Weekly Wrap: Critical Mass Achieved, Gold's Breather and Rio's Lithium Vision

Institutional moves in lithium, gold, and hydrogen point to a longer-term re-rating as smart capital positions ahead of the next cycle

Global markets and sentiment have swung like a pendulum between risk-on enthusiasm and nail-biting caution this week, but the much talked about US-China trade deal gave equities a welcome shot in the arm.

It seems nothing settles an economic dust-up between superpowers quite like slashing triple-digit tariffs.

But outside Trum and Xi calling barleese for a few months, here’s what caught our attention:

Top End Energy crossed the 30,000-acre mark at its natural hydrogen project.

Gold records its first bad week for a while, but UBS and JP Morgan (and us) remain bullish.

Rio Tinto confirms lithium commitment with South American intentions.

Top End Energy Expands its Patch in Kansas

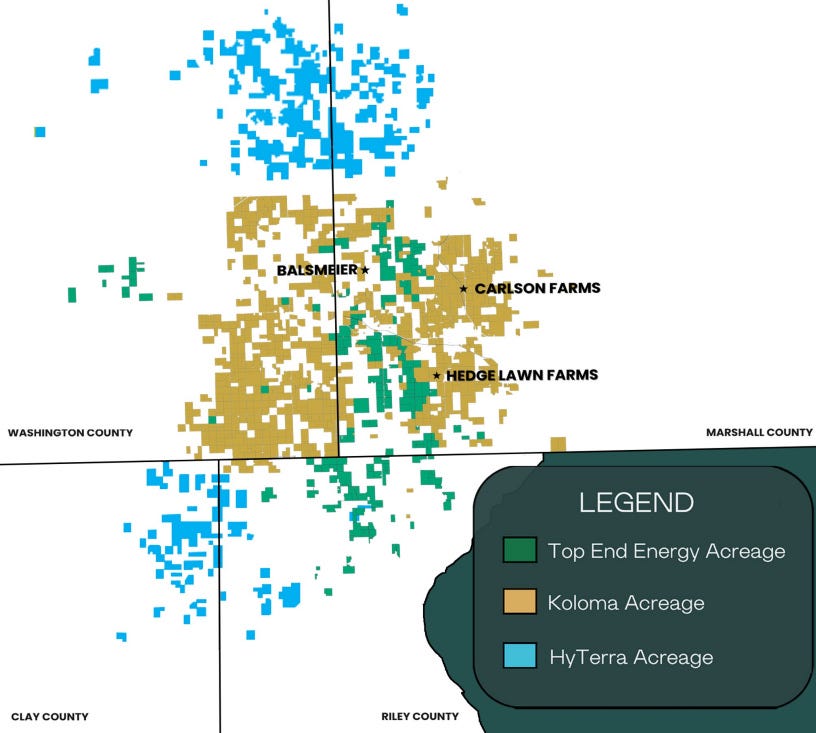

Top End Energy (ASX: TEE) has crossed the 30,000-acre mark at its Serpentine natural hydrogen project in Kansas, meaning critical mass has been achieved.

This milestone gives TEE one of the most tightly clustered positions in a proven hydrogen fairway.

Not just any fairway, mind you, but one where neighbouring HyTerra (ASX: HYT) just hit a jaw-dropping 96% hydrogen concentration in their Sue Duroche 3 well.

The landholdings are now large enough to support a multiple well drill campaign, putting the company in a strong position to attract future partners. With Fortescue backing HyTerra and the likes of Gates and Bezos hovering nearby through Koloma, TEE's in rather illustrious company.

In practical terms, the announcement marks a shift in strategy: from land acquisition to operational planning.

Here’s our chat with CEO Luke Velterop on the announcement:

Key points:

Strategic landholding in the Kansas hydrogen corridor now exceeds 30,000 acres.

Transitioning from the leasing phase to drill planning and subsurface mapping.

Surrounded by billion-dollar players in a proven hydrogen region.

Valued at just $18 million market cap, trading at a steep discount to peers.

