Weekly Wrap: Metals Lose Their Minds, Lithium Thaws and Robots Are Scaling

When your mate who doesn't follow markets starts texting you about gold prices, you know emotions have taken over. Friday reminded everyone what often happens next

Metals went parabolic this week. Then they came crashing back to earth.

Gold, silver and copper all printed fresh records before Friday’s sell-off reminded everyone that vertical moves don’t last forever. The headlines swung from, “New paradigm” to, “Is this the top?” in about 48 hours.

Behind all the noise, some quieter shifts are happening. Lithium producers are leaning back in. Zinc keeps on surprising. And US rare earth policy just took a turn that likely matters for us here in Australia.

Some action across the week:

Fortuna Metals enters trading halt on results as SVM keeps running

Gold smashing through US$5,500 before Friday’s correction

Silver hitting US$121, then giving most of it back

Copper ripping to US$14,500 before momentum stalled

Pilbara Minerals says lithium winter is over

Zinc bucks the trend trading at three-year highs

Top End Energy and the US data centre scramble

US backing away from rare earth price floors

Before we get into it, WTF just happened?

This was one of the most volatile weeks in commodities in a looooong time. When gold and silver start making headlines on regular news sites and your mate who doesn't follow markets is suddenly texting you about prices, emotions have taken over from fundamentals.

(a worthwhile moment to remind you of our standing advice: do not invest off headlines alone).

By Saturday morning the tone had flipped completely. Headlines screaming about bloodbaths and carnage after gold and silver pulled back from historic runs. Single-session moves like that grab attention, but they don't change the underlying picture that's been building for months.

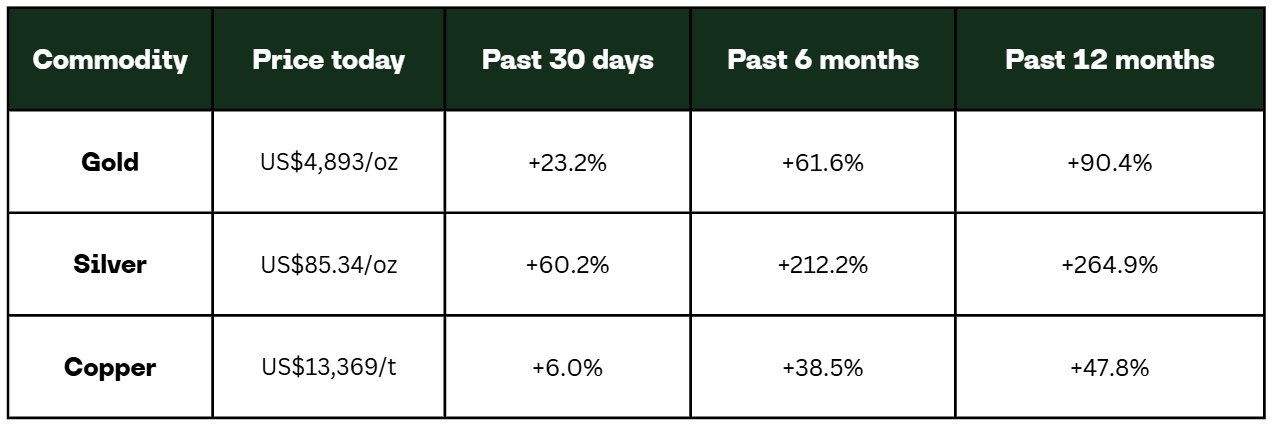

Here’s where the major metals sit today:

As we know, markets move in waves, and never in straight lines. If you trade off yesterday’s headlines, you’ll miss what’s building right in front of you.

Fortuna heads into halt ahead of rutile results

Fortuna Metals (ASX: FUN) entered a trading halt on Thursday. Results from its Malawi rutile project land tomorrow.

Next-door neighbour Sovereign Metals (ASX:SVM) has added about $125 million in market cap over the past two weeks as the market reprices rutile discoveries in the region, and Fortuna sits on the same geological sequence with results that stack up against SVM's early work.

Right now, Fortuna trades at roughly 7% of SVM’s valuation. That gap won’t close overnight, but if the results coming out of the halt land well (and with many more not far away), there’s a lot of leverage sitting in this one.

