Weekly Wrap: Drills, Deals and Government Dollars

Capital floods back to mining as copper soars, governments wake up, and small caps ride the momentum. Plus, who's winning our stock tipping comp?

The mining sector's on a roll as capital flows back into commodities. Investor appetite for raisings has lifted, and small caps are catching the wave.

This week we released our take on the Fraser Institute’s top mining locations. Fortuna Metals stayed front of mind with exploration about to begin. Copper is breaking out, super cycle chatter is back on the table, and governments are finally throwing weight behind critical minerals.

Here’s what stood out over the week:

Fortuna Metals exploration kicking off imminently

The world's best mining location revealed

Have commodities entered a new super cycle?

Copper hits a 15-month high on US rate cut optimism

Data centres are the new driver for future copper demand

US drops $5 billion into critical minerals

Qatar's sovereign wealth fund buys into a major miner

Zijin Gold lines up a record IPO

Australia tightens 2035 emissions targets, reshaping mining strategies

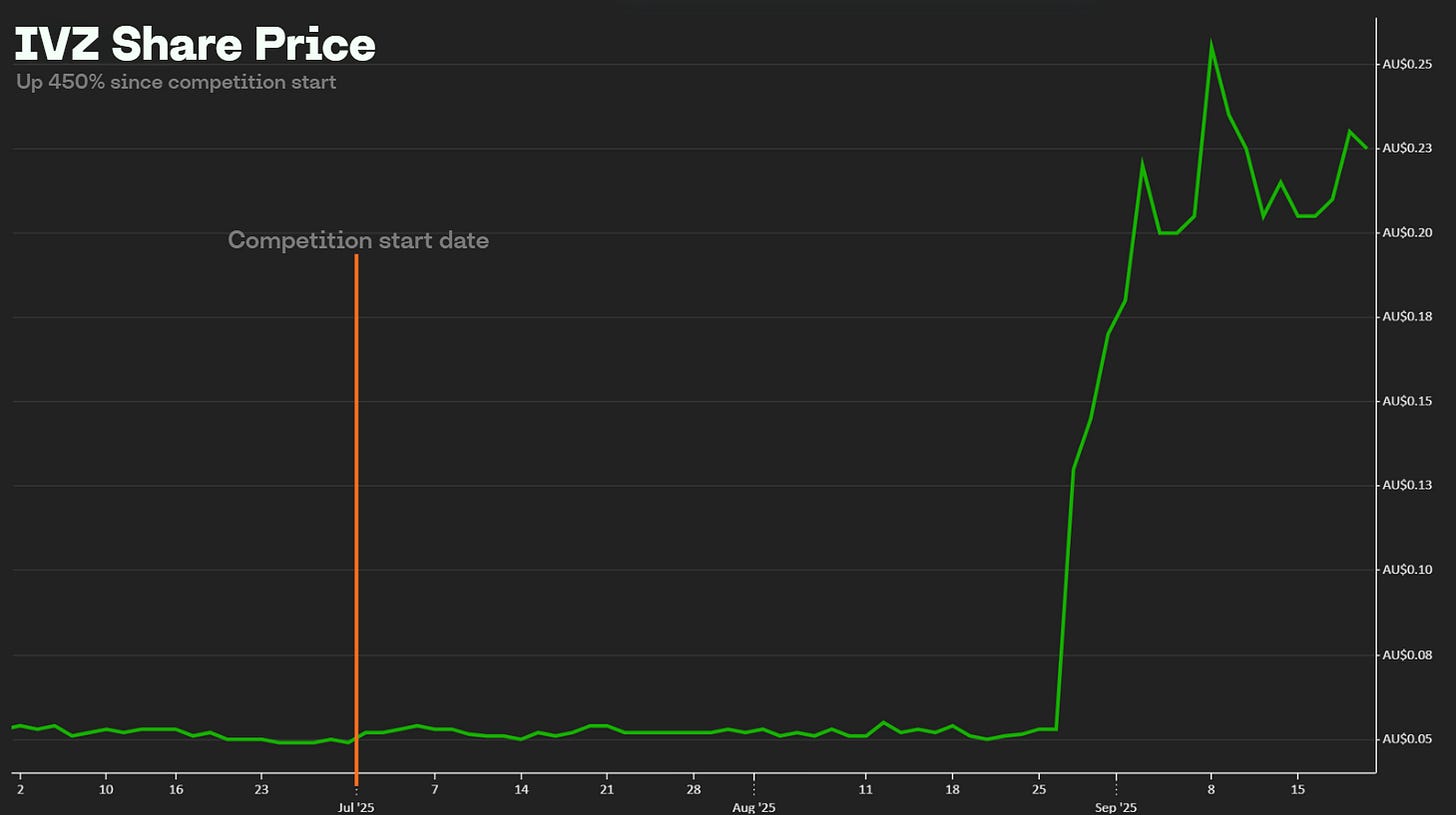

Someone Just Hit 450% up in Our Stock Competition

Earlier this year we ran a simple comp: pick one ASX stock, let it ride from 1 July to 1 December, and the best return takes home $2,500 cash.

Entry was free, winner takes all.

We’re now just past the halfway mark, and Rob H is in front as the only one who picked Invictus Energy (ASX: IVZ), which has surged 450% since the comp began.

Only small caps can throw up those sorts of moves when the right deal or drill result lands. So, Rob, sit tight and let's hope IVZ stays strong for you.

If it does, $2,500 will be coming your way as an early Christmas present.

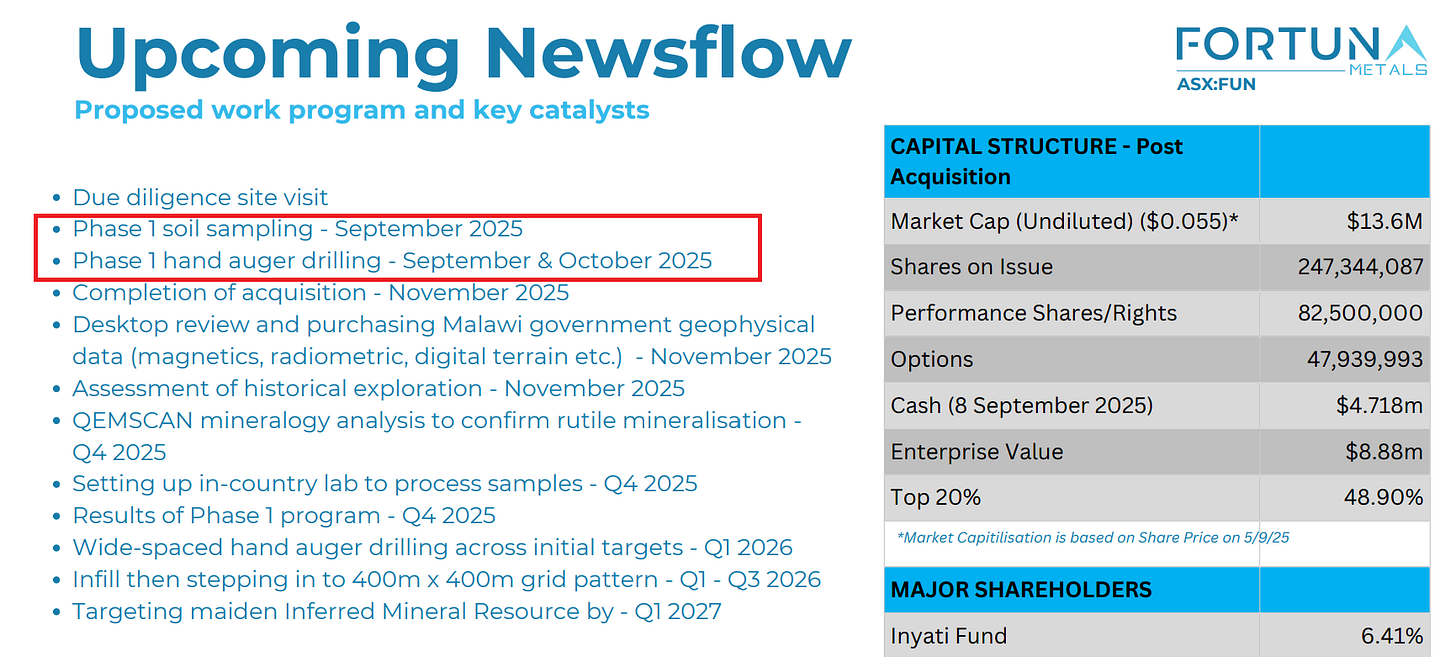

Fortuna Drilling Countdown: Start in Sight

Last week we added Fortuna Metals (ASX: FUN) to the portfolio as our second pick of 2025. It’s already up 57% since we first mentioned it.

