The hottest region in Australia right now

The West Arunta is going Bunta. We dive into three stocks in the West Arunta hunting for Niobium and Rare Earths that have caught our eye

Western Australia keeps delivering world-class mining discoveries that ignite a frenzy in one of its regions.

These discoveries are revolutionary for the regions where they are found, turning penny stocks into blue chips and transforming the lives of those who invested early.

The latest region to blow up? The West Arunta.

The West Arunta went into overdrive after a recent major Niobium discovery, which led us to run the magnifying glass over the area. We found three companies with near-identical prominent magnetic anomalies – that's a huge clue they might be onto something big.

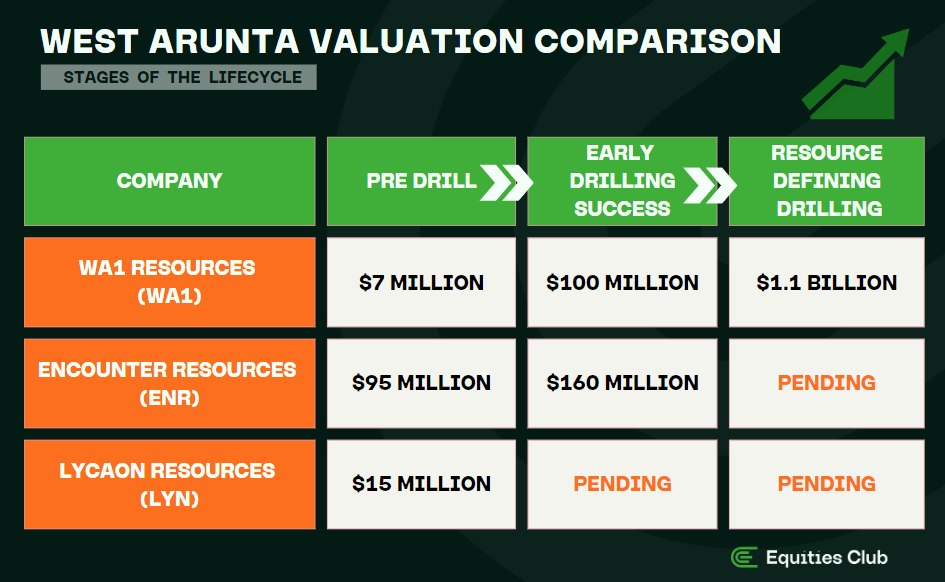

We've got the first mover with a massive valuation based on drilling success, the scrappy junior with early success, and the tiny contender with huge upside potential. Let's dive into the West Arunta and the range of plays for potential investors....

Is the West Arunta the next big thing?

The Equities Club team says yes. We believe the West Arunta region is poised for a major transformation with the discovery of a substantial Niobium deposit. The discovery, which we mentioned above and discuss further below, is still in its early stages but has the potential to revolutionise the global Niobium market and create lucrative investment opportunities for those with drilling success in the region.

Before we begin, why should you care about Niobium?

Niobium could revolutionise how your next car is built. This rare metal makes steel lighter, and batteries last longer – perfect for electric vehicles.

Adding tiny amounts of Niobium drastically improves strength and reduces the weight of steel. Just 300 grams can make an electric car 200kg lighter, a huge deal for efficiency, while adding Niobium to batteries can improve their life by as much as 10 times.

But here's the problem: Up until now, Brazil has had a near monopoly on Niobium – more than 90% of the world's supply comes from a single mine there. That's why the Australian government added Niobium to its Critical Minerals Strategy in 2020. They recognised that Niobium is essential for our tech future, and the supply chain is shaky. This is why we’re calling the Niobium discovery in the West Arunta region a game-changer.

Now, here are the three in the region that caught our eye:

The discovery

WA1 first drilled its targets in late 2022, and the share price went vertical from 20c to $18 after they struck it big with the Luni Project discovery.

Prior to the discovery, geophysical magnetic and gravity surveying, surface sampling, and mapping had been done. Since the first drilling, the deposit has only gotten bigger, stretching over kilometres and lying just below the surface.

It's no wonder the company's valuation ballooned from $6 million to $1.1 billion in less than 24 months. It’s an absolute monster and a remarkable win for investors.

Turning back the clock

Imagine the payoff if you'd invested in WA1 before their discovery. In our eyes, that's what Lycaon Resources presents to potential investors.

It's early days, and exploration always carries risk, but there are five compelling reasons we like the look of Lycaon:

The Stansmore target consists of a prominent 700m long magnetic feature analogous to WA1's discovery; in simple terms, it's a very similar-looking target to the one that led WA1 to success.

LYN is planning to start drilling in mid-2024. This relatively short timeline means that investors don't have to wait long to see if LYN is on to the next big discovery.

Like WA1, the WA government sees potential—it's awarded LYN an Exploration Incentive Scheme grant for drilling, covering costs up to $180,000.

LYN has a cheap valuation at only $15 million and provides significant leverage if a discovery is made; we saw WA1 rocket upon discovery.

A tight capital structure means that if a discovery is made, there will be a rush for the small number of shares available. Lots of buyers, few shares, equals shares up.

The start of something

Encounter Resources (ASX: ENR)

Sitting at a $200m valuation, Encounter Resources has already had success drilling and is looking to continue its exploration program.

Nothing is given when drilling and the West Arunta targets that have shown promise may fall away when further drilling is conducted; if they don't, here are five reasons why we like the look of ENR:

Drilling success on a small scale has shown there is potential for ENR to find a much larger system.

A large-scale drill program planned for testing shows ENR will leave no stone unturned when looking for the subsequent significant discovery.

ENR's land is right next door to WA1's. They're hoping that monster discovery might extend onto their property.

We noted in a recently released substantial holder that Chalice Mining, a major player, owns over 5% of ENR. That's a vote of confidence.

A strong cash position with $16 million will allow ENR to go drilling and work through an exploration process without raising any time soon.

All the companies we mentioned were smart – they grabbed their West Arunta land before the frenzy started. Now, they've got similar prime exploration targets.

So whether you're after the significant discovery from the first mover, the junior with early success, or the small cap with sizeable potential upside, we think we'll be talking about the West Arunta for some time to come.

This article originally appeared on https://equitiesclub.com/the-hottest-region-on-the-asx/