Weekly Wrap: Record Flows, Copper Deals and Radioactive Returns

Record gas flows put Beetaloo on the map, Chilean copper deal lands with heavyweight backing and Sprott goes big on uranium

June usually brings quiet markets as half the industry escapes winter for warmer shores, but a few stories this week proved there's still heat in the small-cap market.

Tamboran Resources set a new flow record in the Beetaloo Basin (with knock-on effects for Top End Energy next door), FMR Resources locked in a Chilean copper play while bringing in a heavyweight managing director, and uranium came charging back into the headlines with a major fund buying up.

Here’s what caught our attention:

Tamboran delivers record Beetaloo flow rates, what it means for Top End Energy

FMR's Chilean copper move lands, the stock up 71% since our early coverage

Sprott plans a uranium buying spree, what it means for small-caps

Our $2,500 stock-picking competition enters its final week, don’t miss out

Tamboran proves up the Beetaloo

The Beetaloo Basin delivered this week, with long-awaited results from Tamboran Resources (ASX: TBN) confirming commercial potential.

TBN delivered a basin-defining result, posting a record 30-day IP flow rate of 7.2 million cubic feet per day from its Shenandoah South 2H sidetrack well.

For context, that's a figure that compares favourably to wells in the dry gas window of the Marcellus Shale in the US, the world’s leading shale gas basin.

The company has additional wells planned, an offtake deal with the NT Government locked in, and production set to begin in mid-2026. East Coast gas prices aren't budging either, so domestic supply like this matters.

