Why We’re Backing Exultant Mining (ASX: 10X)

This $7 million explorer is trading below its IPO price despite going after gold, silver and copper, with drilling only weeks away

We’re backing Exultant Mining (ASX: 10X) with our own money, and adding it to the Equities Club portfolio.

At a $7 million market cap with $4.3 million in cash, the market is valuing 10X’s projects at roughly $2.7 million. That looks too cheap to us.

The early-stage explorer listed on the ASX at 20 cents in December 2025. No fanfare. No hype cycle. No crowded register full of day-one flippers.

Multiple Australian projects chasing gold, silver and copper in proven districts, all loaded with high-grade historical hits that nobody has gone back to test with modern gear. Drilling starts in weeks.

Since then, gold is up 18%. Silver is up 24%. Copper is up 9%. But the share price has drifted the other way, down to 18.5 cents.

That disconnect caught our eye.

Most of the risk feels like it's already baked into the price. The next 6 to 12 months of drilling could change how this company is valued entirely.

We've put our money where our mouth is because at $2.7 million enterprise value, one decent drill result could change everything for this company overnight.

The commodities behind 10X

We’ve been banging on about gold, silver and copper in our weekly wraps for the better part of a year now, and the case keeps getting stronger.

10X gives us exposure to all three.

Gold is trading above US$5,000 an ounce, up from US$2,000 an ounce at the start of 2024, and investment banks are now predicting US$6,000 by year end. Central banks have been buying month after month, while retail investors keep piling in. Inflation remains a problem, global debt is climbing, and rate cuts are on the way (well, in the US at least).

That combination has driven gold higher for two years straight, and there's no quick fix for the world economy that's going to slow it down.

In the past two years, silver's gone from just over $20 an ounce to trade at $80 an ounce now. It rides gold's coattails as a safe haven, but silver has its own demand story building underneath.

Solar panels, electronics, EV infrastructure and data centres all need more of it than the market was expecting. Years of underinvestment have left silver inventories thin and discoveries aren't replacing what's being consumed. Demand has put a serious squeeze on supply.

Copper is the one we keep coming back to. Demand from electrification, grid upgrades, EVs and AI data centres keeps rising while the supply side falls further behind. Mined grades are falling, new discoveries are rare, and the timeline from finding copper to actually mining it keeps blowing out to 15 or 20 years.

Bloomberg reported inventories falling to multi-year lows. S&P Global is saying that copper supply is expected to fall 10 million metric tons short of demand by 2040. That's big if we're only producing 28 million tonnes a year.

Since 10X listed on 11 December 2025, the backdrop has only improved. Gold, silver and copper are all higher while 10X trades below its IPO price.

The valuation setup

Strip out the $4.3 million in cash 10X has and the market is valuing the company’s assets at roughly $2.7 million. ($7 mil market cap - $4.3 mil cash).

The capital structure is tight too, with only 37 million shares on issue. That's tiny. If results land, there aren't a lot of shares to absorb the demand. In a world where plenty of juniors list with bloated registers and endless overhang, 10X comes to market lean.

For that valuation, you get multiple Australian projects in proven mining districts, historical drilling and sampling with high-grade results, a clear and funded path to drilling, and a board that knows what it’s doing.

We’re not saying success is guaranteed. At this early stage it never is. But expectations are priced at close to zero, and that’s often where the best risk-reward setups start.

10X has several Aussie projects that could move the dial (more on those below). One decent result from any of them and this company looks very different. At $7 million, the market is pricing 10X as if none of it exists. We think that's wrong.

