Weekly Wrap: Gold Climbs, Copper Hits and a 28-Bagger Gets Bought

Gold climbs amid global tension, AZ9 hits more copper, and one of the great ASX small-cap runs ends in a $1.3B payday

The ASX 200 reached a record high early in the week before flattening out, a reminder that markets can hit milestones even as uncertainty simmers beneath the surface.

Despite the sideways finish, a couple of stories caught our eye:

Gold surges past US$3,400 on the back of rising geopolitical risk, inflation concerns and debt anxiety.

Asian Battery Metals keeps hitting high-grade massive sulphides at Oval, with the story growing deeper.

The Adriatic Metals cinderella story from 20c share price concluded this week with a $5.60 takeover.

Gold Hits Two-Month Highs as Conflict Fears Rise

Gold surged past US$3,400 this week, and frankly, it's not hard to see why. The Middle East has well and truly kicked off with Israel and Iran trading serious blows that have raised fears the conflict could spill beyond the region.

What started as tensions has escalated into armed drones and missiles flying back and forth between the two, with casualties sadly reported on both sides.

Analysts from FX Street and CNBC also pointed to the mounting pressure from sovereign debt levels, inflation persistence and a weakening US dollar.

Amid it all, gold rocketed to eye-watering levels.

The gold spot price jumped more than 4% in two days and has shown little sign of retreat. Traders are now openly wondering if we’re at the start of a new bullish cycle rather than a temporary spike.

Some forecasts are already pencilling in US$3,650/oz this year if this conflict escalates further and macro conditions keep deteriorating.

This has direct implications for ASX investors with gold producers finally starting to see margins expand, and developers with quality ounces in the ground being reassessed.

Juniors with credible targets and tight capital structures, such as Bubalus Resources (ASX: BUS), should be front and centre in our eyes.

Even though BUS continues to trade at a $7 million valuation and $4 million in cash, those pending assay results could be a serious catalyst if they come back showing any decent gold grades.

