Weekly Wrap: Panic to Recovery as Commodities Lead the Charge

Confusion gave way to recovery as quarterlies landed, false headlines faded, and copper, gold, and critical minerals drove small-cap momentum

What started as a week of confusion quickly turned into one of recovery. Markets absorbed a flurry of quarterly reports, geopolitical headlines, and commodity swings, yet most of what looked negative on Monday was forgotten by Friday.

Across small caps, selling turned to selective buying and the big themes didn’t budge – copper strength, critical minerals, and gold’s resilience stayed intact.

This week in review:

It’s quarterly season, and what it means for small caps

Malawi headlines trigger a sell-off that quickly unwinds

Trump and Xi’s meeting steadies global sentiment

Arafura locks in $475 million and puts its NT neighbour Bubalus in focus

Gold dips, then rebounds above US$4,000/oz

Copper races to record highs as supply tightens

Whitebark breathes new life into the Warro Gas Field

Tungsten’s back, thanks to Almonty’s US play

ASX Quarterlies. What They Mean and What to Watch

For those new to the small-cap space, every three months, many ASX-listed companies release quarterly reports. Think of them as a quick health check on how they’re spending money and how projects are progressing.

For pre-revenue explorers and biotechs, these cash flow statements are mandatory and show exactly how much is going into drilling, development, and overheads.

For producers, especially in mining and energy, quarterlies aren’t required but are still expected. The market wants regular updates on production, costs, and margins, and these numbers often move share prices well before half-year results.

For investors, it’s about reading between the lines. If cash burn is high or balances are shrinking, a raise is usually around the corner. But when companies report steady operations, active programs, and disciplined spending, confidence returns quickly.

Mountain of a Molehill in Malawi

Companies and markets sometimes panic before getting the facts straight, and Malawi this week was a textbook example.

Lindian Resources (ASX: LIN) announced on Monday that the Malawian Government might restrict raw mineral exports. Within hours, investors were selling anything linked to the country.