The Five Reasons We’re Backing Exultant Mining (ASX: 10X)

1. Australian assets in Tier 1 mining districts

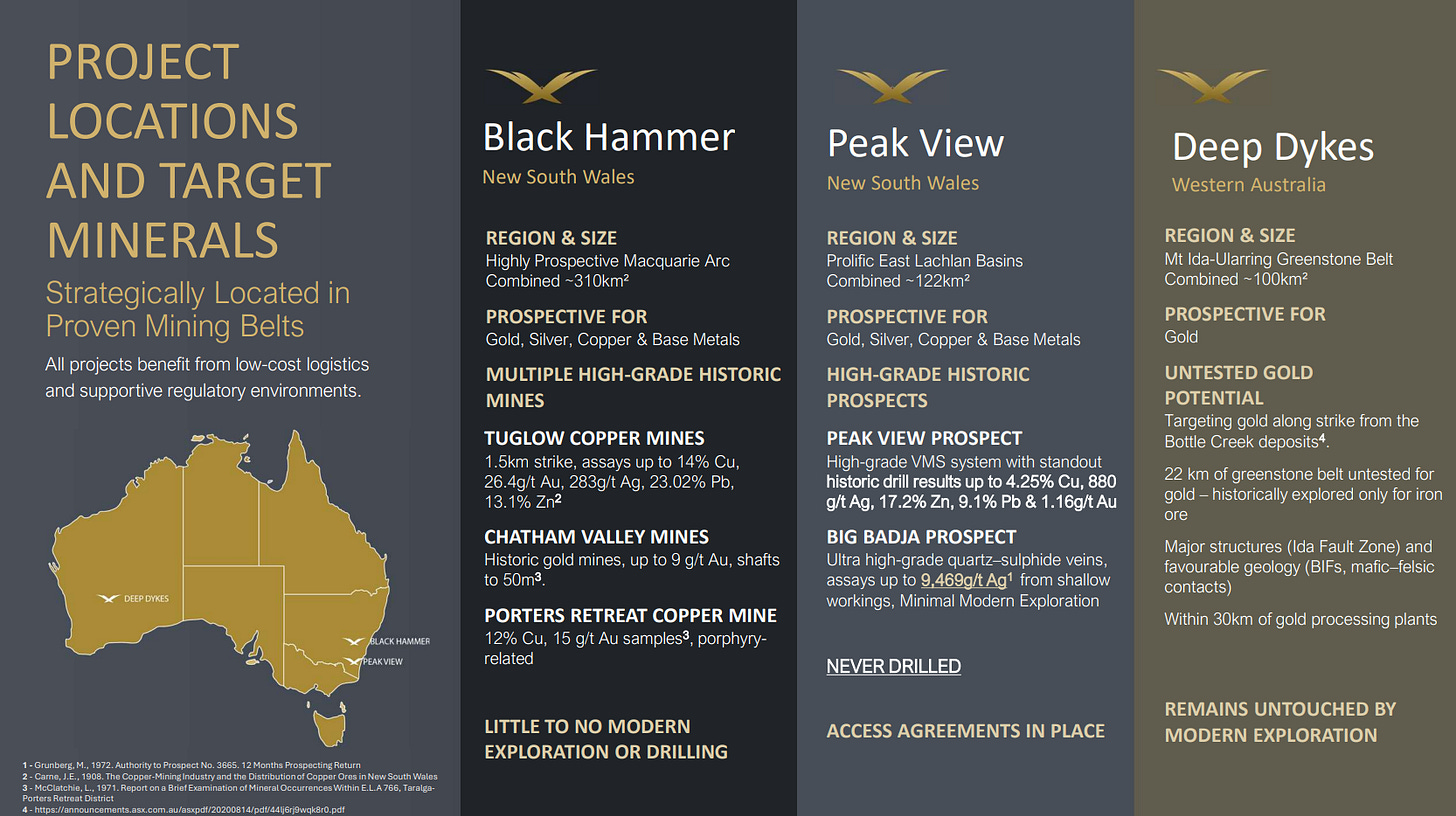

10X’s projects are all in Australia, spread across New South Wales and Western Australia in some of the most productive mining regions in the country.