The Equities Club portfolio is built carefully, with only a handful of names we think can deliver outsized returns. We take our time and we’re picky about what goes we back. FUN is now one of them.

FUN sits along strike from Sovereign Metals (ASX: SVM), which holds the world’s largest rutile and the second-largest graphite deposit. SVM is valued at about $560M. FUN, by contrast, is just $21M, yet looks to share the continuation of the geology from SVM.

The company flagged in a presentation last week that sampling and drilling would kick off in September, so an update must be around the corner.

If FUN can prove up similar geology to SVM at scale, the valuation gap will close fast. FUN has the potential to re-rate to multiples of its current valuation if exploration is successful.

Fraser Institute Drops Bombshell Mining Rankings

We put out a deep dive this week on the Fraser Institute survey, ranking the world's best location to mine. It’s always a contentious list.

It even caught the eye of legendary natural resource investor Rick Rule, who shared it on X, and the response told us the results ruffled a few feathers

Some familiar names slipped down the order, and a new number one emerged that few would have tipped.

For small caps, operating in these "tier-one" addresses can make or break a capital raising. The difference between an oversubscribed round and struggling to attract any investment can often come down to address.

Our article also covered seven ASX names already operating in these regions that have big potential. As we said in the article, geology matters, but location often tips the scales.

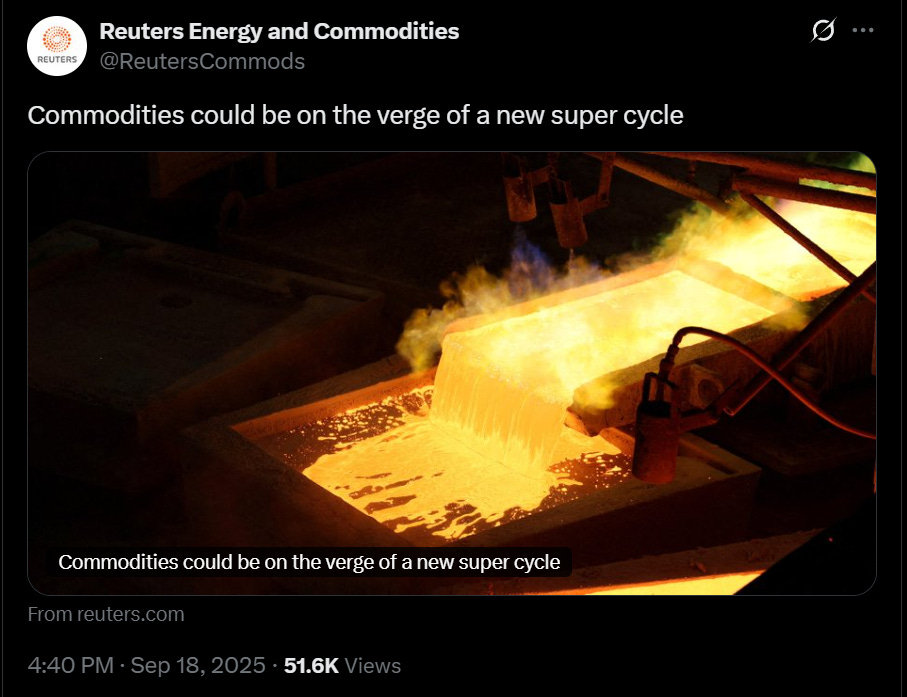

Super Cycle Chatter Builds

The talk of a super cycle in commodities has begun.

After a decade of under-investment in key commodities like copper and rare earths, supply chains look tight, while demand from decarbonisation and AI-driven electrification keeps climbing.

Analysts are pointing to copper and rare earths as the main drivers of this cycle, but we think oil and gas may also benefit from ongoing geopolitical disruptions.

For those newer to the term, a super cycle is a long structural uptrend in prices, usually sparked by big global shifts that squeeze supply.

The driver this time is the electrification in the west, re-industrialisation in the US, and continued demand growth in Asia.