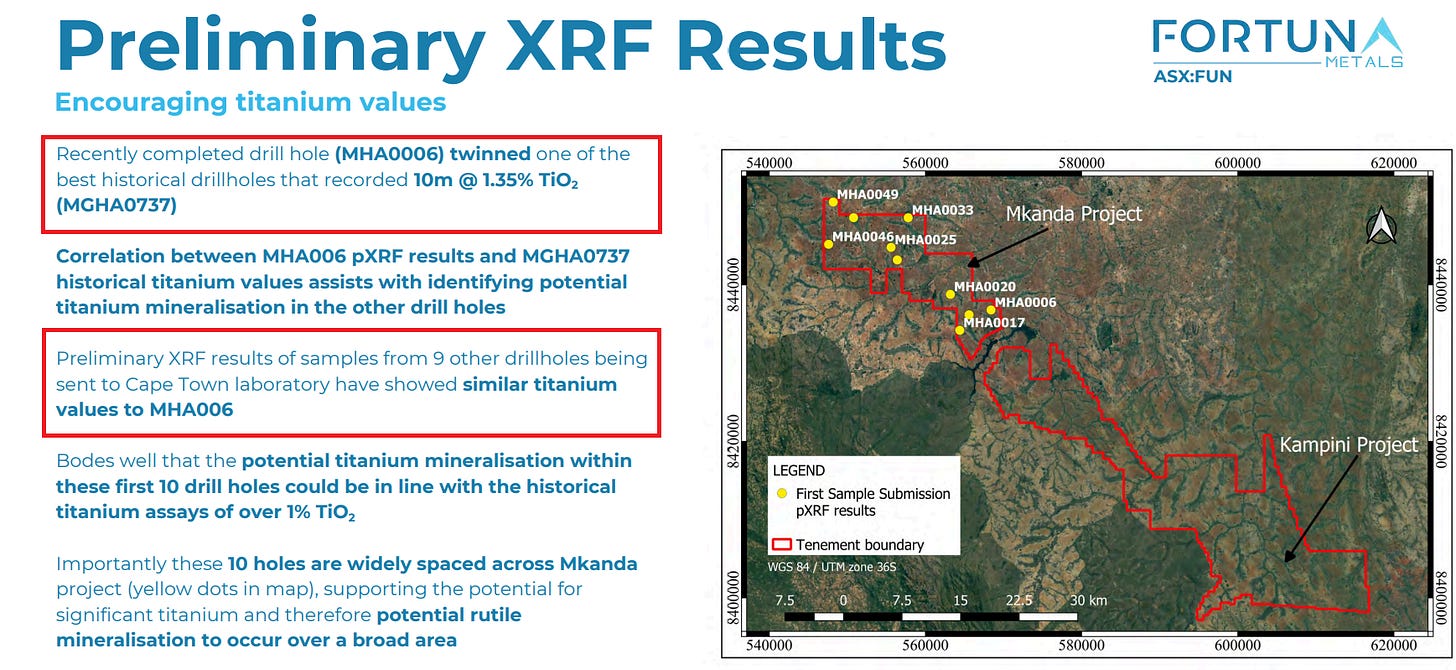

Our investment in Fortuna Metals (ASX: FUN) was caught up in the panic, falling from 22c to 11c in a matter of minutes before recovering to finish the week at 15c, despite having zero exposure to the issue.

By Wednesday, the facts emerged and everyone felt a bit silly. Both LIN and Sovereign Metals (ASX: SVM) confirmed their projects were unaffected, as is FUN’s.

The government clarified the rule only applies to raw, unprocessed minerals. Anyone processing in-country was always fine.

The sell-off was pure panic, while the fundamentals hadn’t changed one bit.

It was a classic case of shoot first and ask questions later, as companies that process or beneficiate their material in-country, like LIN, SVM, and FUN, remain fully compliant. The sell-off was overdone. The market reacted before understanding the facts, and valuations tumbled on emotion rather than logic.

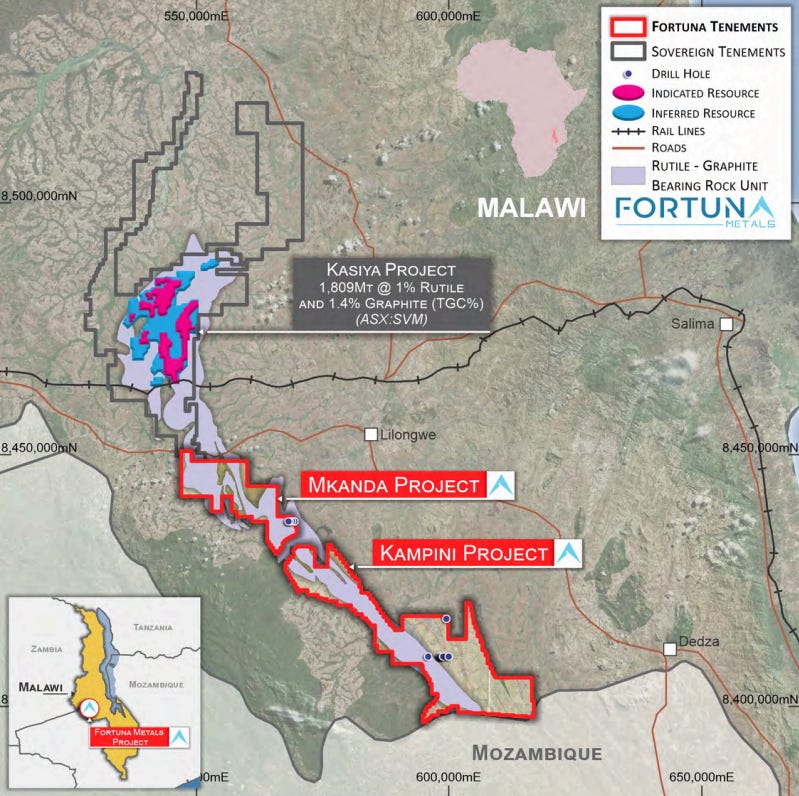

FUN’s fundamentals haven’t changed. The valuation gap between FUN and SVM, roughly $27 million vs $430 million, is still too wide to ignore when both sit on the same geological sequence (shown above).

What looked like a crisis on Monday turned out to be a blip by Friday, and with drilling results due this month, FUN remains in a strong position to start closing that valuation gap.

Trump and Xi: Real Progress or Just Another Handshake?

Trump had a “12 out of 10” meeting with Xi in Busan this week and struck a deal that actually matters for critical minerals – China agreed to suspend its export controls on rare earths for a year.