Address matters in small-cap exploration. It affects how easy it is to raise capital, how quickly you can permit and drill, and how the market reacts when results land. Australian addresses get attention.

The portfolio covers ground in the:

Macquarie Arc (home to some of Australia’s largest copper-gold deposits)

East Lachlan Fold Belt (long-established region for high-grade base and precious metals)

Mt Ida-Ularring Greenstone Belt in Western Australia (proven gold country with processing infrastructure nearby)

These are belts that have delivered major discoveries before. Across all of them, 10X holds ground with high-grade historical results that have never been followed up with modern exploration.

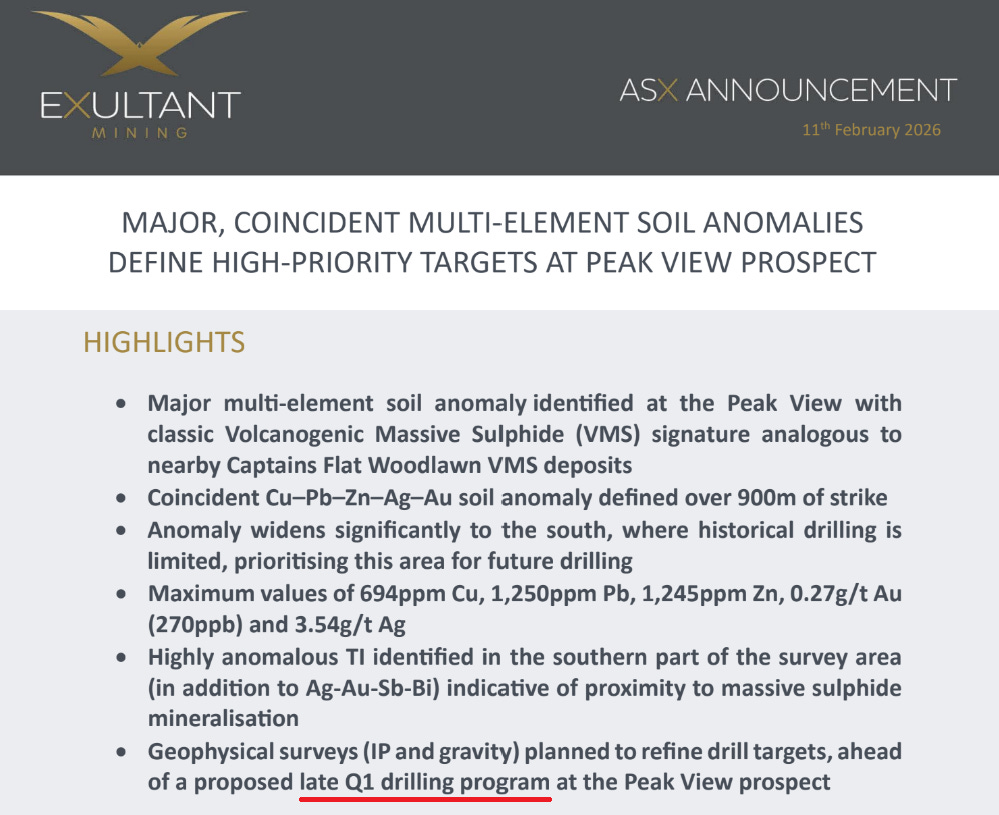

2. Peak View has proven grades and barely been tested

Peak View is the project that first sharpened the story for us.

It’s in the East Lachlan Fold Belt in NSW. It’s a polymetallic sulphide system carrying copper, lead, zinc, silver and gold, all packed into a compact zone of ancient volcanic rock.

Historical drilling returned serious grades:

2.1m at 1.79% Cu, 5.89% Pb, 11.83% Zn and 105 g/t Ag

2.7m at 3.0% Cu, 1.41% Pb, 3.88% Zn and 52 g/t Ag

0.8m at 1.21% Cu, 11.60% Pb, 22.0% Zn, 0.50 g/t Au and 119 g/t Ag

Those grades speak for themselves, but the real point is that most of the prospective volcanic horizon remains untested.

