Why We’re Backing FMR as our First Pick of 2025

We’re adding FMR Resources (ASX: FMR) to the Equities Club portfolio - our first new pick for 2025. Here's why we're on it

We’re backing FMR Resources (ASX: FMR) to unlock one of the biggest copper discoveries on the ASX.

Copper’s drying up. Demand keeps climbing. The cupboard’s looking bare. We think FMR is one of the few ASX juniors with a real shot at something big.

FMR is heading straight into Chile, which pumps out almost a quarter of the world’s copper, to chase a massive porphyry system that has all the makings of a company-making discovery.

Their Southern Porphyry Target at the Llahuin Project is giant: 1.5km by 1.5km of barely touched ground right next to some of the world’s biggest deposits - and somehow, it’s never been properly drilled at depth.

Drilling’s only a few months away, the copper price is climbing and the setup ticks a lot of boxes for us - strong ground, funding in place, and a (gale-force) macro tailwind behind it. (more on that later)

We first called FMR Resources at 17c in our Ebook earlier this year, backing the team behind it. Now that they hold a serious copper project, we’re doubling down.

With drilling imminent, a 29.5c share price, $12 million valuation and $5 million in the bank, there’s still plenty of room to move if drilling delivers.

FMR is the kind of early-stage target that can deliver life-changing returns - if the drill hits. Every ASX small-cap investor should have it firmly on their radar right now.

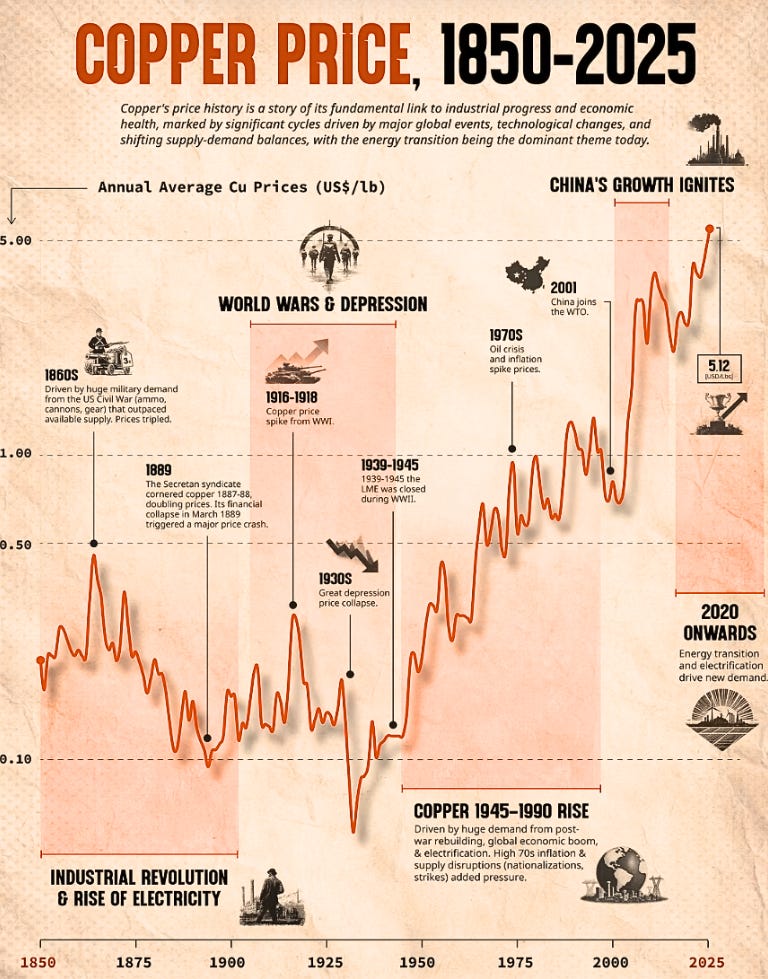

Why the World Needs More Copper, Fast

The world’s running out of copper, and most people have no idea how bad it could get.

Every electric car can need up to 80kg of copper. The data centres powering the AI revolution are copper-hungry. Solar farms, wind turbines, grid upgrades - copper is in everything.

The issue is that discoveries have dried up. The easy stuff’s been found. Grades are falling at existing mines. And the supply crunch is only just getting started.

The timing for FMR could not be better; copper demand is surging globally as the world electrifies, and with that, the copper price is rising quickly.

That’s the backdrop for FMR Resources.

