Weekly Wrap: Drills Loading, Money Moving, Commodities Stirring

Markets woke up this week. Copper targets tightened, lithium rallied off supply cuts, and someone with deep pockets may have started leaning into Victorian gold

Markets found their footing this week. The ASX 200 rose 1% and small caps picked up some of that energy with volume up and volatility creeping back in.

One of our copper plays has the stars lining up for a serious Q4 drill campaign, AZ9 went shopping in Mongolia, and a Victorian gold name suddenly caught attention. Lithium showed signs of life, and rare earths kept rolling through the headlines, with Australia doubling down on its own supply chain.

Here’s what stood out:

FMR’s Chilean copper target is now fully primed for drilling.

AZ9 expanded its Mongolian footprint with a copper-gold acquisition.

China’s closure of a lithium mine boosts Aussie names.

Big Friday buying on BUS pointing to rising interest in Victorian gold.

Rare earths in the spotlight in China–Australia tug-of-war.

FMR Zeroes in on Chile Copper ‘Heart’

It's rare to see everything align as cleanly as it has for FMR Resources (ASX: FMR) this week.

FMR is a junior copper explorer with ground in Chile's copper belt. This week, fresh survey results lit up an unmissable target at their Southern Porphyry project.

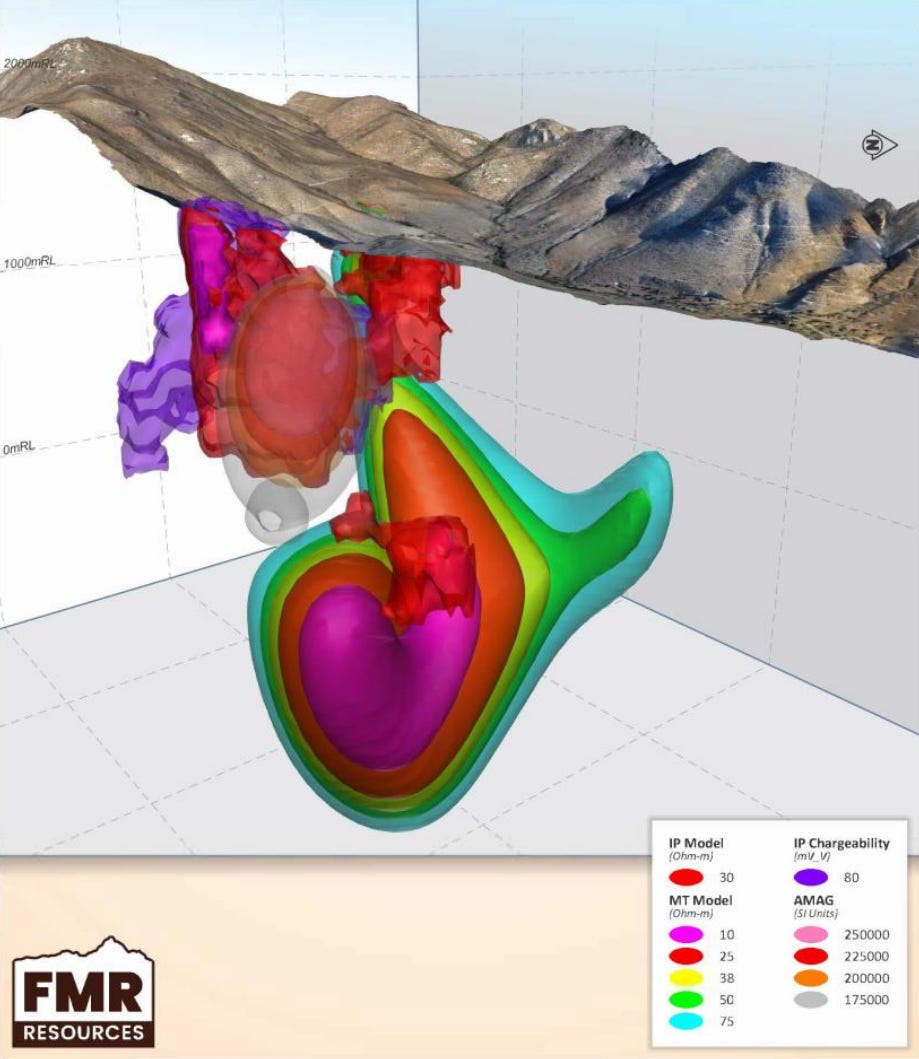

The big, coherent copper blob - or "the heart" as some have been calling it - marks the bullseye for FMR as they close in on Q4 drilling.