Both leaders talked about “strategic stability” and keeping dialogue open, but the real news was China temporarily loosening its grip on materials the West desperately needs. Beijing said they’ll “make it easier” for the US to buy rare earths, though nobody’s pretending this is permanent.

The market viewed the easing of tensions as positive for confidence and trade flows, but the underlying competition for critical minerals hasn’t gone away. China’s just hit pause on the restrictions, not deleted them. The US still knows it needs to diversify away from Chinese supply long-term.

Small-cap resource stocks often do better when tensions are high, as that’s when Western governments start writing cheques for new supply lines.

For Australian rare earth and critical mineral explorers, this temporary truce changes nothing fundamental. Washington remains desperate for alternative sources, and a one-year suspension only underlines how vulnerable Western supply chains really are.

Busan delivered a tactical pause rather than strategic peace, which suits ASX small-caps perfectly. While China controls the taps today, Australian explorers remain the West’s best bet for breaking that monopoly.

Rare Earth Player Arafura’s $475 Million Raise

Speaking of critical minerals and rare earths, Arafura Rare Earths (ASX: ARU) secured $475 million this week to finally build its Nolans Project, with Gina Rinehart’s Hancock Prospecting taking a big chunk of the raise.

The money means the Northern Territory project is now fully funded through construction and into early operations, which is a massive shift for a project that’s been stuck in development hell for years.

With funding locked in and offtake agreements in place, ARU can move into full-scale build-out of its processing facilities, designed to supply NdPr, the key magnets used in EVs and wind turbines, right when Western markets are desperate for non-Chinese supply.

For investors in ARU, Rinehart’s involvement adds weight, stability, and credibility to the project. Her continued support reinforces confidence in the economics and its strategic value to Australia’s critical minerals ambitions.

Once in production, Nolans will rank among the few rare earth projects outside China capable of delivering meaningful volumes into Western supply chains.

Bubalus Sitting Beside the Billion-Dollar Neighbour

While everyone was watching ARU lock in nearly half a billion dollars this week, they missed the small-cap neighbour sitting right next door.