For all the talk of hydrogen's potential, it's rare to find a junior ASX outfit rubbing shoulders with billionaires in the area that could host America's hydrogen motherlode. Looking forward to the rest of the year unfolding here.

Gold Takes a Breather After Record Run

Gold copped a hiding this week, booking its largest five-day decline in six months. The precious metal took a back seat as investors rotated into risk-on positions following signs of easing trade tensions between the US and China.

Spot gold settled around US$3,200 per ounce, down nearly 3% from its recent highs. It’s far from a crash, especially considering the record-breaking tear it’s been on, and looks more like the market catching its breath.

The long-term story remains intact despite this wobble. Both UBS and JP Morgan continue to forecast substantial upside, with UBS recently reaffirming a target of US$3,600/oz by mid-2026.

UBS points to a trifecta of drivers supporting gold's continued rise:

Central bank buying (especially from China).

Rate cut expectations and weakening real yields.

Ongoing geopolitical risk and currency devaluation.

JP Morgan's analysis runs along similar lines, noting that gold typically shines brightest in late-cycle economic environments where uncertainty remains high. The investment bank expects gold to gradually rise as liquidity returns to markets.

So while short-term price action has cooled, the outlook remains positive.

Rio Tinto Signals Lithium Conviction

It’s been a bearish couple of years for lithium with prices crashing from euphoric highs and investor sentiment following suit.

Rio Tinto is taking the long-term view with its lithium strategy, which is anchored by its Rincon project in Argentina and bolstered by the acquisition of Arcadium Lithium.

The mining giant has quietly positioned itself as one of the largest lithium holders globally.

This week, Rio laid out its latest vision for lithium supply, and to nobody's surprise, they're bullish.

CEO Jakob Stausholm reiterated Rio’s belief that lithium demand will remain strong, driven by structural decarbonisation and electrification trends.

Speaking at a conference in the USA, Stausholm emphasised the importance of geographical diversification and noted that South America’s Lithium Triangle would play a pivotal role in Rio Tinto’s electrification efforts.

No sense putting all your lithium eggs in one continental basket, as they say.

Last month's rumoured interest in AVZ's Manono project in the DRC further signalled Rio's appetite for tier-1 resources rather than short-term market plays.

While other mining majors remain on the sidelines nursing their wounds, Rio is methodically accumulating assets near cycle lows. It's a classic contrarian approach that suggests considerable confidence in long-term pricing and demand.

It’s a positive indicator for those still holding battered lithium stocks in their portfolios.

A Quick Word on the 90-day Tariff Pause

It’s been covered ad nauseam this week, and the headlines about Trump and Xi slashing massive tariffs make for good reading, but this 90-day truce is possibly just the opening round of a much longer bout.

While many see China winning this round by getting tariff relief, Washington's objectives go far beyond tariffs, pursuing a strategic reset of trade dynamics that's been brewing across multiple administrations.

Trump's just cranked the volume to eleven. And it’s worth keeping an eye on as it may directly impact which critical mineral projects become strategically valuable in coming years.

The US is trying to disentangle critical supply chains from Chinese control while blocking Beijing's access to advanced technologies, and hoping China weans itself off export addiction while cranking up domestic consumption.

It's being backed up by the UK who's agreed to play ball by phasing out Chinese components from key supply chains.

China, not without its own leverage, is busy fortifying relationships with other trading partners and warning them against making US-friendly deals that hurt Chinese interests.

The last US-China deal took 18 months to hammer out. This current 90-day window might just be the opening act of what could become a prolonged economic drama with commodity markets playing a starring role.

Companies with exposure to critical minerals outside China's orbit should find themselves increasingly valuable as Western nations rebuild supply chains with friendly partners.

The Final Word

Markets remain jittery as May draws to a close, but underneath the cautious sentiment sits some positive news for resource investors.

The outlook for gold, natural hydrogen, lithium and even copper all remains positive.

This week's headlines might not have knocked your socks off, but sometimes the best opportunities arrive with a whisper rather than a shout.

Until next week.