Weekly Wrap: Gold's Seventh Heaven, BHP v Beijing, Biotech Breakthrough

Money's flowing back into small caps, China's testing its leverage over iron ore, and a biotech solves a 40-year puzzle around a shelved cancer drug. Busy week.

After months of watching the big end of town hog all the attention, money’s starting to flow back into the juniors, and it’s happening across multiple sectors at once.

The ASX 200 climbed 2% this week (resources did the heavy lifting), but the real action was away from the majors - gold kept pushing higher, copper hit its best level in over a year, lithium stocks rode a rollercoaster, a biotech jumped 46%, and the Beetaloo Basin landed its biggest deal in years.

Here’s what caught our eye:

Gold lines up seventh straight weekly gain

UBS goes ultra-bullish on gold and silver

BHP and China locked in iron ore dispute

Race Oncology surges on drug mechanism breakthrough

Lithium stocks whipsaw on CATL reserve approval

The Beetaloo Basin consolidates on back of a big deal

Copper price hits its highest in over a year on Grasberg disruption

Bank of America tips resources stocks as AI winners

Gold Keeps Running, Juniors to Follow

It feels like every week we’re talking about gold, but for good reason, as the generational run continues, lining up its seventh straight weekly gain. As we’ve said before, that kind of consistency suggests the trade is running on more than just short-term noise.

The US government shutdown and growing bets on Fed rate cuts have been the latest catalysts, but central banks keep buying and investors keep piling into the safety trade.

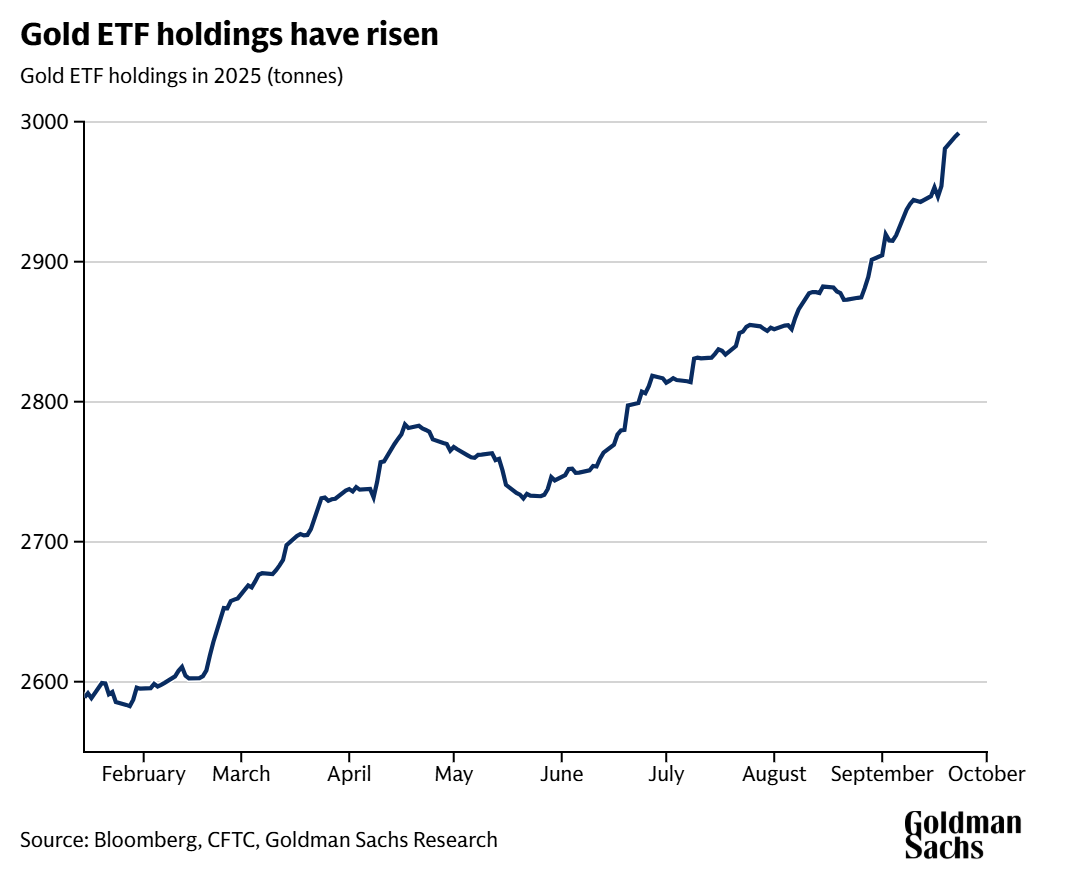

Gold ETFs have also seen steady inflows as the metal grinds higher week after week.

Small gold explorers tend to lag the metal itself, but when sentiment finally shifts their way (like it has lately), moves can be sharp.

With gold this strong for this long, any decent discovery or resource upgrade could get re-rated fast. The market is loving gold, and it won’t take much for sentiment to flow into the smaller end of town.

We’ve backed Bubalus Resources (ASX: BUS), which is drilling high-priority gold targets in Victoria as we type, with results not too far away.

UBS Raises Gold and Silver Forecasts Again

On the back of consistent gains for gold, investment bank UBS has gone ultra-bullish on precious metals, hiking its gold target to US$4,200 an ounce and silver to US$53.

The bank’s pointing to macro uncertainty and ongoing central bank demand, but really it’s just acknowledging what’s already happening - capital keeps flooding into safe havens and nobody’s slowing down.

When UBS puts out such aggressive numbers, it tends to drag more money into the sector and helps sentiment across the board. Juniors included.

China and the US Both Making Moves (Just Very Different Ones)

There were two different stories this week that show just how political commodities are at the moment. While they’ve always had an edge to them, lately the knives seem a lot sharper.