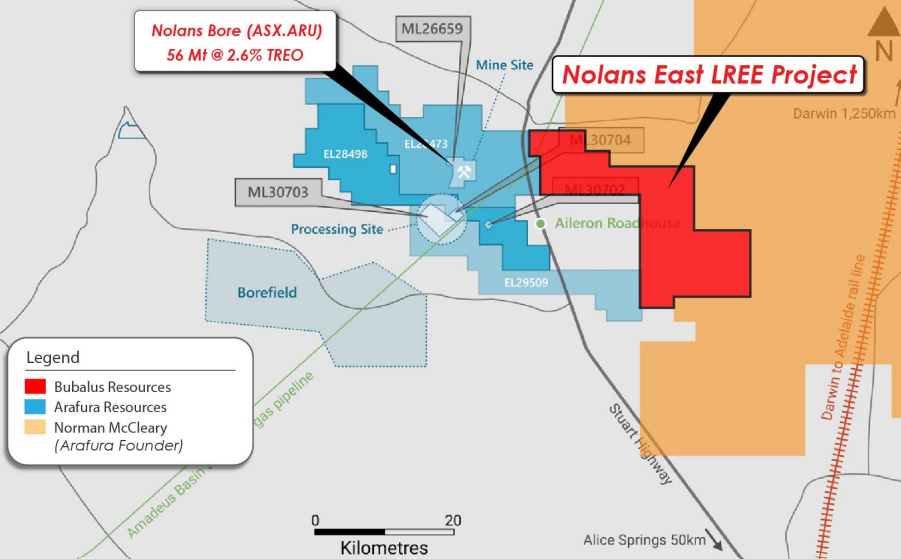

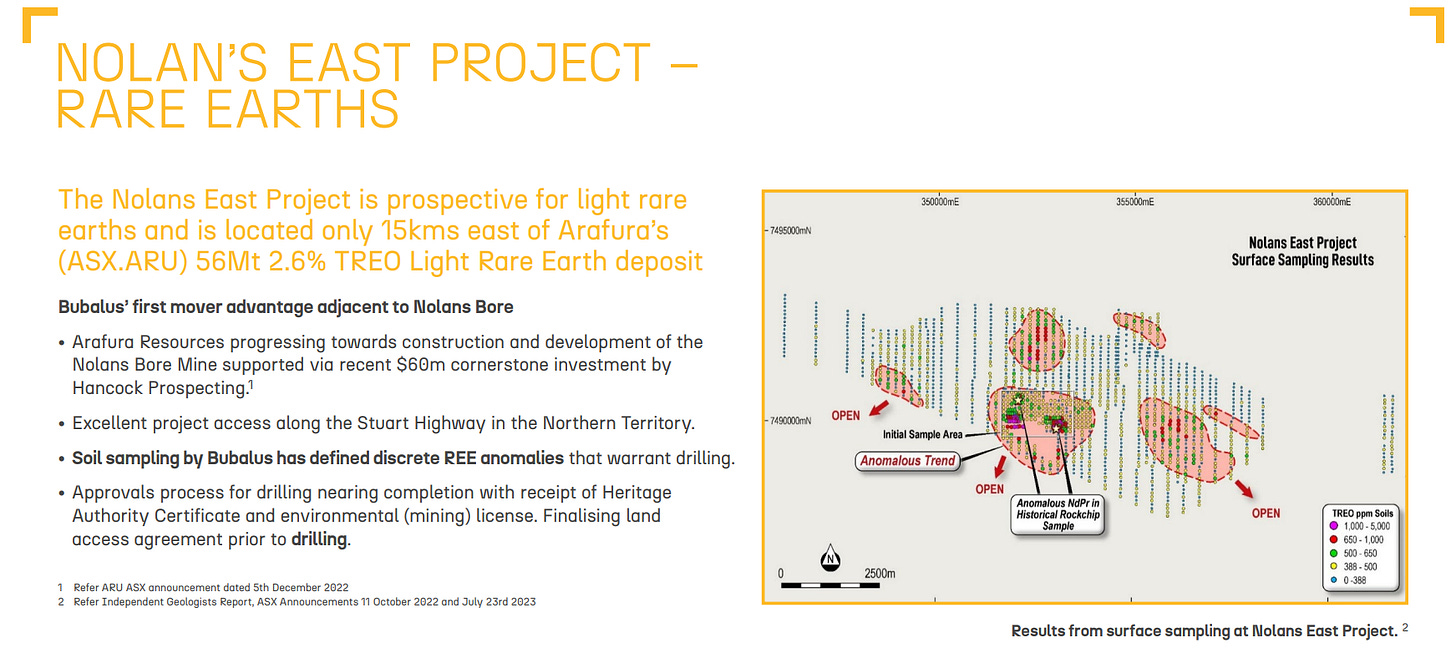

In the Northern Territory, our portfolio company Bubalus Resources (ASX: BUS) holds ground directly beside ARU’s $1 billion-plus Nolans Project, conveniently named Nolans East.

ARU’s week was defined by its $475 million raise and backing from Australia’s richest person, but what’s been overlooked is the smaller neighbour sitting quietly next door.

With a market cap of $10m, BUS trades at less than one per cent of ARU’s valuation. Right now, BUS is drilling high-potential gold targets across its Victorian projects, so it’s easy to forget about its Northern Territory ground. But progress is still being made there.

BUS’ Northern Territory assets sit in the same structural corridor that hosts ARU’s, a geological setup that has already proven world-class. It’s not often you see ground this close to a billion-dollar development still trading in micro-cap territory.

Investors tend to re-rate neighbours quickly when majors move into construction, and that time is now arriving for ARU. For BUS, the final access agreement at Nolans East is due any day, clearing the way for drilling to begin.

If BUS can confirm rare earth mineralisation next door to one of Australia’s most strategic projects, its valuation could climb well beyond one per cent of Arafura’s in short order.