Recent surveys have revealed strong underground signals that all point to a large copper porphyry system, a type of deep deposit where copper spreads through the rock and can form big mines.

Different survey techniques - magnetic, chargeability and resistivity - are all circling the same zone. Surface mapping shows the rock changes you’d expect from hot fluids moving through, and old drill holes already pulled copper above the target.

Managing director Oliver Kiddie called the target “compelling”. Hard to argue. Contractors are being lined up, and drilling is set to kick off in early Q4.

At 40c and a $15M market cap, FMR is getting very close to testing what looks like a textbook porphyry system. Even a single decent intercept could shift sentiment quickly.

AZ9 Grabs More Ground in Mongolia

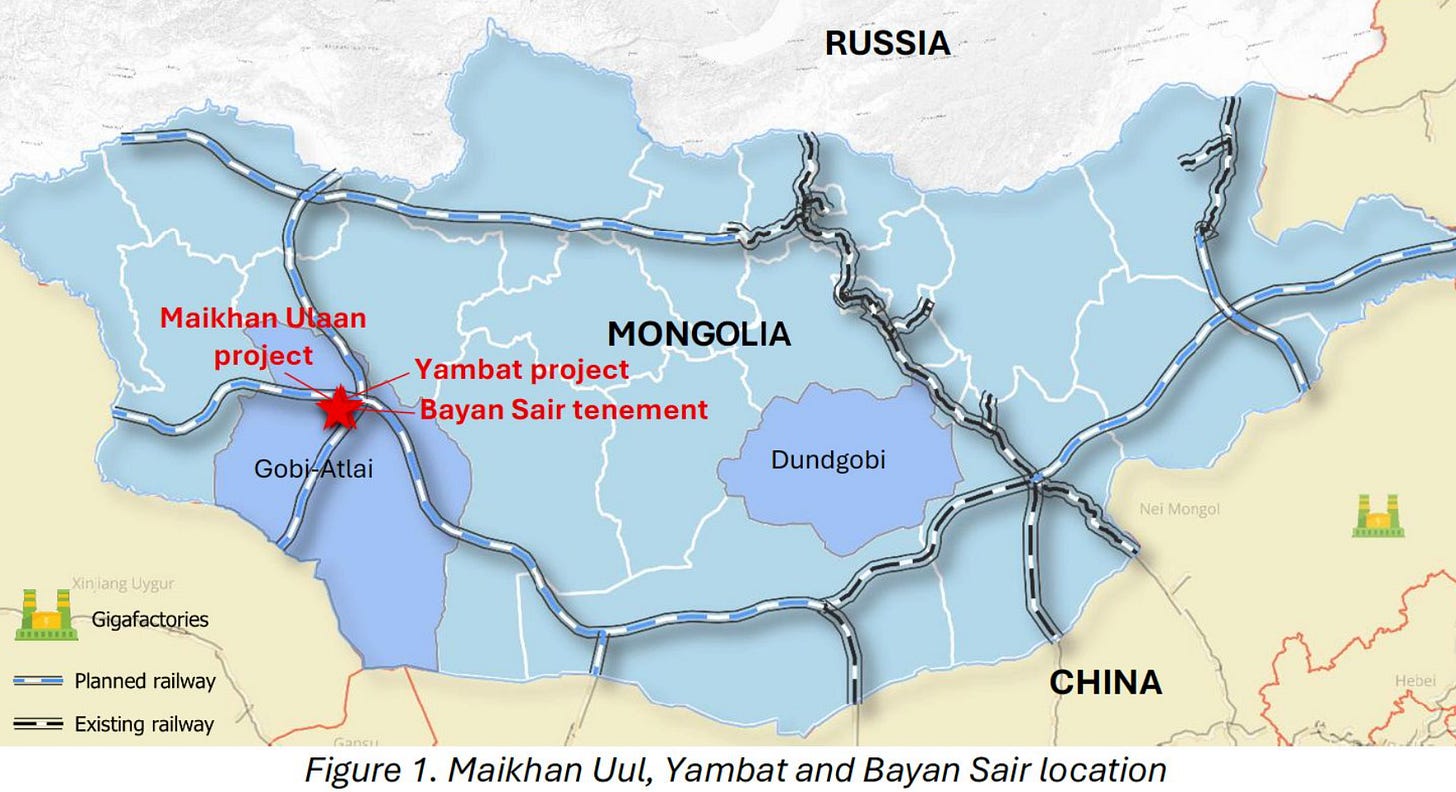

Asian Battery Metals (ASX: AZ9) added more ground around its Oval discovery in Mongolia, acquiring two new blocks this week.