Rutile demand tied to humanoid robots isn’t going away, and Tesla just dropped the bomb they're halting production on Model S and Model X to scale one million Optimus humanoid robots this year instead.

Figure AI also unveiled Helix 02, their most capable humanoid model yet. The robot executed a continuous four-minute task that's never been done before: walking to a dishwasher, unloading dishes, navigating across a room, stacking items in cabinets, loading and starting the dishwasher, all from onboard sensors with zero human intervention. Figure says this is longest task completed autonomously by a humanoid robot to date.

The Themes Humanoid Robotics ETF (NASDAQ: BOTT) has climbed from around US$23 in April last year to a high of US$72 earlier this week. Institutional money is already flowing into the theme, and as traders rotate from one narrative to another, robotics is shaping up as the next major target for capital.

Have a listen to Elon Musk below, talking about Optimus below. It’s clear we’re not too far away from a surreal and major development in tech and lifestyle.

As humanoid robots scale, they add one more demand lever to an already tightening titanium market, where high-grade rutile sits at the top of the feedstock chain.

Gold smashes US$5,500, then gets hammered

Gold had one of its wildest weeks in memory.

Early in the week, spot pushed through US$5,500 and briefly touched US$5,600, a 71% gain over the past year. As usual it was central bank buying, geopolitical nerves and fiscal anxiety that kept the rally going.

But often when positioning gets this crowded and everyone's leaning the same direction, reversals happen fast and they're brutal.

Friday delivered exactly that. Trump nominated Kevin Warsh for Fed chair, who has a reputation for favouring tighter monetary policy over easy money. During a previous stint at the Fed, he was vocal about the risks of quantitative easing and warned about the Fed's balance sheet ballooning. The market read the nomination as a signal that rates might stay higher for longer rather than getting slashed to juice the economy. Some of the gold rally had also been a bet on dollar debasement.

In saying all that, Warsh has hinted he'd work in lockstep with Trump, who's been vocal about wanting rate cuts to lower financing costs on the US debt. Warsh recently criticised the Fed's hesitancy to cut rates and called for "regime change" in how the central bank operates. That makes him harder to read, and the market's still trying to work out whether he'll prioritise inflation control or align with Trump's push for easier money.

After the nomination profit-taking kicked in, the US dollar firmed, and gold dropped more than 8% in a single session. By the close it was sitting near US$4,890, not far off the lows.

Central banks are still buying and deficits are still ballooning, so the fundamentals driving gold higher haven't shifted.

New buyers keep emerging too. Tether, the company behind the world’s largest stablecoin, bought more than 70 tonnes of gold last year - more than almost any central bank (Poland edged them out). They’re still buying 1-2 tonnes per week and storing the lot in a former Swiss nuclear bunker that the CEO calls “a James Bond kind of place”. Total holdings now sit at 140 tonnes worth about $24 billion.

Silver punched through US$121, then collapsed

Silver was even more brutal.

It broke to a new all-time high of US$121.67 on January 29, up more than 60% in a single month. Solar panel demand climbed while physical supply stayed tight after years of underinvestment. And speculative money piled in chasing the rally.

Then it fell apart.

Friday’s sell-off saw silver drop more than 25% in a single session. It was a mix of margin calls, forced liquidations and crowded longs getting squeezed. By the close silver was near US$85, miles off the highs it had printed just hours earlier.

Silver traders who've been around for a few cycles have seen this pattern before. The metal has a habit of rallying hard and reversing harder. It's a small market with thin liquidity and plenty of leveraged players looking for quick gains. Patience in silver often gets rewarded over time, but anyone who overstays their welcome during a parabolic move tends to pay for it.

Whether this is consolidation before another leg higher or the start of something uglier depends on who you ask. The supply-demand picture still looks tight. But weeks like this remind you why silver has a reputation for wild swings.

Copper ripped to US$14,500, then ran out of steam

Copper followed the same pattern as gold and silver. Prices pushed through US$14,000 and briefly traded above US$14,500 on Thursday.

The push came from China ramping up speculative buying while AI infrastructure buildout kept pulling in capital. Electrification demand also provided a structural tailwind underneath. Trading volumes on the Shanghai Futures Exchange hit records and for a moment it looked like copper might just keep running.

It didn’t.

