Weekly Wrap: Fortuna Flies, BUS Drills, Gold Roars

Our new portfolio addition soars, Tribeca backs FMR, BUS readies the rig, gold and silver break records, copper giants merge, and BHP faces its David

Our second portfolio addition of the year moved fast this week.

Fortuna Metals (ASX: FUN) rocketed 128% intraday on Thursday before settling up 43% on $1.6 million in volume. The response suggests investors get the story immediately - a $16 million junior sitting on identical geology to a Rio Tinto-backed giant worth 27 times more.

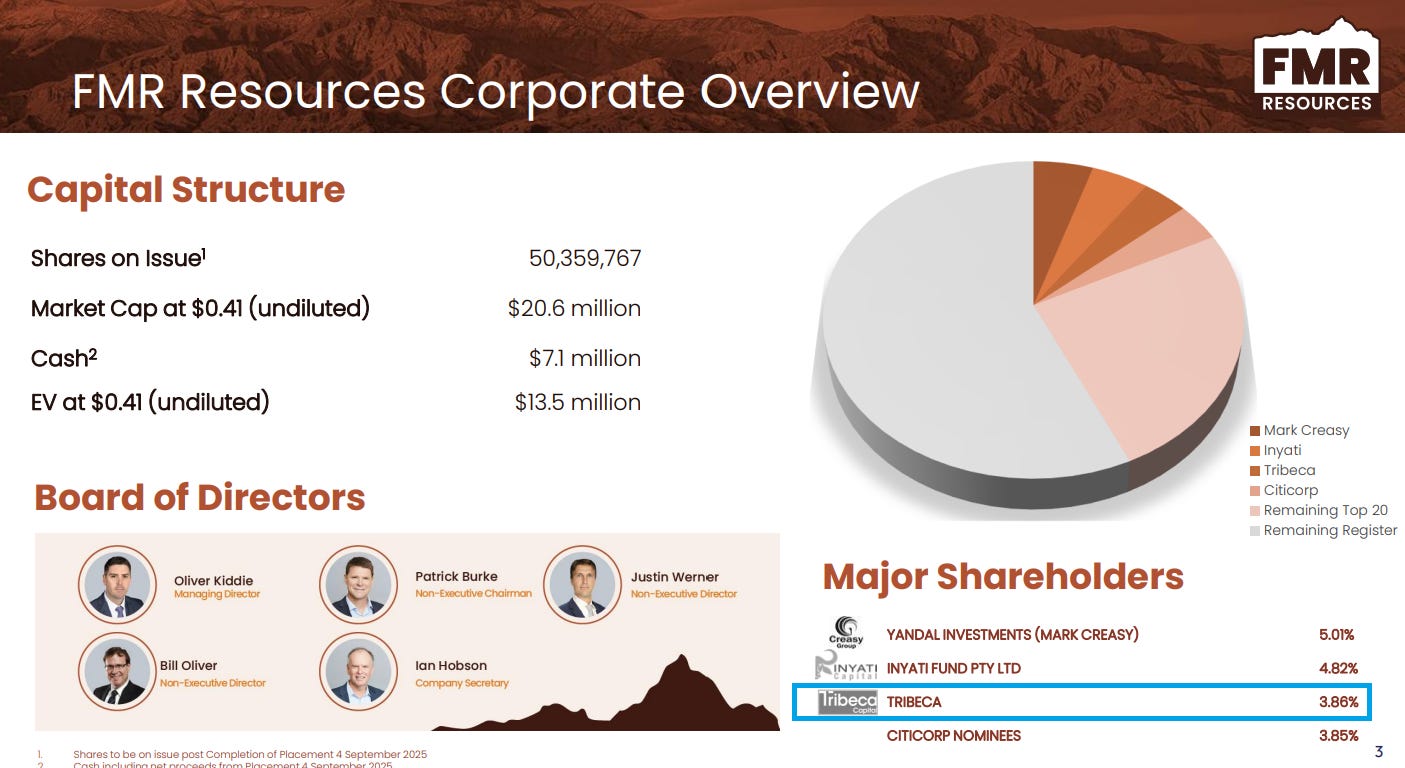

It was our second portfolio add this year after FMR Resources, which is up 150% since we backed it. The market is clearly responding to juniors with genuine fundamentals, rather than hope and prayer stories.

Here's what caught our attention in the market this week:

Fortuna Metals makes its debut as our second 2025 portfolio pick, with investors latching onto the rutile-graphite story beside Sovereign.