The first is Maikhan Uul – a copper-gold project only 8km from AZ9’s main Oval discovery. It has a mining licence locked in until 2045 and an old (non-JORC) resource estimate of 5 million tonnes at 0.58% copper and 0.16g/t gold.

Non-JORC means it doesn’t yet meet Australia’s strict reporting standards, but the numbers still give a sense of scale.

Past drilling returned shallow copper-gold from a VMS system, the kind that often carries both metals, and AZ9 plans to get rigs and fresh surveys onto it this year.

The second addition is a 3,327-hectare exploration licence just south of Yambat.

Early magnetic surveys (which pick up differences in the rocks below) suggest it could be part of the same system that hosts AZ9’s existing Oval and MS1 targets. More detailed surveys are planned, and it’s a savvy pick-up.

Neither deal needs shareholder approval. For a $16M company with $4M cash, picking up ground this close to Oval is a sharp move - land that could prove valuable if the system keeps growing.

Lithium Jolts as China Shuts Mine

China’s closure of a lepidolite mine this week jolted the lithium market, sending Australian lithium stocks sharply higher on Monday.

CATL’s decision to suspend operations has cut supply, at least temporarily, into a market already swamped with product.

For Australian producers, who’ve been struggling under the weight of low prices and high costs, it was a much-needed breather.

The news lit a fire under names like Pilbara Minerals, Core Lithium and Patriot Battery Metals, with shares jumping several per cent. It showed there’s still life in the sector when the supply picture shifts.

But the longer-term implication may be even more important: China’s dominance is not just a demand-side story. It’s a supply-side wildcard, and that volatility could give Aussie producers an edge as buyers look for steadier, more transparent sources.

A reminder that even in a weak pricing environment, catalysts can still move the dial.

Big Bubalus Buying – Smart Money Sniffing Around?

No news this week from Bubalus Resources (ASX: BUS), but Friday’s trading turned heads.

The stock posted its biggest ever volume day without a fresh announcement, and that’s hard to ignore. It suggests the market may finally be waking up to what’s coming.

BUS is due to drill a Fosterville-style target in Victoria, followed by drilling a historic high-grade gold mine to finish 2025.

There’s also the Falcon Metals angle. Falcon raised $20 million this week to fund its Victorian drilling, showing there’s serious money chasing gold upside in the region.

Falcon has already had drilling success and now trades on a $142M valuation. BUS, by comparison, sits at a $6M market cap with $3.5M cash.

If smart money is rotating out of stocks that have already run, this could be the kind of early positioning we’ve seen before in stories that later caught fire. When volume jumps and there’s no news, someone’s buying for a reason.

Rare Earths Strategic Race Continues

China still controls more than 80% of global rare earth processing, and that grip remains the biggest hurdle for the West’s energy and defence ambitions.

Australia now looks like it’s trying to carve out its own supply chain. More government funding, new trade partnerships and fresh project support are all being thrown at the sector to help establish local production of rare earths.

The challenge is cost. Australia knows it can't beat China on price - that's not the point. Producing rare earths in Australia is far pricier than in places like Africa, so it’s about building a stable, local supply chain for when things get messy geopolitically.

With projects like Iluka's refinery and Lynas expanding in Kalgoorlie, there's momentum building. But propping up an entire industry against cheaper competition takes serious, sustained funding.

The question is whether the political will lasts long enough to make it stick.

This Week’s Thread

The drills are coming. That's the thread running through everything this week - from Chile's copper heartland to Victoria's goldfields, the smart money knows what's next.

FMR has a porphyry target with every dataset pointing the same way. AZ9 is quietly stitching together a district in Mongolia. And someone/s with deep pockets is loading up on BUS before the market catches on.

We’re heading into a part of the year where interest starts to return, and for investors looking to get set early, now’s the time to do the work.

This is how fortunes get made in small caps. Not when the headlines hit, but in the quiet weeks when the setup's only obvious to anyone actually paying attention.

The window's open. It may not stay that way forever.