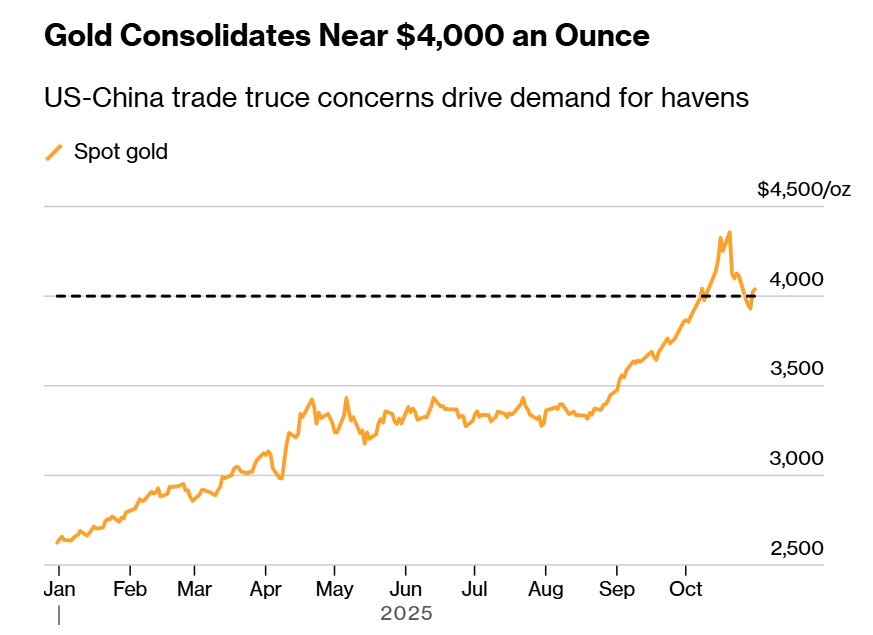

Gold’s Dip and Snapback Above $4,000

Gold gave investors a proper scare early this week, dropping below US$4,000/oz on Monday as the US dollar flexed and yields spiked. By Friday, it was back above $4,000, and anyone without ‘diamond hands’ who sold the dip was probably kicking themselves.

The pattern’s becoming familiar – gold dips, weak hands panic, central banks buy more, and the price bounces right back. Traders who held through the volatility this week were again rewarded as buyers piled back in, recognising the pullback for being just a blip in a bigger trend.

The long-term fundamentals haven’t changed for gold: Inflation remains sticky, global debt is climbing, and major economies are edging toward rate cuts in 2026.

News outlets Kitco and Bloomberg both report that long-term forecasts remain unchanged, with several banks still predicting US$5,000/oz in 2026.

Central banks have been the quiet buyers underpinning this entire rally, adding to reserves month after month while retail investors debate whether it’s topped out.

Gold’s resilience through the volatility underlines one thing: the bull market isn’t over. Central banks are still buying, currencies are still under pressure, and investors are again recognising the importance of gold.

Copper Charges to Record Highs

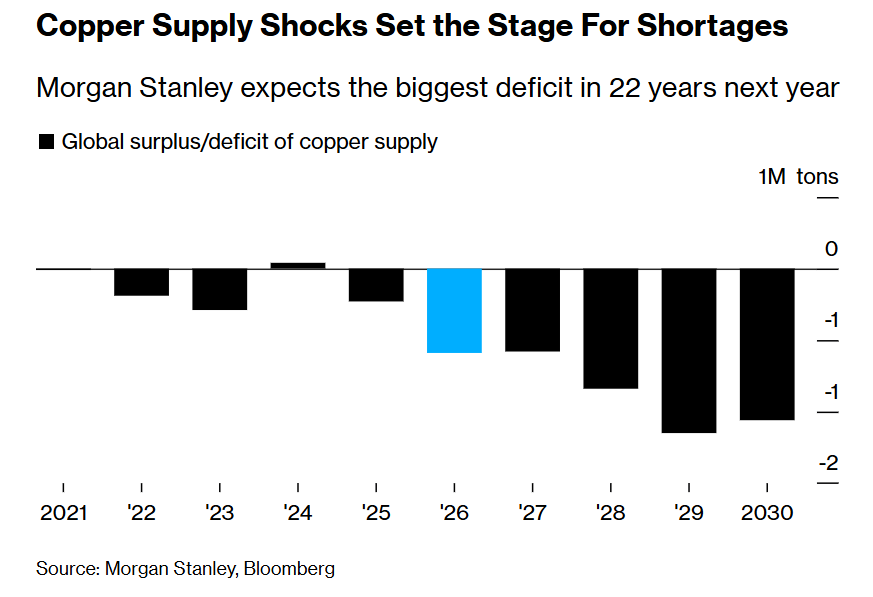

Copper hit record highs above US$11,200/t this week, and it wasn’t just the Trump-Xi handshake driving it. Anglo American dropped the news that they probably won’t hit their 2026 production targets due to grade declines and delays in South America.

