juniors drilling into these trends. Sometimes the best opportunities come when everyone else is looking the other way.

Until next week.