They’re targeting a huge porphyry system in one of the best copper addresses on earth right as the macro winds are turning in their favour. If they hit something meaningful, they won’t be short on buyers.

The Five Reasons We’re Backing FMR

1. Right in the Heart of Chile’s Copper Powerhouse District

You won’t find a much better address for copper exploration than central Chile. FMR’s Llahuin Project sits in the Coastal Cordillera - a region packed with world-class porphyry copper deposits.

They’re just 8km from El Espino, a copper-gold project where Resource Capital Funds recently tipped in US$90 million for a 23% stake.

Los Pelambres (controlled by $18 billion copper giant Antofagasta) is only 65km away. That mine alone holds over 5 billion tonnes at 0.53% copper.

Llahuin is also close to grid power (5km), a sealed airstrip (20km), and major ports (200km). It’s also got good roads, established mining services, and a skilled local workforce.

If FMR makes a discovery, they’re not stuck in the middle of nowhere trying to figure out how to develop it.

Chile knows mining and is a strong jurisdiction with a supportive government. And when you’re sitting next to proven operations, any discovery instantly becomes more attractive to partners and the majors looking for their next acquisition target.

2. A Giant Copper Target That’s Barely Been Touched

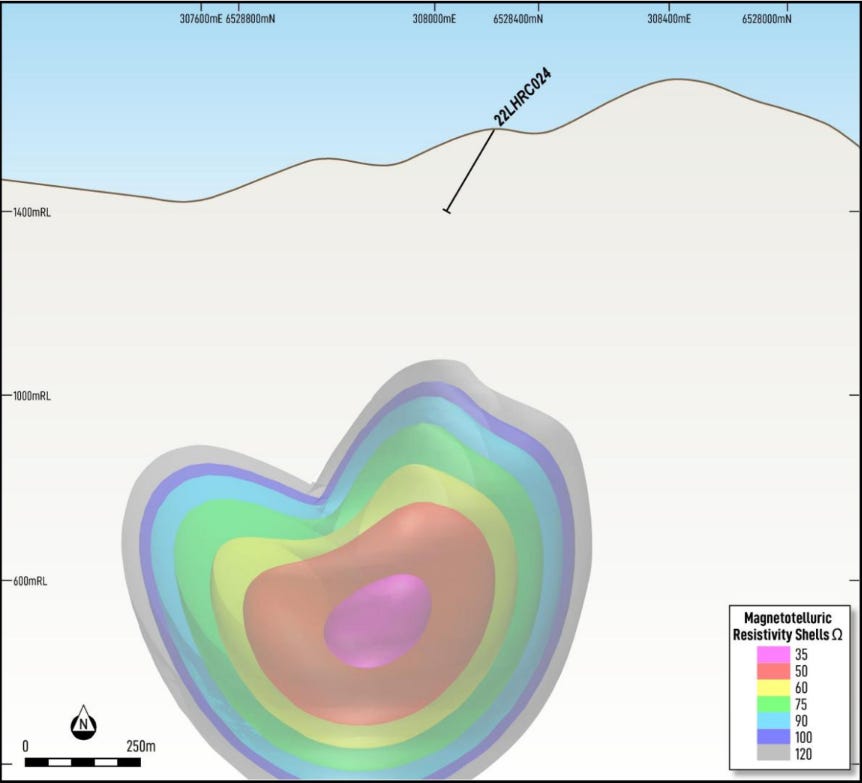

The Southern Porphyry Target is huge - roughly 1.5km by 1.5km in area, going down to a depth of 2km.

Multiple overlapping geophysical surveys have mapped this thing out (think underground X-rays), but what’s wild is it’s never been drilled at depth.

Historic drilling has already pulled up copper-gold-molybdenum hits from shallow levels. One hole returned 164m at 0.16% copper equivalent from just 2m down, including a higher-grade section of 2 metres at 1.45% copper equivalent from 168m.

That’s solid mineralisation sitting right above the main target.

Yet the deeper porphyry core, the zone where the richest, highest-grade mineralisation is typically found, is untouched.

Think of it like this: they’ve found smoke on the surface, but no one’s drilled down to find the fire yet. If there's a substantial system down there, this could get very interesting very quickly. That’s the part we’re watching.