It is another reminder that supply growth is struggling to keep pace with demand. Few new mines are being built, ore grades are slipping, and project approvals now take more than a decade.

Meanwhile, demand from EVs, data centres and grid upgrades isn’t slowing down for anyone.

The equation is pretty straightforward: Demand keeps rising, supply keeps tightening, and inventories are near record lows, while copper remains the metal of the energy transition.

Our copper portfolio companies, FMR Resources (ASX: FMR) and Asian Battery Metals (ASX: AZ9), are both waiting on drilling results, and strong hits from either could be transformative.

With fundamentals this tight, the latest surge feels like reality catching up.

Whitebark Bringing Warro Back to Life

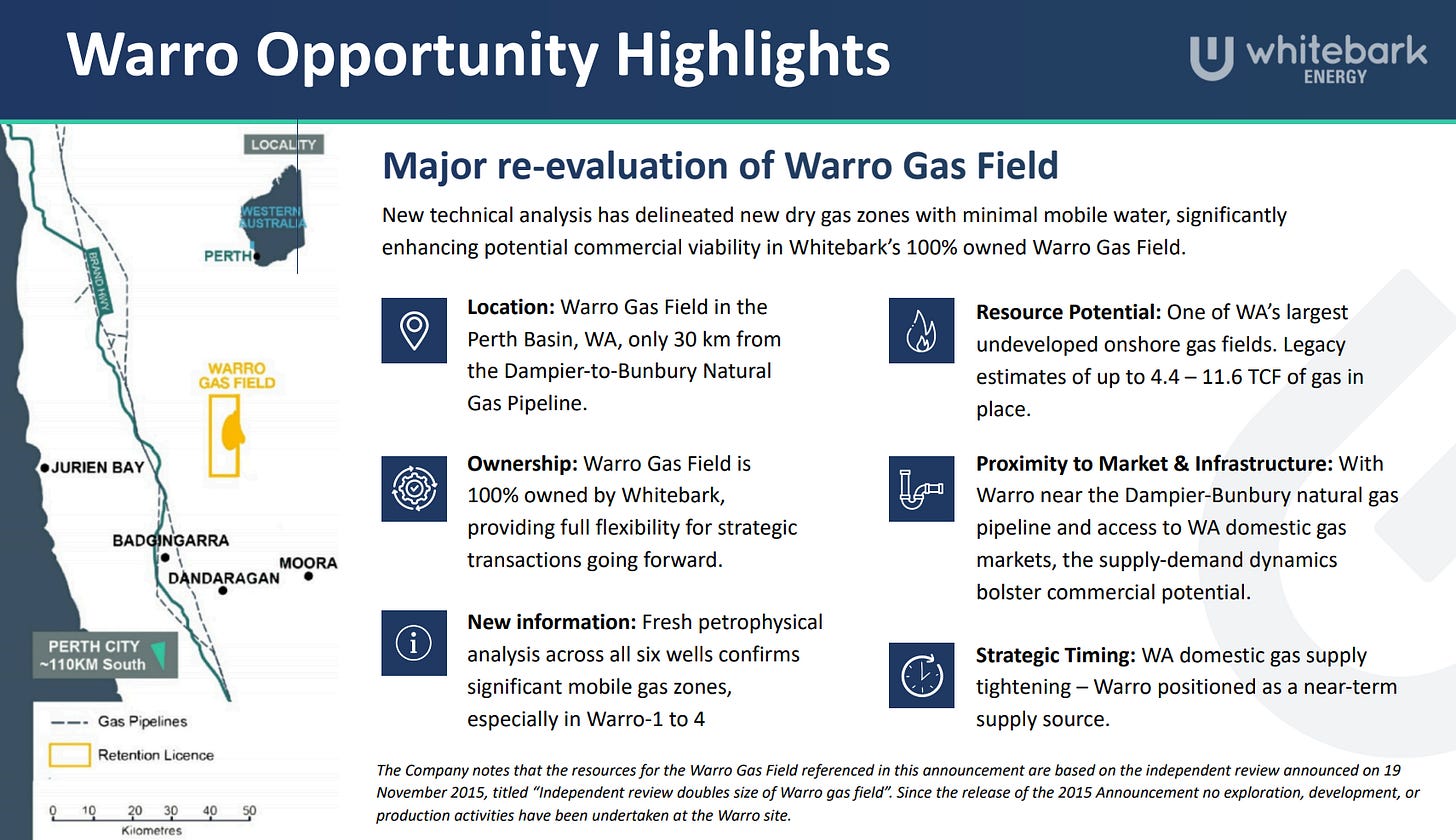

Whitebark Energy (ASX: WBE) jumped 33% this week after new independent work showed the Warro Gas Field in the Perth Basin has thick gas zones that previous drilling completely missed.

