In the world of investing, the key is to win

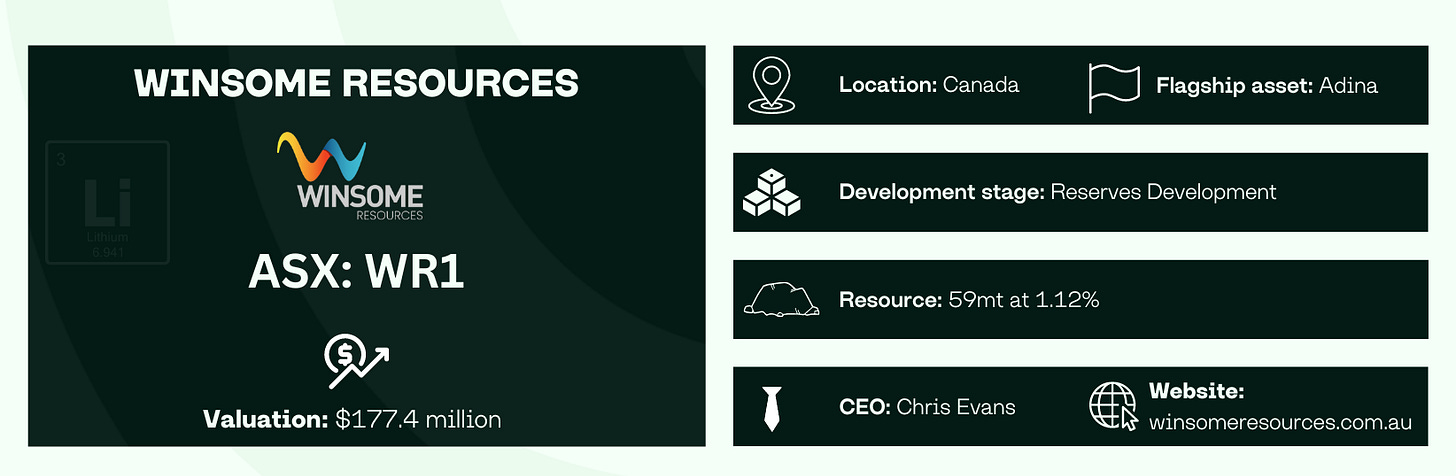

We're back in Canada's lithium sweet spot for part 3. With a winning combination of growing resource, government backing, and prime location, could Winsome Resources be a big player in North America?

Isn’t it funny what a couple weeks in the lithium market can do?

Just last week, whispers of supply cuts and price increases were everywhere. Fast-forward to Monday, and we see multi-billion dollar lithium beast Mineral Resources make a big move – snapping up a nickel concentrator plant and tenements in the Goldfields region of WA.

Now, why would Mineral Resources do this? Well, the whole setup – the plant, the flotation circuit, everything they used to process nickel – is to be retrofitted to process lithium. Fancy that.

Now, imagine you're back in 2014, talking to a grizzled miner in the Goldfields of WA. You tell him that his whole nickel operation will soon be converted to churn out some white stuff called lithium – you know, for those electric cars you charge in your garage. He'd almost definitely laugh in your face.

Not in 2024.

So, while the Equities Club team keeps harping on about buying out-of-favour commodities (and boy, has lithium been that lately), we see some of the most prominent players making their intentions clear.

As the saying goes, "follow the smart money" with any gamble… sometimes you win some, and sometimes you lose some. This takes us to part three of our five-part series on lithium stocks to watch in 2024. A Canadian lithium story that seems to be under-appreciated…

Here’s what we like about Winsome (other than the name)

A resource that’s growing in real time

Winsome Resources already has a top-20 hard rock lithium resource – 59mt at 1.12%. And they're not slowing down. Their 50,000m drilling campaign in 2024 raises hopes of significantly increasing their resource size.

With five drill rigs on site testing targets, the Equities Club team is bullish on a significant resource upgrade for Winsome in 2024. With the exploration potential shown – we expect Adina to climb into the top 15 lithium resources globally, maybe even crack the top 3 in North America.

Analysis of the drill cores indicates the potential for a dense media separation-only processing route. This method is cheaper and more environmentally friendly, making the Adina deposit even more attractive.

Management expertise

It's a cliche saying, but sometimes it rings true: if you know, you know. As it turns out, WR1 management definitely knew something the rest of us didn't. Few analysts predicted the sharp lithium price drop in late 2023 and into 2024, but WR1 must have seen it coming. They pulled off a savvy move, raising a cool $35 million in October 2023.

The timing of this capital raise is key. Management raised the $35 million at more than double the current share price. This gives them a serious cash cushion, meaning they won't need to tap the markets for a long time. And with the lithium price expected to rebound, the share price should follow suit.

The management team at Winsome Resources has also lived the lithium market's ups and downs. It's a board packed with lithium experience across four continents and all stages of the life cycle. You won't find many companies (if any) with this kind of depth. This kind of expertise is what it takes to survive the tough times and really thrive in the good ones.

Comparative valuation

With an existing resource that's already substantial (with the potential for major growth) and an experienced management team, you would think WR1 would be worth a fair bit.

Well, their current valuation is only $170 million. That seems...low, doesn't it? $170 million for a near 60mt resource, a grade above 1%, AND they're in Canada.

With a resource that we expect to soon place them in the top 15 globally, WR1 will be trading at more than a 50% discount to any other company in that list.

For an easy comparison, we covered Patriot Battery Metals (PMT) in our first lithium article. WR1 currently has a resource 55% the size of PMT's, yet trades at only 13% of PMT's value. Equities Club believes WR1 could be the ultimate sleeper stock in North American lithium.

It’s in the sweet spot

Ohhhh, Canada – it's shaping up to be the place to be for North American lithium. And Quebec? Even sweeter. Strong mining support, excellent infrastructure, hydropower... that's a recipe for attracting investment and making projects happen.

The Canadian government kicked things up a notch in late 2023 with their massive critical minerals infrastructure fund – $1.5 billion to support clean energy projects to help achieve net zero emissions targets.

The Equities Club team thinks WR1 already has a leg up compared to a lot of the lithium hopefuls out there. With this kind of government support rolling in, we're even more convinced they're well-positioned. The North American EV market is developing, the government's backing the sector... WR1's got a front-row seat in Quebec.

Think Permitting and Approvals in Canada are easy, eh?

We like what we see with Winsome Resources – a lot. The only cause for concern is the Canadian Permitting and Project Approvals process. Environmental studies, government, local community and First Nations consultations...these things take time.

Like in Australia, if you don’t respect the First Nations people and the process you are undertaking on their land, your chances of approval are near zero.

We’re not suggesting WR1 is doing anything wrong; in fact, from all reports, they’ve already engaged all the mentioned groups and started environmental monitoring, but like with anything, this stuff isn't quick and requires careful consideration.

Luckily, WR1 has an experienced team. We expect them to understand their duties fully and cooperate with all parties.

Canada seems to be finally starting to embrace mining, understanding there is no net zero without it.

We look at the upside potential here and the comparative valuation to a nearby competitor and like what we see.

Experienced team, a growing resource that's easy to process, and they're still holding their cards close to their chest when it comes to finding a potential partner.

It seems like the market is asleep on Winsome, but that won't last forever. This stock could become a household name before you know it.

Remember to subscribe to make sure you don't miss out on our next Equities Club release

This article originally appeared on https://equitiesclub.com/winsome-resources-asx-lithium-explorer-notching-some-wins/