Both along strike and at depth, no one has gone back with modern surface geochemistry or geophysics to figure out how big this system actually is.

The old drilling proved the system exists. It never answered the bigger question about scale.

Since acquiring the project, 10X has cleaned up decades of historical data and converted it into something modern and usable.

Recent rock chip sampling from other prospects within the Peak View tenement has added to the picture, with 5.42 g/t gold at Undoo Creek and 256 g/t silver with 4.82% lead at Big Badja Silver Mine.

Those results don’t prove a discovery, but they confirm that high-grade mineralisation extends beyond the previously drilled areas. With land access agreements in place, the team can now move from interpretation into action.

Peak View comes with a bit of history too. Chairman Brett Grosvenor tells the story here of Lindo's Reef, a gold deposit found by a UK prospector who never made it back to develop it, and why early sampling has the team going back for another look.

Whether Lindo was right about what he found, the team is going to find out.

3. Black Hammer covers a huge footprint in Australia's best copper belt

If Peak View grabbed our attention on grade, Black Hammer grabbed it on scale.

This project sits within the Macquarie Arc, one of Australia’s most productive copper-gold provinces. It covers a large footprint with multiple historic mines and prospects across the tenement package.

The standout is the Tuglow Copper Mines, where historical records report grades of up to 14% copper, 26.4 g/t gold, 283 g/t silver, 23.0% lead and 13.1% zinc.

Very little modern work has been done across the broader area. Much of the ground has never been drilled, despite extensive surface mineralisation and strong structural controls.

Since listing, 10X has been out on the ground collecting rock chip samples and mapping across multiple prospects. They’ve confirmed intrusive centres, sulphide-bearing alteration and veining that fits with fertile mineral systems.

Several prospects haven’t had a single drill hole put into them. In a belt like the Macquarie Arc, that kind of ground tends to get picked up quickly once results start flowing.

4. Drilling is funded and ranking the targets is underway

10X has followed a process that a lot of small-caps skip entirely. They've cleaned up the historical data, built geological models, run surface geochemistry and geophysics, the targets will be ranked shortly, and then it’s time for drilling.

At Peak View, soil sampling and geophysical surveys are wrapping up and drilling will start in the coming weeks.

At Black Hammer, aircore drilling and ground magnetics are planned across priority areas, with targeted drilling to follow once anomalies are defined.

There’s no rush to put holes in the ground just to generate headlines. 10X is doing the groundwork first, which means when the drill does turn, the targets have a better chance of delivering.

We like that approach because it tends to produce better results and doesn’t waste cash on low-probability holes.

5. The people running 10X have done this before

At this stage of the cycle, the people running the show matter more than most investors give them credit for.

10X is chaired by Brett Grosvenor, who has taken projects from early exploration through to development and production over a multi-decade career. That kind of experience counts when a company is moving from desktop study to drill rig, which is exactly where 10X sits today.

Rather than chasing attention since listing, the board has focused on fundamentals. Access, data, geology and methodical target generation. That approach has been consistent across every announcement since listing, and it’s a big reason we were comfortable taking a position early.

Our view

10X is early stage, weeks away from putting its first drill holes in the ground. At $2.7 million enterprise value with drills about to turn, it wouldn't take much to change how this company is priced.

We backed in because the commodity cycle is working in 10X’s favour and the projects have genuine high-grade history in parts of Australia that get attention when results land.

The drill programs over the next few months will tell us whether the historical grades hold up with modern work. We reckon they will, but we’ve been around long enough to know exploration can surprise you either way.

If results come through, a $7 million company with 37 million shares on issue and no need to raise capital is going to look very cheap, very quickly. We’d rather be early than late on this one.

We’ll be covering 10X closely from here, and with a ticker like that, we reckon it’s going to be fun to follow.