For small-caps, the reward is the leverage to price movements if discoveries are made. We are seeing that any hint of a discovery is being rewarded handsomely in this market, and we expect that to continue through 2025.

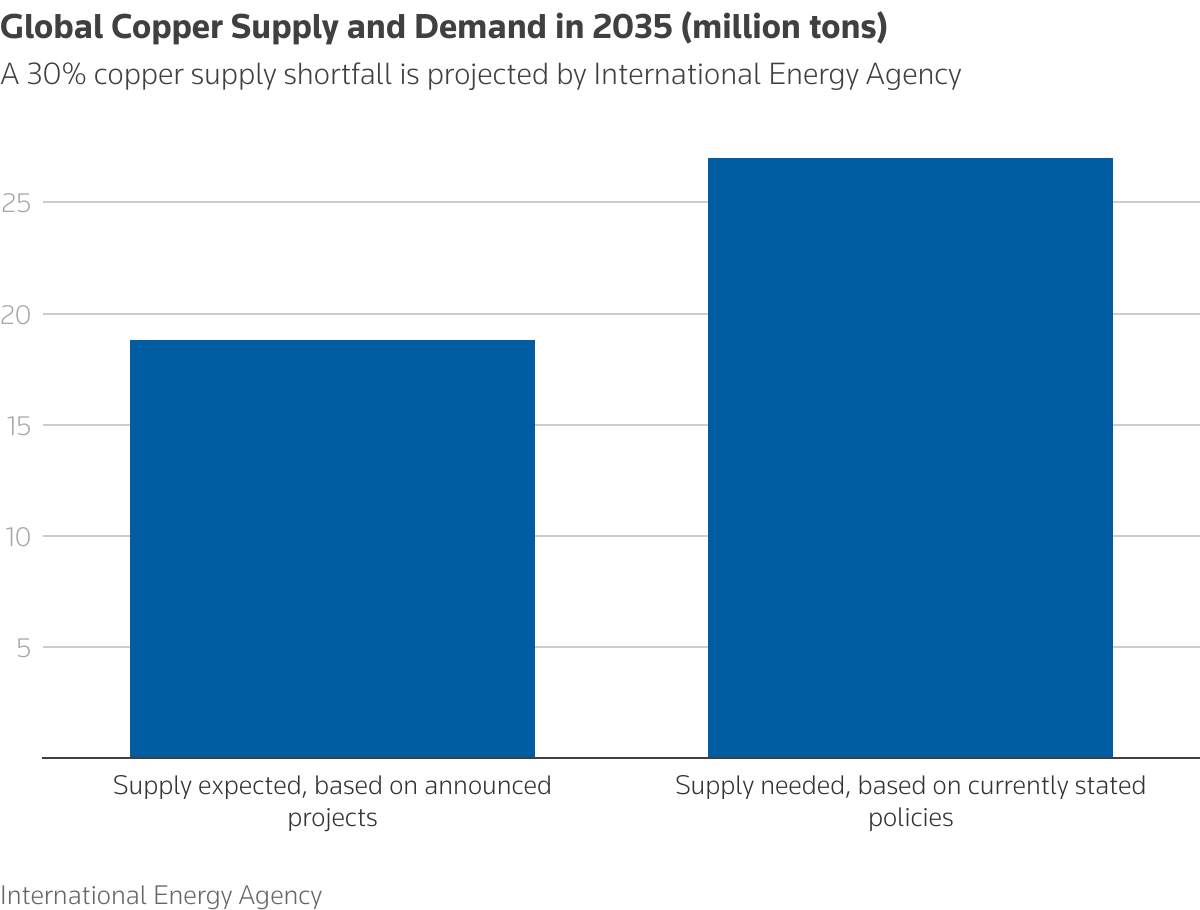

Copper Hits 15-Month High on Fed Bets

Copper rallied to a 15-month high this week after the US Fed flagged its first rate cut of the cycle.

A softer US dollar and cheaper capital are good news for industrial metals, with copper particularly sensitive to global growth expectations. Copper futures surged as traders bet that demand from construction, EVs, and electrification will outstrip constrained supply.

Supply disruptions also keep hitting Peru and Panama, while inventories sit at historically low levels. The simple equation is that disruptions + low stockpiles = higher prices.

For ASX juniors the repricing is meaningful, as higher copper prices make capital raising easier and improve sentiment toward early-stage explorers.