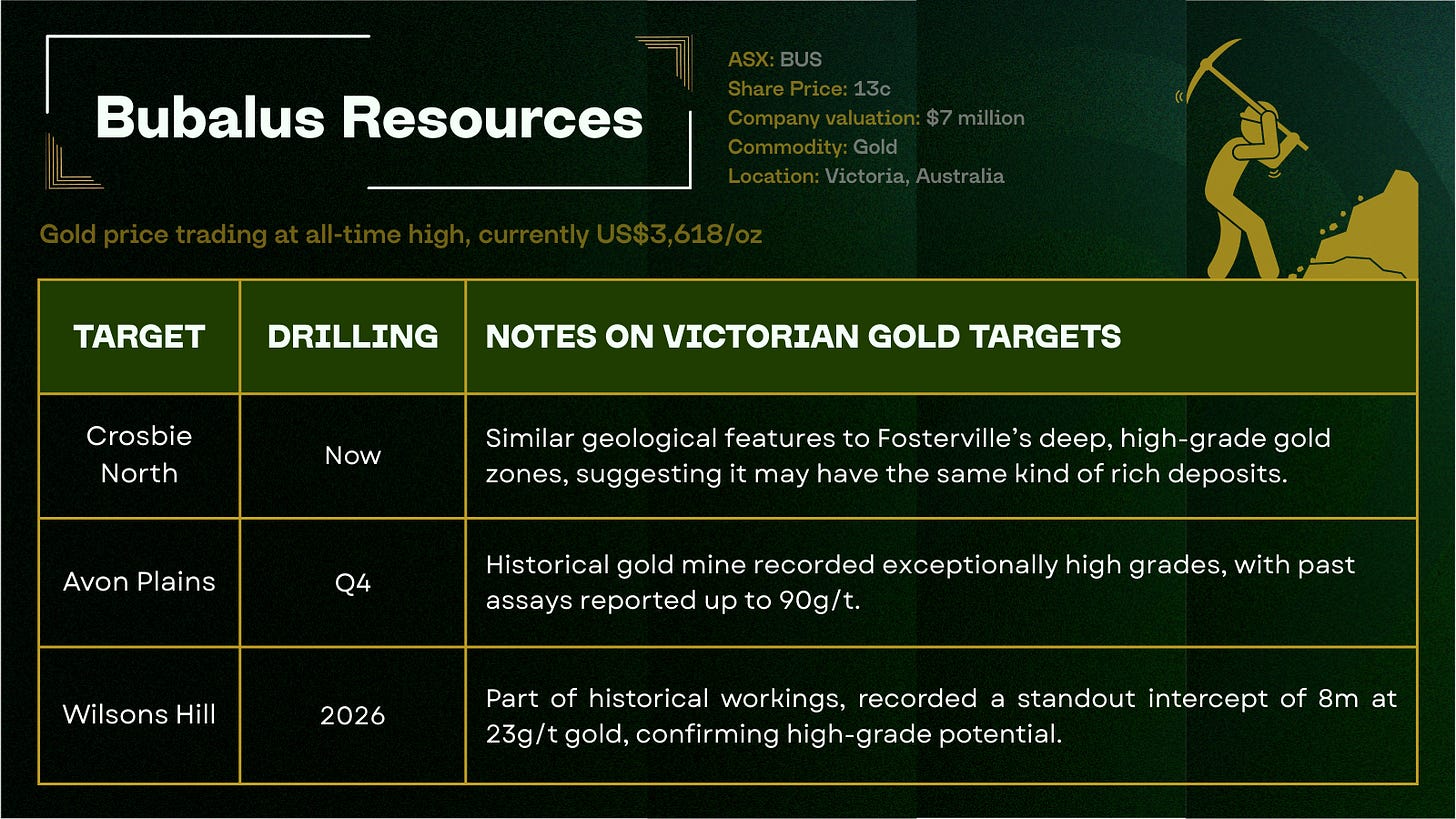

Bubalus Resources kicks off drilling at Crosbie North next week, targeting the same geology that hosts Fosterville just 15km away.

Big names join the FMR Resources register in a new investor presentation

Gold price surged to fresh all-time highs

Silver hit a 14-year high

Anglo American and Teck announced a merger to create a copper behemoth

David vs Goliath battle as BHP took on the little guy in South Australia

Fortuna Erupts on Return

Our new portfolio addition Fortuna Metals came out of a halt on Thursday and doubled before lunch, running from 7c to 16c before easing back to close at 10c.

FUN is chasing rutile and graphite in Malawi, two minerals in serious demand as robotics and EVs scale up. Rutile is the clean path to titanium (essential for robots, aerospace and more), while graphite makes up a large part of every EV battery.

The narrative took on extra weight this week with Elon doubling down on his prediction that Tesla’s Optimus robot “will be the biggest product ever”.

Considering that the consumer-focused robots (and those being built by Amazon, Google, and China) will need a whole lot of titanium to scale, it’s a good time to be in rutile.

FUN now holds 658 square kilometres of ground right next door to Sovereign Metals, which sits on the world's largest rutile deposit and is backed by Rio Tinto. The same weathered geology also continues straight into FUN's ground.

Fortuna starts soil sampling this month, with first results due before year-end.

Read the full breakdown on why we added FUN to our portfolio here.