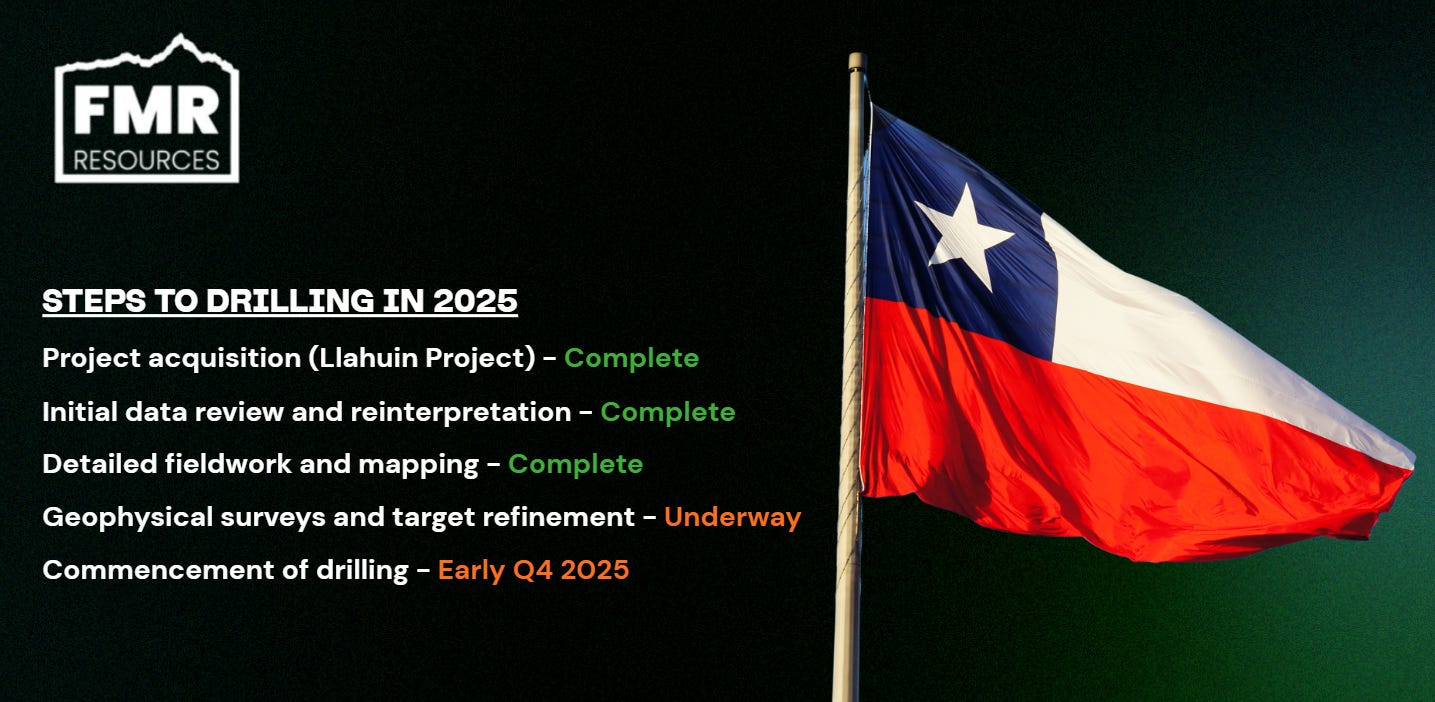

3. FMR Will be Drilling in Early Q4, 2025

The beauty is we won’t be waiting long for answers. FMR is aiming to put holes in the ground in early Q4 this year.

They’re already deep in the planning - crunching geophysical data, pinpointing drill targets, lining up contractors. The wheels are in motion.

In big porphyry systems like this, one decent intercept can change everything. We’ve seen it time and again: a strong hit puts the company on the map. Brokers get interested. Instos start circling. And majors - always hungry for the next big copper growth story - start paying attention.

Copper inventories are already tight, and supply is falling behind. If FMR lands something meaningful this year, it’ll land in a market that’s more than ready for it.

4. Heavy-Hitting Team With Serious Names Supporting

Driving FMR’s Chilean push is experienced managing director Oliver Kiddie. A geologist with over 20 years of experience, Kiddie has worked across major discoveries in Australia and internationally. He’s worked with the Creasy Group and Legend Mining and been around for more than a few discoveries.

His track record encompasses exploration, resource definition, and development, providing him with the breadth necessary to lead a high-stakes copper campaign like this one.