The earlier operators drilled too wide and let water flood the wells, which masked what was actually there. Fresh data now shows cleaner, gas-rich sections that could finally unlock the project’s value.

Warro holds up to 11.6 trillion cubic feet of gas (enough to power Perth for decades), and it’s been sitting idle while WA gas prices keep climbing. Earlier wells already proved the gas flows, even with outdated drilling techniques. Now WBE has better data showing exactly where to target.

New management’s moved fast, funding a re-test program to prove up what the data suggests. The field sits just 30km from the Dampier to Bunbury pipeline, so they won’t need to build expensive infrastructure to get gas to market.

With WBE valued at under $10m, the setup is hard to ignore. Any positive result could see WBE trade at multiples of its current value.

After years on the sidelines, Warro might finally be ready for a proper run.

Tungsten’s Return to the Spotlight

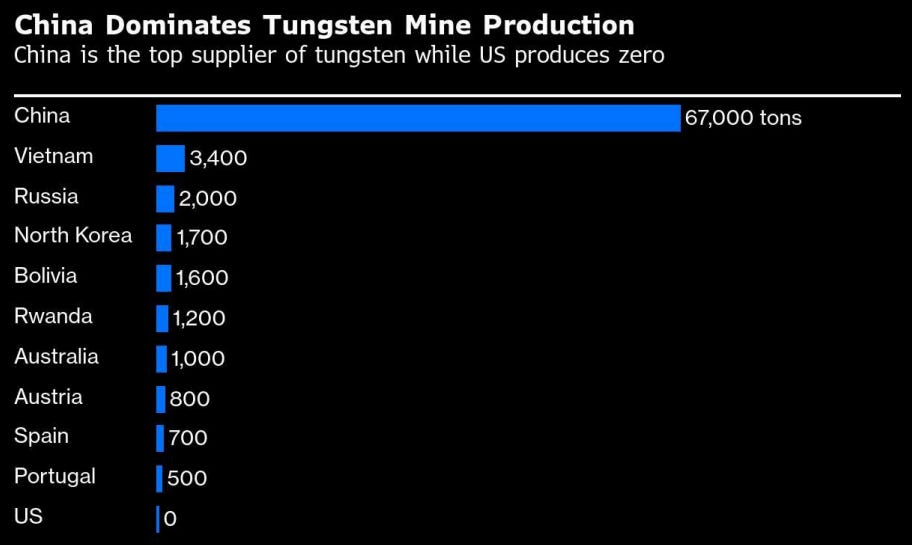

Tungsten got interesting again this week when $2 billion Almonty Industries (ASX: AII) bought an old US tungsten mine to bring it back into production.

America produces none of the tungsten it uses despite needing it for military hardware, aerospace components, and semiconductors. China controls more than 80% of global supply, which is exactly the situation that had Washington panicking about rare earths.

The US Government just allocated a billion dollars for critical mineral defence projects, and tungsten’s right there on the list alongside rare earths and lithium. Both the US and Australian governments have officially labelled it critical, yet many investors have forgotten about it entirely.

Only days ago, China tightened export rules on tungsten, antimony and silver for 2026-27, signalling a push to conserve resources and tighten control over key minerals.

For ASX investors, this shift could revive forgotten tungsten projects, just as rare earths went from niche to mainstream, tungsten’s return to strategic relevance could put a few overlooked explorers back on the radar sooner than most expect.

The Wrap

The week that began with fear ended with clarity. Malawi’s panic faded, Trump and Xi cut a deal, and commodities kept grinding higher through all of it.

Copper broke records, gold stayed firm, and new themes like tungsten’s revival gave investors more to think about heading into year-end.

Quarterly reports reminded everyone that balance sheets matter just as much as big ideas. Cash, catalysts, and credibility continue to separate the stories worth owning from the noise.

The trend we keep coming back to remains clear - gold and critical minerals are driving the small-cap market right now, and that’s not changing anytime soon.

Till next week.