The BHP situation first, with Beijing moving to restrict some iron ore cargoes from the major miner. Chinese authorities reportedly told steel mills and importers to stop taking BHP cargo (though Beijing hasn’t formally confirmed it). The dispute centres on pricing, with China wanting more control over how iron ore gets valued amid arguments that the majors (BHP, Rio, Vale) have too much say.

Iron ore has long been the backbone of the trading relationship between the two countries, with China relying heavily on Australian supply and BHP, Rio and Fortescue dominating the flow.

Beijing’s prepared to test how much leverage it actually has, and iron ore makes for a useful pressure point.

Then you’ve got the Americans. Reports this week said the US has approached Australian critical minerals producers about taking direct equity stakes in their projects.

There was no company names confirmed, but Washington’s willingness to write cheques directly into mining ventures shows how seriously they’re taking supply chain security outside Chinese control.

So in the same week we got China using its buying power to push for better pricing on iron ore, and the US trying to secure a future supply of critical minerals by becoming a direct investor.

They’re different commodities with different strategies, but it shows how political the space is.

For Australian juniors, it’s a reminder that customer base matters more than it did five years ago. Companies that can sell beyond China are going to look more attractive, and those holding critical minerals assets the US wants are suddenly in a much stronger negotiating position.

Race Oncology Soars on Mechanism Breakthrough

Race Oncology (ASX: RAC) had the kind of week most biotechs dream about, with its stock price surging 46% on Thursday after scientists figured out how its lead anticancer drug actually works at a molecular level.

The breakthrough matters because bisantrene (the drug Race is developing) has been around since the 1980s, but nobody really understood how it worked.

Race showed the drug latches onto the genetic switches that drive cancer growth, including MYC - a master gene active in about 70% of cancers and long thought untouchable.

This means Race can now pick which cancers to target more precisely, design better drug combinations, and develop tests to identify which patients will benefit most. It also makes regulatory approval more likely and lifts the odds of landing a big pharma partner.

Race’s managing director is Daniel Tillett, who’s built something of a cult following in biotech after successive wins. Management quality makes or breaks early-stage biotech stocks, and Tillett’s track record speaks for itself.

Race shares have more than tripled over the past 12 months, climbing from lows of just 92 cents.

RAC has a huge retail following and an impressive team, so we’ll be keeping an eye on how this one develops.

A shoutout for their announcement detail and formatting too, which is good at distilling the technical down to us laymen.

Lithium Stocks Whipsaw on CATL Reserves

Lithium is still at the mercy of Chinese policy moves, and this week proved it again.

ASX lithium stocks were on a rollercoaster after Chinese regulators approved a reserve report for CATL’s Jianxiawo mine in Yichun, clearing the way for a restart.

The headline was enough to spark fears of more supply hitting the market, and mid-week, lithium names were dumped across the board.

By the end of the week, though, many had already bounced back and were trading higher than where they started.

The quick recovery suggests sentiment in the sector hasn’t completely rolled over, but the volatility is a reminder of how exposed these stocks can be to policy decisions out of Beijing.

Tamboran Drops $172m on Beetaloo Ground

Tamboran Resources (ASX: TBN) just paid $172 million to acquire Falcon Oil & Gas, consolidating more of the Beetaloo Basin under one roof.

The Beetaloo sits in the Northern Territory and has been talked about for years as a potential gas province that could help fill Australia’s looming energy shortfall, but progress has been slow.

The deal values Falcon’s acreage at roughly $169 per acre, and TBN jumped nearly 50% as the market worked out what it means. This is the first real price tag on Beetaloo ground.

Top End Energy (ASX: TEE) holds nearly 50% more Beetaloo land than Falcon just sold for $172 million. TEE’s market cap sits at $8 million. Apply Tamboran’s per-acre valuation to TEE’s ground, and the company is trading at roughly 1% of what its acreage might be worth based on this deal.

The valuation gap exists for a reason as Falcon’s ground is more advanced, Tamboran has the operational nous, and TEE is earlier stage. But when consolidation is happening and buyers are paying these kinds of multiples, juniors holding ground next door could start getting phone calls.

We’ve held TEE for its Kansas natural hydrogen exposure, but the Beetaloo acreage is starting to look like an interesting near-term play.

Copper Surges on Grasberg Disruption

Copper hit its highest level in more than a year this week after a catastrophic mud rush at Indonesia’s Grasberg mine collided with the US Fed signalling a more dovish stance on rates.

The mud rush killed two workers and left five still missing, underscoring the scale of the disaster at Grasberg.

Grasberg is one of the world’s biggest copper sources, so any major incident there tightens the market fast. Throw in easier policy settings out of the US and there’s now stronger demand expectations colliding with shaky supply.

Small-caps with drills turning tend to benefit most when copper’s running hot because price strength makes discoveries more valuable and brings capital back into the space.

Two of the stocks in our portfolio, FMR Resources (ASX: FMR) and Asian Battery Metals (ASX: AZ9), are both turning drill bits on copper projects as we speak.

Bank of America Links AI Boom to Mining Stocks

Bank of America called out copper, lithium and rare earths this week as the commodities that’ll benefit most from AI’s expansion. Their argument is the same one we’ve banged on about for a while - data centres, electrification and AI infrastructure all need massive amounts of raw materials.

Every new data centre needs copper for cabling and cooling, rare earths for servers, and lithium for backup power. Multiply that across thousands of facilities being built around the world, and you’re looking at demand that wasn’t even on the radar a few years ago.

When a major bank like BofA publicly ties AI growth to mining demand, it gives investors who’d normally ignore resource stocks a reason to look.

That matters because it opens the door to tech-focused capital flowing into the space - money that’s historically avoided small-cap explorers entirely.