Backing him is mining legend Mark Creasy, who joins the FMR register as a major shareholder. Creasy is one of the sharpest operators in Australian mining and no stranger to spotting winners early. Creasy is known for supporting exploration success stories that have evolved from ASX small-caps to billion-dollar discoveries.

Sirius Resources (ASX: SIR) went from $6 million to a $1.8 billion takeover. Azure Minerals (ASX: AZS) did something similar - $10 million to a $1.7 billion takeover. Creasy backed both. Now he’s backing FMR.

And when someone with a track record like his puts serious money behind a project, people notice. Not just because of the cash but because of the doors it opens. The calls that get returned. The quiet nods in the right rooms.

It’s just how this game works when someone like Creasy is in your corner.

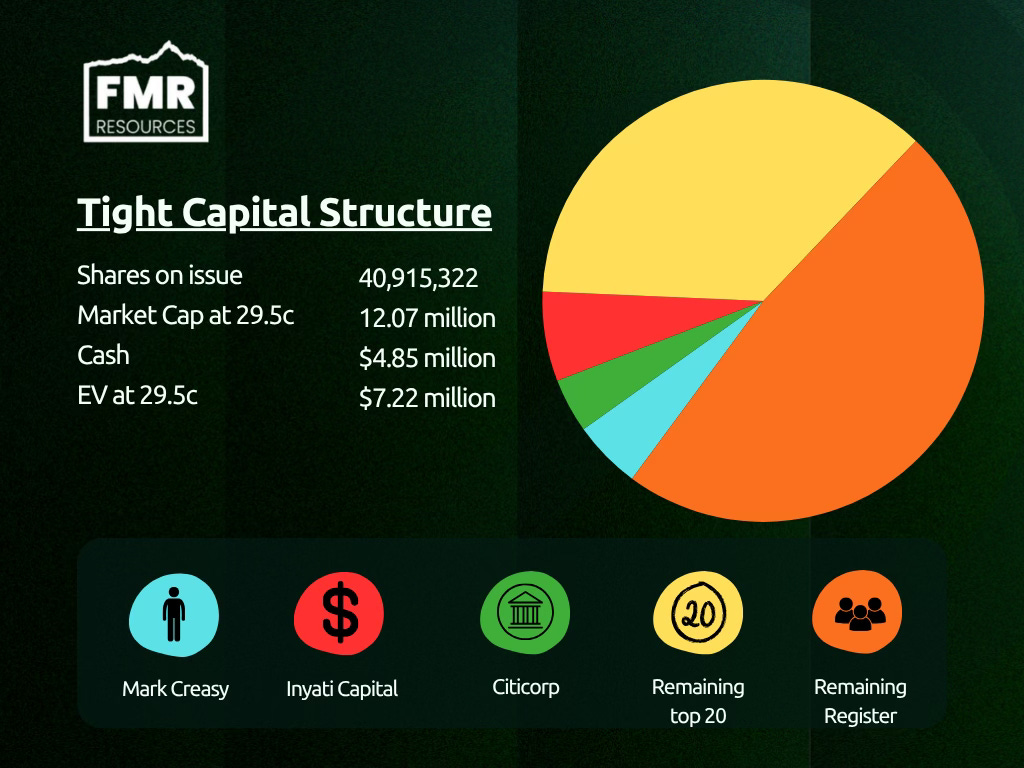

5. A Very Tight Capital Structure

FMR isn’t one of those bloated juniors with a billion shares on issue.

Post their recent $2.2 million raise, they’ve got just over 40 million shares outstanding, with a market cap of around $12 million.

This means any discovery gets amplified. There’s no massive share register to absorb the good news.

If they hit something decent, the rerating can be explosive for existing shareholders. And if a major fund or mining company wants a meaningful stake down the track, they’ll need to pay up.

In a world where many juniors have blown-out registers and endless dilution, FMR’s structure works well for early shareholders.

Our View

FMR’s got everything we like in a high-risk, high-reward copper play.

They’re stepping into Chile’s copper heartland, targeting a large porphyry system that, somehow, hasn’t been properly drilled. The structure’s tight. The team’s sharp. And the ground looks the goods.

Drilling’s not far away and if they hit something meaningful, all the ingredients are there for a serious rerating.

Copper stories can move fast when they work. Supply’s tight, demand’s climbing and the majors are hunting for their next acquisition target.

That’s why we’re backing FMR. Some of the best returns come from getting in early on quality ground, with quality people, right before the drills start turning.

And when it works, the market tends to catch up fast.

Worth a bit of a wager on.