AZ9 Continues to Build a Discovery Story in Mongolia

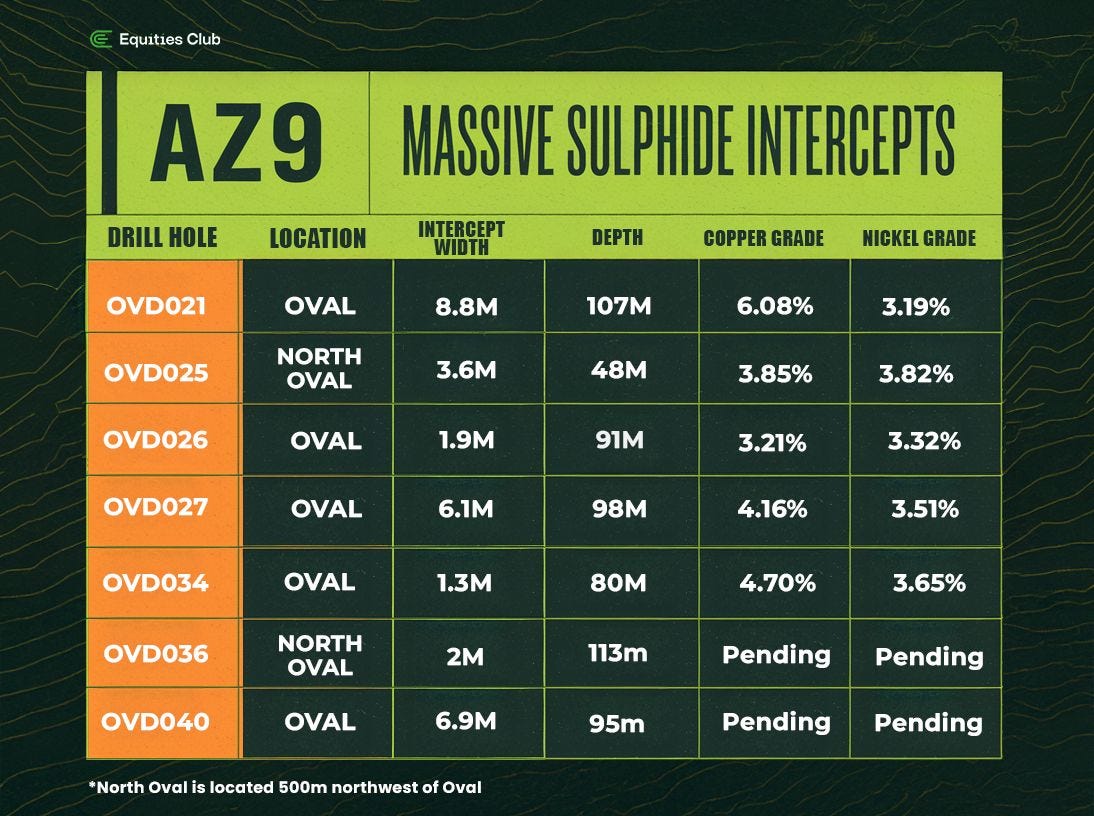

Asian Battery Metals (ASX: AZ9) released the first batch of assays from their phase 3 drilling this week, building out a much larger picture at their Oval discovery.

The response was initially positive, with the stock up more than 10% before being sold down to close the week.

As AZ9 shareholders, that sell-off surprised us a bit as we saw more thick, high-grade hits near surface and signs the system’s still growing.

Put simply, they’re getting closer.

The company still has a modest market cap of $11 million with a strong cash position of $5 million, which is plenty to keep exploring. We haven’t sold a share and will continue to hold.

There were a few highlights from the AZ9 announcement this week:

Drill hole 34 returned 1.3m of massive sulphide with over 4% copper and over 3% nickel, from only 80m deep.

Drill hole 33 delivered 27m at 1.36% copper and .86% nickel within a broader 88.5m mineralised zone at .62% copper and .45% nickel.

Drill hole 32 intercepted sulphides from 293m deep, indicating that there may be a larger system at depth.

With copper supply tightening globally and exploration success stories few and far between, AZ9 finds itself in a position where each drill result is adding weight to the investment case.

Adriatic’s 20c IPO to $5.60 Takeover Shows What the Right Small-Cap Can Do

Adriatic Metals (ASX: ADT) first listed on the ASX back in 2018 at just 20 cents per share, quietly raising $10 million to fund exploration in an under-explored region of Bosnia.

This week, it was confirmed that Canada’s Dundee Precious Metals will acquire the company for US$1.3 billion, valuing Adriatic at the equivalent of $5.60 per share.

That's a 28-bagger for early believers.

The scale of that uplift is about backing a team that kept delivering across every stage of the value curve.

Adriatic advanced the Vares Project into one of Europe's most robust, high-margin polymetallic mines with a clear path to production and low operating costs in a favourable jurisdiction.

Dundee's willingness to pay a premium shows the quality of the underlying asset and their confidence this thing will print money for years to come.

For retail investors and small-cap followers, it’s a real-world example of the upside that only this end of the market can offer.

Most small-caps don't deliver anywhere near this kind of return, but the ones that do usually have strong management, consistent execution, and the ability to raise capital without diluting the story.

Opportunities like this still exist on the ASX, particularly in the metals space where supply gaps are widening and majors are hunting for new inventory.

Finding them early and holding on through the ups and downs is tough, but when it works, as Adriatic just proved it can, you're looking at retirement money.

The Wrap

Gold has reasserted itself as a true safe-haven, copper is getting tighter, and quality exploration stories are finally starting to show their teeth. With all exploration stories we just need the drilling to return something substantial and we are off to the races.

This week we've seen the kind of deal that makes us all remember that investing in the small-cap space is worth it. Can we find the next ADT? We hope so, we'll keep on researching and informing you as best we can along the way.

And Don’t Forget…

There’s still some time to get your tips in for our $2,500 stock-picking competition.

It’s a bit of fun and a little thank you to our community. If you’ve missed it so far - there’s $2,500 up for grabs if you can pick the best performing ASX stock from July through December.

Pretty straightforward - back your best conviction play and see how it stacks up.

Takes 30 seconds to enter and it’s completely free. Worth throwing your hat in the ring if you've got a stock you're genuinely excited about, and you might earn a nice Christmas bonus for your troubles.

Give it a crack and send to any mates or fellow stock punters you think might be interested.