BUS Begins Three Shots on Gold

Bubalus Resources (ASX: BUS) is about to put the first holes into Crosbie North - a gold-antimony prospect in the heart of Victoria’s goldfields.

The company’s sitting on $4M cash and trading at a $7M cap, yet it’s pointing three loaded barrels at Victorian gold. Crosbie North kicks it off next week, Avon Plains is ready for Q4, and Wilson’s Hill is waiting in the wings with its mouth-watering 8m at 23 g/t from historical drilling.

For a tiny explorer, that’s a lot of live ammunition in a record-breaking gold market.

Crosbie North sits just 15 kilometres from Fosterville - one of Australia’s most successful high-grade, low-cost mines. BUS will sink about 1,000m across seven diamond holes, chasing electrical anomalies in the same folded rocks that host Fosterville’s Eagle and Swan zones.

Rock chips hit 12.1 g/t gold and 2.02% antimony sitting right above the drill targets.

It comes as gold tears through fresh records while Goldman Sachs throws around US$5,000 price predictions. If even one of BUS' three shots connects, this won't be a $7 million company for long.

A Big Name Joins the FMR Register

FMR Resources dropped an investor presentation early in the week, and one detail stood out from the recent raise. Tribeca Capital now holds just under 4% after backing the placement.

For those unfamiliar with Tribeca, they’re an investment bank that manages about $1.7 billion in assets and often takes an interest in small-cap companies in the mining sector with big potential.

We’ve been harping on about the potential that FMR has with its copper drill campaign just days away now, so it’s good to see an investment bank with the same thinking as us.

Gold Goes Full Send

Another week, another record. Gold smashed through US$3,600 this week, hitting US$3,680/oz on Tuesday with no signs of slowing down.

The metal has rocketed more than 75% since January 2024, when it traded near US$2,063/oz. Weaker US jobs data only added fuel to the fire this week, reinforcing what's becoming obvious - gold's in raging bull mode.

For companies drilling (like Bubalus Resources), the backdrop couldn’t be stronger. Every ounce discovered in this market is worth more than ever (literally), and investors are backing juniors with the right geology and immediate catalysts.

Silver's Having its Moment Too

Gold wasn't the only precious metal making moves this week. Silver hit a 14-year high, closing just shy of US$42/oz.

Just like gold, silver has seen an incredible run, up roughly 80% since the start of January 2024.

While it's riding gold's coattails as a safe haven, silver's got its own industrial demand story driving prices higher.

Silver is widely used in several industries for its conductivity and durability, making it essential in electronics, solar panels, medical devices and batteries. As green energy and tech demand accelerate, so does silver consumption.

The all-time high of US$48.45 from 2012 is starting to look achievable.

Copper's New Power Couple

A US$53 billion merger dropped this week that could reshape the copper landscape. Anglo American and Teck Resources are combining forces, creating a producer big enough to challenge BHP's dominance.

Remember the 2024 rumours of Rio Tinto swooping on Anglo American? Well, Teck got there first.

The merged entity will control long-life, tier-one copper mines just as the world heads into a supply crunch. Copper has become the bottleneck of the energy transition, with data centres, EVs, renewables, and power grids all demanding more metal than new discoveries can provide.

BHP tried to swallow Anglo American in 2024 but couldn't get the deal done. Now they're watching their biggest competitor get stronger while copper shortages loom.

David vs Goliath: BHP vs Altair

Altair Minerals (ASX: ALR) is staring down BHP in court over the Olympic Domain project in South Australia. The $51 million junior is up against the world’s largest mining company, weighing in at $207 billion.

Goliath may have met his match.

ALRs’ ground sits next door to BHP’s Olympic Dam, one of the biggest copper-uranium systems on the planet, and could very well host the same style of giant mineralisation.

For BHP, securing the adjacent land means extending the system, feeding their mill, and locking up regional dominance. For Altair, holding onto it could be worth hundreds of millions if exploration delivers.

Most juniors would fold against that kind of pressure from the world's biggest miner. ALR is digging in, which suggests they believe strongly in what they've got beneath the ground.

The legal battle continues, but the stakes are high - control of potentially massive copper-uranium resources in one of Australia's premier mining districts.

Commodities Come Alive

The commodities space has come alive as we push into the final months of 2025.

Our portfolio additions this year are doing good business - FUN and FMR are well up since we backed them. Both have exploration programs firing up in the coming weeks, so we expect the momentum should continue.

Bubalus Resources could be the sleeper. They're drilling Victorian gold targets just as the metal hits fresh records. With any decent results, this $7 million company likely won't stay that way for long.

Silver hit 14-year highs, copper giants merged while BHP watched from the sidelines, and a junior is standing toe-to-toe with the world's biggest miner in court. After a sluggish start to 2025, the mining sector has woken up.

The fundamentals are all aligning - record commodity prices, supply constraints tightening, and capital finally flowing back into quality stories. For those paying attention, the opportunities are stacking up.

If you’re not already subscribed, we suggest now is the time.