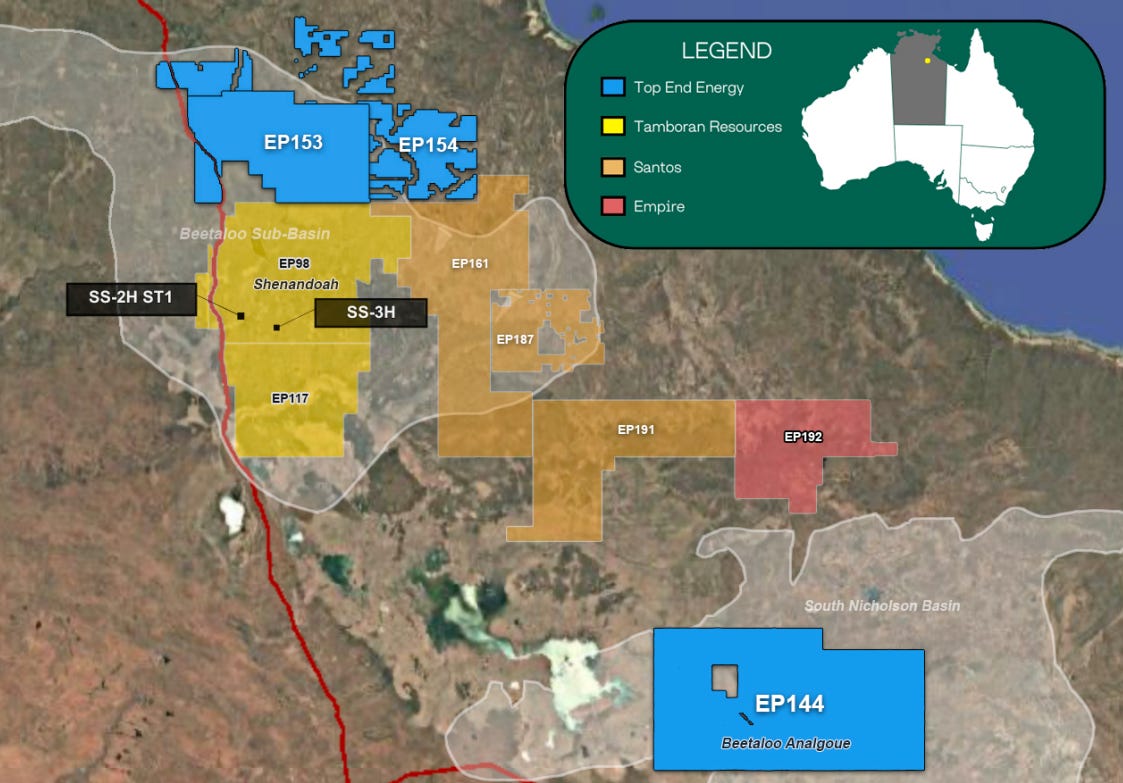

What makes this particularly interesting for investors who have been following Equities Club is that Top End Energy (ASX: TEE) holds permits immediately north of Tamboran's EP98 block.

TBN currently trades at $266 million, while TEE trades at only $12 million.

TEE's permits sit along the same pipeline infrastructure and remain unexplored despite the geological similarities. With TBN proving the broader basin works, TEE becomes a leverage play.

The market hasn't priced this connection yet. As TBN's drilling activity accelerates through the second half of the year, we expect more and more eyes to look at TEE.

FMR delivers in Chile - and Equities Club readers were early

At the start of this year, we called FMR Resources (ASX: FMR) one to watch in our Equities Club ebook. This week the stock has rocketed up 71 percent.

This week's announcement shows why we flagged FMR early.

The company has locked in an earn-in on a highly prospective copper-gold-molybdenum porphyry project in Chile - the Llahuin Project - and brought on respected geologist Oliver Kiddie as Managing Director.

Chile is the world's largest copper producer, with porphyry deposits remaining one of the highest-margin and most sought-after assets globally.

The Southern Porphyry target at Llahuin has matching geophysics and shallow drilling that confirms a fertile system. Deeper drilling is locked in for Q4, with a clear chance of a material copper discovery.

This shows what happens when you back the right stories early. The setup now looks even stronger with a strong MD and major shareholder, Mark Creasy, on the register.

We'll be watching closely.

Sprott’s uranium bet has the sector back on the move

Uranium stocks got a proper kick this week when Sprott Asset Management - the Canadian fund house that lives and breathes commodities - announced they’re doubling the size of their latest uranium trust raise to US$200 million. This came as the uranium spot price hit yearly highs.

The move reflects building momentum in physical uranium demand and comes at a time when long-term contracting by utilities is accelerating.

In the background, Japan’s nuclear restart program continues to gather pace, and the UK, US and EU are all expanding nuclear capacity as part of their net zero policies.

ASX uranium names got a lift - Paladin (ASX: PDN), Deep Yellow (ASX: DYL) and Boss Energy all moved higher on the news, with smaller developers and near-term producers following along.

The uranium market is still tight. Inventories aren't as deep as some think, and buyers are coming back in numbers. When someone like Sprott doubles down, it tells you which way the wind is blowing.

We’ll be watching closely, especially across the ASX mid and small-cap names that remain well below their pre-Fukushima highs. The sector has wind in its sails again.

The Wrap

Three companies, three different stories, one common thread - momentum when it matters.

Tamboran confirmed the Beetaloo's potential and TEE sits next door with a fraction of the market cap. FMR locked in Chilean copper ground and brought in serious management - proving again why it's worth backing small-caps early. And uranium got its mojo back thanks to Sprott's vote of confidence.

Drill programs are ramping up, corporate activity is picking up pace and there's a feeling the market might finally be ready to reward quality again.

Not a bad way to head into the back half of the year.

And Don't Forget…

Our $2,500 stock-picking competition is in its final week - no more procrastinating.

The rules haven't changed: pick the best-performing ASX stock from July through December, and if you nail it, $2,500 heads your way. Perfect timing for Christmas shopping or a January getaway.

Takes about 30 seconds to enter and costs nothing. If you've been sitting on a conviction play all year, this is your chance to put some money where your mouth is.

Give it a crack and send to any mates or fellow stock punters you think might be interested.

Until next week.