Physical buyers stepped back at elevated prices. Banks flagged that demand destruction and rising scrap supply could cap the rally. Friday saw copper drop nearly 4%, retreating toward US$13,370 by the close.

The long-term story hasn't changed. Copper supply is getting harder to find and the world needs more of it than it used to. Vertical moves like this week's across gold, silver and copper all followed the same pattern: parabolic rallies into crowded positioning, then sharp corrections when sentiment flipped. The structural case for copper remains intact. So does the volatility.

Pilbara says the lithium winter is over

After 18 months of pain, lithium is finally showing signs of life.

Pilbara Minerals (ASX:PLS) managing director Dale Henderson said this week that the “lithium winter is over” as the company looks at restarting its Ngungaju processing plant at Pilgangoora. That’s 200,000 tonnes per annum of mothballed capacity being brought back online.

Producers don’t restart mothballed plants unless they think pricing and demand can hold. That’s what makes this interesting.

Spot spodumene prices have bounced off the lows. Pilbara achieved around US$1,161 per tonne in the December quarter. EV demand is still grinding higher. China’s inventory build looks like it’s normalising.

The euphoria of 2022 is gone, replaced by a tighter and more cautious market. That's actually better for the well-funded producers and quality developers who can weather a cycle. Risk-reward is starting to shift back to the upside.

Zinc won’t stop surprising

Zinc was supposed to be boring this year. The consensus was calling oversupply, with inventories rebuilding and prices drifting sideways or lower.

None of that happened.

A squeeze in October caught the market offside and zinc has carried that momentum into 2026. It’s now trading at three-year highs on the LME.

Mine supply looks fine on paper, but the refined metal hasn't shown up in the volumes everyone expected. Bottlenecks at ports and smelters meant deliveries came slower than planned. Restarts that were supposed to add supply were slower than expected. Chinese concentrate markets stayed tight when the forecasts said they'd loosen.

The models missed, and zinc kept climbing.

Galvanising demand has held up better than feared too. Infrastructure spend and steady construction have kept the floor under prices.

Small-cap zinc plays on the ASX are seeing better margins, and projects that looked marginal a year ago are suddenly worth another look as prices hold at these levels.