We've backed Asian Battery Metals (ASX: AZ9) and FMR Resources (ASX: FMR) as two of our copper bets, with both drilling copper targets shortly.

AI's Massive Copper Appetite

One of the biggest new sources of copper demand is coming from AI and hyperscale data centres.

Hyperscale data centres are massive facilities that power cloud services, AI workloads, and tech giants like Amazon, Microsoft, Google, and Meta. They need enormous amounts of copper for power cabling, cooling systems, and grid connections.

Each facility can chew through up to 30,000 tonnes of copper over its lifetime. With AI adoption going through the roof, this creates another major source of demand on top of EVs and renewable energy.

Traditionally, copper demand has been linked to construction and industrial activity, but the digital economy is now a serious consumer.

With the lack of large copper discoveries over the past decade, any major discovery is likely to be valued sky-high in such a tight supply market.

US Drops $5 Billion into Critical Minerals

A US$5 billion initiative to secure critical mineral supply was announced by the US government this week. It’s a fund aimed directly at reducing reliance on China and strengthening domestic processing (two Trump’s favourite things).

The fund will back projects aligned with strategic metals, including copper, nickel, lithium, and rare earths.

The fund isn't only for US domestic projects either - it's designed to secure supply chains for America and its allies, with us loyal Aussies explicitly listed as a preferred partner.

This is big news for small-cap ASX explorers as they can potentially access funding through joint ventures or supply agreements, particularly if their projects align with US defence and clean energy priorities. God bless America.

Qatar Writes $500M Copper Cheque

Nothing says "we want copper exposure" quite like writing a half-billion-dollar cheque, with the Qatar Investment Authority taking a $500 million stake in Ivanhoe Mines.

QIA manages Qatar's surplus revenue from oil and gas, estimate at over US$500 billion. The fund was set up in 2005 to diversify away from just pumping hydrocarbons, and this Ivanhoe investment (led by mining legend Robert Friedland) shows they're serious about it.

It's part of a broader trend of Middle Eastern funds hedging their oil dependency by backing other commodities.

The key takeaway for investors is that not only are the US and China wanting to fund critical minerals projects, but now strategic capital is flowing into the sector at scale from the Middle East.

Small-caps with credible projects are increasingly becoming acquisition targets, or at minimum finding it much easier to raise capital when sovereign wealth funds join the party.

Zijin Lines up Record Gold IPO

Speaking of China, Zijin Mining announced this week that Zijin Gold is seeking to raise US$3.2 billion in what would be the world's largest IPO since May.

The funds are earmarked for new projects and expansion, particularly in gold and copper. Zijin has been busy this year snapping up gold assets across Mongolia, Kazakhstan and Ghana.

The multi-billion IPO shows there's serious investor appetite in China for resource stocks (particularly gold and copper), even while broader equity markets stay choppy. It shows that when the commodity story is right, capital is still there for big raisings.

For ASX juniors, it's a reminder that timing and commodity focus matter. If copper and gold can attract billions at the big end of town, that appetite should filter down to smaller players with the right assets.

Canberra Revises 2035 Emissions Bar

The Albanese government announced a new 2035 emissions target this week, aiming for a 62-70% reduction from 2005 levels.

For miners, that means significant investment in electrified fleets, renewable power, and abatement technology.

The timing is interesting though - BHP just dumped its solar and battery projects last week, the very sort of tech aimed at cutting emissions.

Small-cap explorers will follow the majors' lead, but only if the numbers stack up. Adding another layer of compliance costs when you're relying on capital markets to survive seems like a stretch.

The government needs to recognise that asking cash-strapped explorers to fund decarbonisation might be putting the cart before the horse.

Exploration Ramps, Capital Flows Back

It's busy out there in commodity markets. Exploration starting up, copper surging, capital flowing back into the sector, governments finally waking up to the need for commodities, and an Australian government still focused on emission targets.

The small-cap space is hot at the moment, exploration is being rewarded and those who go after it stand to benefit the most. The time to back well-run companies with strong balance sheets is now; a discovery of any sort can change the fortunes of your portfolio.

With exploration programs kicking off for three or four of our portfolio stocks in BUS, AZ9, FMR and FUN in the coming weeks, we hope a little luck falls our way. We'll report back on any developments worth noting.

Until next week.