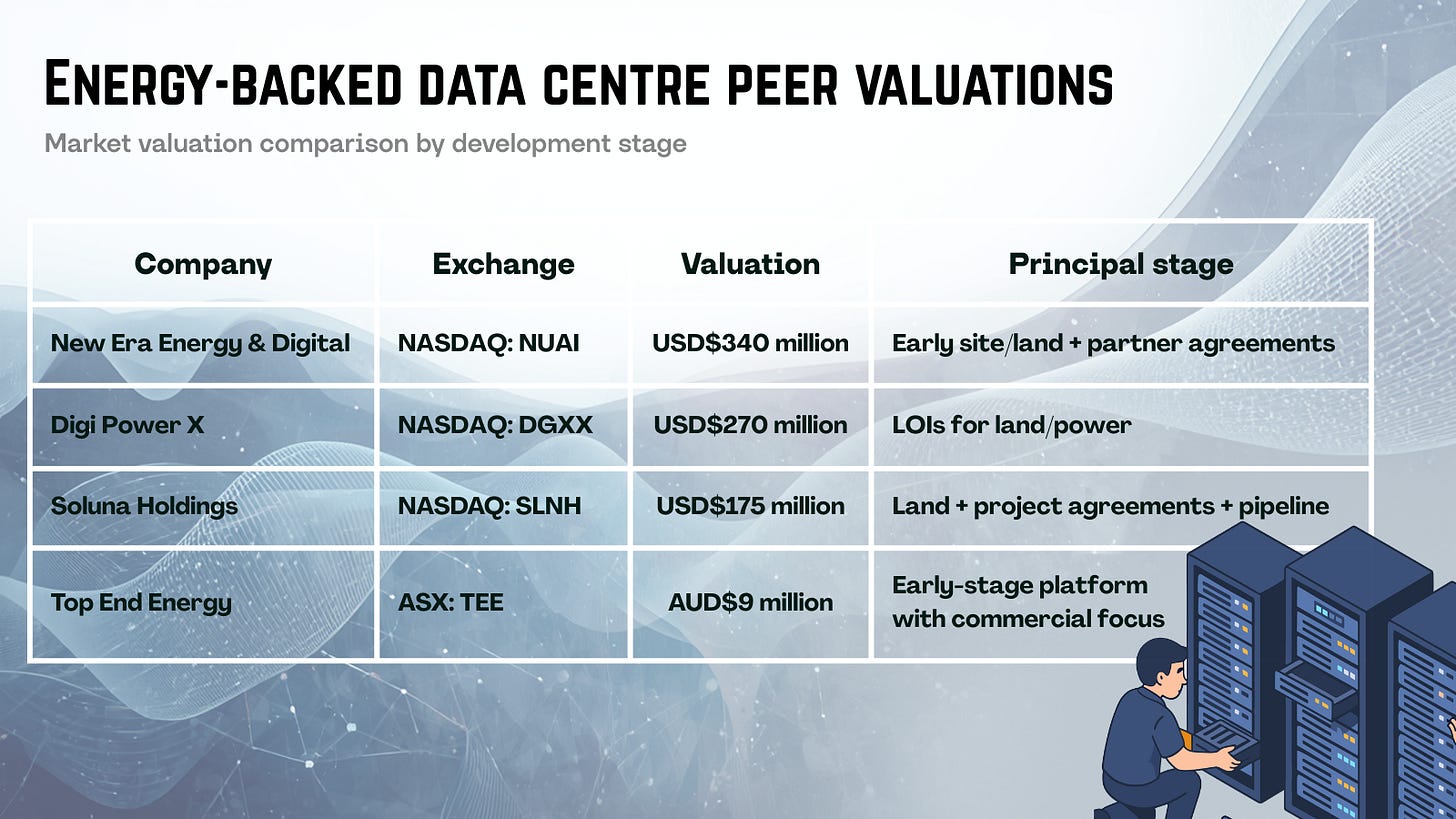

Top End Energy targets the US data centre scramble

Top End Energy has pivoted into one of the hottest infrastructure themes going: AI data centres and the race to secure power.

The US is forecast to spend $2.6 trillion on data centre buildouts. Power has become the primary constraint, with sites unable to get online fast enough to meet demand. TEE is targeting that gap with behind-the-meter energy solutions in Texas.

At a market cap of around $9 million, TEE is tiny. US-listed peers chasing similar land-and-power strategies already trade at hundreds of millions.

TEE is aiming to secure land, energy inputs, and approvals so bigger players can move fast when they're ready to build. If TEE can convert early site work into a real partnership, the valuation gap doesn’t need much to start closing.

Execution risk is obvious at this size. But the setup has real asymmetry if they deliver.

US cools on rare earth price floors

The US has quietly backed away from guaranteed price floors for rare earths.

According to Reuters, Trump administration officials have told industry at a closed-door meeting this month that future projects will need to stand on their own commercially. Congressional constraints and the difficulty of setting market prices were cited. The existing price floor for MP Materials stays in place, but the expectation that this model would be rolled out more broadly is fading.

Australia's been floating its own A$1.2 billion critical minerals strategic reserve. Resources minister Madeleine King said the US backing away won't change Canberra's plans, and they're still looking at price floors to support local projects.

A US pullback might take some momentum out of those plans. Then again, it strengthens the argument for doing this as a coordinated Western strategy rather than Australia going it alone. Washington’s now pivoting toward exactly that, with a senior Trump official saying this week the US will push for allied consensus on a pricing mechanism to stabilise rare earth markets. If an Australian price floor does happen, it’ll probably be as part of that broader allied push rather than a standalone subsidy.

What a week

Weeks like this separate the tourists from the traders. Gold, silver and copper all printed records, then reminded everyone that parabolic moves come with parabolic corrections.

The structural stories haven’t changed. Central banks are still buying gold. Silver’s supply-demand picture is still tight. Copper is still getting harder to find. Lithium producers are leaning back in.

But timing matters, and so does position sizing. The trend may be your friend until it reverses in a single session and wipes out a month of gains.

We’re watching Fortuna when it comes out of halt tomorrow. We’re watching lithium for signs the bottom is really in. And we’re keeping an eye on how far gold and silver need to fall before the buy-the-dip crowd steps back in.

Plenty still to play for.

Till next week.